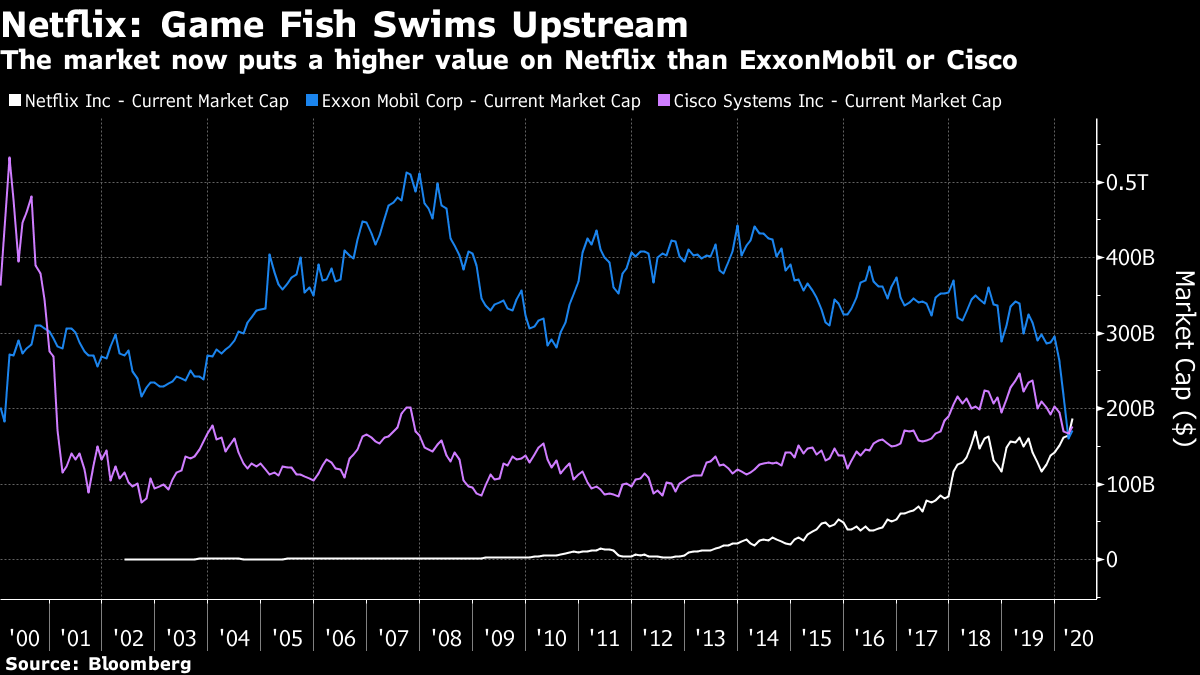

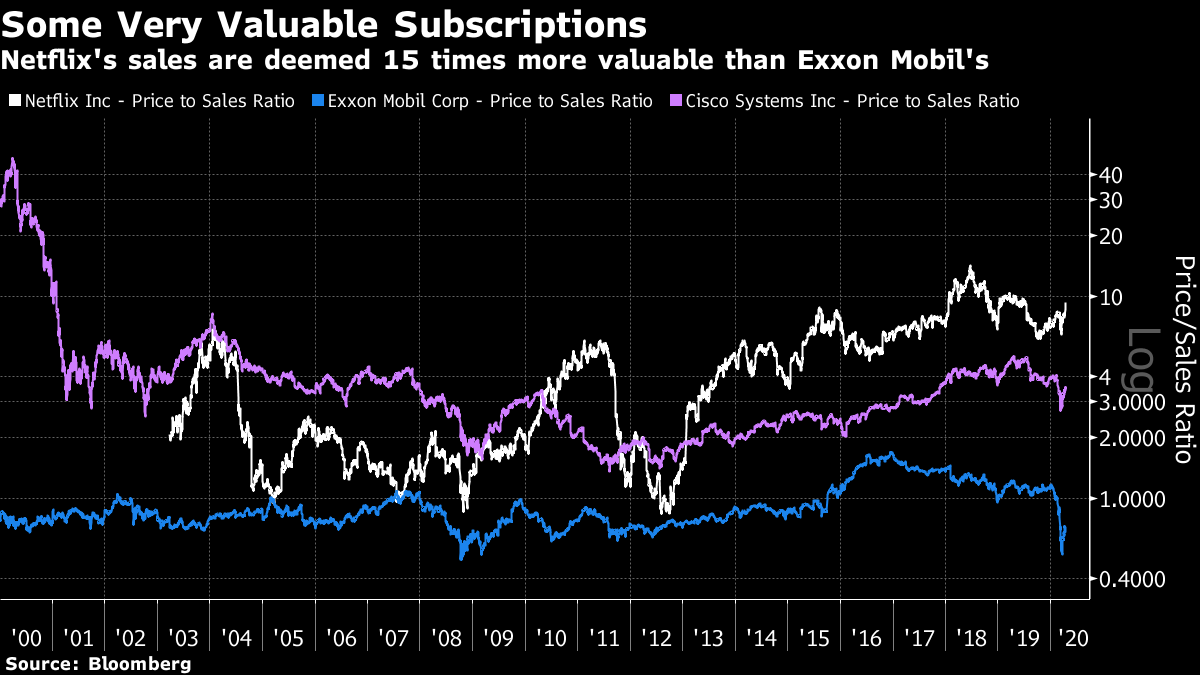

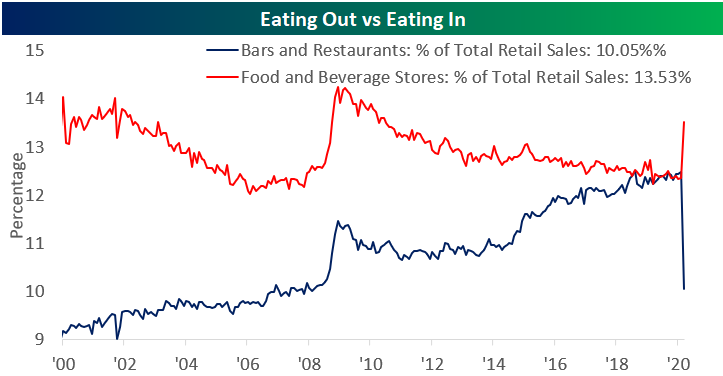

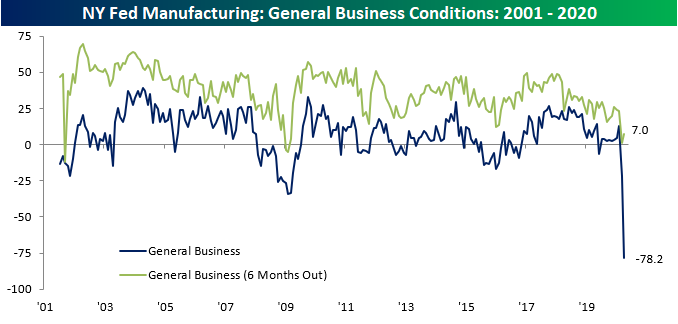

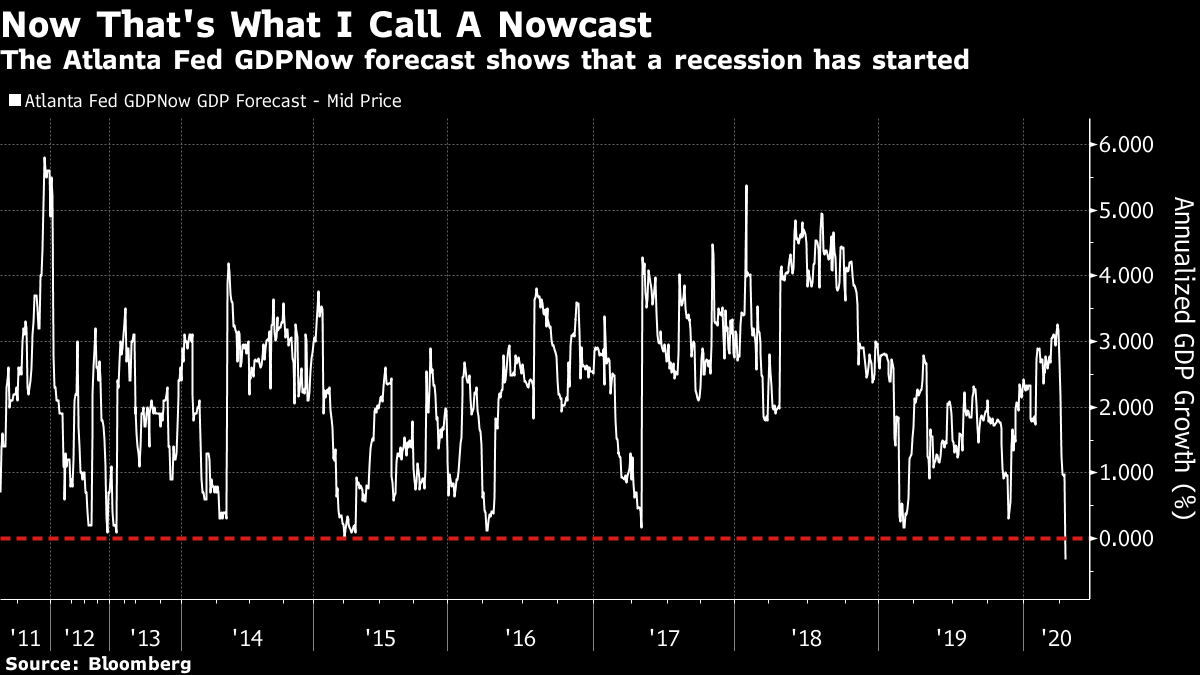

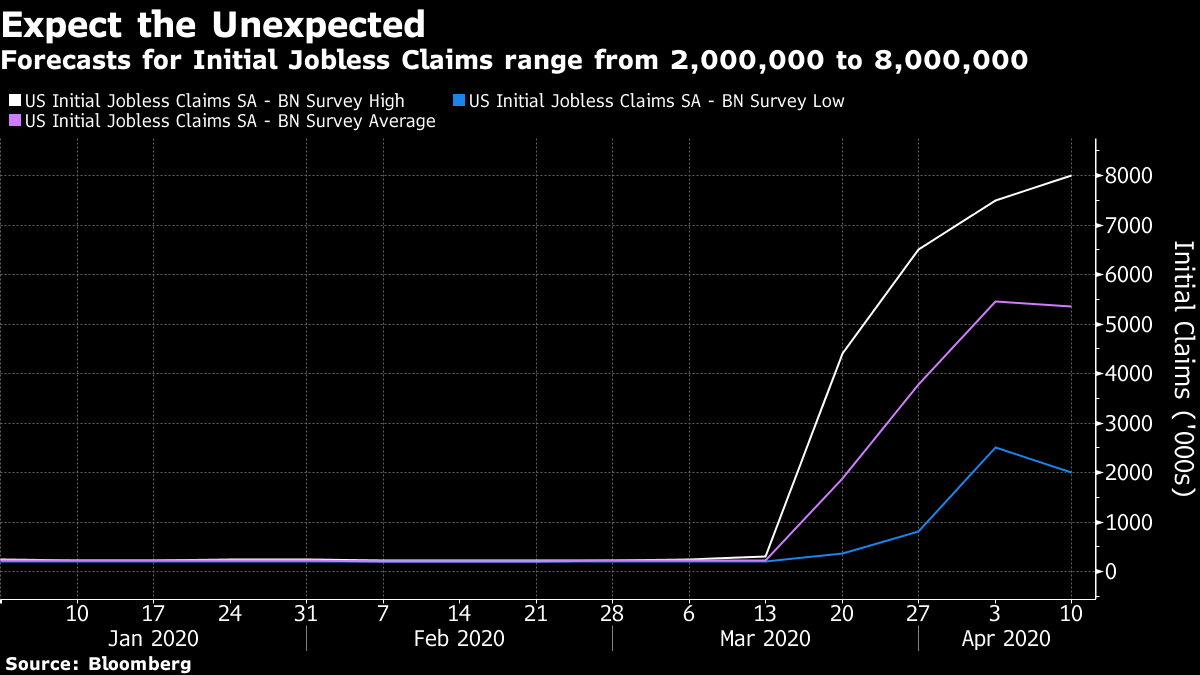

| Like everyone else, I'm spending a lot of time with Netflix. That's not only because I find myself binge-watching television. It's also because I find little alternative but to keep writing about the market phenomenon that is Netflix Inc. Wednesday brought yet another landmark in corporate history. With Netflix rising to a new all-time high while the market had its worst day in three weeks, the streaming king is now valued at more than Cisco Systems Inc. and even Exxon Mobil Corp.:  Cisco and Exxon Mobil have both, in their time, been the largest company in the U.S., and valued at more than $500 billion. The Exxon franchise is as powerful a machine for extracting oil from the ground and selling it to people as exists anywhere in the world. Cisco is well entrenched as the dominant provider of technology that provides the infrastructure of the internet. As we spend more time online during the Covid crisis, presumably we find ourselves adding to the demand for Cisco products, even if we don't do so consciously or pay for it directly ourselves. Netflix is a leader in a field where it's now facing competition from some of the most powerful brands on the planet — led by Walt Disney Co., which is still for now valued at $10 billion more than Netflix. It also depends on pumping out new content, which it will be unable to do for months. Competitors are snatching away some of its most prized content. And it is borrowing, heavily. Undoubtedly a hugely important internet pioneer, it is nowhere near as well entrenched as the likes of Amazon.com Inc., Apple Inc. or Alphabet Inc.'s Google. It is still possible that it could join the ranks of MySpace, Altavista, Netscape or Lycos. Or, it could turn out to be another Cisco — a great and enduring company that becomes wildly overvalued. Cisco's brief reign as the world's most valuable company came as the dot-com bubble went out of control in 2000, when it sold for 40 times revenue. Its sales multiple is now a tenth of that. Meanwhile, Netflix sells for almost 10 times sales, while Exxon sells for about two-thirds of its. Obviously, Exxon's sales multiple should be low given the state of the oil market. Even so:  This leads all good contrarians to ask one question: Is it time to short Netflix and buy Exxon? A look at the chart of Netflix relative to Exxon shows exponential growth, a concept of which we are all very sick. It looks like a bubble due a big reversal some time soon:  So, what can possibly be the arguments for staying long in Netflix? For enlightenment, I asked Andrea Ruggeri, CEO of Infusive Asset Management Inc. His company has a strategy that has left it deliberately and unapologetically invested in all the big and exciting names of the moment — the FAANG stocks, big consumer discretionary names like Nestle SA, and highly successful payment groups like Visa Inc. Infusive practices a form of growth investing. The strategy is to identify what gives consumers joy and contentment, follow the data to identify as yet unknown pleasures, and then load up on the companies that show that they can feed those wants. By identifying good companies that already understand those desires, they aim to catch new trends and ways to appeal to those wants. Infusive's U.S.-listed exchange-traded fund has the ticker symbol JOYY, which is great because it gives me an excuse to link to some songs by Joy Division, and you can find its portfolio here. It is a great list of companies that have performed brilliantly, even during the Covid-driven market disorder. They are comfortably ahead of the S&P 500 for the year — although still down overall. JOYY has a 2.56% weighting in Netflix — and also 2.68% in Disney. As far as Ruggeri is concerned, it has made a bet on good companies and on streaming as a concept to gain long-term benefits from the lockdown. "If this accelerates the growth of streaming for the next five years, will it be Netflix or Disney or Apple or Amazon who wins? It's tough. Disney is spectacular, and they are all getting more competition than they would like. They've all got good brands. We own all of them." Ruggeri says he holds these companies because they have shown the know-how to satisfy consumers' desires, rather than because of a desire to own every player in streaming. As for the lockdown, which has driven the latest leg of excitement about Netflix, he suggests that it's unlikely to change trends, because people will generally want the same things after the confinement as before. It may, however, accelerate them. One example, which feeds into the streaming battle, is pets. Social distancing has left many of us even more grateful for the company of our animal friends, so the increasing popularity of pets over recent years is likely to intensify. Infusive hopes to benefit through its holding of Nestle, which has built a large pet food business, and which it holds for other reasons as well. It is undeniable that this approach has worked well of late. It also underlines the point that there may be other ways to profit from these trends than buying Netflix. Buyers of the biggest five stocks, which now make up more than 20% of the S&P 500, might be following a dubious logic. Buy each of Apple, Amazon, Alphabet, Microsoft Corp. and Facebook Inc. and you will virtually guarantee owning the winner in many of the different battles for internet supremacy. But what if each of them is priced on the assumption that it will be the winner? Bad News Bears Stocks had a bad day Wednesday. As they had had a good one Tuesday, there is little need to worry. It's possible that some of the data emerging about the economy had an effect on sentiment. While little was truly surprising, a confirmation of worst fears might explain why traders went back to being "risk-off," at least for a day . Retail sales figures for the U.S. included one striking example of a trend that has been absolutely reversed by the lockdowns. For years, restaurants had steadily gained at the expense of home-cooked food. They were about to take the lead. Not any more:  The chart is from New York's Bespoke Investment Group, and we can expect the number for bars and restaurants to get much worse. It is obvious that the restaurant business will be grievously damaged. Manufacturing, though, should be performing much better. Instead, the Empire State survey, carried out by the New York Fed, showed an unprecedented collapse in business conditions. And companies don't expect things to be much better in six months:  There was another number that confirmed the dismal reality. The Atlanta Fed's "Nowcast" tries to gauge how GDP growth is doing in real time. The sudden stop caused by the lockdowns has turned it into a lagging indicator. On Wednesday, for the first time, the Nowcast showed that the U.S. is in recession:  None of this should have been surprising, so there is no clear reason why it should push stocks down. The reality of such dreadful numbers may have convinced a few people that they had been thinking wishfully. Meanwhile, initial jobless claims are due Thursday morning in New York. Last week's number was followed immediately by the firing of the Fed's bazooka. This time, the only certainty is that many will be surprised. Forecasts have never been so spread out before. But as the best outcome that anybody is hoping for would see another 2 million Americans sign on as jobless, we can be sure there won't be any good news:  Survival Tips After that, I don't have much in the way of suggestions for survival. I do want to thank the kind reader who sent me an entire copy of the Asterix book Mansions of the Gods, translated into Hungarian. Magic. Yesterday, we learned that the Polish for the noise a fish makes when it hits someone in the face is "Plask." For those who want to know how to translate that into Hungarian, here is your answer:  Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment