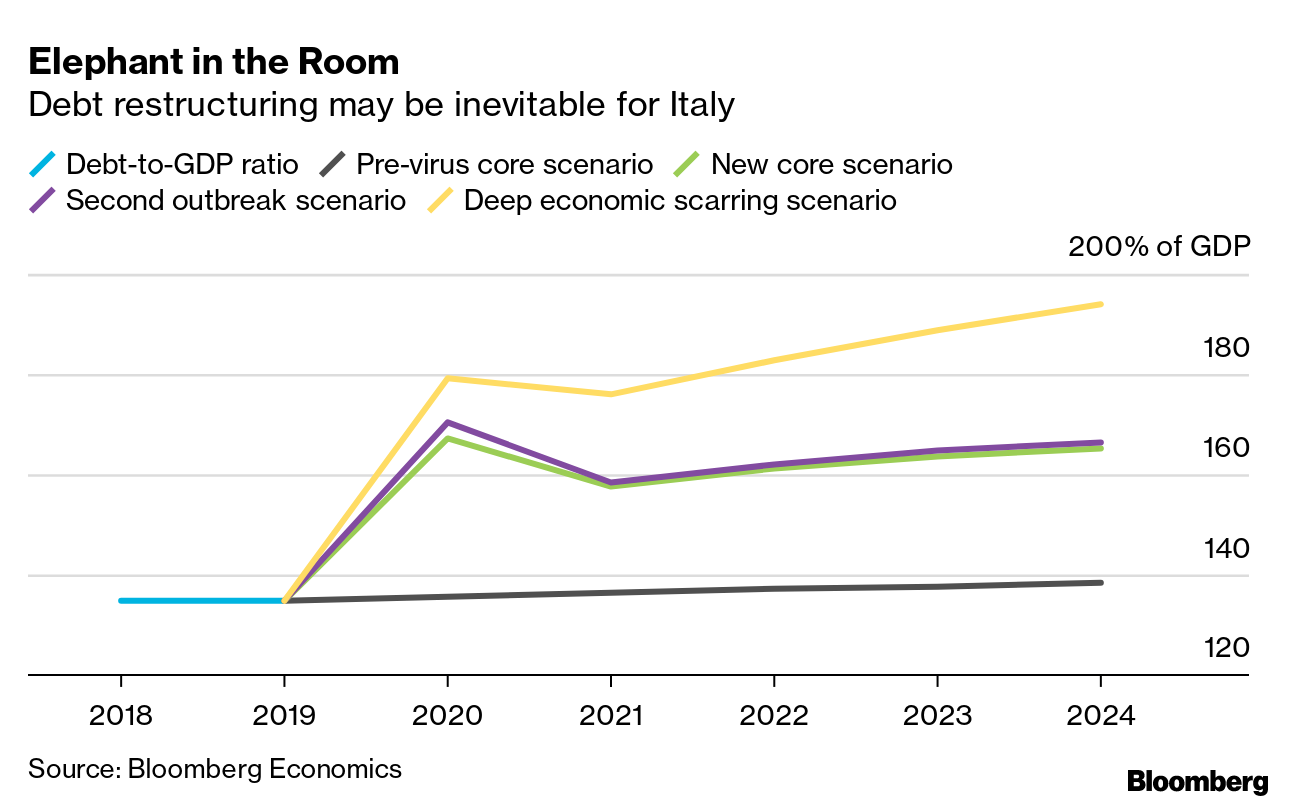

| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union. The Franco-German engine is finally running again. To bankroll countries hit hardest by the pandemic, Europe's two biggest economies unveiled a breakthrough proposal that features 500 billion euros of debt issued by the European Commission and backed by Germany's fiscal muscle. What's more, Paris and Berlin seek a decisively green recovery, with stricter targets for emission cuts for 2030, a minimum price for pollution permits, punitive measures for imports from polluters abroad, significant changes in state aid rules and a repatriation of critical industries. A key question following the German concessions on issuing jointly-backed EU debt is whether other northern hawks will fall in line. And as with every grandiose plan, the devil is in the details. But at least we have a plan. — Nikos Chrysoloras and John Ainger What's Happening Big Spender | Germany is leaving other European nations in its wake when it comes to doling out virus help, accounting for more than half of the nearly 2 trillion euros in state aid approved by regulators. It serves to highlight just how economically divided the continent has become. Talking Trillions | Margrethe Vestager, the commissioner overseeing state subsidies, might have something to say about that when she speaks exclusively to Bloomberg TV today. She's policing trillions of euros that governments are spending on companies during the pandemic. Virus Reawakening | Europe is slowly reawakening from its forced economic hibernation. Here's the data — from movement to restaurant bookings — that capture some of the changes taking place across the continent. Leading the Charge | The EU has vowed to make its recovery plan green and companies involved in the newly formed Battery Alliance are keen to use the stimulus to accelerate plans to rival foreign battery makers. The industry will today discuss how it can contribute to the economic revival. Cheap Loans | Efforts to cushion the pandemic's impact will dominate talks between finance ministers who will today seek a deal on cheap loans for companies. But first, they'll need to agree on the scope of eligible companies and an acceptable level of expected losses. In Case You Missed It ECB Defiance | The ECB's bond-buying programs will continue despite Germany's top court questioning the legality of one of them, President Christine Lagarde said in an interview with multiple European newspapers. "We remain undeterred in delivering on our price stability objective," she said. Your Vacation | If you've still got your sights set on a holiday abroad this summer, we don't want to dash your hopes, but it's not looking too promising. Germany's foreign minister cautioned that the revival of tourism will be gradual, and it won't be the same as before. Tracking Covid | In Germany, home to some of the world's toughest privacy laws, tracking the coronavirus required a more human approach. This is the story of how Germany's relentless contact tracers helped beat the outbreak. Role Reversal | Normally, it's the EU that goes after the likes of Apple and Google over data privacy, but the coronavirus is flipping the relationship. The Silicon Valley giants are the ones imposing limits on the intel health authorities can siphon off from cellphones. Here are the implications. Radio Silence | Adding concern over Poland's shift away from democracy, the state radio broadcaster censored a song ridiculing the country's political leader. Some of the country's biggest artists called for a boycott of the station, comparing it to communist-era crackdowns on free speech. Holy Water | As we come to the end of our lockdowns across the continent, spare a prayer for the monks at Saint-Sixtus abbey in Belgium, who have been inundated with orders for their fabled Trappist Westvleteren 12 ale. If you want to get your hands on a crate, good luck! Chart of the Day  Italy's debts run the risk of becoming unmanageable, and a creeping rise in borrowing costs shows investors are getting nervous, according to Bloomberg Economics. If there's long-lasting damage from the coronavirus, low growth combined with government spending could push the debt well beyond 150% of gross domestic product. That would reinforce the view that the country needs more fiscal help from the EU or even raise the issue of restructuring. Today's Agenda All times CET. - 4 p.m. Press conference by Commission Vice President Maros Sefcovic and European Investment Bank Vice President Andrew McDowell after meeting wit the European Battery Alliance

- EU trade chief Phil Hogan delivers the opening address by videoconference of the 2020 Global Forum on Responsible Business Conduct

- Video conference of EU finance ministers

- Video conferences of EU ministers of culture and of youth

Like the Brussels Edition? Don't keep it to yourself. Colleagues and friends can sign up here. We also publish the Brexit Bulletin, a daily briefing on the latest on the U.K.'s departure from the EU. For even more: Subscribe to Bloomberg All Access for full global news coverage and two in-depth daily newsletters, The Bloomberg Open and The Bloomberg Close. How are we doing? We want to hear what you think about this newsletter. Let our Brussels bureau chief know. |

Post a Comment