Decision day at the Fed, OECD is gloomy, and Fauci warns pandemic is far from over. GuidanceThe Federal Open Markets Committee will release its first quarterly forecasts since December along with the latest monetary policy decision at 2:00 p.m. Eastern Time today. The Fed is all but certain to keep interest rates in a zero to 0.25% target range and signal it is not yet ready to exit emergency policies introduced to keep credit flowing during the pandemic. Last week's surprising payrolls numbers are unlikely to see any major change to the outlook yet, with economists surveyed by Bloomberg not seeing a hike in rates until 2022. The announcement will be followed by a press conference with Fed Chairman Jerome Powell at 2:30 p.m. HoldThe OECD this morning released its latest forecasts for the global economy which make for grim reading. The organization emphasized the need to maintain stimulus measures as it predicts a 6% slump in global economic activity this year, or a 7.6% contraction if there is a second wave of the virus. It also warned that any recovery would be uneven, echoing sentiments from the World Bank earlier this week. The cautious approach to stimulus withdrawal is at odds with some Republican lawmakers who are now questioning the need for more help for the U.S. economy. Not there yetNew coronavirus infections rose at the slowest pace since March in the U.S. yesterday while data from states like Texas showed that hotspots still remain. Anthony Fauci, director of the National Institute of Allergy and Infectious Diseases, described the pandemic as his "worst nightmare" and warned that the outbreak is far from over. President Donald Trump said he may resume holding large campaign rallies as soon as next week. Reopenings in Europe have not yet shown any signs of an increase in cases there. Markets riseEarly-morning attempts to rebound from yesterday's dip in global equities have been derailed, on the heels of the OECD's party pooper. Overnight the MSCI Asia Pacific Index added 0.4% while Japan's Topix index closed 0.2% lower. In Europe, the Stoxx 600 Index gave up earlier gains to trade down 0.3% by 5:50 a.m. S&P 500 futures also turned slightly lower, the 10-year Treasury yield was at 0.799% and oil dropped. Coming up...The U.S. inflation report for May published at 8:30 a.m. is forecast to show both headline and core CPI at 0% for the month. Oil inventories data at 10:30 a.m. may show the biggest build in stocks since April. The May U.S. monthly budget statement is at 2:00 p.m. Treasury Secretary Steven Mnuchin appears before Senators from 10:00 a.m. Guess? Inc. is among the companies reporting earnings. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningLast week I wrote about how it looked like investors were fast-forwarding to the end of the videotape and thinking: "We know this story ends with record high stock prices and low interest rates, so why not just go there now." But beyond the ferocious market rally, if you just look at the performance of different sectors, it increasingly looks like we may have just done a complete market cycle in the span of four months which might in some other era have taken a decade.

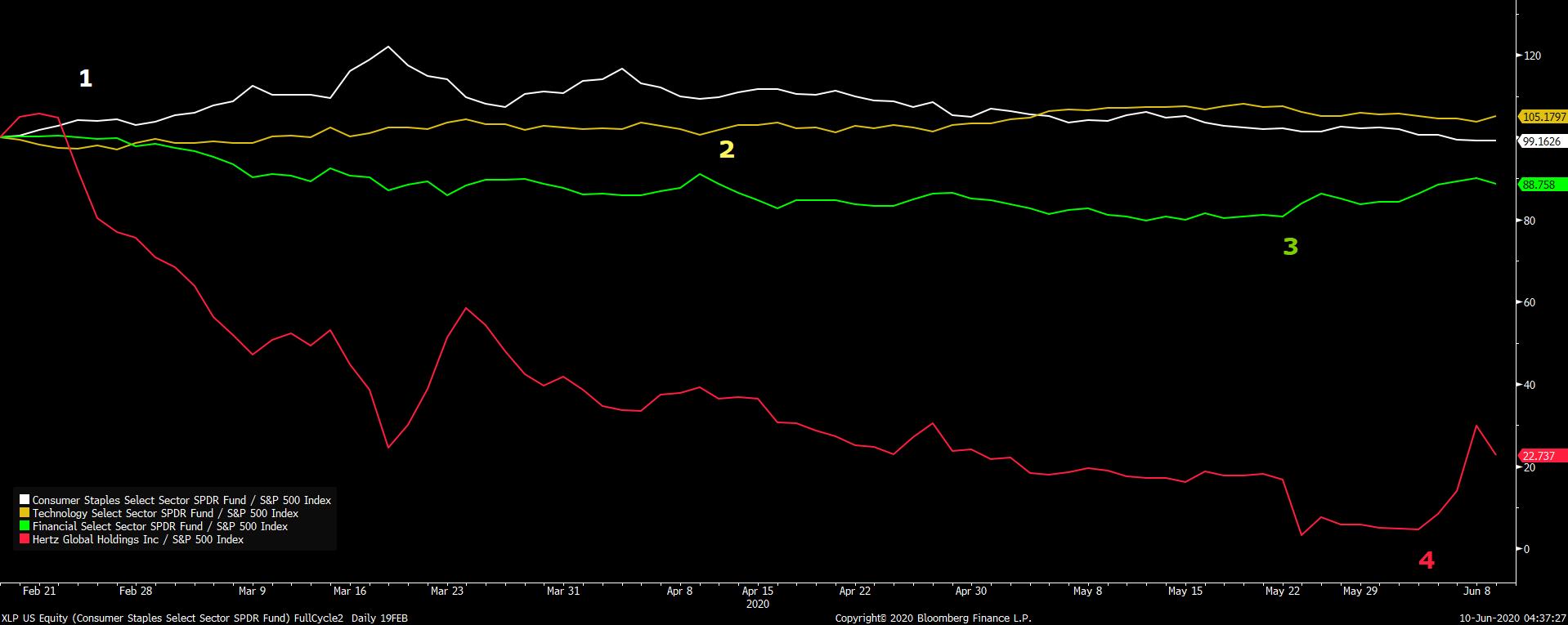

The below chart is marked with four phases. The first shows consumer staples stocks outperforming the S&P 500. This was the downturn, and of course during this period, companies that make stuff like canned soup and toothpaste outperformed, because that's what does well in a bear market or recession. The second phase shows how in early April tech stocks (the yellow line) really started outperforming. As people started to grow a little more confident, they bought stable growth companies with strong balance sheets as a kind of safe way to go long the market. Then the third phrase shows when financial stocks (the green line) started outperforming the overall market, as people started to actually bet on a potentially decent economic recovery. And then finally the fourth phase is the incredible last few days, where we saw a true dash for trash as bankrupt companies like Hertz (the red line) started outperforming the market. This last phase calls to mind the infamous BusinessWeek cover story by Luke Kawa about crazy message board traders on Reddit pushing the market around.  So that's your complete cycle: From toothpaste to tech stocks to bank stocks to trash. All since mid-February. Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. A Japanese edition of Five Things is coming soon.世界のビジネスニュースが届くニュースレターへの登録はこちら。日本時間の朝に配信します。 |

Post a Comment