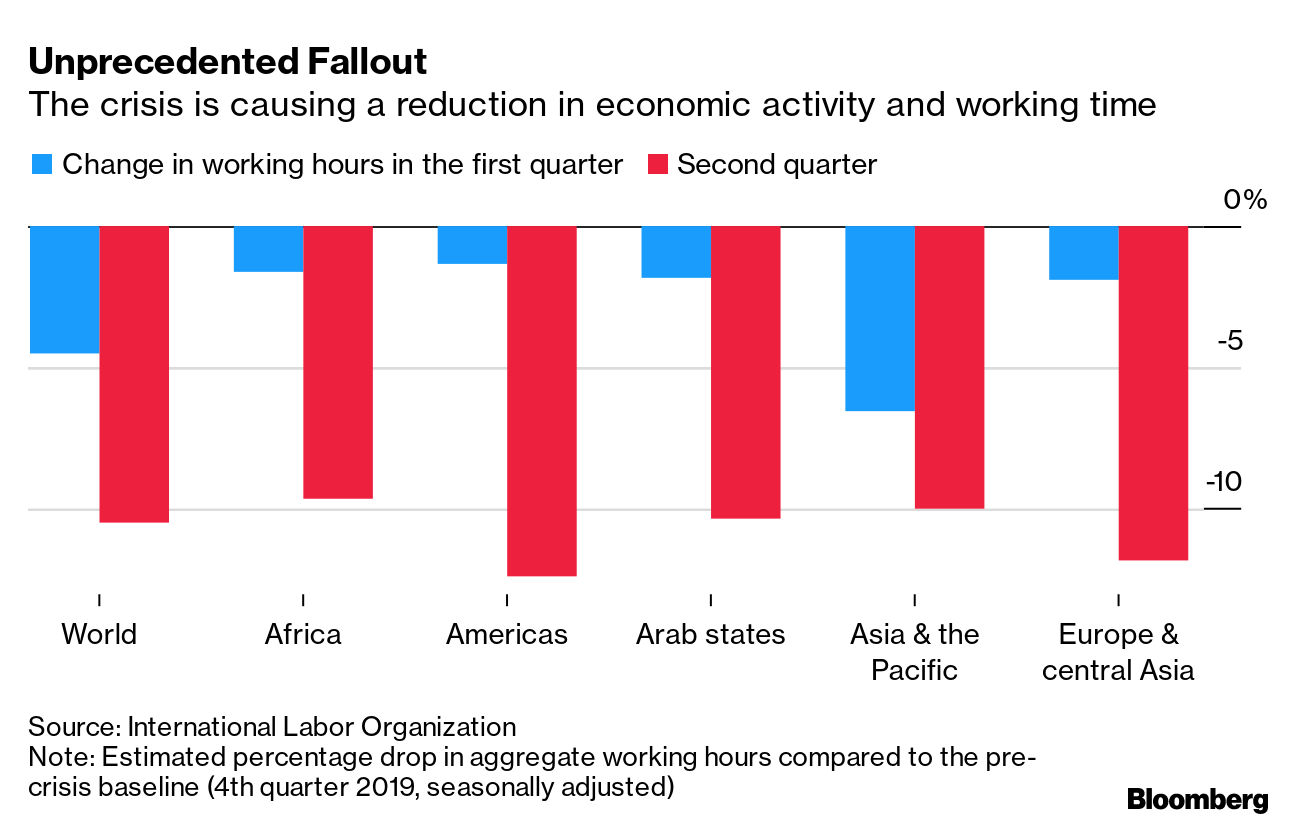

| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union. With EU leaders having made little headway in coming up with a plan to mitigate the effects of the deepest recession in living memory, the burden is once again falling on the shoulders of European Central Bank President Christine Lagarde. Along with her Governing Council colleagues, she is set to decide today if the region needs more stimulus on top of more than 1 trillion euros already pledged. She'll have to consider the likelihood of renewed tension in financial markets and the risk that lockdowns have to be extended or reimposed if infections flare up again, further damaging the economy. She also won't want to give countries any further excuse to eschew their own, more sustainable, solution. —John Ainger What's Happening Painful Memories | If Lagarde needs a reminder why such drastic support is needed, then she just has to look to Germany, which is headed for the worst recession since the nation began its recovery after World War II. Eurostat will publish economic data today for the euro region on April inflation, March unemployment and first-quarter GDP. It's unlikely to make for pleasant reading. Virus Update | The moment of truth is coming for Europe as countries across the block tentatively begin to open up their economies. Fatalities in Italy and Spain have steadied, with Spanish Prime Minister Pedro Sanchez this week announcing a plan to end the lockdown within eight weeks, and Poland aims to ease restrictions in the run up to its May 10 election. Here's the latest. Fresh Contender | Germany's efforts to contain the pandemic have upended the race to succeed Chancellor Angela Merkel. Markus Soeder, Bavaria's state leader, has emerged as the new frontrunner, becoming one of the nation's most popular politicians after he acted first to declare a lockdown last month. Who's up and who's down? Takeover Threat | Thrust into a new era of big government, European officials are scrambling to protect their most prized assets after the worst stock-market rout in nearly a decade left them vulnerable to predators. Here's how leaders are protecting key companies from the prospect of takeover by China and the U.S. Amazon vs. Europe | For years, Amazon has mostly prevented organized labor from penetrating its employee ranks, helping keep costs down even as the company offers faster service for its customers. But in Europe, its handling of the coronavirus has provided fresh ammunition for the continent's powerful unions and activist regulators, raising the stakes for Amazon in its second-biggest market. In Case You Missed It Listen Up | We're back for episode two of The Brussels Edition podcast. Francesco Papadia, former general director for market operations at the ECB, tells us that Italy's economic situation is precarious but the ECB shouldn't overreact to credit-rating moves just yet. Bloomberg also interviewed the renowned inequality economist Thomas Piketty. Here's what he had to say. Junk Yard | Fitch Ratings downgraded Italy to one notch above junk status, putting it on the brink of a potential investor exodus just when it needs them most to help keep borrowing costs in check. The country still has one buyer at least, with the ECB having loosened its rules for Greece, while also accepting junk bonds as collateral for loans. Fossilizing Fuels | Now's the time to get rid of fossil fuel subsidies, with the collapse in global oil prices providing an opportunity to accelerate Europe's transition to a net-zero-emissions economy, Energy Commissioner Kadri Simson told us. Currently the EU spends as much as 200 billion euros a year on subsidizing oil, coal and natural gas. Stand Accused | Poland was accused by the EU of undermining judicial independence and violating the bloc's rules in another sweeping rebuke of Warsaw's controversial reforms to the legal system. The nationalist Law & Justice party is already under fire at home and abroad for its decision to push ahead with presidential elections in May, even as the lockdown has severely restricted the opposition's campaigning. Cashing Out | Germany has long been a holdout against moving toward electronic payments, but that is all changing with the fear that someone might have coughed or sneezed on the tenner that's in your pocket. Chart of the Day  The damage to labor markets around the world is proving far more severe than initially estimated after governments extended shutdowns to damp the spread of the coronavirus. The International Labour Organization said yesterday that working hours will be 10.5% lower this quarter than before the crisis started, equivalent to 305 million full-time jobs. Today's Agenda All times CET. - 9:30 a.m. EU top court publishes non-binding opinion in second case related to the diesel scandal

- 11:00 a.m. Eurostat to publish data for euro-area inflation, unemployment and first-quarter GDP

- 1:45 p.m. European Central Bank rates decision, Lagarde press conference at 2:30 p.m.

- EU tech and antitrust chief Vestager participates in a virtual event at Carnegie on the "EU and U.S. approaches and potential areas for mutual lessons learned and collaboration going forward"

Like the Brussels Edition? Don't keep it to yourself. Colleagues and friends can sign up here. We also publish the Brexit Bulletin, a daily briefing on the latest on the U.K.'s departure from the EU. For even more: Subscribe to Bloomberg All Access for full global news coverage and two in-depth daily newsletters, The Bloomberg Open and The Bloomberg Close. How are we doing? We want to hear what you think about this newsletter. Let our Brussels bureau chief know. |

Post a Comment