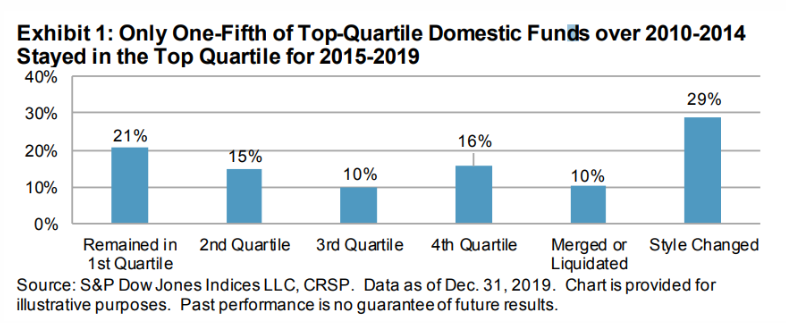

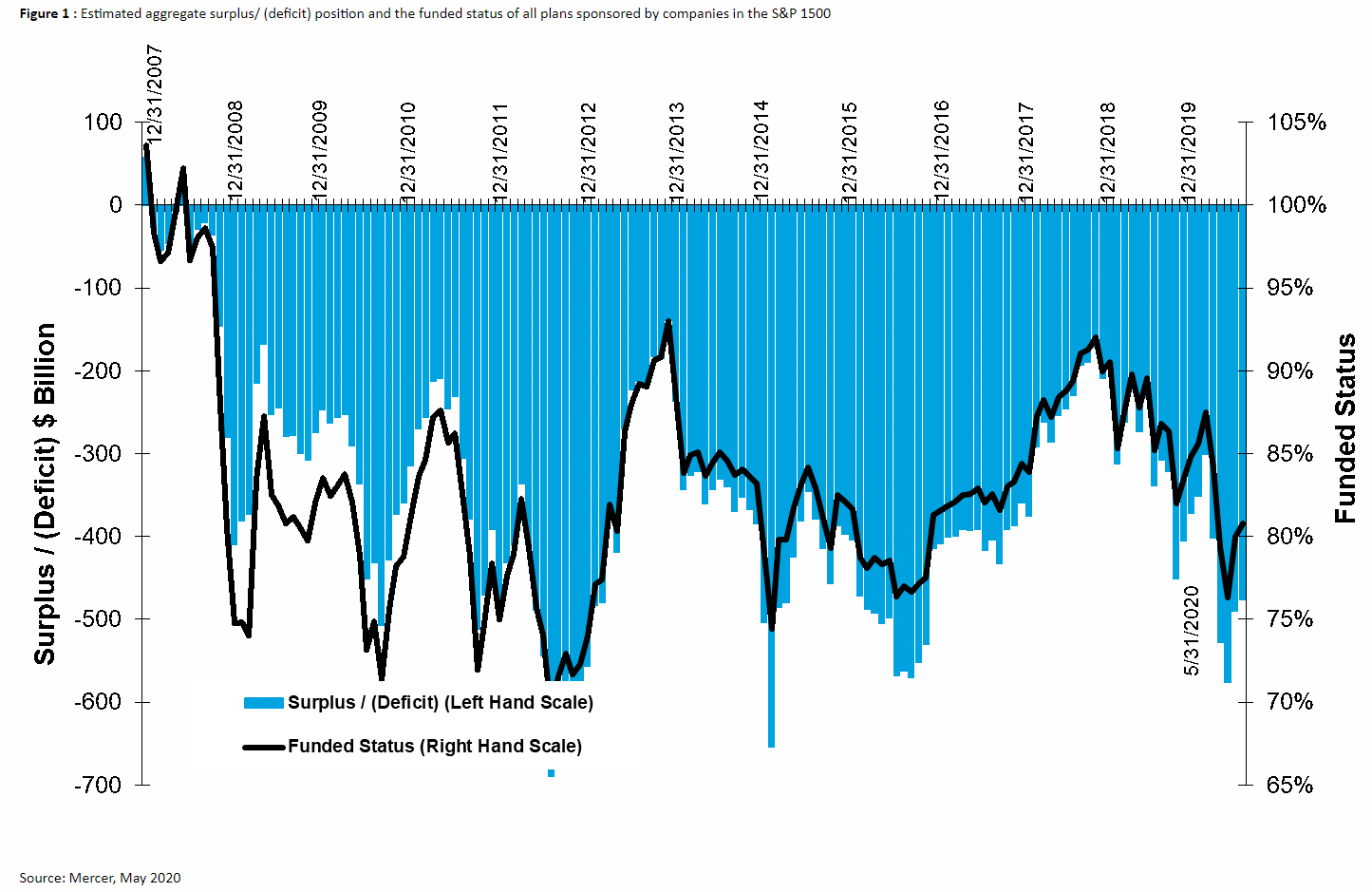

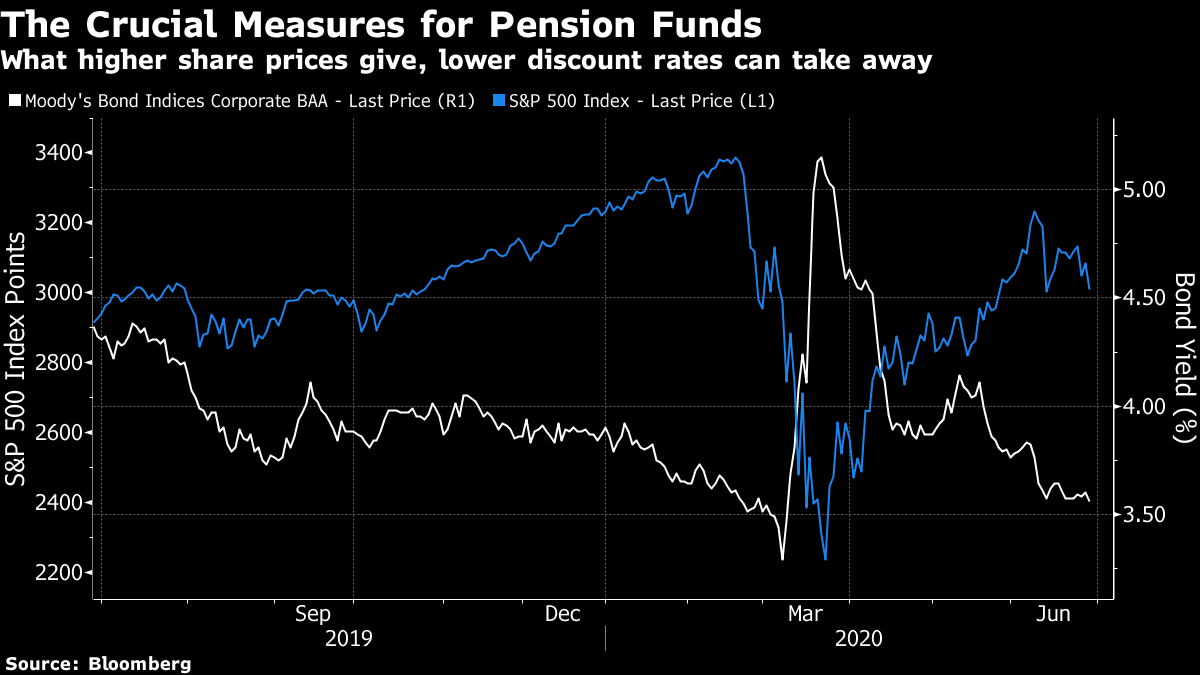

Persistence Marketing for mutual funds always carries the disclaimer that past performance is no guarantee of future returns. And of course it isn't. But the degree to which past performance fails to persist over time goes far beyond the ups and downs of the market, and remains one of the biggest arguments against active management. The latest persistence scorecard for U.S. mutual funds produced by S&P Global Indices, which can be found here (it is worth also downloading the full document) shows that strong recent relative performance is almost a reason to avoid a fund. The link will also take you to similar S&P studies for Australia and Canada, but for now I will restrict myself to U.S. funds, with apologies to Australian and Canadian readers. Of the funds that made it into the top 25% of returns in the five years from 2010 to 2014, only 21% of them managed to stay in the top quartile for the following five years. By comparison, 29% of the 2010-14 top performers switched and started investing in a different style — so whatever worked for them at the beginning of the decade, they did not trust it to keep working for them:  Over the years, mutual fund marketing has generally evolved from boasting about past returns, and journalistic coverage has moved on from publishing league tables of funds' returns. The S&P study, which uses data from Center for Research into Securities Prices (CRSP) at the University of Chicago, and uses Lipper definitions for the investment styles that funds follow, shows that these are healthy developments. However, it is most unhealthy that active managers find it so difficult to keep performing well year after year, as a healthy active management industry should help with price discovery and market efficiency. The case for active management in government bonds looks much stronger, with 61% of top quartile managers from 2010-14 holding on to that position in 2015-20, and there were similar examples of persistence in a range of other fixed income asset classes. This is good news, as indexing in fixed income tends to involve giving more money to borrowers with more bonds outstanding. Note however that the samples are small, with only a few funds in each sector. The problem grows more acute for small-cap equities, for which the case for indexing is weaker and where there should be a clearer role for active managers conducting their own research and spotting diamonds in the rough. But the slings and arrows have been particularly brutal. Small-cap managers who finished in the top quartile for 2014-16 were far more likely to appear in the bottom quartile for 2017-19 (25.8% of them) than in the top quartile again (only 1.6%). Good recent performance was literally a reason to expect bad performance in future. Aye Soe of S&P Global suggests that this is largely due to swings in market sentiment. At one point "quality" small-caps, with strong balance sheets, were in favor; and then very suddenly, it became fashionable to bet on small stocks in danger of bankruptcy. Over the very long term, good and disciplined small-cap managers should still be able to prove their worth. But unfortunately they have almost no way of proving that they will be among the survivors on the basis of their most recent performance. The Road From Here Last week I took part in an online chat with Esty Dwek, head of global market strategy for Natixis Investment Managers, which you can find here. If you sit through all of it you will get to see guest appearances in the background from my wife, all three of my kids, and even one of our cats. One exchange lives in the memory, on Covid-19. This is the only contribution I feel like making today to this ever more unpleasant and divisive topic. Esty, who is based in Geneva, suggested that life was more or less back to normal there, and questioned the degree of negativity I was voicing about the continuing problem with the pandemic here in the U.S. And certainly it does appear that a number of major European countries have reopened, more or less without incident, having previously suffered outbreaks worse than anything seen in the U.S. outside of the New York area. It would be useful to try to isolate what the difference is between the way the likes of Switzerland, Austria, Germany and France have handled reopening after the pandemic, and the way that the Sun Belt states are handling it. It's possible that it's something as simple as the prevalence of air-conditioning in the U.S. It's possible that the declining mortality rates may yet render the whole question moot. And it is possible that the U.S. states reopened too soon, or without safeguards that European countries had put in place. Either way, it would be constructive for the debate over Covid-19 in the U.S. to focus on the apparently far more successful record of countries in continental Europe. Supreme Indifference There is no institution more fascinating than the U.S. Supreme Court. The last few weeks have brought any number of momentous surprises, culminating in Monday's 5-4 decision that the court's jurisprudence on abortion, effectively leaving the right to abortion intact, should remain in place. That decision came from John Roberts, the chief justice, who cited the need to obey a precedent set in a case where he himself had been one of the justices to dissent. You can read Noah Feldman's fascinating take on this legal drama here. It's not my job to write about the Supreme Court and I am not a lawyer, so I will restrict myself to covering one of the lowest-profile decisions the court made this term, on pensions. The jurisprudence behind the decision may well have been correct, but in my opinion the decision is an unfortunate one that could yet stoke deep problems for seriously under-funded pensions in the U.S. In Thole v. U.S. Bank, two retired members of U.S. Bank NA's pension plan had sued for the right to bring a class action against the pension plan on the basis that it had been poorly investing the plan's assets. They requested the repayment of approximately $750 million to the plan in losses suffered due to what they regarded as mismanagement. They had never, however, suffered any interruption to their own pension payments, which had continued in line with the contractually agreed amounts. The court ruled that they could not bring an action against the pension plan because: "They have received all of their vested pension benefits so far, and they are legally entitled to receive the same monthly payments for the rest of their lives. Winning or losing this suit would not change the plaintiffs' monthly pension benefits." The fact that defined-benefit plans have a legal duty to keep paying pension benefits does not, however, guarantee that they will find the money from somewhere to pay it. From my perspective, ignorant of the specific legal principles at stake, this decision seems naive. It would instead make sense to offer as many avenues as possible to put pressure on pension plans to make sure that they are able to pay. Or, to quote the dissenting justices: "The Court holds that the Constitution prevents millions of pensioners from enforcing their rights to prudent and loyal management of their retirement trusts. Indeed, the Court determines that pensioners may not bring a federal lawsuit to stop or cure retirement-plan mismanagement until their pensions are on the verge of default. This conclusion conflicts with common sense and longstanding precedent." This matters, because the Federal Reserve appears determined to put a cap on corporate bond yields. Defined-benefits plans are dependent on two factors: returns on assets (largely stocks), and bond yields, which determine how expensive it is to buy an income – or in other words to meet their liabilities. The latest figures from the actuaries at Mercer, up until the end of May, show that S&P 1500 plans were in deep deficits, of about $500 billion, although the counter-acting effects of higher share prices and lower discount rates have largely stopped the deficit from deepening any further.  