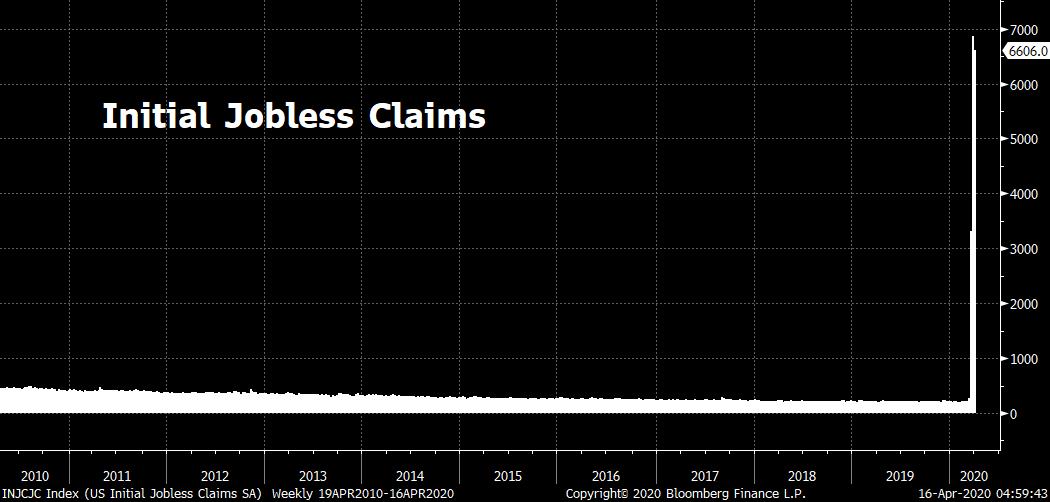

Trump to unveil guidelines for reopening economy, another huge jobless number expected, and Morgan Stanley reports. Peak?President Donald Trump said that he will announce guidelines today to ease the stay-at-home rules, saying that data suggests the U.S. has passed the peak of new cases. Yesterday the president had a marathon round of calls with business leaders from across the country who urged him to move forward on reopening the economy, while calling for a robust testing regime to be in place. One of the biggest problems Trump faces in his attempt to get the economy back to work is whether he actually has the power to do it, as he continues to hit against the limits of his authority over states and Congress. Millions moreWhile the peak of the outbreak may be near, for many Americans the economic pain is far from easing. Today's initial jobless claims number at 8:30 a.m. Eastern Time is expected to be another mammoth print with the median estimate from economists surveyed by Bloomberg for 5.5 million new claims, in a range of between 2 and 8 million. That median number would put the four week total at 22 million, wiping out all the jobs gains since the last recession. Wall Street earningsMorgan Stanley wraps up what has been an earnings season dominated by huge loss provisions on the one hand and a surge in trading revenue on the other for Wall Street's biggest banks. Lenders that have already reported this week have seen their shares under pressure while management attempts to estimate the costs from the economic shutdown. Bank of New York Mellon Corp. also announces earnings today. Markets mixedGlobal equity investors continue to walk the line between a hoped-for end to the coronavirus shutdown and the raft of terrible economic data showing the damage already done. Overnight the MSCI Asia Pacific Index dropped 1% while Japan's Topix index closed 0.8% lower as the country seems set to extend the state of emergency nationwide. In Europe, the Stoxx 600 Index was 0.8% higher at 5:50 a.m. as traders were willing to take on some risk as they rotated out of defensive stocks. S&P 500 futures pointed to a gain at the open, the 10-year Treasury yield was at 0.638% and gold was slightly higher. Coming up…As well as jobless claims, the April Philadelphia Fed Business Outlook and U.S. March housing starts and building permits are at 8:30 a.m. President Donald Trump takes part in a G-7 leaders' teleconference this morning. All speaking at various events today: Atlanta Fed President Raphael Bostic, New York Fed President John Williams, Federal Reserve Bank of Richmond President Tom Barkin, San Francisco Fed President Mary Daly and Federal Reserve Bank of St. Louis President James Bullard. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningWith U.S. COVID-19 cases thought to be roughly near the apex, there's growing interest in what "reopening" the economy will look like, and when it will happen. The White House is expected to offer some details of its vision today. Nobody thinks there's going to be some moment where everybody is told they can go back in the pool and life returns to normal. And despite the head-scratching resilience in stocks, virtually nobody on Wall Street is calling for a V-shaped economic recovery. Still it's worth noting, just as the economy can't suddenly be flipped on again, nobody turned it off either. As Charles Fain Lehman laid out yesterday in a piece at the Washington Free Beacon, economic activity started collapsing before widescale shelter-in-place orders went out. The economy powered down, so to speak, organically as the virus fear really started setting in. Back on March 13, the Seattle Times used the term "Great Recession, only on hyperdrive" in a story about the collapse in dining out activity. Again, this was before official closure orders had been put in place. Meanwhile, it's been over two weeks since Congress passed the CARES Act, and yet economists are still expecting another 5.5 million initial jobless claims to be reported today. That shows the measures in D.C. haven't come anywhere close to stopping the obliteration of the labor market that started when consumer behavior did a 180 starting in early March.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment