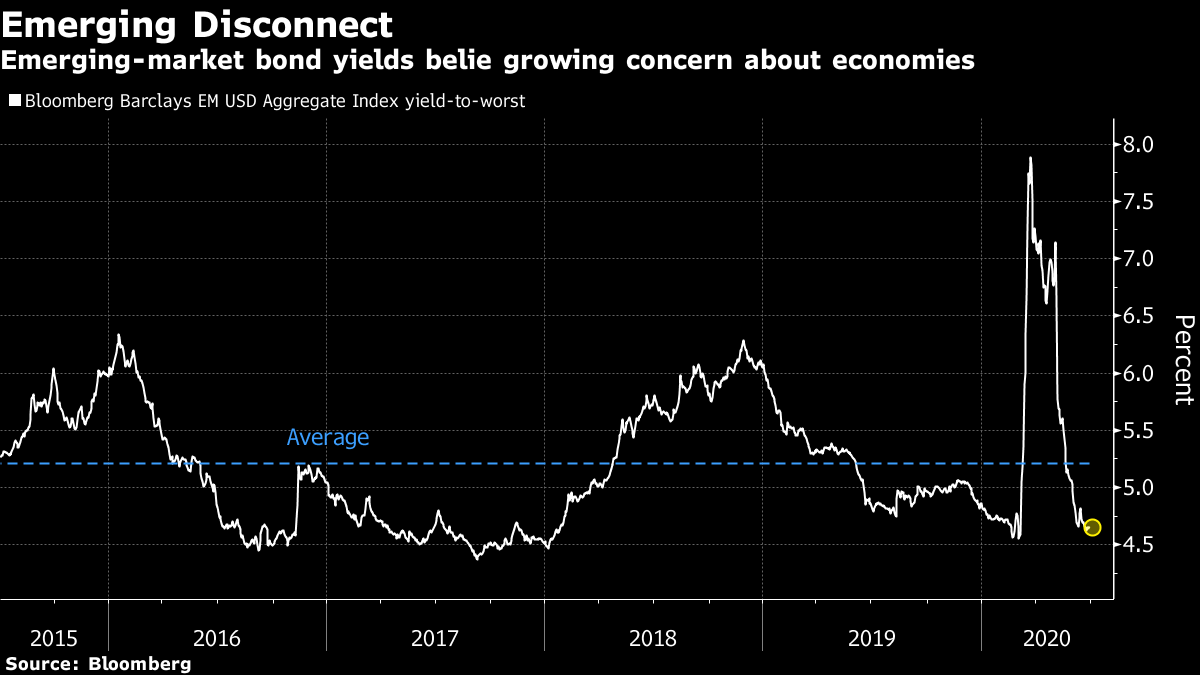

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. China approved a controversial Hong Kong law, there's new uncertainty for the travel and leisure sector and the second quarter is drawing to a close. Here's what's moving markets. China Acts on Hong Kong China's top legislative body approved a landmark national security law for Hong Kong, seen as an attempt to quell dissent that risks U.S. retaliation and the city's appeal as a financial hub. The Trump administration on Monday made it harder to export sensitive American technology to Hong Kong, suspending regulations allowing special treatment for the territory over dual-use technologies like carbon fiber used to make both missile components and golf clubs. "Sanctions will not scare us," replied Hong Kong Chief Executive Carrie Lam, and China said it will impose a visa ban on U.S. citizens who interfere with the legislation. The official Xinhua News Agency will publish details of the law today, marking the first time the law will be fully disclosed to the public, the South China Morning Post reported. Fresh Travel Uncertainty Travel and leisure investors face fresh uncertainty on several fronts. European Union governments are likely to extend restrictions on U.S. residents for at least two weeks, according to a draft decision seen by Bloomberg that signals the travel ban won't be lifted until American authorities control the spread of Covid-19. The bloc will lift restrictions for Chinese residents as of July 1, however, on the condition that Beijing reciprocates. Separately, Greece said it won't allow any direct flights from the U.K. and Sweden until July 15. Finally, investors in U.K. leisure will hope the fortunes of coronavirus hotspot Leicester are not a sign of things to come. The U.K. government confirmed the city's non-essential shops will close again and its hospitality sector won't be part of this weekend's grand reopening. All this, just as the World Health Organization warns the worst of the pandemic is still to come. A Quarterly Rebound European equity index futures pointed flat to marginally higher when they eventually began trading following a delay for an unknown reason on the Eurex derivatives exchange. Asian stocks advanced and the MSCI All Country World Index is up about 18% for the quarter on the last day of the period, the biggest advance in 11 years -- on the heels of the worst quarter since 2008. Elsewhere, the euro was unchanged against the dollar after German Chancellor Angela Merkel gave her backing to the European Union's proposed Covid-19 stimulus package, in a speech alongside French President Emmanuel Macron, and the pound edged higher ahead of U.K. Prime Minister Boris Johnson's expected announcement on infrastructure spending. Finally, for commodities watchers, it's worth mentioning copper, which is up again and headed for its best quarter since 2010, partly aided by supply disruption in South America due to the virus. Deals Dry Up. Almost Global merger and acquisition activity has almost dried up. With Covid-19 clouding the outlook for nearly every sector, deal volume in the second quarter was the lowest since the late 1990s, according to data compiled by Bloomberg. There are signs of life, however, with Monday's news that BP Plc agreed to sell its petrochemicals business to Ineos Group Holdings SA in a $5 billion transaction and Bloomberg reporting that utility Electricite de France SA is considering a disposal of its waste-to-energy business. Elsewhere, yoga-pants firm Lululemon Athletica Inc. is to buy Mirror, a maker of in-home fitness equipment, for $500 million, and Max Factor cosmetics parent Coty Inc. snapped up a 20% stake in Kim Kardashian West's beauty business for $200 million. Not bad for a quiet market. Coming Up… On the Beach Group Plc reports interim results with the vacation retailer's stock having recovered partly from a year-to-date plunge of more than 70% at the height of the virus-driven selloff. We'll also get an update from South African retailer Steinhoff International Holdings NV, and watch chipmaker stocks, too, after U.S. firms Micron Technology Inc. and Xilinx Inc. gave strong sales forecasts. Elsewhere, euro area inflation and a final reading of U.K. first-quarter gross domestic product are on the data schedule. Finally, Bank of England Chief Economist Andy Haldane speaks during a webinar and U.S. Federal Reserve Chairman Jerome Powell will warn of an "extraordinarily uncertain" outlook but note a "welcome" bounceback in economic activity in testimony in Washington later. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning With more disconnects than a cellphone in the 1980s, global risk assets seem increasingly at odds with a still uncertain economic recovery and the spreading coronavirus. Prominent among them is the stellar performance of emerging market bonds, with a gauge of dollar-denominated debt set for its biggest quarterly advance in over a decade. The yield-to-worst on the Bloomberg Barclays EM USD Aggregate Index has slumped to 4.7% from a peak of 7.9% in March, and is well below its 5-year average of 5.2%. Obviously the flood of central bank stimulus is behind the move, even though unlike U.S. and European government and corporate debt, the Federal Reserve and European Central Bank are not directly buying emerging market bonds. That makes them a distinctly riskier proposition to their developed market peers, especially as developing nations won't have the same monetary firepower or investor patience should economic recoveries fail to quickly materialize. That risk doesn't look like it's in the price.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Clos |

Post a Comment