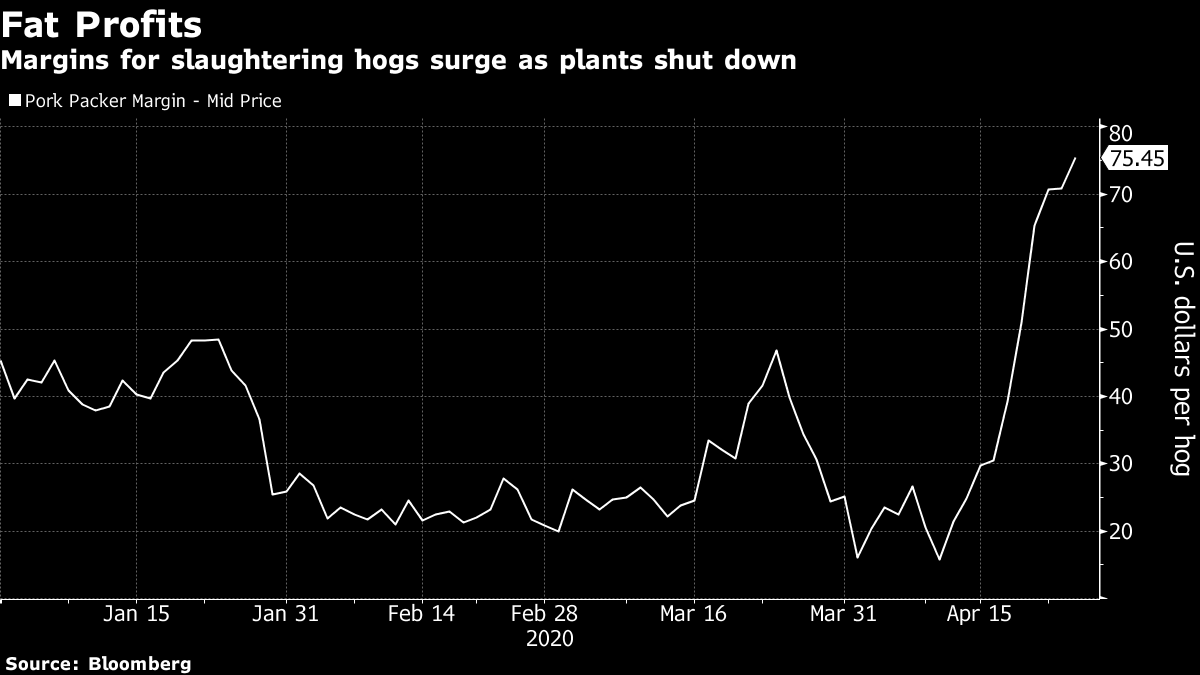

| Singapore is now Asia's coronavirus hotspot, the mystery surrounding North Korea's Kim Jong Un's health deepens and Asian markets look toward a muted start to the week. Here are some of the things people in markets are talking about today. While some coronavirus-hit countries are considering easing lockdowns, Singapore — with one of Asia's smallest populations —now has the region's biggest number of cases after the world's two most populous countries.The island nation reported 931 new cases on Sunday, with the total number of infections exceeding 13,000, overtaking Japan. In Asia, only China and India have more cases. The majority of infections are among migrant workers living in close quarters in dormitories. Meanwhile, U.S. coronavirus cases rose 3.3%, below the one-week average. Italy will ease its lockdown on May 4 after reporting the fewest deaths since mid-March. Fatalities in the U.K. and New York were the lowest in more than three weeks. Spain and France reported the smallest number of fatalities in more than a month as both nations set plans to reopen their economies. New York Governor Andrew Cuomo sketched out a phased-in reopening that begins with construction and manufacturing as soon as May 15. Bill Gates shifted his philanthropy to work on a vaccine. Follow the latest virus news here. Currency markets were steady in early Monday trading amid positive signs in the fight against the coronavirus and as traders awaited a key Bank of Japan policy meeting. The Australian dollar erased early modest losses and moves were muted elsewhere across foreign-exchange markets. Asian equity futures rose after a move higher for U.S. stocks on Friday. The Federal Reserve joins the BOJ and the European Central Bank announcing policy decisions this week. Several major economies will release GDP numbers, while corporate earnings will keep flooding in, including from Amazon.com, Barclays and Samsung Electronics. China- and Hong Kong-listed firms have come to a consensus on how to best survive this era of pandemic uncertainty: by retaining profits instead of distributing them to shareholders. In the first quarter, the most Hong Kong dividend payers in at least 35 years are taking this route. Meanwhile, though valuations recently reached a historical low in the city, firms haven't picked up their stock-repurchase pace. Instead, sales of additional stock are near their highest since 2018. The data help illustrate how the pandemic has distressed the corporate side of China's economy, which started 2020 with a contraction — the first quarterly decline in decades. Speculation about Kim Jong Un's health intensified over the weekend after tantalizing — and as yet unverified — reports of a visit by a Chinese medical team and movements of the North Korean leader's armored train. A prominent South Korea adviser, though, rejected ideas that Kim was ailing or dead. China sent a team including doctors and senior diplomats to advise its neighbor and longtime ally, Reuters reported on Saturday, citing three people familiar with the matter. Meanwhile, Kim's sister is emerging as the most likely successor to the North Korean leader. With the coronavirus pandemic just starting to ebb in New York, the world's largest banks are busily designing logistics to eventually bring staff back to mostly empty towers. Inside Citigroup's headquarters in Manhattan, executives are trying to solve a problem bedevilling much of Wall Street: How to get employees up elevators. Citigroup, Goldman Sachs and JPMorgan are all trying to figure out how to reorganize their lobbies and elevators to prevent contagion. JPMorgan might station attendants outside elevators to help push buttons, so fewer workers need to touch keypads. Goldman is exploring ways to open doors without contact, possibly setting out towelettes that can be used to touch handles and then discarded on the other side. More broadly, big banks are exploring taking an active role in monitoring the health of their employees. Wall Street banks are facing a slew of challenges, with Citigroup cautioning employees to expect a slow, gradual return with no set dates. Some might spend the rest of the year working from home. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Tracy's interested in this morning The oil market's been stealing the spotlight recently, but there's another commodities market where things are getting really interesting. Not one but two viruses are currently threatening the world's supply of pork. African swine fever has dented supply for months, of course, but now Covid-19 is causing added disruption by preventing pork processors from operating at full capacity. As Bloomberg reports, about a quarter of America's pork production has been shuttered as companies furlough workers during the outbreak.  The strange thing about this dynamic is that it's now forcing prices for finished pork products (bacon, hot dogs, and the like) higher, while prices for live pigs are falling because there's limited capacity to convert them into usable (and delicious) products. If you think about it like the oil market, the disruption to refinery capacity is far outweighing the drop in supply of the raw material. In the meantime, pork packer margins — the equivalent of crack spreads in the oil market — are surging. You can follow Bloomberg's Tracy Alloway at @tracyalloway. For the latest virus news, sign up for our daily podcast and newsletter. |

Post a Comment