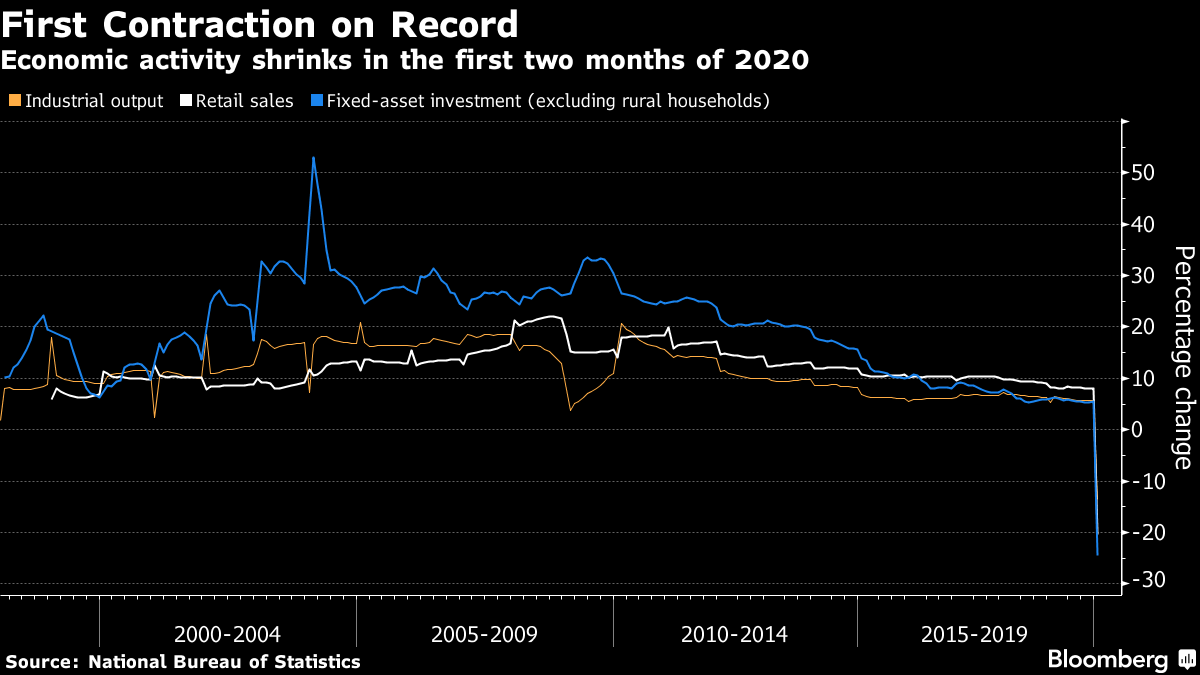

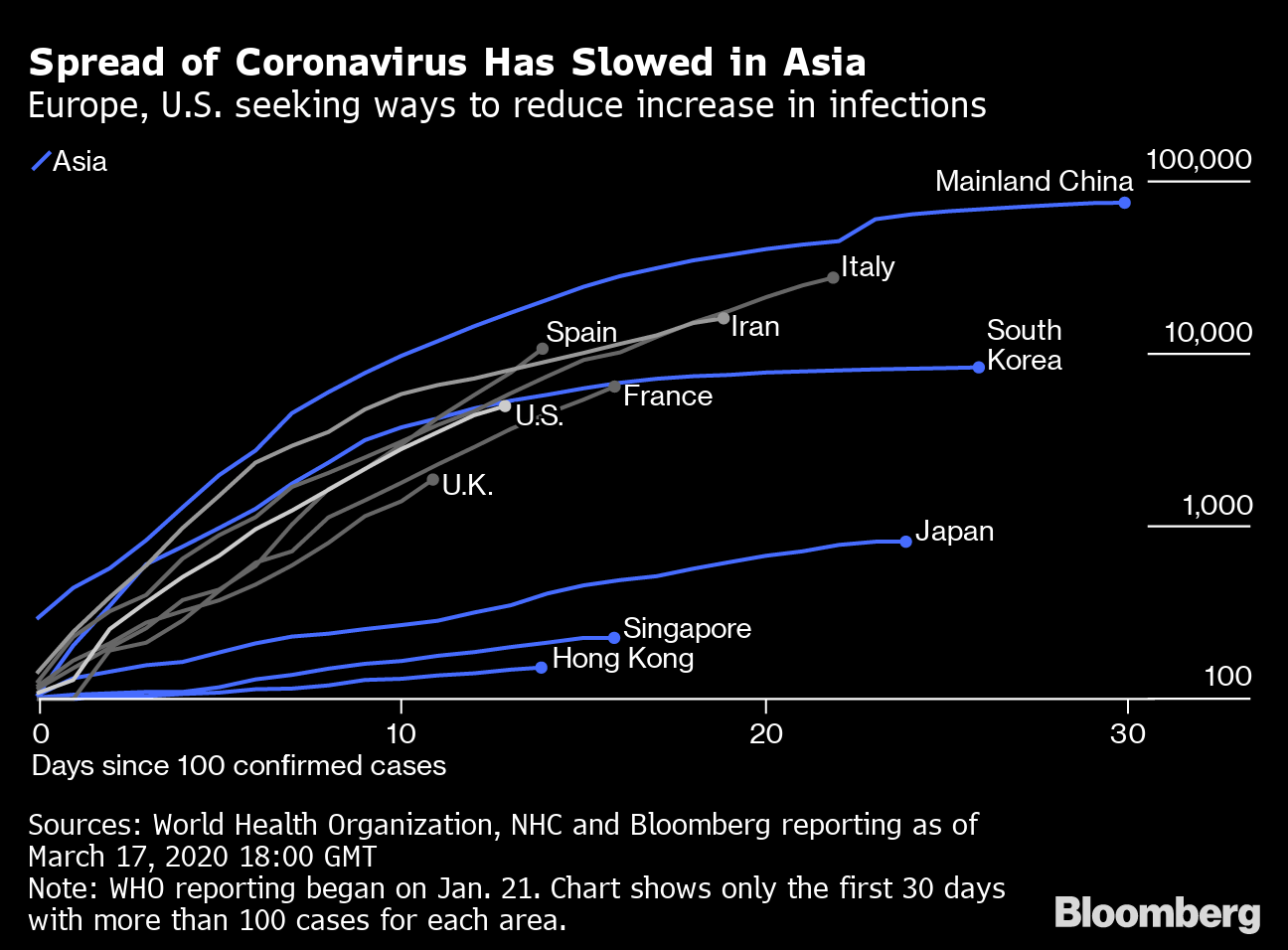

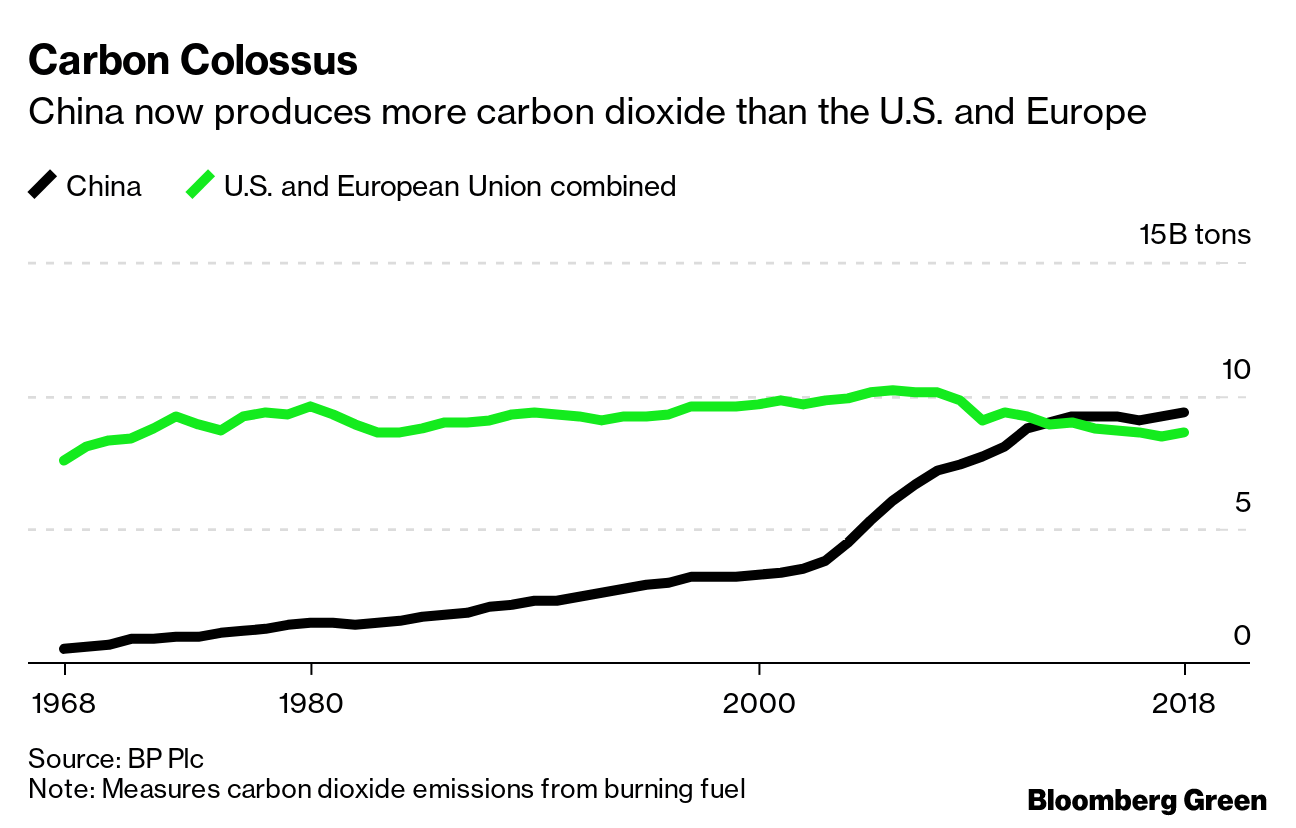

| China's economy is starting the year off in a hole thanks to the coronavirus. That was widely expected. The surprise is how deep. Data released this week for retail sales, industrial production and investment were far worse than expected. So bad, in fact, that economists were sent scrambling to adjust their forecasts. Morgan Stanley now expects China's economy to shrink by 5% in the first quarter. Goldman Sachs sees a 6% slide while the team at Bloomberg Economics forecasts an 11% contraction.  That's a staggering deterioration in outlook given that just three weeks earlier, a Bloomberg survey of economists put expectations at 4.3% growth for the quarter. Now the question is how Beijing will respond. Far from sitting on their hands, Chinese policy makers have already rolled out a slew of measures to buoy the economy. But as infections have surged globally and countries have unveiled dramatic stimulus packages, China's steps have looked more modest by comparison. It's possible that could change, of course, though there is also reason to think China would rather not join the "whatever it takes" camp if it doesn't have to. One reason is debt. Beijing is all too familiar with the unwelcome side effects of broad-based stimulus. The mountain of debt the country sits on today – near three times the size of GDP – has its roots in a 4 trillion yuan package introduced during the global financial crisis. That's an experience policy makers will be loath to repeat. China's currency is another. The yuan has been notably stable as of late, outperforming its peers as the coronavirus has rocked global markets. Much of that strength derives from China's decision to not massively cut interest rates. With memories of the turmoil caused by the yuan's 2015 devaluation still fresh on Beijing's mind, doing anything that undercuts that stability will be unappealing. Other countries, meanwhile, have been more aggressive. In the U.S., the Trump administration is seeking a stimulus package in excess of $1 trillion. The European Central Bank is buying $850 billion of bonds. Canada unveiled a package equal to 3% of GDP. There's still the chance Beijing could opt for something just as big. It's hard to rule anything out given how little is known about the coronavirus. What seems safe to say is that China will almost certainly be late to the party. Shifting Focus Apartment complexes across Beijing, without exception, have put guards at their gates to vet those seeking entry. Originally assigned to identify who may have recently been to Hubei province, where the virus first emerged, their focus has more recently turned to anyone who's traveled outside China. Plenty happened this week to explain why. Hubei on Thursday announced for the first time in months that it had no new infections during a 24-hour period. That news came a day after Europe surpassed China in terms of total infections. A surge in the price of air tickets from various European cities to China further underlined how the epicenter of the pandemic has shifted.  Rivalry Endures This global outbreak has not engendered much goodwill, something that's been especially pronounced in the context of China's relationship with America. Tensions between the world's foremost powers bubbled a little hotter this week as President Donald Trump doubled down on his use of the term "Chinese virus," a description Beijing has publicly objected to. Confronted at a press conference about whether the term was racist, Trump defended its use, and in doing so cited a Chinese foreign ministry spokesman's attempt to promote a conspiracy theory that the U.S. military spread the virus. Bilateral ties look even worse when you add on Beijing's decision this week to expel a dozen American journalists in retaliation for Washington earlier kicking out Chinese journalists. It's hard to imagine how this sort of diplomacy overcomes a pandemic. Emissions Standards Bluer skies have been one of the few nice things about the outbreak. But the forces that have cut pollution are the same ones that have battered China's economy, which should also mean any sharp improvements in air quality are temporary. It was revealed this week, for example, that Beijing is exploring easing some emissions standards for the car industry, which has seen sales plunge as buyers stay home. Similar steps aimed at helping other industries are very possible as Beijing weighs longer-term environmental goals against short-term economic needs. As the world's largest source of emissions, where China comes down on that balance will have substantial global implications.  What We're Reading: And finally, a few other things that got our attention: |

Post a Comment