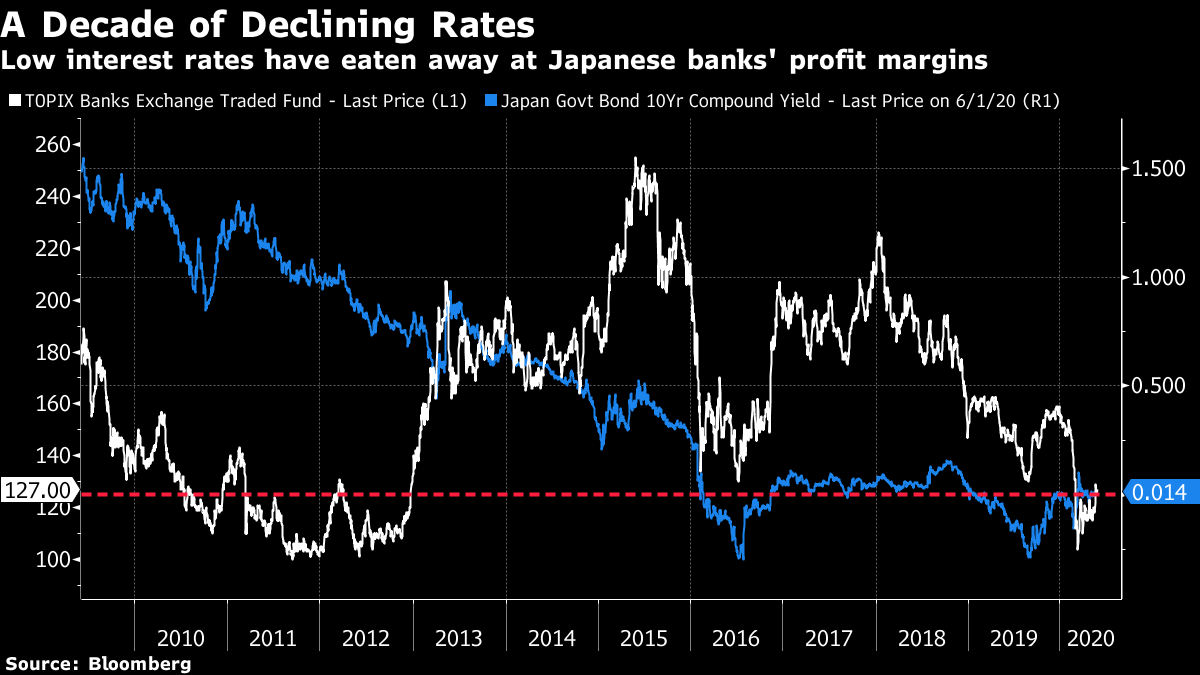

| Trump faces harsh criticism over his handling of protests. Stocks shrug off the social unrest in the U.S. And Facebook's CEO defends stance on allowing inflammatory rhetoric on the social media platform. Here are some of the things people in markets are talking about today. U.S. President Donald Trump came under harsh criticism from religious leaders and Democrats for the government's violent dispersal of a peaceful protest outside the White House on Monday, while some Republicans expressed disapproval and the U.S. military distanced itself from the episode. The Catholic archbishop of Washington said it was "reprehensible" for a shrine to Saint John Paul II in the city to host Trump. The president's presumptive re-election challenger, former Vice President Joe Biden, said in a speech that the country is "crying out for leadership." Two Republican senators said they did not support the use of tear gas, rubber bullets and flash-bang devices to disperse protesters gathered Monday in Lafayette Square, across the street from the White House. Trump has championed an authoritarian government response to nationwide protests over the death of an unarmed black man in Minneapolis police custody last week. Pentagon officials on Tuesday distanced themselves from both the police actions in Lafayette Square and Trump's threat to use the military. Here's how Bloomberg is tracking the protests. Asian stocks looked set to follow U.S. shares higher for a third day as investors continued to bet on an economic recovery from the coronavirus pandemic. The dollar dropped. Futures pointed higher in Japan with the yen slumping overnight. Contracts in Hong Kong and Australia also advanced. Earlier, the S&P 500 climbed to its highest since early March with energy shares rising as crude oil extended its rebound. Gunmakers extended rallies as Trump vowed to dispatch troops if social unrest isn't contained. Treasuries retreated. Crude oil advanced. Facebook CEO Mark Zuckerberg told staff at a companywide meeting that he won't change his mind about a decision to leave up a post shared by Trump last week, which many employees felt violated the company's policies against violent rhetoric. Zuckerberg told workers that he and other members of the company's policy team couldn't justify saying that the message clearly incited violence, meaning that it didn't break Facebook's rules, according to two people who attended the meeting. Facebook is responding to the most intense internal protest in its history, involving public resignations and increasing outrage over Zuckerberg's decisions. Zoom Video Communications reported quarterly sales that leapfrogged estimates, showing that a surge in demand for its video-conference service during the coronavirus pandemic has translated into more paying customers. The company also roughly doubled its annual revenue forecast. Zoom projected sales of as much as $1.8 billion in the fiscal year, from a forecast of as much as $915 million in early March. Analysts estimated $930.8 million. While security and privacy issues plagued the system early in the quarantine, Zoom has become an essential social network, attracting more than 300 million participants some days, up from 10 million in December. China's success in luring foreigners into its domestic debt market, the world's second largest, faces a new test in coming months as officials try to drum up interest in a record wave of bonds from local authorities. International funds now hold 8.6% of China's central government bonds, several times more than the share just several years ago, and not terribly far from the 13% overseas stake in Japanese sovereigns. Inflows continued through the coronavirus crisis, and the U.S. trade war. Officials are hoping that interest might extend to local government notes, where foreign ownership is merely 0.01%. Issuance will climb to 4.73 trillion yuan ($666 billion) this year to help bolster economic growth that is expected to be the worst since the 1970s. What We've Been Reading This is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in this morning I've written before that Valeant — the pharmaceutical company that pursued outsized growth with aggressive acquisitions and accounting — is emblematic of a wider dynamic in markets during an era of low interest rates and sluggish economic growth. The company was able to borrow cheap money, thanks to investors clamoring for yield, which it then used to finance deals that would continuously add to its bottom line, creating a lucrative feedback loop between capital markets and equity valuations. The implication is that in an environment of low economic growth, taking shortcuts that quickly manufacture growth can be tempting.  Anyway, I was reminded of that dynamic after CreditSights published a 10-year retrospective on Japan's beleaguered banks. The analysts note that the country's biggest lenders have grown their loan books by 31% between 2010 and 2020, with almost all that growth coming from "overseas through both organic loan growth and acquisitions." The amazing statistic here, however, is that acquiring all that risk in the form of foreign assets and new businesses still hasn't been enough to offset Japan's low interest rates as asset yields continue to fall. Profit margins at the banks as measured by net interest revenue are down 17% in the decade, according to CreditSights. Japan is often described as the developed world's future as interest rates continue to plumb new lows. Its banking system may be emblematic of the limits of engineering growth. You can follow Bloomberg's Tracy Alloway at @tracyalloway. The best in-depth reporting from Asia and beyond. Sign up here to get our weekly roundup in your inbox. |

Post a Comment