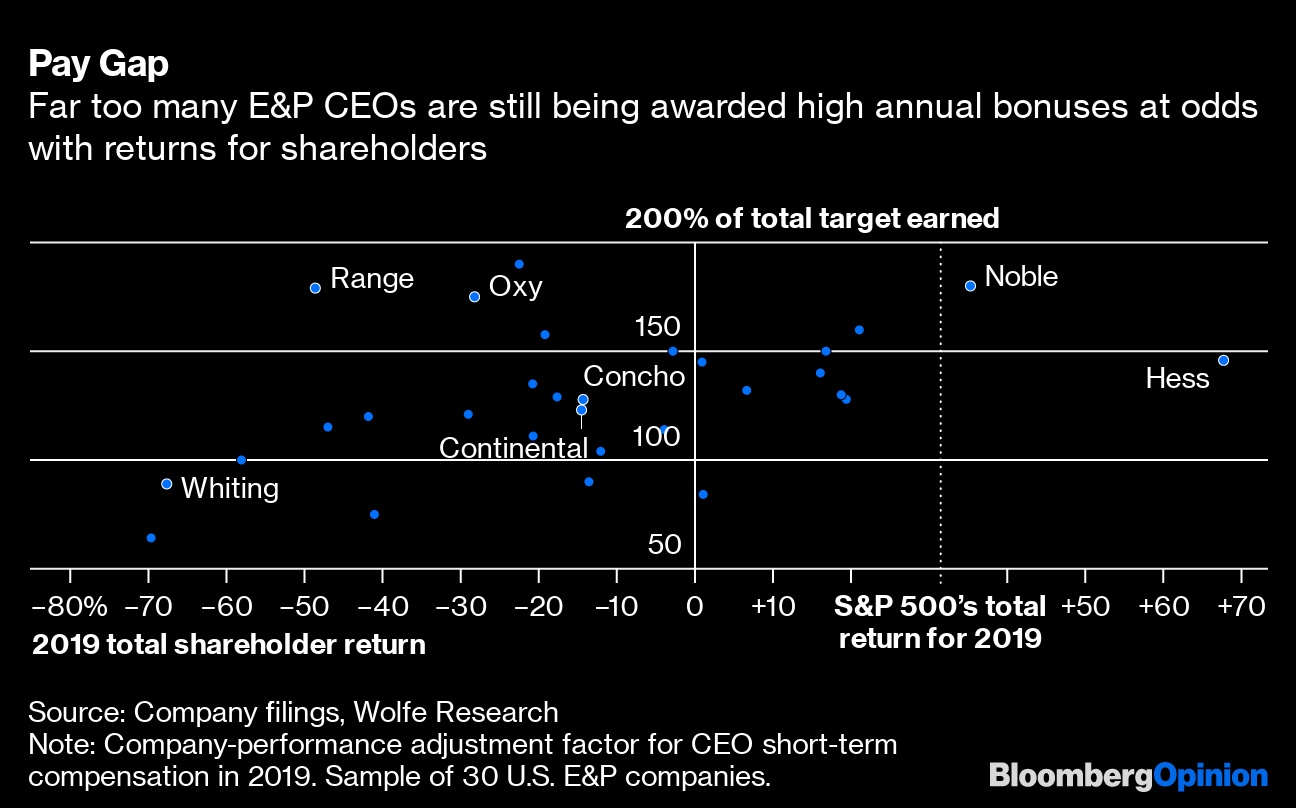

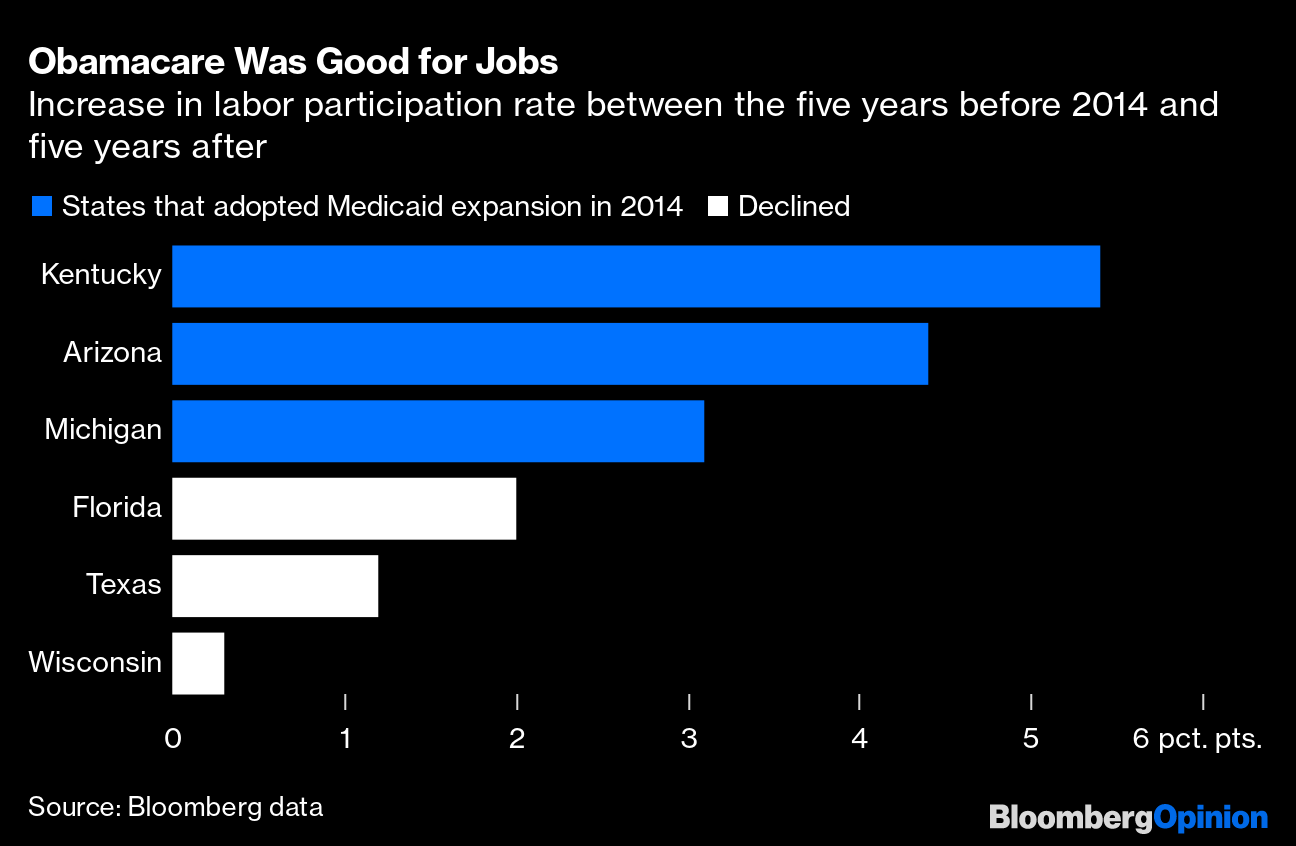

| This is Bloomberg Opinion Today, a global kumbaya moment of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  Not responsible for people drinking bleach or much else. Photographer: Drew Angerer/Getty Images North America The World Needs a Leader Too Those of us lucky to live in these interesting times have seen many crises and expect them to follow a certain rhythm. By now we should have had a global kumbaya moment, with world leaders awkwardly holding hands and pledging to stop financial contagion or terrorism or whatever. But somebody needs to organize these get-togethers, and until recently America has been that cousin who makes family reunions happen. Unfortunately, the current president of the United States is more worried about reuniting Fox News with Diamond and Silk than with building a global consensus, writes Michael Bloomberg, the founder and majority owner of Bloomberg LP. Hand-holding confabs are out in this pandemic, but someone needs to organize the world's response the way American presidents once did. Until then, we can't expect more than the disjointed, beggar-thy-neighbor approach we've seen so far. Speaking of disjointed, beggar-thy-neighbor approaches: The U.S.'s recently replenished small-business relief fund keeps being run poorly and funneling money to places it doesn't belong, writes Tim O'Brien. To the ranks of dubious relief recipients that already includes Harvard and Shake Shack, we can now add the L.A. Lakers, AutoNation Inc. and several other large, publicly traded companies, along with more that have unseemly Trump ties. We could use leadership at home too. To Trump's credit, he does seem finally to have accepted the reality his administration is hopelessly behind on helping the country test enough people for Covid-19, writes Jonathan Bernstein. But this is more a case of Trump's monumental denial giving way only after months of criticism and pain. This is not leadership. It's the Stupid Economy Global coordination might help with lifting social restrictions around the world. Right now it's happening on a country-by-country, state-by-state, city-by-city basis — though that may be the only way to do it. What's increasingly clear is that reopening won't be like flipping on a switch; barring a miracle cure, people will be afraid to return to the old normal, meaning the V-shaped recovery many once hoped for is a pipe dream, writes Clive Crook. Instead we'll see each country, state and city balance between loosening restrictions and protecting public health, hopefully learning from one another's mistakes. Hopefully. Meanwhile, millennials who long preferred spending money on experiences — trips, meals, parties — will now spend it on stuff instead, like a bunch of Boomers, writes Conor Sen. For them a pretty nice little Saturday may now be a trip to Home Depot, maybe going to Bed, Bath, & Beyond, if there's enough time. (h/t Sarah Green Carmichael for the "Old School" reminder) One thing we don't have to worry about right now, thankfully, is the U.S. government's ability to borrow money to throw at the problem. In fact, judging by market response, there's not enough Treasury debt to go around, writes Robert Burgess, an encouraging sign for proponents of modern monetary theory. Of course, all this bailing-out of companies and mopping-up of debt must carry some kind of price, writes John Authers. A Deutsche Bank study of decades of recessions and defaults suggests bailouts keep warping the system, making recessions worse and driving productivity down. But dealing with that problem seems like a long-term luxury. Right now, deflationary forces are building, warns Tim Duy. Not only do we have the demand shock of nobody wanting to go shopping any more. But we have seen immediate cuts to wages of the sort we didn't see even in the Great Recession or Depression. That may keep unemployment relatively low, but will keep prices and demand low too. Oil's Living in the Past Nothing says "deflation" quite like "negative oil prices." The recent swoon of one month's oil-futures contract deep into the red can be explained away as a technical glitch, but traders are getting ready for many more such instances, writes Matt Levine. The real problem is that (a) demand has crashed, (b) producers keep pumping and (c) there's nowhere to put all the oil. Somebody may want to notify to the oil industry, which apparently is stuck in the year 2014, just before the previous big crash. Sure, we all enjoyed "Happy," but times change. For one thing, there are now far too many U.S. frackers for today's level of demand, writes Liam Denning. And they still pay their CEOs way too generously, as this Elaine He chart shows:  Meanwhile, BP Plc is stretching itself thin and hurting its own future just to keep pointlessly paying a dividend, writes Chris Hughes. You're not a room without a roof, BP. We Need More and Better Coronavirus Weapons The mantra in this newsletter and elsewhere is that we can get back to something like normal if only we have enough tests. But Cathy O'Neil points out we don't just need more tests, we need better ones — ones that are fast, accurate and widely available. Otherwise normal life will stay out of reach. A vaccine, assuming one is even possible, would be the best solution. But it takes a long time to prove vaccine safety, and they're expensive to mass-produce and distribute. Scott Duke Kominers writes we must promise drugmakers money up front to encourage them to bear the cost. Telltale Charts Red states that belatedly embraced Obamacare's Medicaid expansion had better job markets than those that didn't, writes Matt Winkler. Something to keep in mind in the Covid-19 reality.  Further Reading Everybody's mad at Amazon.com for taking business in the pandemic, but it built itself for this moment while its rivals didn't. — Alex Webb and Andrea Felsted Brazil led a Latin American boom, and now it's leading the bust. — John Authers Straightforward rules about what businesses should do to protect workers could solve reopening's liability problem. — Noah Feldman Letting businesses fully deduct capital spending in the first year will boost investment. — Karl Smith Little stands in the way of Israel annexing West Bank territory now. — Zev Chafets It's a bad look for the U.S. to use the nuclear deal to pressure Iran, considering it walked away from said deal. — Hussein Ibish ICYMI Trump will order meat plants to stay open. 200,000 H-1B workers could lose legal status. Waffle House is a reopening test case. Kominers Conundrum Update Last weekend's Kominers Conundrum seeks a strategy to help prisoners escape a light-switch-filled labyrinth. If you're still befuddled, here's a hint: Once you've got a solution to the one-room version of the puzzle, is there a way to set up the switches to replicate that strategy room by room? (Although that's not the only way to approach the problem!) And of course, it's OK if the strategy takes a long time to work. — Scott Kominers Kickers Animal Crossing's central bank slashes rates to zero, pushing investors to speculate on tarantulas. The British Museum makes 1.9 million photos available free. Brain implant restores man's arm motion and sense of touch. How to grow your own food. The best reality-TV character bracket. Note: Please send tarantulas and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment