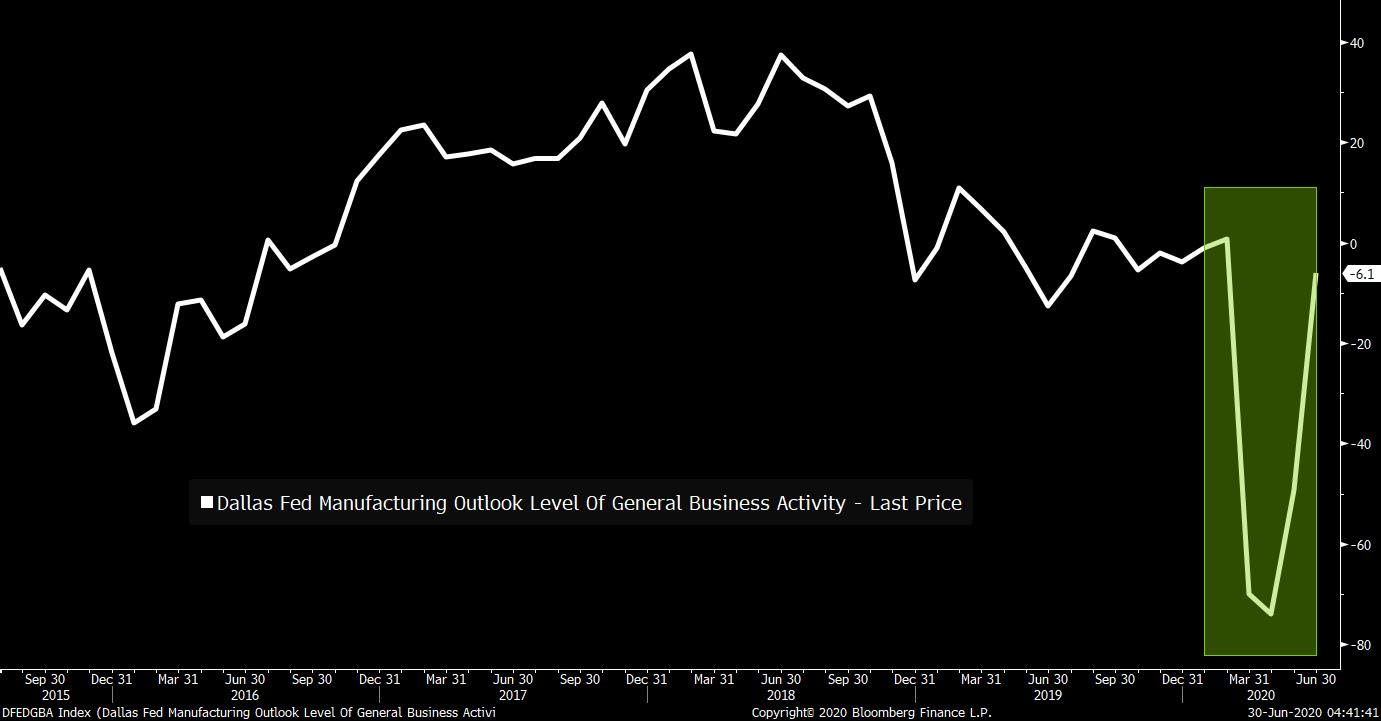

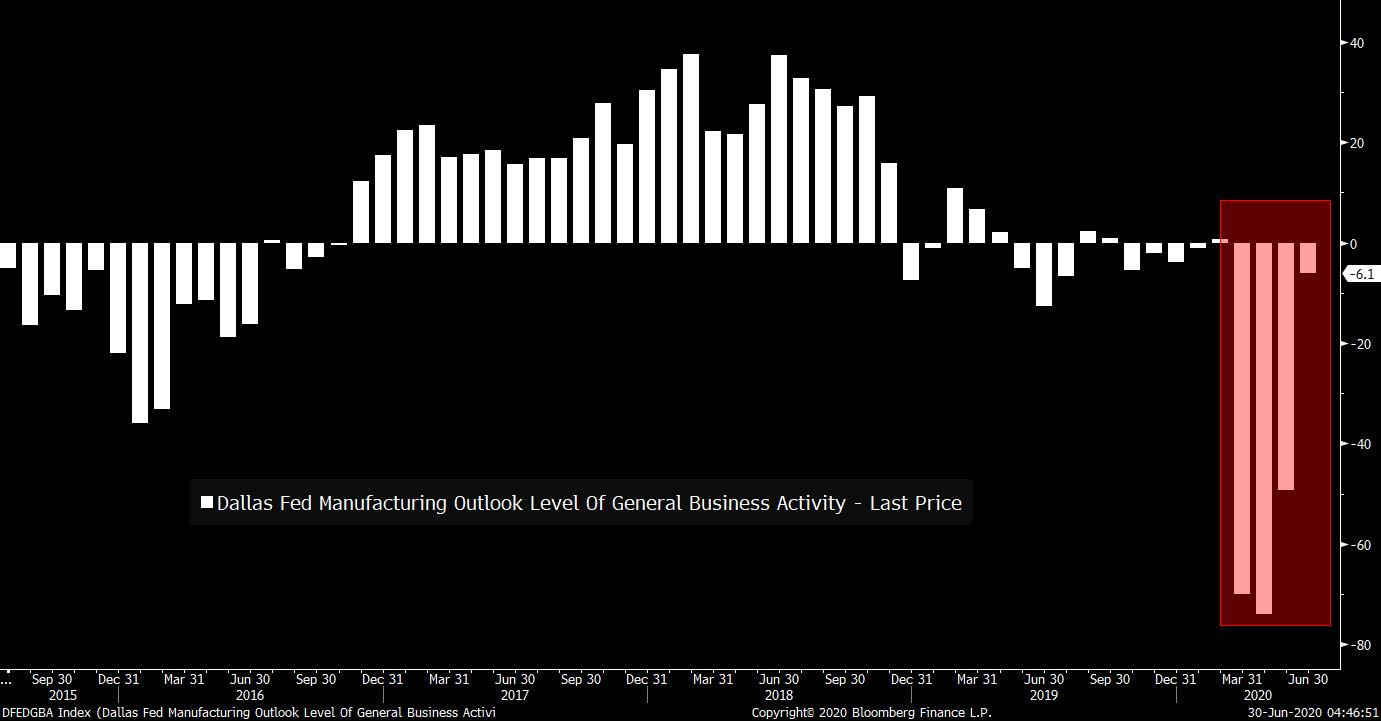

Powell warns of extraordinary uncertainty, WHO warns the worst is yet to come, and U.S. starts to roll back Hong Kong's special status. UncertainFederal Reserve Chairman Jerome Powell will warn the path forward for the U.S. economy is "extraordinarily uncertain" in his prepared remarks for testimony before the House Financial Services Committee from 12:30 p.m. Eastern Time. Treasury Secretary Steven Mnuchin will join Powell in the House to discuss the fiscal and monetary response to the pandemic shutdown. Powell will make clear that the government measures to provide relief would need to remain in place "for as long as needed." Going to get worseThe World Health Organization warned that the world is far from seeing the end of the pandemic, saying the worst is yet to come. In the U.S. more states took steps to scale back reopenings with Arizona closing bars and New Jersey halting plans for indoor dining. Australia imposed a four-week lockdown across parts of Melbourne, while in Iran 10,000 health-care workers have contracted the virus. The German infection rate remained below the key 1.0 threshold, while in the U.K. Prime Minister Boris Johnson will commit to infrastructure spending in an effort to rebuild the virus-ravaged economy. Hong Kong China's top legislative body approved a landmark national security law for Hong Kong in a unanimous vote this morning. The Trump administration yesterday escalated pressure on Beijing when it ended some special treatments for Hong Kong regarding the export of sensitive technology. The U.K. said the passage of the law is a "grave step" amid fears that the former British colony's status as an international commercial hub could come under more pressure. Markets mixedIt's the last trading day of what has been a very eventful first half of the year and stocks are not doing very much at all. Overnight the MSCI Asia Pacific Index added 0.6% while Japan's Topix index closed 0.6% higher. In Europe, the Stoxx 600 Index was 0.2% lower at 5:50 a.m. in a session that has seen the gauge fluctuate between gains and losses. S&P 500 futures were pointing to a small drop at the open, the 10-year Treasury yield was at 0.633% and oil slipped. Coming up...Democrat lawmakers will go to the White House this morning for a briefing on reports that Russian operatives in Afghanistan offered bounties for the killing of American soldiers. S&P CoreLogic U.S. house prices for April is published at 9:00 a.m., with Chicago PMI for June at 9:45 a.m. As well as Powell, we will also hear today from New York Fed President John Williams, Fed Governor Lael Brainard, Minneapolis Fed President Neel Kashkari and Atlanta Fed President Raphael Bostic. Dr. Anthony Fauci testifies before the Senate Health and Education Committee. FedEx Corp. reports results and SpaceX is scheduled to launch a Falcon 9 rocket. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningBy this point, you're probably tired of hearing the economy described in alphabet shapes. V-shaped, U-shaped, K-shaped etc. Nonetheless, it's worth pointing out how easy it is to be deceived by certain types of data, especially manufacturing surveys, into thinking the recovery is more robust than it is. Yesterday we got the Dallas Fed Manufacturing index, and the general shape of it certainly looks pretty V-ish. It's almost back to where it was pre-crisis.  But it turns out this isn't a V at all. The key reason is that these regional Fed surveys, or PMIs, or ISMs (they're all similar) aren't measuring some absolute level of activity. They're measuring how the panelists' businesses are doing relative to the month before. So you'll notice that the Dallas Fed chart above shows a reading of -6.1. Because it's below 0 that means respondents on net actually said business was worse than it was in the prior month. Here's the same data as above, but presented as a bar chart, which makes the situation even more clear. As you can see, manufacturers in Texas have now reported four straight months of the situation being worse than it was in the month before. Yes, the pace at which it's getting worse is less severe, but it's still a sequential deterioration.  Anyway, all you have to do is take one look at the actual survey, and you'll see there's no V. The employment situation is getting worse. More manufacturers are still laying off workers than expanding payrolls. Only 29% of survey respondents see a better economic future than they saw the previous month. Business uncertainty is still growing. And if you read the anecdotal comments, there's already some talk from companies about how the latest rise in Texas virus cases is an economic concern. Bottom line: there are a lot of charts that look like a V, but in reality they don't show anything close to a snapback to normal.

Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment