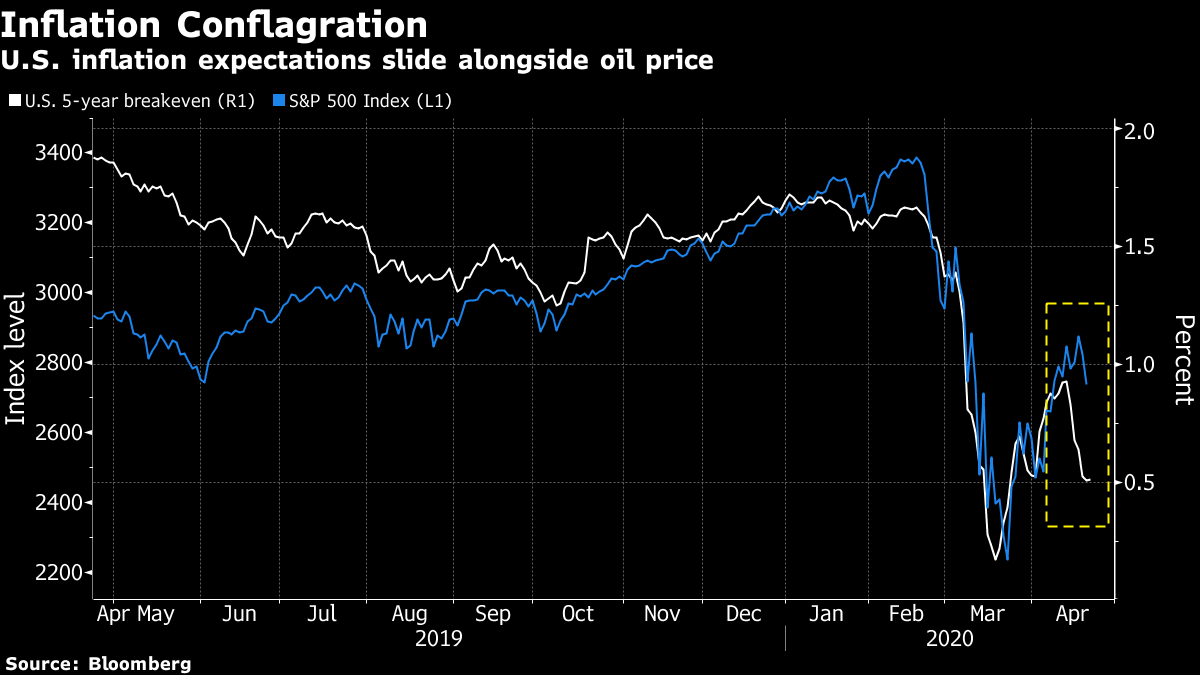

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. Brent crude futures are following WTI's lead, the coronavirus picture remains mixed across Europe and Netflix Inc. had a bumper quarter. Here's what's moving markets. Brent Slumps Europe's main oil benchmark is now firmly part of the rout that sent U.S. oil futures below zero for the first time ever this week. Brent for June delivery lost 16% to trade near $16 a barrel on Wednesday, adding to a 24% drop on Tuesday. New York's West Texas Intermediate, meanwhile, fell around 9%, following a 43% collapse yesterday. The Trump administration vowed to come to the rescue of the U.S. energy sector with stimulus funds and other measures, while a fund that offers investors exposure to fluctuations in crude prices might be worth less than nothing. Here's an updated reminder of how this all happened. Improvements and Setbacks The virus picture is improving in some areas, but not without setbacks along the way. The Netherlands moved to begin easing restrictions as new infections drop, while Italy aims to roll out a detailed restart program beginning on May 4. In France, the number of patients in intensive care with Covid-19 fell to the lowest in three weeks, but in the U.K., a sharp increase in daily deaths provided a reminder of lingering dangers. In the U.S., infections rose the most since April 10. And over in Asia, the one-time standard bearer for taming the virus, Singapore, reported more than 1,000 cases for a second day. Streaming King If the name Joe Exotic means anything to you, then you might not be surprised to hear that Netflix Inc.'s business is booming. The company added a record 15.8 million paid subscribers during the first quarter, almost double the 8.47 million expected by Wall Street, as lockdowns around the world saw people binge-watch hit new releases like "Tiger King." The firm's stock was already up 34% year-to-date and spiked again in after-hours trading before erasing the gain as some investors questioned how long the explosive growth would last. A pause in production, meanwhile, may have only temporarily lowered costs. U.K. Government Test Boris Johnson's coronavirus strategy faces its first major political test since the U.K. was put on lockdown a month ago when members of Parliament question ministers in a sitting conducted via video-conference. The prime minister remains out of action recovering from his own severe case of Covid-19, so in his place will be Foreign Secretary Dominic Raab, facing new opposition Labour Party Leader Keir Starmer. The session should give ministers a sense of how much pressure they're under to start easing Britain's lockdown. Separately, the U.K. will begin human trials of a coronavirus vaccine Thursday. Coming Up… European stock futures are edging up after shares in the region suffered their worst daily decline in almost a month on Tuesday, and U.S. futures are marginally lower as investors shrugged off the the Senate's passing of $484 billion in new pandemic relief funds. Elsewhere, Turkey is expected to cut interest rates again, and euro area consumer and French manufacturing confidence are likely to plunge further. It's another busy earnings day with Swiss drug-maker Roche Holding AG and Dutch brewer Heineken N.V. among those reporting. Luxury goods group Kering gave a cautious assessment of rebounding luxury sales in China. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning Fresh warnings from the bond market on rapidly retreating inflation expectations should be raising concerns for equity bulls too. The 5-year U.S. breakeven rate -- a proxy for annual average inflation in the next half-decade -- has fallen back to about 0.5%, in part thanks to the historic slump in crude oil prices. While the worst of the oil price slump is of course due to short-term supply and storage issues, ten-year breakevens are also declining, suggesting bond traders are leaning toward the view that the coronavirus pandemic will be a deflationary phenomenon. That of course raises question marks about the pricing power of companies, and the risk to revenues and profitability. Notably breakevens bottomed in March a few days before stocks did and their rebound closely tracked the equity rally. A continued decline back to and through their year-to-date lows would signal renewed worries about expectations for economic growth and could lead to increased pressure on stocks.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment