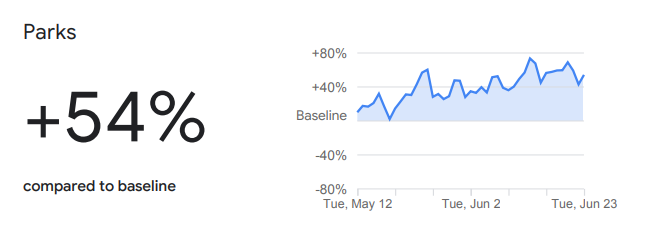

| The U.S. moves closer to revoking Hong Kong's special status. Fed Chair Jerome Powell warns of extraordinary uncertainty. And Tesla shares rose above $1,000 again after Musk said the company might break even. Here are some of the things people in markets are talking about today. Hong Kong Status The Trump administration escalated pressure on China Monday over its crackdown on Hong Kong by making it harder to export sensitive technology to the city, the latest step toward revoking the former U.K. territory's special trading status. Rules giving preferential treatment to the city, including the availability of export-license exceptions, are suspended, Secretary of Commerce Wilbur Ross said, and more steps are under consideration. The move comes as China's top legislative body is poised to approve new national security legislation for Hong Kong — a sweeping attempt to quell dissent that risks U.S. retaliation and the city's appeal as a financial hub. The National People's Congress Standing Committee was expected to make a final administrative push to impose the law on the former British colony when it wraps up a three-day meeting Tuesday in Beijing. Federal Reserve Chair Jerome Powell stressed the importance of keeping the coronavirus contagion contained as the U.S. economy bounces back from its deepest contraction in decades. "We have entered an important new phase and have done so sooner than expected," Powell said in remarks prepared for testimony before the House Financial Services Committee on Tuesday with U.S. Treasury Secretary Steven Mnuchin. "While this bounceback in economic activity is welcome, it also presents new challenges — notably, the need to keep the virus in check." The Fed released the text of his remarks on Monday afternoon. The Fed chair struck an optimistic note as economic activity resumes. Hiring is picking up, he noted, and spending is increasing, though 20 million Americans have lost their jobs. Meanwhile on the virus front, the World Health Organization has warned that "the worst is yet to come." Asian stocks looked set to track gains in U.S. counterparts Tuesday after better-than-estimated economic data overshadowed concern over an increase in coronavirus cases. The U.S. dollar and Treasuries advanced. Futures in Japan and Australia pointed higher. Hong Kong assets will be closely watched after the latest U.S. response to China's new security measures. The S&P 500 erased its June decline after a report showed U.S. pending home sales posted a record gain, exceeding all forecasts. The tech-heavy Nasdaq extended gains as Facebook Inc. wiped out its losses, while elsewhere, oil advanced and gold remained steady. Stock investors wanting to preserve capital could do worse than look to China, whose relative stability stands out against the chaos in global markets. The country's equities have gone back to the upward grind that has marked past rebounds since a bubble burst in 2015. The calm has allowed the CSI 300 Index to post at least 14 up sessions in June, the most for any month since November 2016. Thirty-day volatility has remained below that of the S&P 500 since early March, the longest stretch in more than eight years, while a gauge of expected swings on a large caps is about 18% lower than the VIX. That peace prevails in the face of second-wave virus concerns, China's slowing economy, mounting offshore defaults and a liquidity scare in government debt shows Beijing's ability to suppress swings in stocks. Chinese investors are betting the rebound will continue, driving margin debt past 1.1 trillion yuan ($155 billion) to the highest since January 2016 last week. Tesla Inc.'s stock price climbed back above $1,000 after a report said Chief Executive Officer Elon Musk sees a possibility the electric-car maker will avoid a second-quarter loss. "Breaking even is looking super tight," Musk wrote in an email to employees, obtained by the blog Electrek. "Really makes a difference for every car you build and deliver. Please go all out to ensure victory!" Tesla shares surged 5.2% on Monday to close at $1,009.35. The stock has soared 141% this year, putting its market capitalization on course to rival Toyota Motor Corp., the most valuable automaker in the world by that measure. Musk, 49, has routinely sent emails to rally the troops at the end of a quarter or year, and Tesla hasn't always lived up to the expectations set by his internal memos. The company reported a record 97,000 deliveries for the three months that ended in September, though that fell short of the 100,000 mark he floated in an email to staff days earlier. What We've Been Reading This is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in this morning We talk a lot in this space about exceptions in economic data given the uniqueness of the current situation. A lot of data just wasn't designed for the entire shutdowns of economies that we've seen during the coronavirus crisis. However, let's talk about a data set that was designed for the time of Covid-19. And that's Google's mobility data, which tracks people going out to restaurants, grocery stores, places of work, and compares that info to pre-Covid trends. That mobility data has shown some improvement in recent weeks, especially parts of the developed world that are gradually reopening. For instance, analysts at UBS point out that visits to parks in developed markets have jumped from 93% of a baseline "normal" in April to 153% now. Meanwhile, in emerging markets, the increase has gone from 50% to 77%.  Google Mobility Data for people in the U.S. going to parks shows some improvement compared to the baseline. Bloomberg So why are people in the developed world suddenly all going to parks, even more so than before the Covid crisis? It is, of course, a quirk of the data. Google's Mobility series is benchmarked to January, generally the most miserable month in the Northern hemisphere and, as the UBS analysts point out, a time when "most people, like us, were probably curled up on the sofa with a hot cup of cocoa." In other words, the improvement we're seeing in mobility could easily be skewed by seasonal factors like the weather. It's a good reminder that when we're comparing the abnormality of our current economic state, we should always consider what "normal" actually is. There's now a Japanese edition of Five Things. 世界のビジネスニュースを毎朝メールでお届けします。ニュースレターへの登録はこちら。 |

Post a Comment