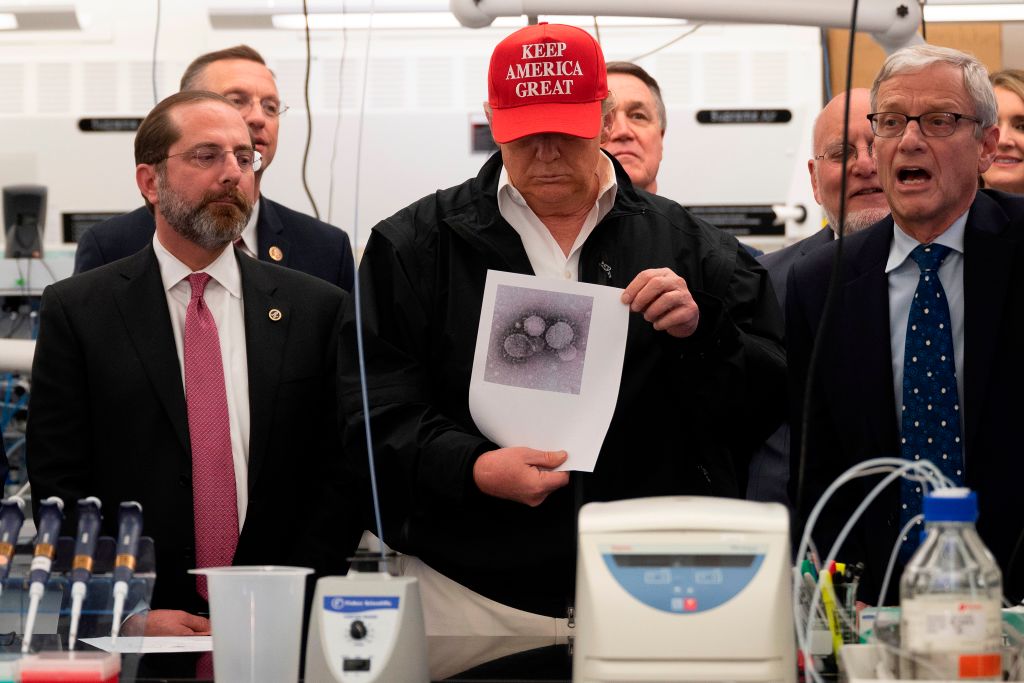

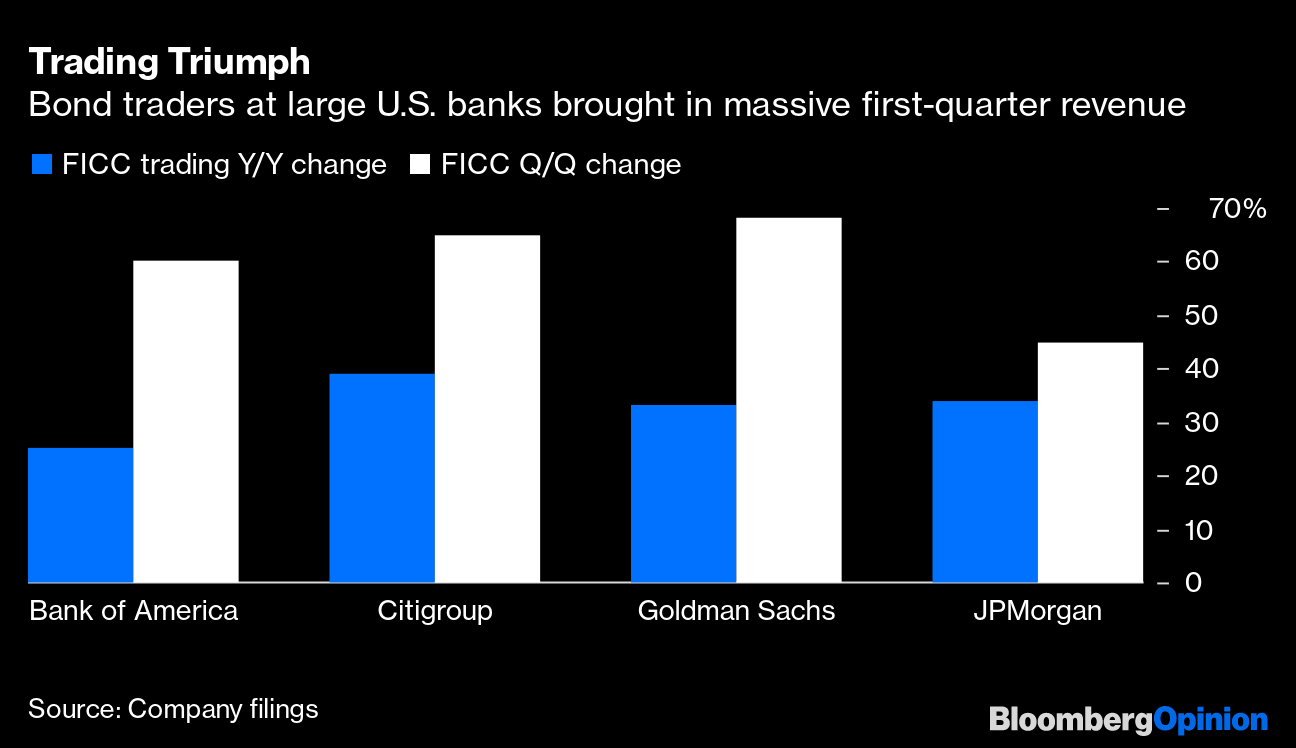

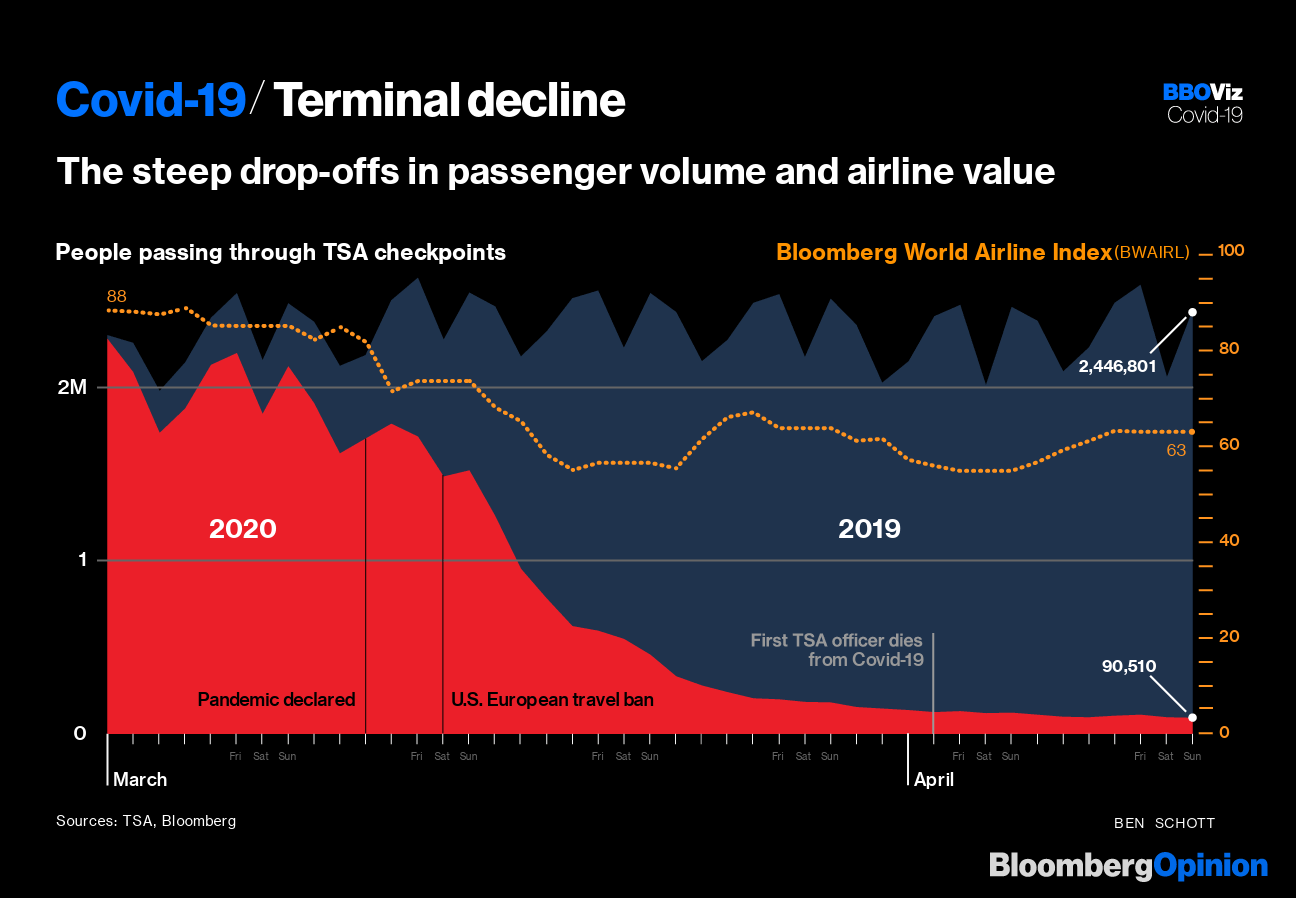

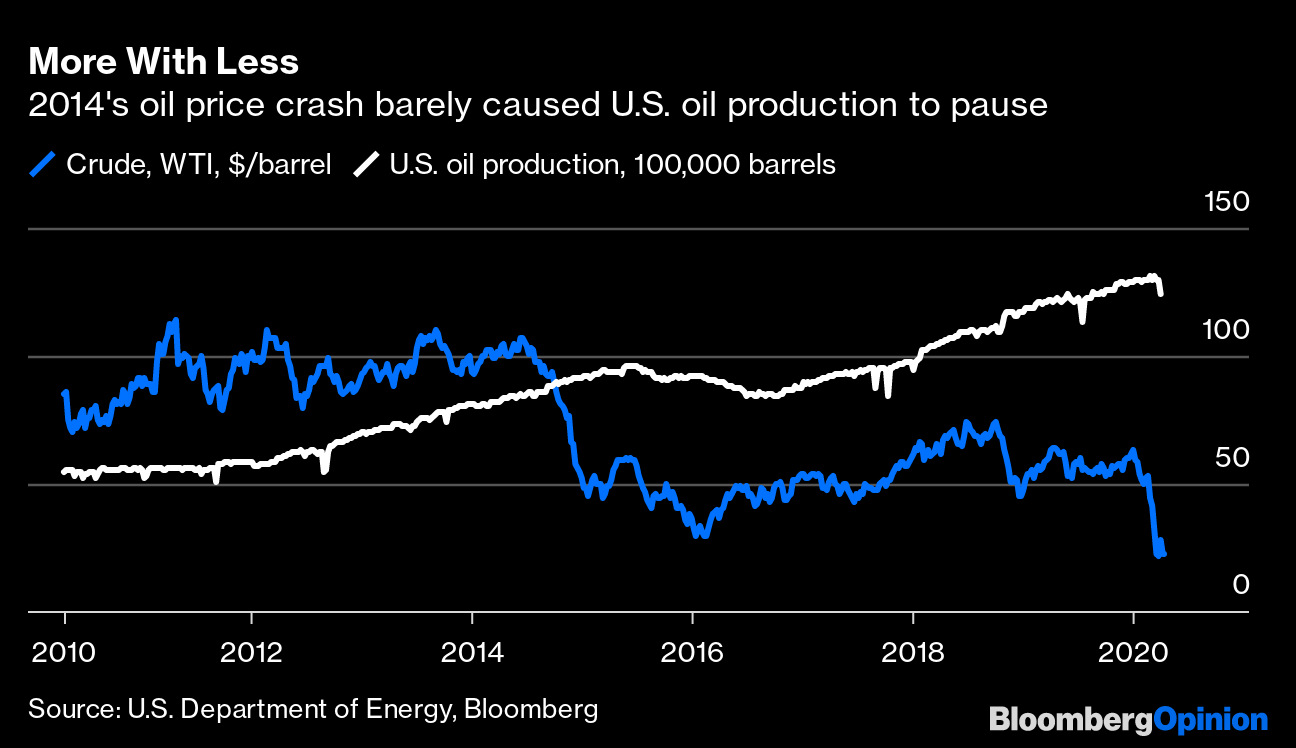

| This is Bloomberg Opinion Today, a global supply chain of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  President Donald Trump, getting to know the coronavirus in early March. Photographer: JIM WATSON/AFP/Getty Images Not Everybody Was So Shocked by Coronavirus If only the U.S. government had been more like Fastenal Co. A new study suggests 90% of America's Covid-19 deaths could have been prevented if the Trump administration had put social-distancing guidelines in place on March 2, just two weeks earlier than it did. About that time, President Donald Trump declared the coronavirus pandemic "an unforeseen problem." But several weeks earlier — about the time health officials started warning him Covid-19 could be more than just a problem, concerns he publicly dismissed — supply-chain management giant Fastenal was already bracing for the worst, writes Brooke Sutherland. It got busy rerouting parts of its own supply chain, practicing social distancing and making sure essential pandemic-fighting equipment went to the right places. Quick action didn't keep Fastenal from losing business to the lockdowns, Brooke notes, but it did soften the blow. Fastenal's in the global supply-chain business, so seeing threats to the, you know, global supply chain is maybe not shocking. A more pleasant surprise in these difficult times has been America's banking sector. A decade ago it was setting all of the money on fire, but now it's protecting the money. Bank of America Corp., a toxic-debt minefield in the financial crisis, is now a solid corporate citizen, Brian Chappatta notes. It's promising raises and no layoffs, while also keeping money flowing in a thirsty economy. Like Fastenal, it's not immune to economic disaster, but careful (if often regulator-mandated) preparation got banks ready for this crisis. Even credit markets going bonkers were a gold mine in the latest quarter, Brian Chappatta notes in a second column:  These are some of the happy corporate stories; the unhappy ones are far more numerous. Take JC Penney Corp. Inc. Hoo boy. It wasn't in great financial shape before the pandemic, Andrea Felsted writes. Coronavirus will likely tip it into bankruptcy (it said today it's skipping a $12 million interest payment). It won't be alone. Want Americans Back at Work? It'll Cost You Trump yesterday spent 10 minutes reading from a long list of CEOs he says will advise him on lifting lockdowns (which he can't do alone) and getting the country back to work. Reportedly many of those CEOs will tell him to hurry it up, especially given the grim economic data we keep getting. Their workers may have other ideas, though. As Nir Kaissar points out, American companies have spent the past few decades racking up record profits at the expense of worker pay, with CEOs especially enjoying the fruits:  As Amazon.com Inc.'s latest labor troubles have shown, many of these workers suddenly realize they're (a) more essential than ever and (b) not getting paid enough to risk their lives working in a pandemic. Raises, possibly even generous ones, will be part of the cost of CEOs getting workers back on the job. Then again, with unemployment at perhaps 20%, available workers will be plentiful. Fortunately, we can address our unemployment problem and our coronavirus problem at the same time by hiring hundreds of thousands of people to be contact tracers, writes Tracy Walsh. They would chase down the contacts of coronavirus patients, helping limit the disease's spread. Further Do-Something-Already Reading: Hey, has anybody seen Congress lately? — Jonathan Bernstein Trump Stunts Won't Help Pandemic or Trump Trump may not have a plan for getting us out of quarantine, but he has been busy. Yesterday he held up the delivery of stimulus checks to make sure his name was on them, something no other president has ever bothered doing. It probably won't help him politically, notes Jonathan Bernstein, as many check recipients will never see his name or will forget by Election Day that it was on that $1,200 check they got months earlier. And to the extent it produces bad publicity, it could even hurt him. Yesterday Trump also cut funding to the World Health Organization, which sort of needs the money these days. He's right the organization has many problems, writes David Fickling, but starving it of cash during a pandemic won't solve them. The U.S. should strive to top China's influence in WHO, not just complain about it. Trump is also trying to let the Postal Service die by refusing to give it bailout money. Joe Nocera points out this would hammer his own core voters at the worst possible moment, in a recession and ahead of an election. About Those Pandemic Numbers Cathy O'Neil earlier this week wrote about all the ways those coronavirus tallies we watch obsessively are inaccurate. Studies of virus hot spots in New York and Germany suggest the official case count in those places could be off by a factor of 10, writes Justin Fox. For example, it's possible a million people in New York City may already have the disease, whether they felt symptoms or not, compared with the official count of more than 111,000. The good news is that means the true fatality rate is less awful than it seems, at about 1% (which is still awful). But other spots have very few cases, meaning the whole nation is far from "herd immunity," with big implications for how we climb out of this thing. Further Virus Reading: Humanity's exploitation of wildlife makes pandemics more likely. — Mark Buchanan Telltale Charts As if you needed further evidence, airline traffic has absolutely cratered, writes Ben Schott.  American frackers may come out of the oil collapse leaner, as they did during the previous crash, writes David Fickling.  Further Reading Pandemic or no, Boris Johnson will probably stick to the current Brexit deadline. — Therese Raphael Pension funds face a double whammy of slashed stock dividends and negligible interest rates. Good luck retiring any time soon. — Mark Gilbert Investors are rushing back to gold. That's not a great sign. — John Authers India is playing with fire by not supporting its economy and finance industry more. — Andy Mukherjee Yes, Warren Buffett is taking more Occidental Petroleum stock, but don't you fill your boots. — Liam Denning You may want a divorce after quarantining with your spouse, but it will be unusually complicated right now. — Alexis Leondis ICYMI Harvard researchers suggest we might be social distancing into 2022. New York will start antibody testing essential workers. Trump's favorite malaria drug doesn't clear the new coronavirus, a study has shown. Kickers Judge orders lawyers to get out of bed, wear shirts for Zoom hearings. (h/t Ellen Kominers) How a nuclear submarine officer learned to live in tight quarters. We might live in a lopsided universe. The pre-pandemic world was the fiction. Note: Please send antibody tests and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment