America takes steps towards reopening economy, early signs of success in virus treatment trial, and oil's plunge continues. Damage doneThe coronavirus shutdown in China spurred the first economic contraction in decades at minus 6.8% in the first three months of 2020 from a year ago. With many of the restrictions there now lifted, attention is turning to how other countries will start to get back on track. President Donald Trump yesterday unveiled guidelines on reopening the U.S. economy which could see an end to many of the current social distancing practices within four weeks. The plan from the White House leaves the timing of measures to state governors and businesses, a reversal of the president's previous assertion that he had total authority to make such a decision. Treatment hopeWhile scientists around the world are hard at work on a vaccine, there are signs that a treatment for those worst hit by the virus may be emerging. A report on a Chicago trial of Gilead Sciences Inc.'s drug remdesivir — previously used to treat Ebola patients — pointed to promising signs, with patients showing "rapid recoveries in fever and respiratory symptoms." Shares in Gilead are more than 10% higher in pre-market trading. Bottomless oilThere seems to be no end in sight to the bad news for the crude market. Less than a week after the historic agreement to cut production, OPEC predicted that demand for its crude will drop to the lowest level since early 1989. Earlier this week, the International Energy Agency predicted the world may soon run out of places to store the commodity as demand evaporates. West Texas Intermediate for May delivery is trading close to $18 a barrel this morning, with cargoes of Brent trading at steep discounts, according to S&P Global Platts. Markets rallySigns of a path towards reopening the world's largest economy and the possibility of an effective treatment are giving risk assets a boost this morning. Overnight, the MSCI Asia Pacific Index added 1.9%, pushing the gauge to the cusp of a bull market, while Japan's Topix index closed 1.4% higher. In Europe, the Stoxx 600 Index had rallied 3.1% by 5:50 a.m. Eastern Time with every sector, including oil and gas, posting gains. S&P 500 futures pointed to a pop at the open, the 10-year Treasury yield was at 0.64% and gold was dropped. Coming up…The Conference Board U.S. Leading Index for March is expected to show a record decline when it is published at 10:00 a.m. Federal Reserve Bank of St. Louis President James Bullard speaks this morning. The Baker Hughes rig count is expected to drop below 600 for the first time since 2016 when it is released at 1:00 p.m. Procter & Gamble Co., State Street Corp. and oil-services giant Schlumberger Ltd. are among companies reporting earnings. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Luke's interested in this morningSomewhat predictably, Bank of America's April survey of fund managers showed a record low share of respondents (5%) wanted to see companies boost shareholder returns (via buybacks, dividends, or M&A). Conversely, a record high 79% want management to focus on improving corporate balance sheets. Ironically, at this juncture there's a large swath of firms for whom "improve balance sheet" means "add more leverage to bolster your current position," as the deluge of issuance indicates. However, upon any return to quasi-normalcy and economic expansion, the scars from this crisis could result in a lingering focus on deleveraging among Corporate America. That has negative implications for future growth and equity market returns. "The flood of money going into corporate bonds is a near-term positive because it is allowing many companies to survive and term out their debt," writes Brian Reynolds, chief market strategist at Reynolds Strategy LLC. "That corporate balance sheet transformation is a longer-term negative, as we believe companies will have to focus on debt buybacks, not stock buybacks, in the next cycle."

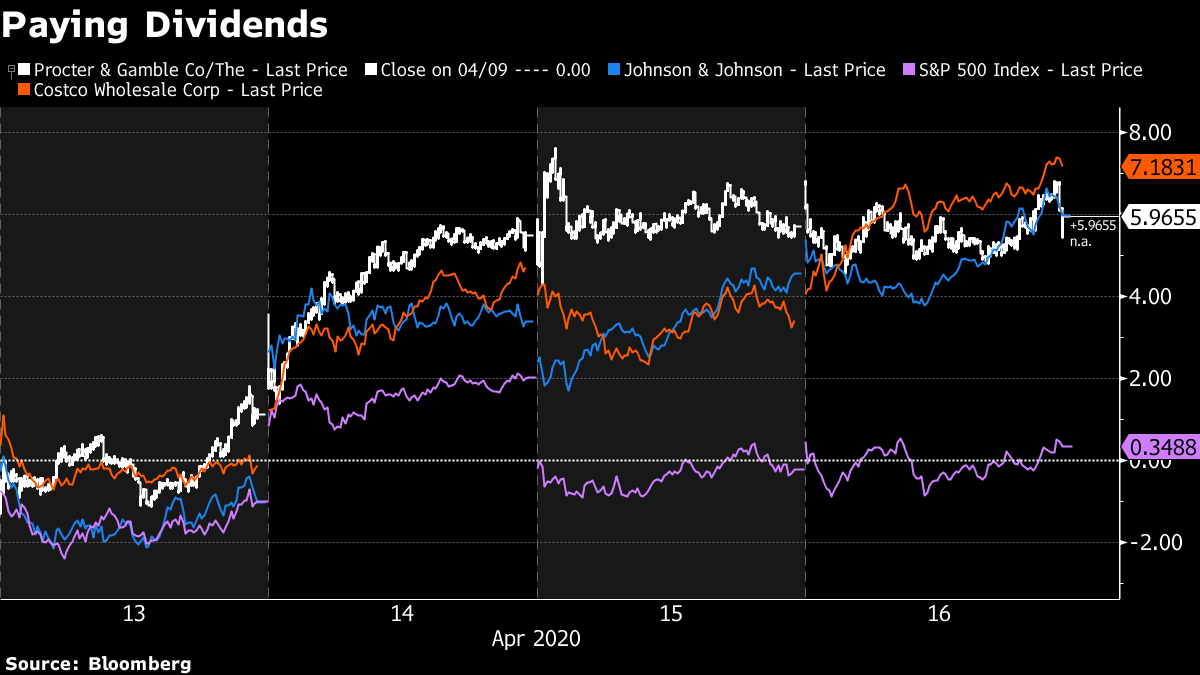

If this comes to pass, and as past experience with the zero lower bound dents any optimism that may be embedded in longer-term borrowing costs relative to 2009, there's a clear advantage for companies able to credibly retain a focus on returning money to shareholders. Three companies that hiked their dividends this week – Procter & Gamble, Johnson & Johnson, and Costco – are all trouncing the S&P 500. So much for fund managers seeking balance sheet improvements over shareholder-friendly actions!  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment