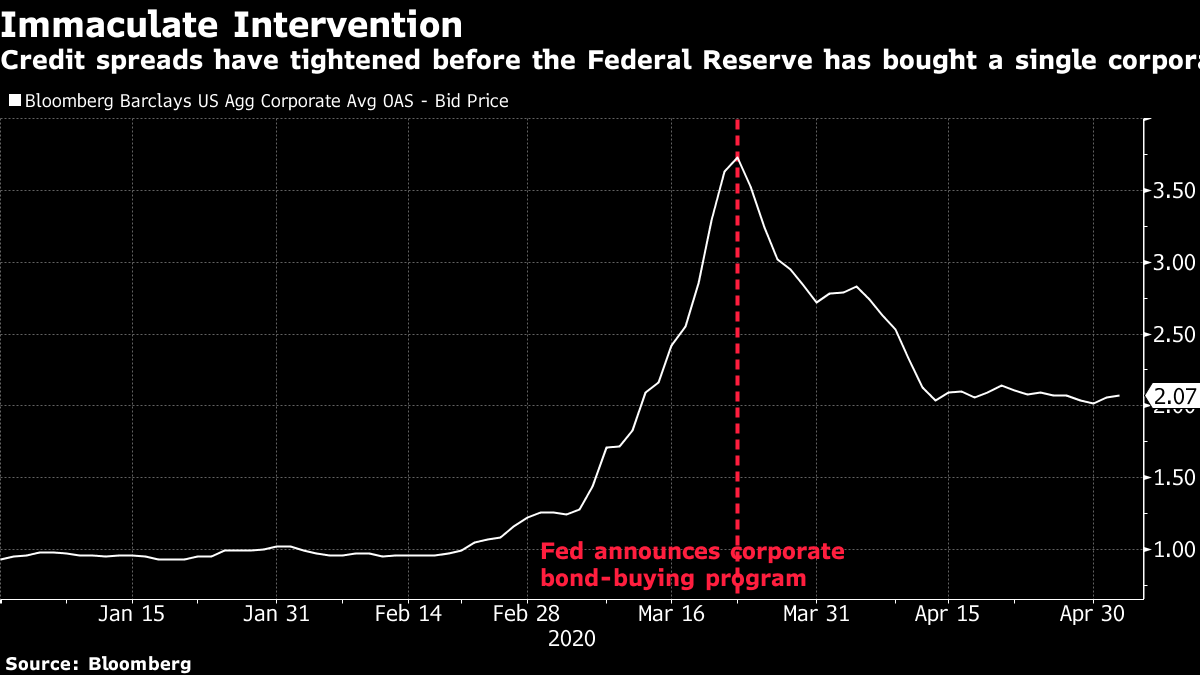

| The world's intelligence communities are skeptical of Trump's claims that the coronavirus pathogen likely escaped from a lab in China. Jack Ma's MYbank is on track to issue a record $282 billion of new loans. And there's a crisis of confidence in capitalism that will alter markets for years to come, according to key players. Here are some of the things people in markets are talking about today. To hear U.S. President Donald Trump and Secretary of State Michael Pompeo tell it, the evidence is clear: The novel coronavirus that has killed more than a quarter million people worldwide likely escaped from the Wuhan Institute of Virology, a laboratory that studies some of the world's most dangerous pathogens. But the U.S. intelligence community is less convinced, and so too are others. A majority of the 17 agencies that provide and analyze intelligence for the U.S. government believe the pandemic started after the virus was leaked from the Wuhan lab, according to a person familiar with the matter. Others more familiar with the intelligence, however, describe pronounced divisions among and within the agencies, which often look at the same set of facts but come to different interpretations. The case for any possible origin is largely circumstantial, since the U.S. has very little information from the ground to back up the lab-escape theory or any other, they said. On the pandemic front, the U.K.'s coronavirus death toll soared passed that of Italy, making it the worst hit country in Europe. Hong Kong moved to ease restrictions, and the state of Bavaria set out plans to reopen its economy in what may serve as a blueprint for the rest of Germany. Meanwhile, Pfizer administered the first U.S. patients with its experimental vaccine for the virus. Stocks in Asia looked on course for a mixed start Wednesday, following a late-day swoon for U.S. equities, as investors weighed optimism that more economies are moving toward easing lockdowns against cautionary comments from Federal Reserve officials. Oil surged. Equity futures were modestly higher in Hong Kong, while contracts slipped in Australia. S&P 500 futures edged up at the open after the benchmark earlier rose for a second day, led by gains in health care, utilities and information technology companies. The gain of almost 2% was cut in half in the last hour of trading after Fed Vice Chairman Richard Clarida warned the economy will need more government support. St. Louis Fed President James Bullard said the central bank's efforts are "very much an experiment." President Donald Trump continued to blame China for the global pandemic, stoking fears the trade war will reignite. Treasuries dipped. With China's economy in free fall and millions of small businesses running low on cash, the online lending platform backed by billionaire Jack Ma entered crisis mode. It was mid-February, near the peak of China's coronavirus outbreak, and MYbank had to decide whether to reduce its exposure or keep doling out loans. After a two-day marathon of calls and emails from self-isolation, the firm's executives agreed with 25 partner banks on a potentially risky strategy: cut interest rates and turn on the credit taps like never before. Now, MYbank is on track to issue a record 2 trillion yuan ($282 billion) of new loans to small- and medium-sized companies this year, up nearly 18% from 2019. On the eve of the biggest boom in U.S. bond sales since World War II, cracks are appearing in the exclusive Wall Street club responsible for ensuring the market functions smoothly. For decades, the firms, known as primary dealers, have sat at the nexus of the Treasuries market, buying newly issued bonds to disseminate throughout financial markets and trading directly with the Federal Reserve. This relationship has helped the Fed implement its policy goals, yet the implosions of recent months suggest that the group is under duress. Dominated by big banks like JPMorgan Chase & Co. and Goldman Sachs Group Inc., the 24 primary dealers struggled to keep money moving within the core of global finance during the coronavirus panic in March. One proposed solution: end Wall Street's near-monopoly on club membership. Bond giant Pacific Investment Management Co. argues that asset managers should be included in the group. That could benefit the Newport Beach, California-based firm and would add trillions of dollars to the collective firepower of primary dealers, further boosting the influence of these investing behemoths. As public officials the world over have raced to put a floor under the stricken world economy, the world's biggest bailouts are sparking a crisis of confidence in capitalism that will affect markets for years to come. A long list of measures that would have looked extraordinary just a few weeks ago has been deployed as central bankers offered loans to an unprecedented range of borrowers and finance ministers said they would shoulder the cost of business payrolls. Airlines, oil-drillers and other troubled industries are in line for bailouts, while banks are being browbeaten to stop paying out dividends. There's even open talk of the two arms of economic policy uniting to monetize public debt. The purpose of the multi-trillion dollar, wartime-scale mobilization is to stop a recession turning into depression. But it's also likely to change the dynamic of industries and markets as prices that were once steered by open trade are now more influenced by the visible hand of policy makers. And history suggests that it will be a long road before such measures are unwound - if they ever are. Here's what market players have to say. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Tracy's interested in this morning Speak softly and carry a big stick is said to have been former U.S. President Theodore Roosevelt's recommendation for foreign policy. The Federal Reserve seems to have taken a leaf out of that political playbook by announcing that it would buy U.S. corporate bonds to soothe the jangled nerves of credit investors, but so far having neglected to actually make a single purchase in the market. Since the announcement, just the promise of Fed intervention has been enough to tighten risk premiums on U.S. corporate debt and send issuance of new bonds soaring, thereby allowing companies to tap vital financing to survive the virus lockdown.  It's not the first time a central bank has jawboned a market, of course (Mario Draghi's famous "whatever it takes" comments spring to mind). But the miraculous impact of the Fed's announcement is so notable that Citigroup strategists are jokingly calling it an "immaculate intervention into corporate credit." The question, of course, is whether that effect can continue without some sort of follow-through from the central bank. There are rumblings of dissatisfaction, with Bank of America Merrill Lynch analysts issuing their own prayer to the Fed, writing that: "A lot of investors (including non-credit ones) have bought investment-grade corporate bonds the past two months on the expectation they can sell to you. So [it] would be helpful if you soon began buying broadly and in size." You can follow Bloomberg's Tracy Alloway at @tracyalloway. |

Post a Comment