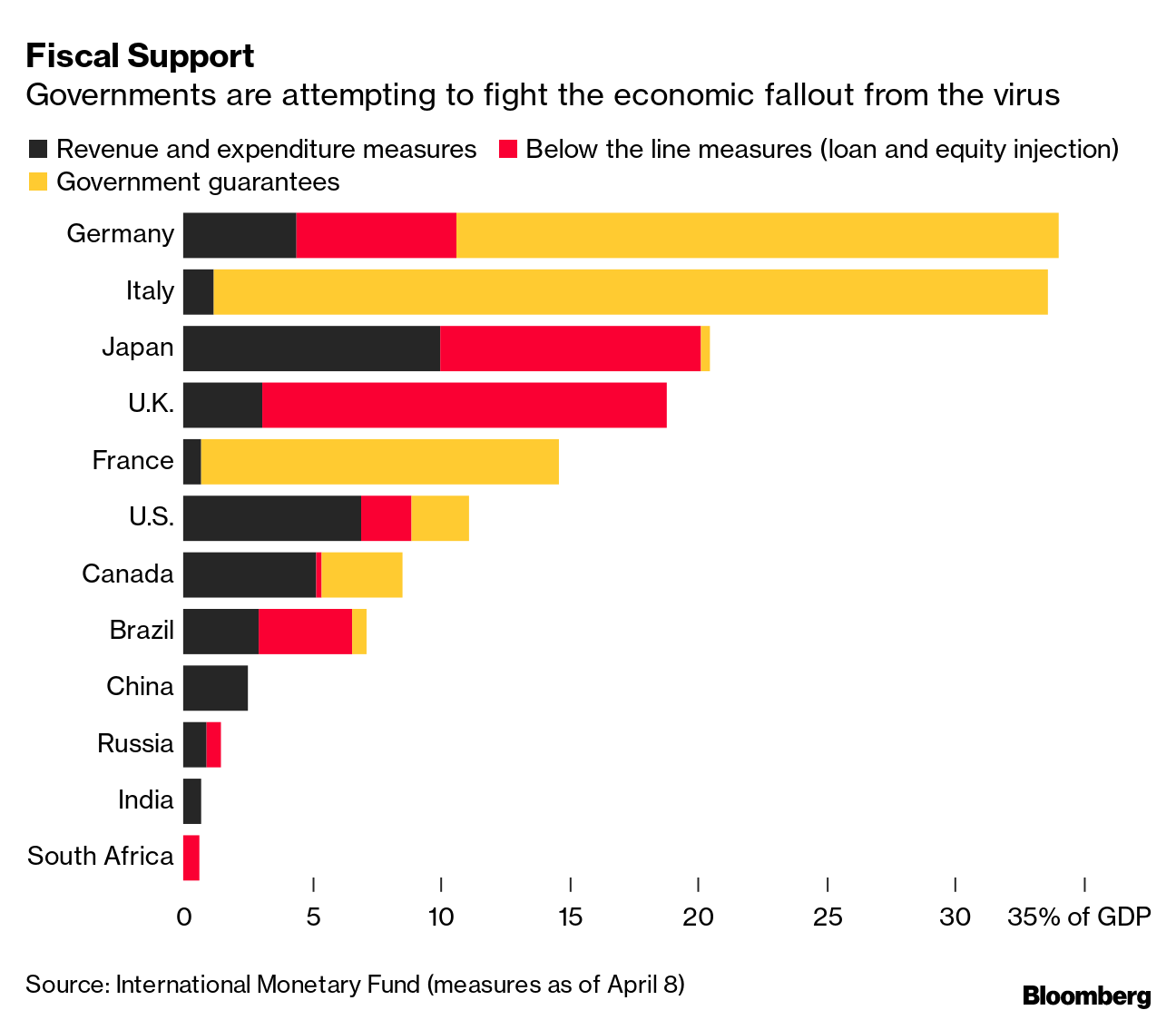

| Easing lockdowns just got more difficult in Italy and France with both countries reporting the most new cases in four days. Wall Street has become even more bullish on Netflix, but not without some apprehension. And Huawei is emerging as the winner in the 5G race. Here are some of the things people in markets are talking about today. New York Governor Andrew Cuomo reported 474 fatalities, the lowest daily rate since early April, pushing the total deaths for the state past 15,000. Italy and France both reported the most new cases in four days, complicating efforts to gradually ease containment measures. In Spain, where the daily case count was mostly steady, lawmakers extended a state of emergency to May 9. Singapore reported more than 1,000 new cases for the third day, pushing total infections past 10,000. Indonesia has extended a partial lockdown in Jakarta, while lockdowns in India are deepening economic distress there. Over in Israel, meanwhile, investors are proposing a build-it-yourself breathing machine. Around the world, the number of virus cases surpassed 2.6 million, with deaths topping 182,000. Here are the latest developments. Asian stocks looked set to follow their U.S. peers higher as investors took some comfort from earnings reports and signs the coronavirus outbreak is easing. Treasuries fell and a day after trading negative, futures for West Texas Intermediate crude surged above $13 a barrel after President Donald Trump ordered the Navy to destroy any Iranian gun boats that harass American ships at sea. Equity contracts rose in Japan, Hong Kong and Australia. S&P 500 Index futures opened little changed in Asia. The S&P 500 rebounded from the worst sell-off in three weeks amid quarterly results. Treasury Secretary Steven Mnuchin said he anticipates most of the economy will restart by the end of August. House lawmakers on Thursday are set to pass another round of aid. The U.S. is investigating whether traders with inside information on Russia's negotiations with other oil producing nations made hundreds of millions of dollars from illegal wagers on crude price swings, according to two people with direct knowledge of the matter. The Commodity Futures Trading Commission probe is focused on whether aspects of the strategy that the Russian government pursued last month with other members of the OPEC+ coalition leaked out to market participants ahead of time, said the people who asked not to be named. For the same reason, the U.K.'s Financial Conduct Authority is also investigating suspicious trades in futures contracts, one of the people said. The inquires predate the Monday spasms in oil markets that pushed U.S. prices into unprecedented negative territory. Wall Street has become even more bullish on Netflix after it released its first-quarter earnings that showed monster subscriber growth in the stay-at-home era. But not all is positive. The Los Gatos, California-based company has warned investors that some of the virus-induced growth may be temporary and cautioned that a stronger dollar could reduce the value of its sales abroad. Content production could also soon take a toll on next year's slate, it said. Despite the "staggering growth," Loup Ventures analyst Gene Munster said "unfortunately, the truth is people want to spend less time at home." Huawei is emerging as the runaway winner in China's $170 billion effort to build out its fifth-generation wireless networks, part of a concerted effort by Beijing to seize the lead in a key technology from the U.S. while rebooting a virus-stricken economy. Since the beginning of the year, Huawei has secured 28.4 billion yuan ($4 billion) worth of 5G equipment orders from the country's largest carrier, China Mobile, beating out competitors like Ericsson AB and ZTE Corp. to win more than half of the 5G contracts awarded by the operator during the period, according to an analysis of procurement data by Bloomberg News. Huawei is relying on its home market more than ever, at a time its growth has all but evaporated. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Tracy's interested in this morning Modern Monetary Theory (MMT) says that the only limit to government spending is inflation, and that realizing this should somehow change the political dialogue around said spending. I tend to be somewhat cynical when it comes to that theory: The annual U.S. deficit of more than $1 trillion suggests that the government spending limits are indeed arbitrary (and have been for some time), and yet we still have arguments about how money should be spent. In other words, the limit on government spending has always been political rather than fiscal.  There's a big caveat to that statement, however. The other major criticism of MMT is that it only seems to apply in full to developed economies (and perhaps a handful of those at that). Emerging markets without fiscal capacity and reserve currencies can only dream of being able to spend money and drive up debt levels without the market "punishing" them in some way. That nuance is very visible in the stimulus response to coronavirus. While some developed markets like Germany and Italy have allocated more than 30% of GDP in direct spending to offset the outbreak, emerging markets in Africa and Latin America are so far spending just tens of millions of dollars. You can follow Bloomberg's Tracy Alloway at @tracyalloway. For the latest virus news, sign up for our daily podcast and newsletter. |

Post a Comment