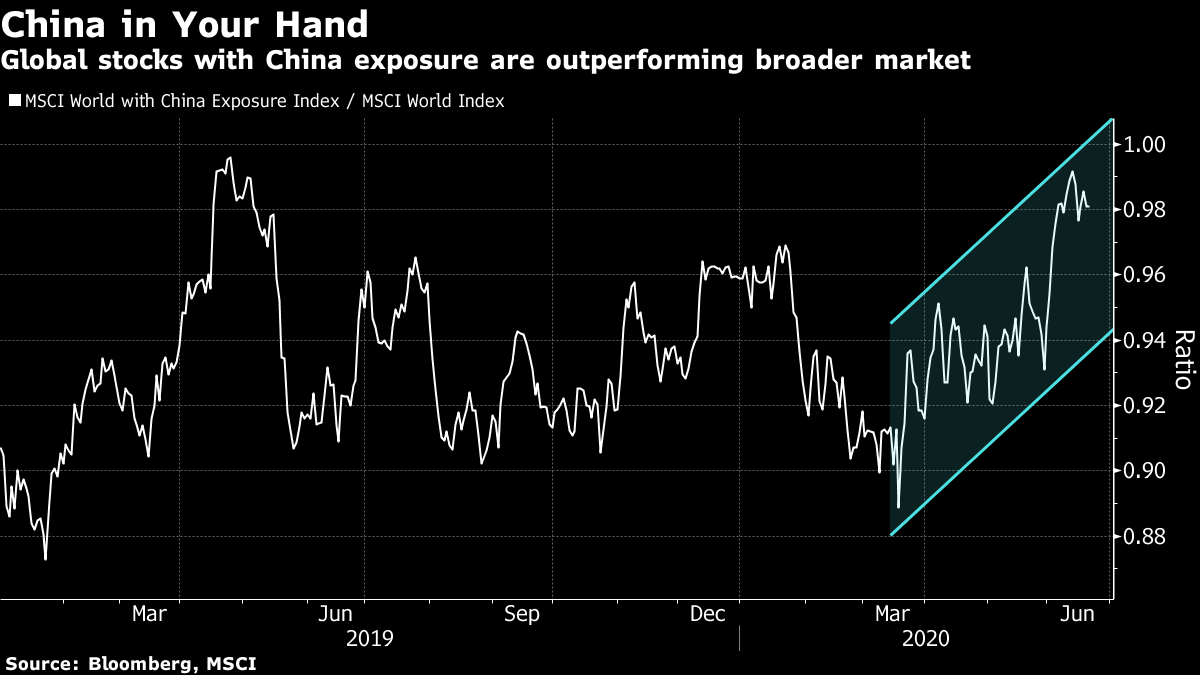

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. EU leaders start trying to work out their differences over a recovery plan, coronavirus deaths top 450,000 and Wirecard suspended an executive. Here's what's moving markets. EU Recovery European Union leaders will begin the effort to hash out a 750 billion-euro program to funnel money to those countries most affected by the economic effects of the coronavirus. Don't look for a deal today: The video conference that begins this morning is an initial session where heads of state are going to be doing a lot of listening to the objections of the holdouts, principally the Netherlands, Austria, Denmark and Sweden. Investors would be cheered if member states come out of the meeting with a bit of momentum and a roadmap for how to get a deal in July, as Angela Merkel and Emmanuel Macron have called for. If divisions become confrontation, however, it would dent the optimism that has helped lift equities from their March lows. Virus Impact While economies slowly reopen in Europe, coronavirus case numbers continued to mount in places like Texas and Mexico. Deaths globally from the pandemic topped 450,000. New York Governor Andrew Cuomo said he may order a quarantine for visitors from Florida, while California made masks mandatory. Public-health experts say people need to reset their expectations and change their behavior. "People are fatigued. They mistakenly feel that things were going away," said Cameron Wolfe, an infectious-disease doctor and associate professor of medicine at Duke University. "We're going to have to figure out a way to live with this." BOE Fallout The Bank of England's surprisingly restrained tone on the economy hasn't gone down well with investors. Both the pound and U.K. government bonds sold off after the central bank said Thursday it would slow the pace of its asset purchases, despite a 100-billion-pound boost to the size of the program. The market's gloomy response to the BOE suggests U.K. assets will be more vulnerable to shifts in sentiment in the coming weeks, as investors grapple with uncertainties from Brexit to the growth shock from the coronavirus pandemic. Wirecard Woes The story of Wirecard AG's finances, and whether they were what they appeared to be, ticked away in the background for the past year, of interest mostly to a small community of short sellers and the analysts and investors who follow or own the stock. That changed in a big way Thursday when the German payments company said auditors couldn't find about 1.9 billion euros in cash. The stock plunged 62%, casting doubt on the company's survival. This saga is likely to have many more twists and turns, and soon: Banks can pull 2 billion euros of loans to the company if it can't publish its annual report by today. Wirecard suspended its chief operating officer after the market closed Thursday. Coming Up… European stocks look set to finish the week on a decidedly subdued note, with index futures drifting and U.S. contracts marginally higher. And it may not feel like it from the choppy action of this week and last, but the rally from the March lows is intact -- the Stoxx Europe 600 Index is up 2.6% for the week, heading for its fourth weekly gain in five. There's little on the earnings calendar beyond a trading update from U.K. engineering-services firm John Wood Group Plc, and not much in the way of economic news either, other than U.K. retail sales. Trading could pick up in the U.S., where it's a so-called quadruple witching, the quarterly event when options and futures on indexes and equities are scheduled to expire. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning When we last checked in on the global basket of stocks most exposed to China in May, they were stuck in a narrow trading range. Since then they have been on a tear, shrugging off the resurgence of Sino-American tensions. MSCI Inc.'s gauge of global developed market equities with the highest China revenue exposure has now climbed 45% since it bottomed on March 18, compared with a 32% rise in the MSCI World Index over the same period. Downplaying the second wave of the coronavirus in China I understand; it seems localized and consensus suggests Beijing has the ability to quickly bring it under control. But a worsening in U.S.-China tensions remains a distinct threat to the Chinese recovery. President Donald Trump went out of his way Thursday to refute comments from his trade representative and confirm that the U.S. could pursue a "complete decoupling from China" in response to unspecified conditions. Strategists at Goldman Sachs warned this week of the downside risks to U.S. stocks with significant sales exposure to China. It seems only logical to extend this warning to the global basket of China-exposed shares.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment