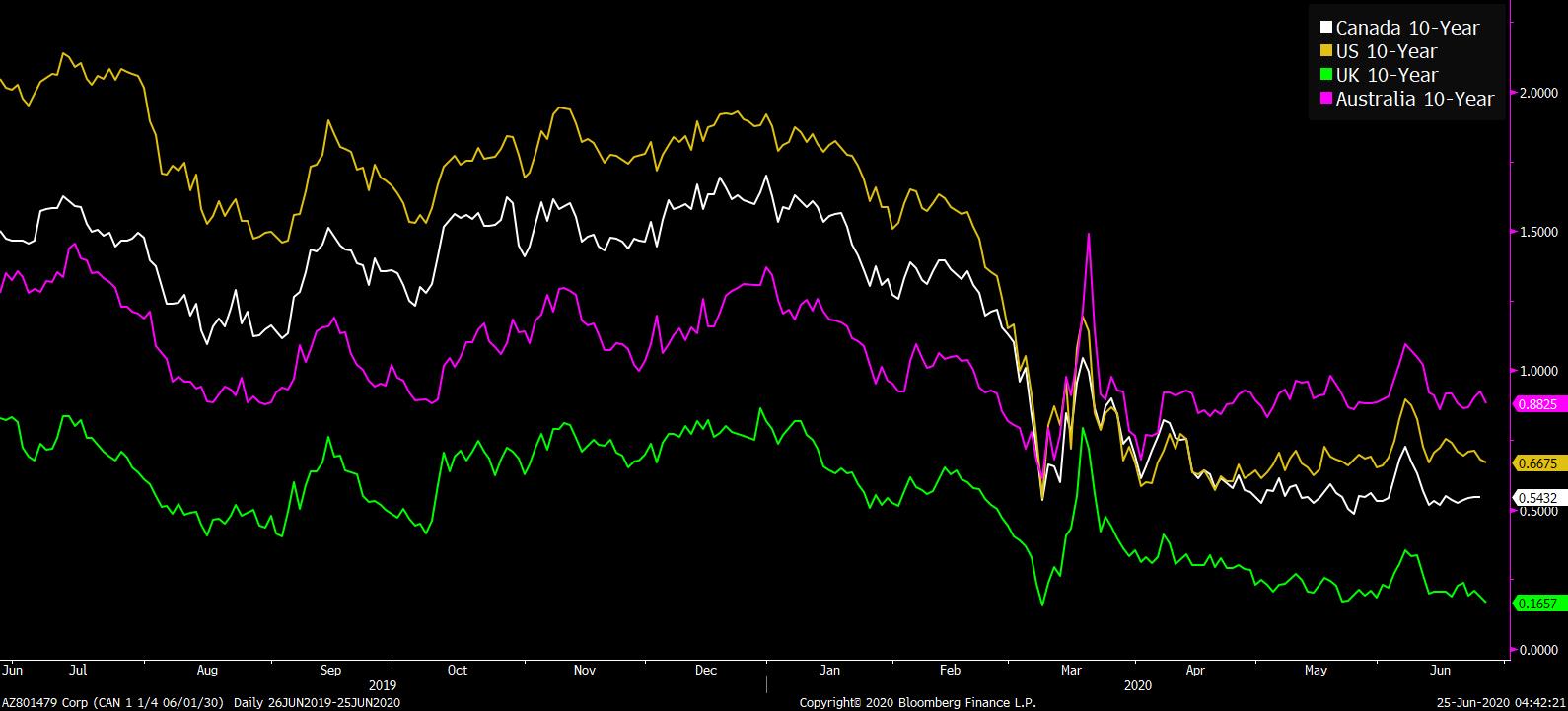

"Massive outbreak" in Texas, jobless claims expected to exceed 1 million again, and Wirecard files for insolvency Rethinking plansThe U.S. saw one of its highest-ever increases in the number of Covid-19 cases yesterday, forcing some of the hardest-hit states to take drastic measures. Texas is experiencing a "massive outbreak" with a surge in hospitalizations, Governor Greg Abbott said. In California, Walt Disney Co. indefinitely delayed the reopening of its theme parks. The University of Washington's Institute for Health Metrics and Evaluation's model now predicts 180,000 Americans will have died from the virus by October, a 10% decrease from its previous forecast. Another million plusEconomists forecast that today's initial jobless claims total will be over 1.3 million, which would make it the 14th week in a row the number has surpassed the previously unprecedented 1 million mark. Continuing claims are expected to remain higher than 20 million when the data is published at 8:30 a.m. Eastern Time. With areas accounting for between one-third and one-half of U.S. GDP suffering increase in coronavirus cases, there are concerns the claims number won't fall for some time. Were-cardWirecard AG, the German payment-processing firm that can't find over $2 billion missing from its balance sheet, filed for insolvency. The company's very rapid fall from grace has seen its CEO resign, then get arrested, and its share price crash from over 100 euros last week to under 3 euros this morning. On a more positive note for German business, Deutsche Lufthansa AG's biggest shareholder said he would back a government bailout of the airline, boosting the company's shares and bonds. Markets mixedWhile global equity investors are still nursing a virus-outbreak shaped hangover, they are finding reasons to buy as some gauges post a small recovery from yesterday's sell off. Overnight the MSCI Asia Pacific Index dropped 1% while Hong Kong and China were on holiday. Japan's Topix index closed down 1.2% lower In Europe the Stoxx 600 Index reversed an earlier slide to trade 0.2% higher by 5:50 a.m. S&P 500 were pointing to a small loss at the open in a volatile pre-market session, the 10-year Treasury yield was at 0.669% and oil was under $38 a barrel. Coming up...At 7:30 a.m. the European Central Bank publishes an account of its June policy meeting. As well as claims data, May durable goods orders and the third reading of U.S. first-quarter GDP are at 8:30 a.m. In Federal Reserve news, the results of the latest round of bank stress tests are released and Dallas Fed President Robert Kaplan and Atlanta Fed President Raphael Bostic both speak. Nike Inc. and Accenture Plc are among the companies reporting results. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningFitch Ratings removed Canada's AAA credit rating yesterday on account of the government's substantial Covid-19 emergency spending. These sovereign ratings downgrades never really matter much. Nonetheless, the news did get me to check the yield on Canadian 10-year debt, and it will surprise nobody to see that it's trading near record-low levels (the white line in the chart). An often-forgotten point is that the U.S. government's ability to maintain ultra-low bond yields while spending enormous amounts of money is not unique. People often talk about how it's something only the U.S. can get away with because of the dollar's special status. But last I checked the loonie wasn't a dominant global reserve currency either. Neither is the Australian dollar. Neither is the British pound. And yet, all those government bond yields are at rock-bottom levels.  Next time you're about to make a point about U.S. fiscal or monetary capacities, and how the dollar is what makes the U.S. special, check what's happening in Canada and see if the argument still applies. You might save yourself some embarrassment. Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment