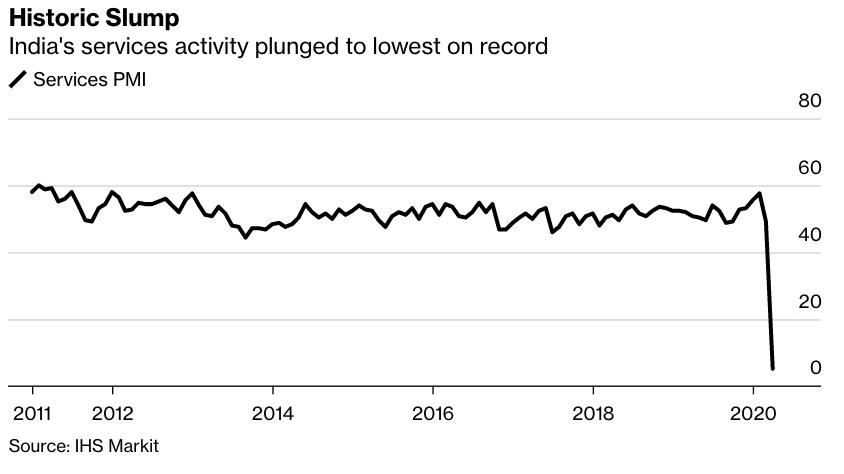

| Secretary of State Michael Pompeo escalated a war of words with China, but wound back his assertion that the coronavirus escaped from a lab in Wuhan. Nomura looks likely to post a fourth straight quarter of profit growth. And Australia prepares for lifting lockdowns in order to reboot the economy, just as winter approaches. Here are some of the things people in markets are talking about today. Secretary of State Michael Pompeo again ratcheted up his criticism of China's handling of the coronavirus pandemic, asserting that it covered up the origins of the virus. But he eased off earlier claims of "enormous evidence" that the virus escaped from a laboratory there. Nonetheless, his comments signal yet another escalation in the war of words between the Trump administration and the Chinese government over who's to blame for the pandemic and which of the world's two biggest economies will take the lead in halting its spread. On the virus front, California reported its biggest one-day jump in cases, and New York Governor Andrew Cuomo warned that his state's improving data is obscuring a worsening U.S. outbreak. The U.K.'s death toll topped 30,000. Germany, Denmark and the Netherlands are planning additional steps to ease their restrictions, while Russian President Vladimir Putin warned against rushing into it. Meanwhile, the WHO says infecting subjects may speed up vaccine studies. Also, Covid-19 research groups are being attacked by hackers. Asian stocks looked set to track losses in U.S. equities, as investors digested mixed corporate earnings and worsening economic data. The dollar strengthened the most in about three weeks and Treasuries slipped. Futures in Japan pointed sharply lower as trading resumes after a three-day holiday. Contracts in Australia and Hong Kong also declined. The S&P 500 fell for the first time in three days, though technology and consumer discretionary shares kept the Nasdaq Composite in the green. A report showed U.S. companies cut a record 20.2 million jobs in April. Yields on 10-year Treasuries rose the most in a week with the U.S. increasing the amount of debt it plans to issue in quarterly refunding auctions to a record high $96 billion. Oil retreated after a rally that had doubled prices in the past five days. Nomura probably joined its Wall Street rivals in benefiting from a jump in trading during last quarter's wild market swings, masking the challenge for its new chief as the coronavirus pandemic hammers the economy. Japan's biggest brokerage is likely to post a fourth straight quarter of profit growth on Friday, helping full-year earnings climb to the highest in more than a decade, analysts predict. The trading boost is expected to make up for weakness in underwriting business as Japanese companies grew cautious in anticipation of a deep recession. Still, Chief Executive Officer Kentaro Okuda may not be able to rely on the boom being sustained, with U.S. banks including Morgan Stanley warning that transaction volumes are waning. Six weeks after shutting down swathes of the economy to contain the coronavirus, Australia is preparing to relax its lockdown on Friday. There could be a cost — new clusters of infections just as the southern hemisphere heads into winter. Closing restaurants, cinemas and pubs and urging people to largely stay at home have seen the daily rate of new infections plunge to less than 0.5% from 20% about a month ago. The country of 25.7 million people will be among the first developed nations to test the resilience of its health system by lifting restrictions just as the weather turns colder. Prime Minister Scott Morrison, who's heralded his government's success in flattening the curve, says the health system is in a good position to cope as he now turns to resuscitating the economy. But the risks are clear. A cluster of almost 50 cases at a meat processing plant is a reminder of how outbreaks can emerge and potentially get out of hand, particularly with winter approaching. A Pacific island nation that's been demanding a bigger share of its mineral wealth from resources companies has forced Barrick Gold to do what a global pandemic could not — cut its 2020 production guidance. Less than a month after saying its output was secure, the world's second-largest gold miner said it expects to produce 4.6 million to 5 million ounces of gold this year, lowering its range by 200,000 ounces, after running into conflict with the government of Papua New Guinea. In April, the Toronto-based miner said it would challenge a decision by the PNG government to deny it the right to keep operating the Porgera gold mine, which accounted for about 5% of Barrick's gold production last year. "We were forced to do that because we didn't have the right to mine," Chief Executive Officer Mark Bristow said Wednesday. A judge in PNG has insisted the mine remain shuttered while the two sides commence "substantive discussions," Bristow said. The miner has been ordered to return to court on May 8 to report on progress. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Tracy's interested in this morning Stop for a second and marvel at the services PMI that came out of India overnight. As a reminder, the Purchasing Managers' Indexes measure momentum in the manufacturing and services sectors of the economy. The "50" level is the dividing line between economic expansion and contraction, and very often you'll see readings cluster in the 40s and 50s. But on Tuesday, India reported an absolutely stunning services PMI of just 5.1 after embarking on the world's biggest coronavirus lockdown. That's the lowest such PMI number on record from anywhere in the world.  But what's really amazing is that this dismal figure has competition: Spain posted a single-digit services PMI of 7.1 on the same day, while Italy's came in at 10.8 In fact, as Deutsche Bank AG strategists put it, there's been a "synchronized dive" in PMIs globally, with not a single country reporting a positive PMI change over the past three months. So India may be diving from 200 feet, but plenty of other countries are jumping from places not very far below it. You can follow Bloomberg's Tracy Alloway at @tracyalloway. |

Post a Comment