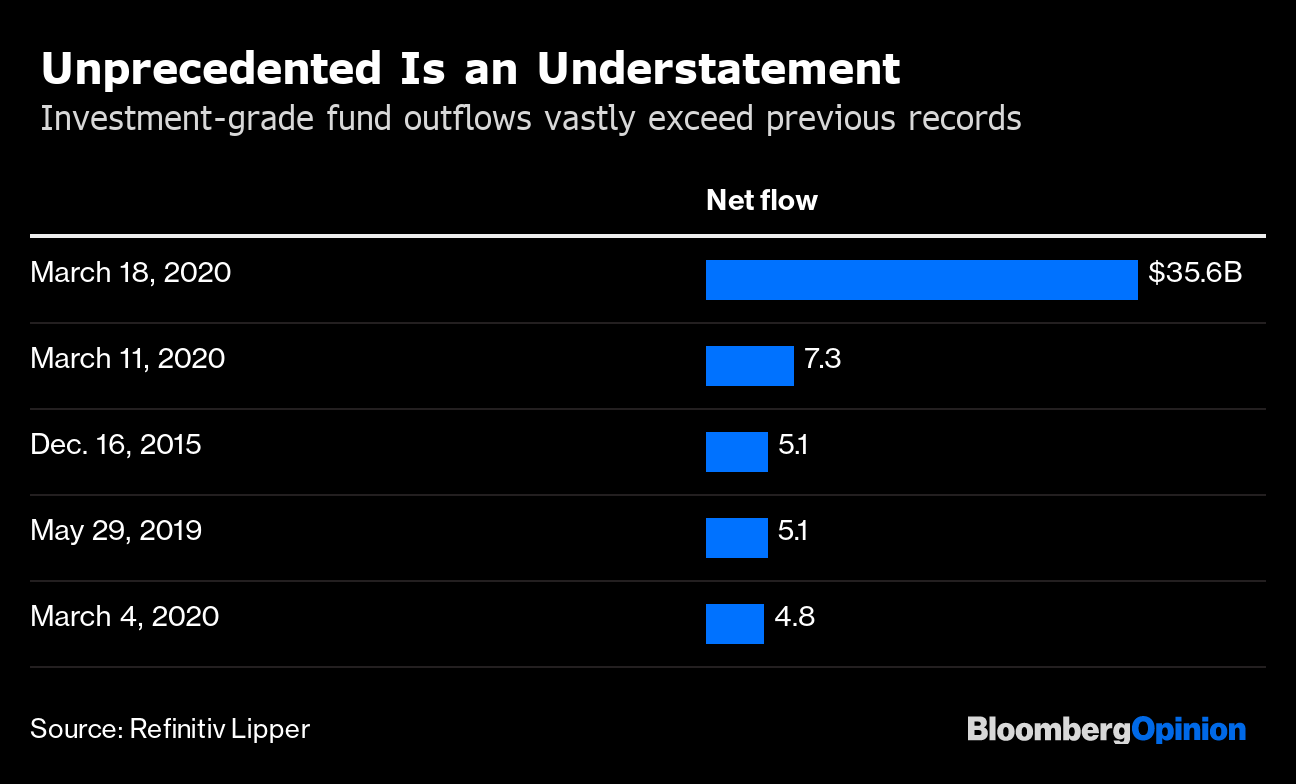

| This is Bloomberg Opinion Today, an Amazon delivery of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  Seriously, don't. Photographer: Cindy Ord/Getty Images North America The Long Coronavirus War So, how's your week been? Ready for, say, seven more? To "flatten the curve" of the coronavirus pandemic, many of us have been hunkering down for the past five days, often with children and other loved ones piled on top of us. We're losing jobs, retirement funds and sleep. Yet Anthony Fauci, director of the National Institute of Allergy and Infectious Diseases, said today that we should expect "several more weeks" of this. If that sounds exhausting, that's because it is. Fatigue will be the biggest enemy in the fight ahead, writes Clara Ferreira Marques. Even in Asia, where they have experience and skill at social distancing, people tire eventually and let their guard down. That could make a second wave of the pandemic worse. People may need to hunker down again and again, and governments must keep pumping cash at them to buy their compliance. It's a sacrifice, but we all must think of the greater good if we're to beat the disease and rebuild the economy, writes Mohamed El-Erian. This includes companies, who must not lay off employees if they can help it, and investors, who must not panic-sell all their good stuff if they can avoid it. Again, government inducements will be necessary. Europe, the current epicenter of the disease, is the worst example of selfishness, notes Lionel Laurent. It's shutting borders, making the movement of supplies difficult, when pooling resources would be much more effective in fighting a virus borders won't stop. But you're seeing signs of this all over the world, writes Robert Kaplan, as the halcyon days of globalization give way to nationalism. It would also help if people would stop hoarding sanitizer, Clorox wipes and such, writes Noah Smith, keeping supplies from people who most need them. In this case, technology could help discourage hoarding, by giving people information about where stuff is available. Think Waze, but for toilet paper. Social distancing is only the first response to what Richard Danzig and Marc Lipsitch describe as a "surprise attack" by the virus. Now we must settle in for the long war, which will include finding treatments and a vaccine, bolstering our health system and protecting vital services against widespread illness. Expect an 18-month project. Of course, people get impatient, especially when they're living in fear of disease and financial ruin. We all hope for a neat, V-shaped end to this. That may be unrealistic, depending on either a rapid miracle treatment or a surrender to the disease that quickly builds herd immunity at a staggering cost in human lives, notes Narayana Kocherlakota. The best-case scenario, the one that protects the most people, depends on us all keeping our heads, hunkering down every so often and being patient. It builds character. Further Long-View Pandemic Reading: 12 predictions about what the global economy will look like after coronavirus. — A. Gary Shilling Getting Stimulus Right All of this will be much easier if we can count on the government keeping money flowing to businesses and workers. A Senate Republican plan to give $300 billion to small businesses that keep employees is a good start, write Michael R. Strain and Glenn Hubbard. But it must be four times bigger to replace lost revenue for three months. The Senate plan would also send $1,200 checks straight to many Americans, but would base relief on income and other factors. This is dumb and self-defeating, writes Karl Smith. Just give everybody the money and encourage them to donate their check if they don't need it. Or tax the rich later. It's especially foolish to use 2018 income for means-testing, writes Ramesh Ponnuru. Incomes from two years ago are fast becoming ancient history. It's a sign of how interesting these times are that Republicans not only favor helicopter money but also agree with, say, Senator Elizabeth Warren that Uncle Sam should take equity stakes in and ban stock buybacks for companies getting bailouts. Companies may not like it, but this is the only thing that will keep pitchfork-wielding mobs at bay, writes Joe Nocera. Bonds Markets Look Ugly Stocks have been relatively quiet the past couple of days, with the S&P 500 falling by a mere 3% today. But troubling things are happening in the bond market, writes Brian Chappatta. The panic-selling of even high-quality credit has been like nothing we've ever seen and shows no sign of letting up.  Even superstar hedge funds are losing money as everything crashes and cash is king, writes Shuli Ren. In Europe, some funds lost existential amounts of money when the ECB goofed by briefly shrugging at a sovereign-debt crisis, write Mark Gilbert and Marcus Ashworth. It has corrected that mistake, but the damage is done. Buyers will pull back from the market just when the ECB needs them. You'd think these would be glory days for perma-bears who have predicted doom for years. But John Authers notes they face a reckoning: When will it be time to become bullish? Further Markets Reading: The worst-case scenarios under which banks have been stress-tested are looking insufficient. — Elisa Martinuzzi A Modest Oil Proposal The Texas Railroad Commission regulates the oil industry in Texas, as you doubtless guessed by the name. Commissioner Ryan Sitton writes in an op-ed article today that he wants President Donald Trump to make a deal with Russia and Saudi Arabia in which those countries and America's frackers cut production to support oil prices. This government intervention will restore free-market balance to oil, Sitton says. But Liam Denning warns Sitton and Texas's frackers to be careful of the kind of help they seek. Getting the government involved in the industry now will open the door to it being involved later, potentially when a more Green New Deal-y president is in office. Telltale Charts Luxury sales are about to collapse, but LVMH will probably still want to buy Tiffany & Co., writes Andrea Felsted.  Further Reading FDR's communication skills improved his crisis; Trump's lack thereof is making this one worse. — Jonathan Bernstein We must secure November's election with absentee voting. Democrats have leverage to force GOP buy-in. — Francis Wilkinson Those Senate coronavirus stock sales aren't examples of egregious insider trading. — Matt Levine California's lockdown law is an incoherent mess. — Noah Feldman Hypertension may put people at particular risk of death from coronavirus. We must address it before the next pandemic hits. — Adam Minter Quarantine-era ESPN is fun, with its seed-spitting and arm-wrestling, but not worth an expensive cable bill. — Tara Lachapelle ICYMI Trump tells states to buy virus supplies, then outbids them. Trump touted a virus drug that can kill in low doses. Then he lashed out at a reporter who questioned him about it. Kickers Oregon creamery makes vodka from milk. How coffee took over the world. Area man builds cellphone with rotary dial. We will relearn to appreciate phone calls. Note: Please send phone calls and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment