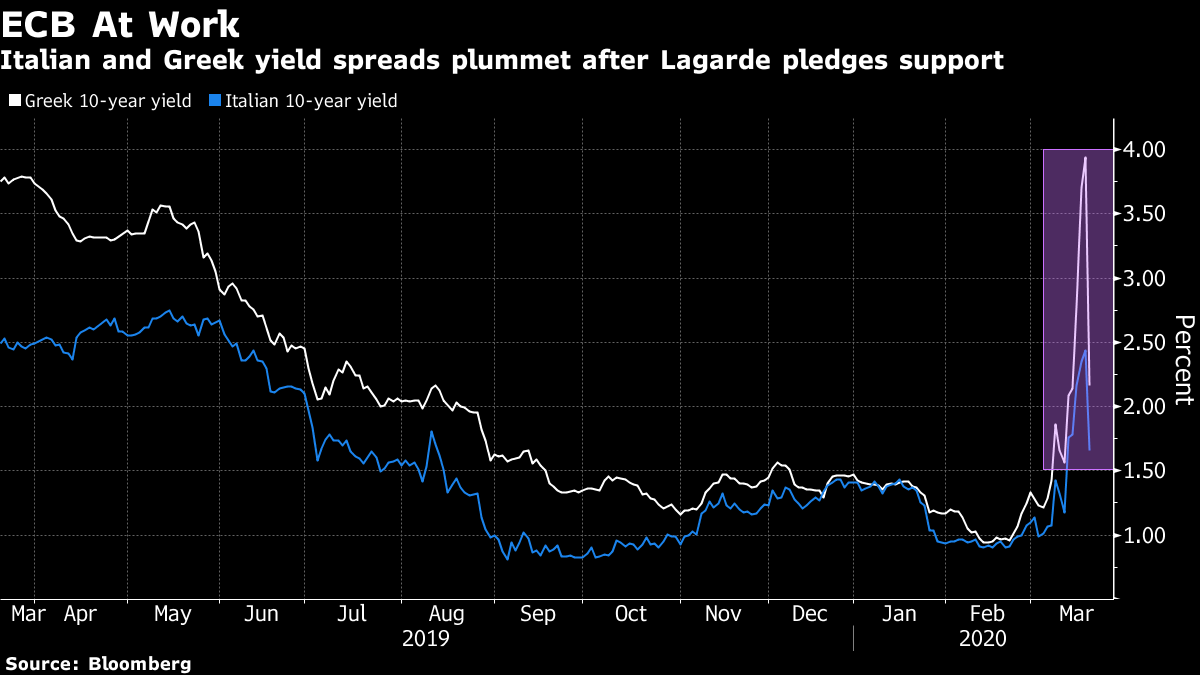

| The ECB goes big, Congress works on second stimulus bill, and a first look at the damage to the U.S. economy. No limits After an emergency meeting last night, the European Central Bank announced a €750 billion purchase program to help fight the effects of the coronavirus in the region. The Pandemic Emergency Purchase Program (PEPP) will expand the pool of assets the bank is purchasing to include commercial paper. Greek government bonds will be eligible for the first time. Yields on euro-area sovereign debt are plummeting across the region, with those on five-year Greek debt dropping more than 200 basis points to 1.5%. ECB President Christine Lagarde said in a Twitter post that "there are no limits to our commitment to the euro" with the bank also promising more purchases if necessary. Another package The ink is barely dry on the multi-billion-dollar House bill President Donald Trump signed yesterday and lawmakers are already rushing to agree on a second package. Even as Senators were voting 90-8 in favor of the legislation approved on Wednesday, they were working on measures which propose at least $1 trillion of aid. Senate Majority Leader Mitch McConnell wants Congress to work "at warp speed" on the complex measure which could include direct payment to taxpayers as well as help for industry and local government. With the House in recess this week, it will be Monday at the earliest before anything is ready for Trump's signature. More action It's not just the ECB that has been stepping up to the plate, with global central banks rolling out a raft of new measures. The Federal Reserve announced late yesterday that it is launching a program to support money market mutual funds as strains continue in short-term funding markets. The central banks of Australia, Indonesia, the Philippines, Taiwan and Brazil have all cut rates in the past 24 hours. The Swiss National Bank held at minus 0.75%, but is stepping up currency interventions to try to stem the franc's rise. Norway's central bank is considering interventions of its own after the kroner slumped 7.5% against the dollar yesterday, following a 14% plunge on Tuesday. Markets messy The huge volatility in global equity markets shows little sign of easing. Overnight the MSCI Asia Pacific Index dropped 2.7% in a session that saw limit-down circuit breakers hit in multiple markets in the region. Japan's Topix index went against the trend, posting a 1% gain as investors bet Bank of Japan would hike ETF purchases. In Europe, the Stoxx 600 Index was 0.7% higher at 5:50 a.m. Eastern Time as the boost from the ECB package was tempered by some awful survey data from Germany. S&P 500 futures pointed to further losses at the open, the 10-year Treasury yield was at 1.196% and gold was lower. Early indicator The weekly U.S. jobless claims total, published today at 8:30 a.m., is going to have a lot more significance in the coming week as economists search for early indications of the fallout from the coronavirus. Today's number covers the period to Mar. 14, so may not show a huge deviation from the 220,000 economists forecast, as the rapid spread of the virus means an awful lot has changed since then. Also today, the Fed will run two $500 billion repo operations, and Accenture Plc and Lennar Corp. report earnings. What we've been reading This is what's caught our eye over the last 24 hours. And finally, here's what Lorcan's interested in this morning The big bazooka that the ECB announced yesterday has already triggered some huge moves in the sovereign bond market. Yields have plunged in the countries that had come under pressure in recent days. An early assessment could easily describe the operation as a success. But (and this paragraph would be no fun without one) there is a major problem. Back in the great financial crisis, massive liquidity, bailouts and rescue programs were needed to save the economy. Anyone around then would remember the constant updates from all manner of doomsayers on the size of the problem compared to the scope of the initial packages. While to some extent the doomsayers were right, the important thing was that in 2008 it was possible to work out roughly how big the crisis would be and then weigh the response and trade accordingly. The current pandemic does not allow for that kind of certainty. Nobody knows how long this will go on for, how much economic activity will be curtailed, and how much permanent damage will be done. The future is completely unknown. So we can only ever judge the ECB action, and all central bank and government actions, after the crisis is over. €750 billion of purchases is enough to move the markets for now. But we may have to rely more on the long-held promise to do "whatever it takes" for comfort over the coming weeks and months.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment