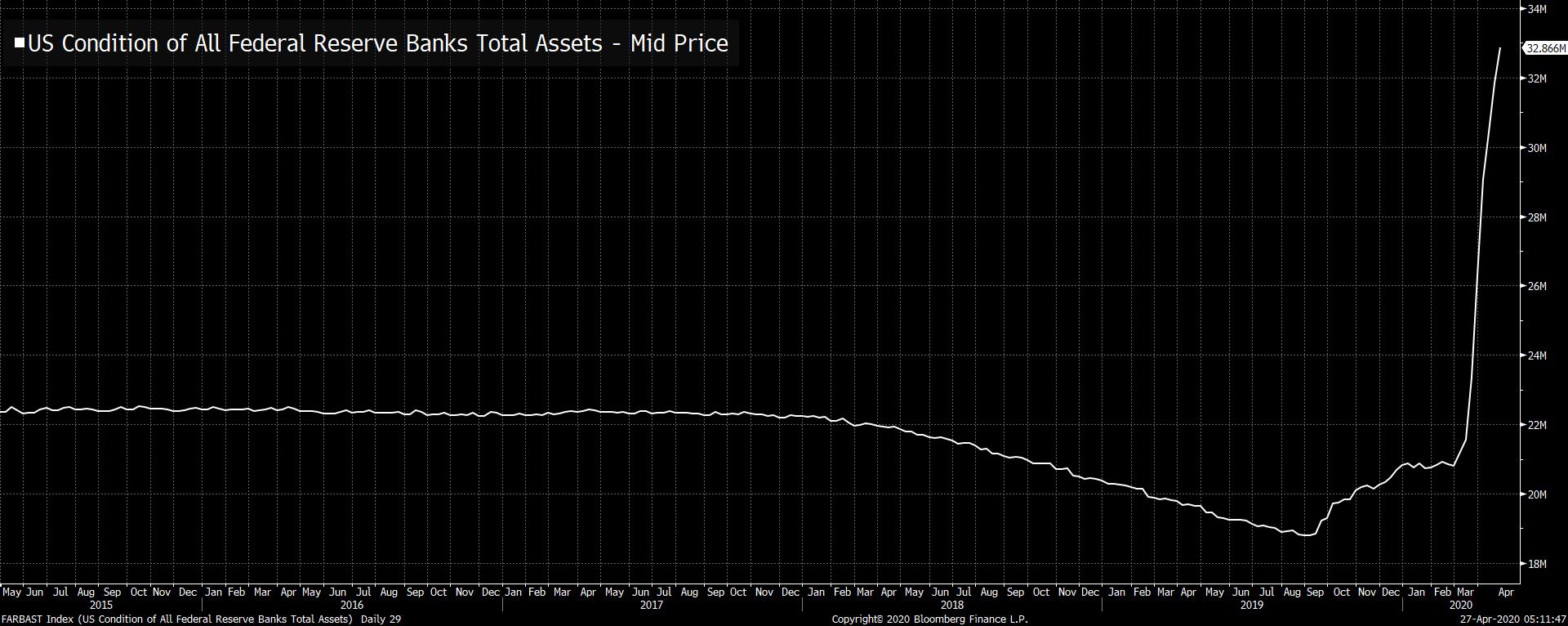

Reopening plans gather pace, a busy week for central banks, and a surprise from Deutsche Bank. Corner turned?New York Governor Andrew Cuomo said a phased reopening beginning with construction and manufacturing could start as soon as May 15, as the state announced the lowest number of deaths in almost a month. Trade groups in the U.S. called for states to adopt uniform reopening standards. In Italy, Prime Minister Giuseppe Conte gave a timetable for restarting the economy which sees some activity resuming after May 4 with schools to remain closed until September. U.K. Prime Minister Boris Johnson, in his first address since returning to work after being hit with the virus, said the country was nearing the end of the "first phase" of the outbreak. More buyingBoth the U.S. Federal Reserve and the European Central Bank have scheduled monetary policy decisions this week, but it was the Bank of Japan that set the tone this morning announcing further purchases of corporate bonds and scrapping the limit on government bond buying. With both the Fed and the ECB announcing a lot of fresh stimulus since their last scheduled meetings, economists have limited expectations for further major announcements this week. The Fed decision is on Wednesday and the ECB is on Thursday, both followed by press conferences. Good news, bad newsDeutsche Bank AG surprised the market by announcing net income of 66 million euros ($72 million), defying analyst expectations for a loss in the first quarter. The bank, which releases more detailed results on Wednesday, set aside about 500 million euros, three times last year's amount, to cover loan losses that may arise from the coronavirus shutdown. Shares in the lender surged as much as 12% in Frankfurt trading. The bank stuck with its capital targets for 2022, calling the current effects from loan losses "temporary." Markets rallySigns that an end may be in sight to the lockdown and more easing from the Bank of Japan has helped boost global equities. Overnight the MSCI Asia Pacific Index gained 1.9% while Japan's Topix index closed 1.8% higher. In Europe, the Stoxx 600 Index had risen 1.7% by 5:50 a.m. Eastern Time with every industry sector in the green. S&P 500 futures pointed to a jump at the open and the 10-year Treasury yield was at 0.627%. Crude came under pressure again, with a barrel of West Texas Intermediate for June delivery dropping close to $14. Coming up…There's more bad news expected for regional manufacturing when the Dallas Fed releases its April survey at 10:30 a.m. Speaking of regional moves, the state of Georgia will push ahead with its reopening plans, allowing movie theaters and restaurant dine-in services to resume business. The Federal Reserve will run liquidity operations totaling $1.5 trillion. Keurig Dr. Pepper Inc., Universal Health Services Inc., and Canadian National Railway Co. are among the companies reporting earnings. What we've been readingThis is what's caught our eye over the weekend. And finally, here's what Joe's interested in this morningAfter the U.S. bailed out banks in 2008 and 2009, it was politically unacceptable to let them go back to their old ways. And in 2010, Congress passed Dodd-Frank, which forced a de-risking of bank business models. So what will be the equivalent this time around? One possibility is that it will center on issues related to domestic production, and attempt to address our inability to manufacture basic protective health equipment at scale during a crisis. But it also seems plausible that we could rethink the non-bank corporate sector specifically. One of the defining actions of this crisis is how the Fed has been forced to intervene in novel ways across credit markets to prevent a de facto run on corporate America. As we discussed on our recent podcast with Nathan Tankus (the author of an excellent newsletter on the Fed and the crisis), officials decided that we can't let the corporate sector, writ large, fail entirely at the same time. But now that we've decided that large scale corporate capacity is, like banks, something of a public good or public utility, will large companies be allowed to go back to the exact old way of doing business? Could they be forced to save more for a crisis, with liquidity demands similar to banks? It's not obvious what kind of political will there will be in the months and years ahead to enact major post-crisis reforms. But it does seem plausible that now that the corporate sector, generally, is seen as Too Big To Fail, bigger changes could come down the pike in terms of how non-bank companies are expected to operate and plan.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment