| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here.

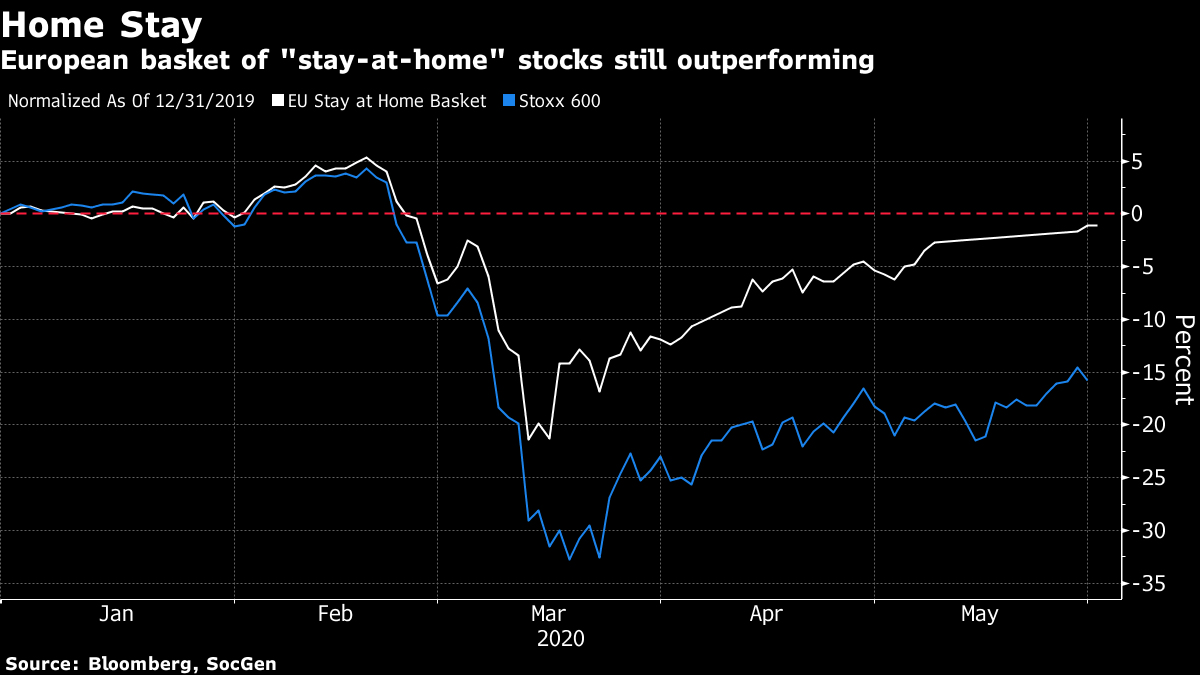

Good morning. Protests raged across the U.S., Beijing trolled Washington over the unrest and the European Union's chief negotiator had a warning for the U.K. Here's what's moving markets. Protests Rage Protests raged from New York to Los Angeles at the weekend over the death of George Floyd and other police killings of black people. U.S. President Donald Trump blamed violent protests on Antifa, a loosely organized movement that is a frequent target of conservative critics, and said he would declare the group to be terrorists. Business leaders from Wall Street to tech firm Apple Inc. spoke out, while Amazon.com Inc. is scaling back deliveries and adjusting routes due to disruption. The unrest also spread to Europe, with thousands gathering in central London. Beijing Trolls Washington China seized the opportunity to troll the U.S. over the rioting, following criticism and threats from Washington in recent weeks over Beijing's moves to quell unrest in Hong Kong. Trump used strong rhetoric about China's actions on Friday but stopped short of specifying tough sanctions. An interesting side note from the weekend was reports that the U.S. government is selling a $1.3 billion-dollar Hong Kong property. Elsewhere, Trump said he's planning an expanded Group of Seven meeting in the autumn, though China wasn't among proposed attendees. Barnier Warns U.K. The European Union's chief negotiator warned Britain it needs to be "more realistic" in its demands as trade talks continue this week. "We will not accept -- never accept -- anything that makes the single market more fragile," Michel Barnier said in an interview with The Sunday Times newspaper. Closer to home, the row over the behavior of U.K. government adviser Dominic Cummings lingered amid fresh criticism from senior scientists and academics. Stocks Rise European and U.S. stock futures are higher this morning while Hong Kong's Hang Seng index jumped more than 3% to pare some of last week's drop. The positive session also comes as Goldman Sachs strategists have effectively bowed to pressure from the continuing rally in U.S. stocks and abandoned a call for another steep sell-off. In bonds, yields are starting to reflect improving market sentiment. Oil is steady after a fifth weekly gain. Coming Up… We're expecting another weak U.S. ISM manufacturing number, while final readings of purchasing managers indices from this region are also due. China's manufacturing PMI missed expectations but still suggested a recovery is underway. Meanwhile, today's corporate earnings slate is light, while index providers Stoxx and FTSE are due to announce reshuffles this week. Several European markets are closed as countries observe the Whit Monday holiday. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning Despite the ongoing push to reopen economies and get people working again, it's the stay-at-home theme that is still resonating with investors. A basket of European stocks chosen by SocGen strategists that benefit from both work and play at home -- food delivery, online entertainment, communication and household product companies -- continues to handily outperform the broader market. The stay-at-home portfolio is up 26% from its March 12 low, compared to a 19% rise in Europe's benchmark Stoxx 600. The gauge is now just 1 percentage point away from breaking into positive territory for the year, while the broader market remains down 16%. The stay-at-home basket even outperformed in May. The moves suggest investors don't expect a sea change in behaviour even as lockdown measures ease across the continent. Monday sees a batch of restrictions lifted in the U.K. and the Netherlands, and Greece will allow visitors from more nations to visit the country from June 15.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close |

Post a Comment