The problem is that the Fed's master plan for getting through the next few years, and financing the huge sums of money that were thrown at the Covid-19 pandemic, is financial repression. This is the phrase for effectively forcing investors to lend to the government at artificially low rates. The Fed's startling decision to move ahead with buying corporate bonds this month (even bonds issued by Apple, a company possibly in less need of help than any other on the planet) shows that financial repression is Plan A. There are arguments that this may be less painful than the alternatives, but it will be excruciating for pension plan managers, as it makes the cost of their liabilities artificially high. If we look at BAA-rated corporate bond yields, which have fallen during June, and the S&P 500, which has stayed roughly where it was, it looks as though the position for pension plans is growing more painful.  The U.S. has already suffered a decade of deepening inequality, largely as a result of the policies put into effect to deal with the previous crisis. With the Fed now embarked on financial repression, the nightmare scenario for the future is that large corporate pension plans will find that they are unable to meet their commitments. That would ratchet up inequality still further. I am not saying that such a nightmare scenario is unavoidable. But the Supreme Court's decision delays any possibility of legal redress against pension managers who slip into trouble until they are right on the verge of default. To a legal novice like me, that looks like a mistake. Survival Tips As well as a survival tip, this is a programming note: I am taking the next week off, and will be back at work on July 7. Depending on your time zone, expect the next Points of Return in the early hours of July 8. I need a break, and I suspect we all need to pace ourselves. I'm off to stay with friends near Boston, and with any luck will be spending Tuesday swimming in Walden Pond, the beautiful lake surrounded by woodlands and made famous by Henry David Thoreau's book Walden. This was the location for his experiment in living closer to nature. Walden is most famous for Thoreau's deathless observation that "the mass of men lead lives of quiet desperation." This now looks dated, as the U.S. and much of the rest of the world is given over to people voicing their desperation very loudly. The political atmosphere, and indeed the atmosphere for substantive debate on any important topic, is as toxic as I can remember. Our levels of trust in each other, and in critical institutions, are dangerously low. So let me offer a few lesser known gems from Walden. "Rather than love, than money, than fame, give me truth," Thoreau said. Truth has never seemed more elusive; the eradication of trust in any given piece of information has much to do with the level of discord in society. Thoreau's idealism can seem wildly impractical but it remains an intoxicating brew: "If you have built castles in the air, your work need not be lost; that is where they should be," he said. "Now put the foundations under them." Let's try to be guided by that sentiment as we try to survive the second half of 2020. Have a good week. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment