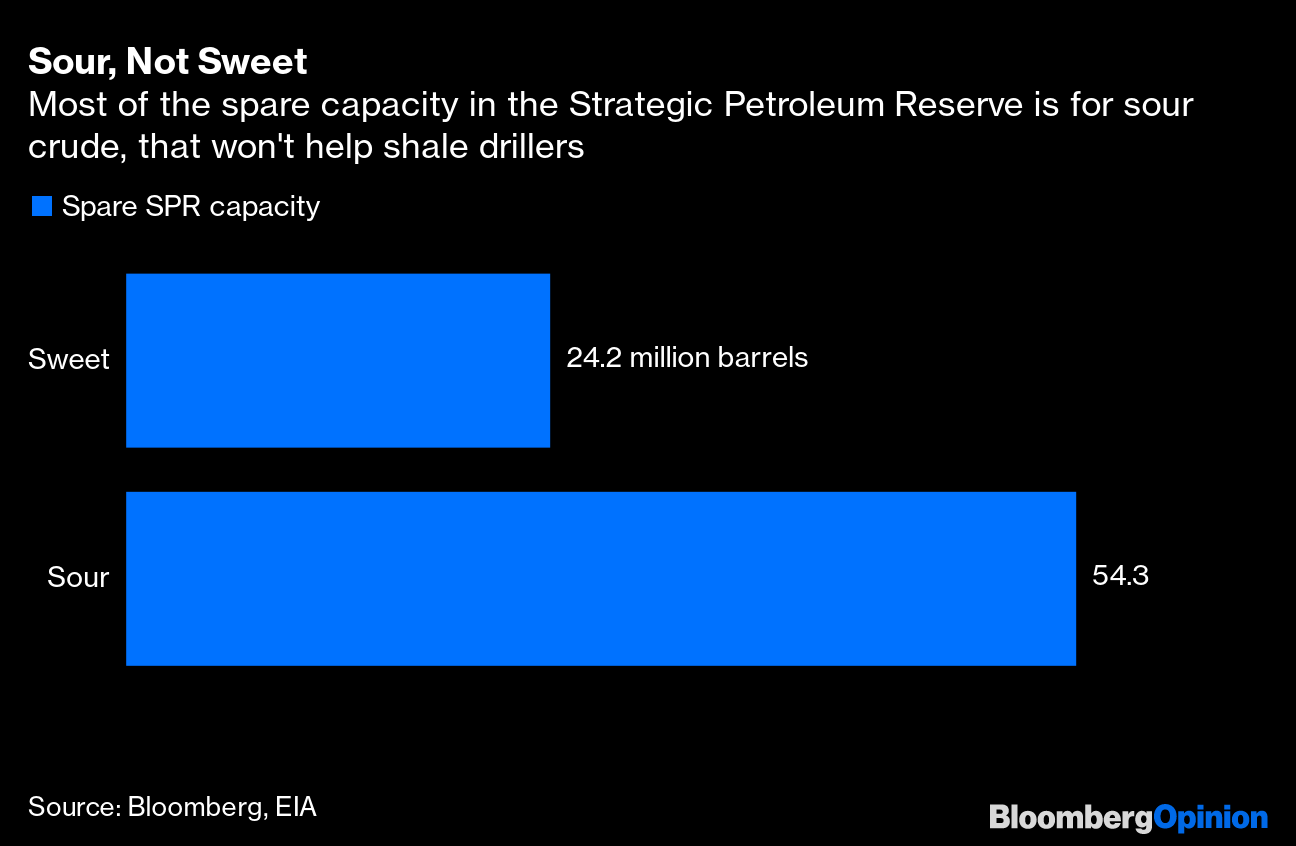

| This is Bloomberg Opinion Today, a New New Deal of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  This guy had some ideas. Photographer: Keystone Features/Hulton Archive/Getty Images A Big Crash Needs a Big Response As we've written, this pandemic is one of those rare events that will change us forever — for the better or for the worse. Tempting as it may be to stock up on guns and toilet paper and retreat from the world, we shouldn't let this crisis go to waste. President Franklin D. Roosevelt understood this during the Great Depression, so he encouraged us to channel fear into building a better nation. We have the same opportunity now, writes Michael R. Bloomberg (founder and majority owner of Bloomberg LP). When the pandemic passes — and it will, believe it or not — we'll need to revive a comatose economy. The various stimulus packages and rescue plans being slapped together as we speak are a good start, but won't be nearly enough. Rebuilding and greening our crumbling infrastructure is a national project with FDR-level ambitions, Mike writes. Putting people to work on big projects will not only boost the economy but also give us hope for the future. And if it feels hyperbolic to compare this moment to the Great Depression; well, sorry, it's not. We're already getting unemployment claims numbers, and they are grim, writes Karl Smith — possibly grimmer than anything during the depression. Some economists expect GDP to shrink at a double-digit percentage rate in the second quarter. Of course, not everybody loved FDR's ambitions, fearing the growth of the state. Already there may be signs in the Treasury market of investors fretting about the huge test of Modern Monetary Theory we're about to experience, writes Robert Burgess. MMT argues, more or less, that we can spend as much as we want if we just print more money. Higher borrowing costs may suggest there are limits. But everybody's got to take chances and make mistakes, as Miss Frizzle would say, at a time like this. Even the European Central Bank has woken up, last night turning its full firepower on the crisis and finally convincing investors it will stop another sovereign debt crisis, writes Ferdinando Giugliano. Back in the U.S., we've got to let the Fed buy muni bonds, writes Marcus Stanley. Suffering state and local governments made the 2008 recession longer and deeper, and we can't make that mistake again. This could also be the right time for the U.S. to issue 50-year bonds, writes Brian Chappatta. We could call them something like Pandemic War Bonds, to help sell them and drive home just how big a moment this is. Patience May Be the Best Pandemic Fighter Such stirring talk might seem hollow right now, though, to those of us cowering in fear at a pandemic that has only just begun to spread. The first real confidence-booster would be some hint of when this nightmare will end. Fortunately, being in and out of quarantine for the next 18 months, as some studies have estimated, probably isn't necessary, writes Justin Fox. Nor should we surrender to the disease, killing millions, just to get it over with in a hurry, as some have irresponsibly suggested. Today's lockdowns will buy time for better solutions for getting back to something close to normal. Better testing is certainly one of those, but we must temper our expectations for it, writes Mary Duenwald. President Donald Trump today suggested we might soon have in-home testing kits, which sounds great to those of us with mild symptoms and rolling panic attacks. But it's unrealistic to think we can all just willy-nilly jam swabs up our noses and get good results, or that we even have the resources to support such testing. (Spoiler: We don't.) Trump also hyped imminent new virus treatments, including a malaria drug he claimed was FDA-approved to treat Covid-19. The FDA immediately clarified that no, actually, it wasn't. None of the drugs Trump mentioned, in fact, are proved as effective or as close to widespread use as he suggested, writes Max Nisen. In China, meanwhile, patience is paying off; after months of harsh lockdowns, Hubei province has no new cases. Beijing may have stumbled at the beginning of this crisis, writes Anjani Trivedi, but it has since schooled the rest of the world on pandemic response. Then again, Japan shows you can limit an outbreak without extensive testing or lockdowns, notes Noah Smith. Closing schools early may have helped, but Japan also has a long tradition of social distancing. People bow instead of shaking hands, and use masks when they're sick. Maybe that's another way we'll change. Rescuing Corporate America Shutting down the global economy for months tends to dash one's business plans, and we'll soon be bailing out companies as a result. Airlines may not be the most sympathetic recipients, with their poor leg room and seemingly endless fees. But they're at the front lines of this crisis, and they've also quickly made many sacrifices, including to executive pay, making it far less galling to bail them out, notes Brooke Sutherland. For whatever reason, Boeing Co. and other airline suppliers haven't bothered yet. At the same time, even as Trump bails out manufacturers and the economy with one hand, he's still hammering them with tariffs with the other, Brooke Sutherland writes in a second column. Lifting these self-defeating duties could help businesses through the crisis and give them more wherewithal to make medical supplies, of which there is a dire shortage. Automakers are high on the list of companies that could lend a hand; even virus-skeptic Elon Musk suggested his Tesla Inc. could make ventilators. But automakers will need help, too.Tesla's red ink will flow again with the interruption of sales of its electric cars, writes Liam Denning. Throughout the industry, shuttered plants will expose those with weaker balance sheets, writes Chris Bryant. Further Crisis Inc. Reading: Telltale Charts We're seeing negative yields on short-term Treasuries, as investors prefer to lose a couple of bucks that way than to lose much more in other markets, writes Brian Chappatta.  Trump's plan to fill the SPR with oil from frackers has a sweet and sour problem, writes Julian Lee.  Further Reading Australia's long stretch of growth is ending, along with its sense of invincibility. — Daniel Moss Iran's virus response has focused on exaggerating death rates and blaming U.S. sanctions. — Bobby Ghosh After 24 years, Patroon's Ken Aretsky is joining other New York restaurants in shutting down. — Joe Nocera ICYMI Yes, young people are vulnerable to Covid-19. 99% of Italy's Covid-19 deaths were in patients with other illnesses. Rich investors are bargain-hunting. Kickers Aquarium shows aren't just for penguins; the New England Aquarium is holding virtual ones for humans daily. Scientists find oil (sort of) on Mars. Researchers are learning how Asian elephants think, to save them. How to WFH with your partner without killing each other. Note: Please send oil and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment