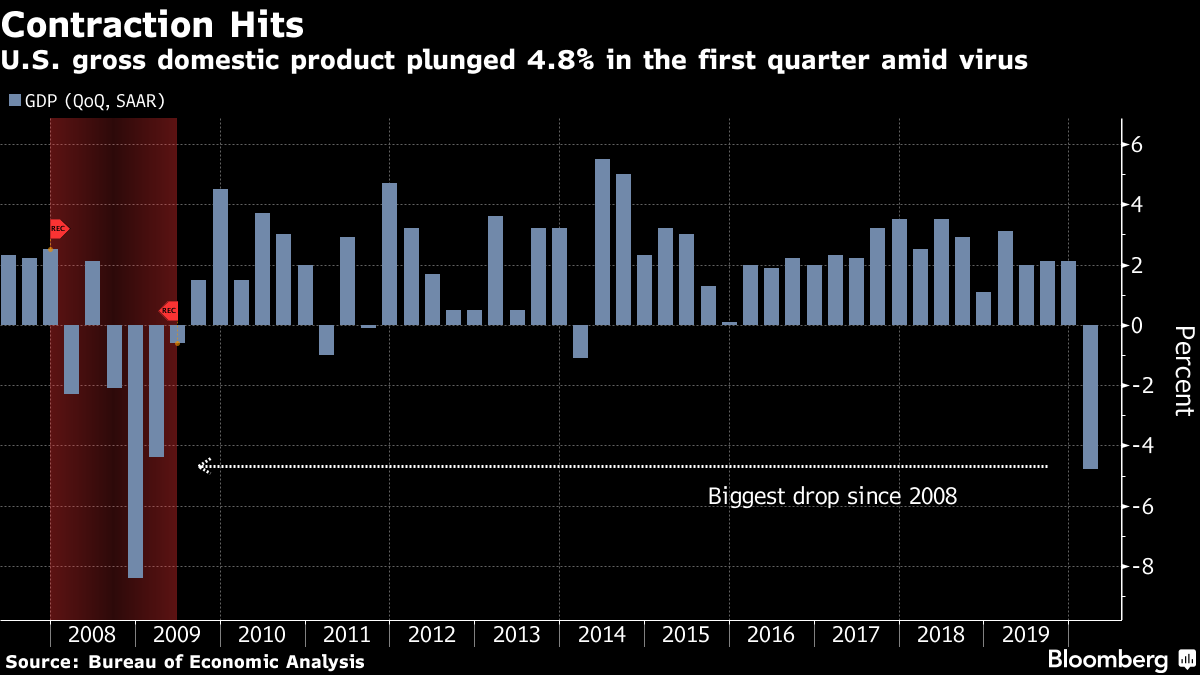

Jobless claims likely to add to litany of dire economic news, Apple among the companies reporting, and it's ECB decision day. Millions moreWeekly jobless claims published at 8:30 a.m. Eastern Time are expected to drop to a still-terrifying 3.5 million for the week ended Apr. 25, bringing the six-week total to close to 30 million. A report from McKinsey & Co. says the pandemic shutdown will hurt 57 million U.S. workers once reduced hours and furloughs are taken into account. Already this morning there was bad news on the health of the euro-area economy, with growth in the region plunging into a record contraction in the first quarter as Spain and France saw their economies shrink more than 5%. Germany reported a 373,000 surge in unemployment claims in April. ECB dayThe dire news on the economy in the euro area combined with data this morning showing inflation this month dropped to 0.4% is likely to focus minds at the European Central Bank as officials meet to make their latest monetary policy decision. Even though policy makers have already announced asset purchases this year of more than 1 trillion euros ($1.1 trillion), economists surveyed by Bloomberg expect another 500 billion euros of purchases to be announced this year. Goldman Sachs Group Inc. says a bump up in stimulus could come today. The decision is published at 7:45 a.m., followed by a press conference at 8:30 a.m. EarningsTech companies continue to outperform during the lockdown, with strong results from Facebook Inc., Microsoft Corp. and others putting the Nasdaq Composite on track to erase losses for the year. Tesla Inc. shares are over 8% higher in pre-market trading after the company beat expectations on profit for the first quarter. Apple Inc., Amazon.com Inc. and Twitter Inc. continue the tech theme when they report after the close today. Markets mixedEarnings season and hopes of an effective treatment for coronavirus are dominating market sentiment, with investors mostly looking past growth and employment data. Overnight, the MCSI Asia Pacific Index gained 1.3% while Japan's Topix index closed 1% higher. In Europe, the Stoxx 600 Index was unchanged at 5:50 a.m. as banks took a hit after worse-than-expected results from some of the region's biggest lenders. S&P 500 futures pointed to a small rise at the open, the 10-year Treasury yield was at 0.612% and oil continued its strong performance. Coming up…The March PCE report is expected to show the biggest drop in spending on record when it is released at 8:30 a.m. MNI Chicago PMI and Bloomberg consumer comfort for April are at 9:45 a.m. The White House may announce plans for loans to help the oil industry today. In non-tech earnings, McDonald's Corp., Gilead Sciences Inc., Kraft Heinz Co., United Airlines Holdings Inc. and American Airlines Group Inc. are among the many companies reporting today. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningFacebook reported earnings yesterday, and soon thereafter these two headlines flashed across the Bloomberg Terminal: *FACEBOOK: SEEN SIGNS OF STABILITY IN FIRST 3 WEEKS OF APRIL *FACEBOOK SEES 2020 CAPEX ~$14-16B, DOWN FROM PRIOR $17-19B The whole debate about where the economy goes next is contained right there. Business activity across multiple sectors basically ground to a halt in unprecedented fashion. And so it's almost math that we'll see some stability and pickup in the weeks ahead as more places start to "reopen." But in the meantime, because of these extraordinary weeks, Facebook will be slashing its capital expenditure budget by $2 or $3 billion for the whole year, representing a significant income hit to third parties working for or on behalf of the company. Now repeat this across numerous companies big and small, and you'll grasp the issue. As Srinivas Thiruvadanthai of the Jerome Levy Forecasting Center wrote on Twitter earlier this week, there are two distinct economic phenomenons playing out. One is the shutdown itself. The other is the cascading effects of the layoffs, hiring freezes, wage cuts, higher indebtedness, and capital-expenditure reduction triggered by the shutdown. Yesterday we got GDP data for the first quarter of the year, and it showed the worst drop since 2020. The official recession clearly began in late February or early March. But it almost feels like economics lacks a word for what we've experienced so far, which might be likened to a medically induced coma. The question now is whether the horrendous shock leads to a more classical recession or whether the positive impulse from the reopenings can stem the negative economic tide.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment