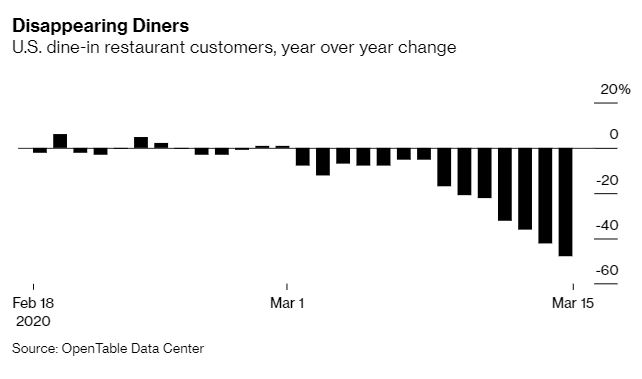

| The fiscal fightback, stocks remain unimpressed and the economic damage assessments look bleak. Measures French President Emmanuel Macron said that the country would guarantee up to 300 billion euros ($335 billion) of bank loans to companies in an effort to stop businesses failing as governments in Europe step up their response to the coronavirus shutdown. In the U.S., there was a change of tone from the administration with President Donald Trump stating that "it's bad," warning against gatherings of more than 10 people and saying the outbreak could last until August. The Senate is on track to quickly pass the House package of measures, with lawmakers eager to follow up with a more ambitious bill once the current one has the president's signature. Big moves It is shaping up to be another wild day in markets. S&P 500 futures, which were trading limit-up at the start of the European session, turned negative 90 minutes later. Overnight, the MSCI Asia Pacific Index eked out a 0.1% gain while Japan's Topix index closed 2.6% higher as the yen slipped against the dollar. In Europe, stocks opened higher, but those gains proved fleeting with the Stoxx 600 Index down 2.7% by 5:40 a.m. Eastern Time. The 10-year Treasury yield was at 0.802% and gold dropped again. Recession warnings Economists are rushing to update their projections for economic growth -- sharply downwards. Morgan Stanley now sees a global recession as its base case, saying the slump is likely to be worse than 2001. Goldman Sachs Group Inc., who are already predicting a 5% slump in U.S. GDP in the second quarter, are predicting China's economy will shrink 9% in the first three months of the year. Bloomberg's monthly survey of economists showed that most view the coronavirus outbreak pushing the U.K. into its first recession since the global financial crisis. Air travel The industry hardest hit by the movement restrictions introduced by governments around the world is air travel, with a growing list of airlines announcing huge capacity reductions as customer demand evaporates. Boeing Co. has asked White House and Congressional officials for short-term aid for itself, suppliers and airlines, as the industry rushes to tap emergency credit lines. President Trump signaled support for carriers, saying the government will back them 100%. In Europe, governments are considering packages to save the industry as the continent imposes restrictions on foreign travelers. Coming up… U.S. February retail data at 8:30 a.m. is expected to show sales growth in positive territory, while industrial production and manufacturing production at 9:15 a.m. are also expected to show growth. Investors are unlikely to have much interest in those numbers as the data will already be viewed as very stale. Instead, they may focus on the results of the Federal Reserve's $500 billion overnight repo operation to gauge any signs of funding stresses. Traders will look for guidance from FedEx Corp. when the company announces results today. What we've been reading This is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morning Yesterday I wrote about how we need to give everyone in the country cash right now. Usually when we give people cash -- via direct checks like after 9/11 or in early 2008, or in the form of payroll tax cuts after the Great Financial Crisis -- it's because we want people to go out and spend to revive economic activity. But this time it's different, because we don't want people to go out. We want people to stay in and keep themselves and others safe. It's an extremely unusual situation. In light of this, we should immediately do a big bailout of bars and restaurants. People are often uncomfortable about the idea of bailouts because of things like "socializing losses, while privatizing gains" or "moral hazard." But none of this is relevant here. Restaurants aren't closing at a rapid clip because they've been irresponsible. They're closing down because of a combination of a once-in-a-generation pandemic causing everyone being told to stay inside, and local governments telling them to shut down as a public health threat. In a functioning market, there's always going to be some churn, as better restaurants put worse ones out of business, and that's fine, and as it should be. That's business. But (excluding restaurants that are optimized for delivery) there isn't a single restaurant that can survive being told to shut down, or have its clientele be told that going out is a threat to the entire public's health. Furthermore, the existence of restaurants is a public good. We want them to exist, and we want people to launch new ones, even though margins are thin in the best of times, and many of them fail. They make neighborhoods and towns better, and as such a restaurant can even benefit people who don't go there. The economic response to this crisis is going to have to be multi-pronged. Cash for everyone is key. The debate about bailing out national industries, like airlines, is going to pick up soon, and that will be controversial, in large part because of how much these companies have spent to keep cash. But I don't think most restaurants have been reckless about buying back stock or anything like that. Their businesses are getting destroyed because the (temporary) destruction of demand is a necessary part of slowing and defeating the virus. So whether it's grants, or extremely generous low interest loans to let them keep paying the rent and employees during the shutdowns, let's get a big bar and restaurant bailout going now.  Photographer: Weisenthal, Joe Photographer: Weisenthal, Joe Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment