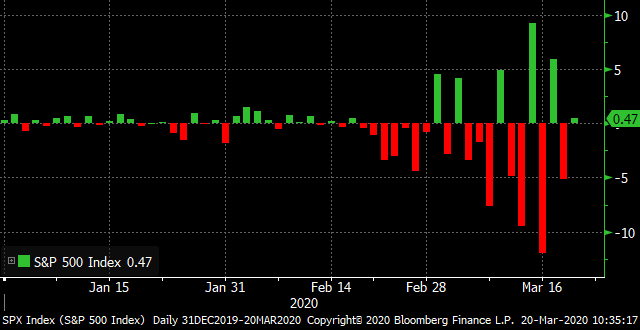

| Markets bounce, virus measures tighten, and Mnuchin asks Congress to hurry. A little risk on After yesterday's relatively calm day in U.S. markets — by recent standards anyway — global markets are moving higher today. Benchmark indexes in South Korea and Taiwan jumped more than 6% overnight, helping to lift the MSCI Asia Pacific Index 3.2%. Japan was closed for a holiday. In Europe, the Stoxx 600 Index was 4.5% higher at 5:40 a.m. Eastern Time with every sector of the gauge posting strong gains. S&P 500 futures pointed to a bounce at the open, the 10-year Treasury yield was at 1.05% and gold was higher. Dollar slide The greenback slumped, losing ground against every major currency after it had gained 8% in the previous eight sessions. Analysts are flagging concerns that the coronavirus outbreak in the U.S. may prove to be worse than feared, pushing the country into a recession and possibly a depression, hitting demand for the currency. On the supply side, the increased number of swap lines opened by the Federal Reserve with other central banks, aimed at reducing the international shortage, are also helping push the dollar lower. Tightening restrictions California introduced the most restrictive measures yet to fight the spread of the pandemic in the U.S., ordering all of the state's 40 million residents to go into home isolation. Businesses deemed non-essential will be shut and people only allowed out to stock up on essentials. The move comes as the World Health Organization said the virus is now infecting people at a faster pace with the global death toll topping 10,000, according to data from Johns Hopkins University. Outside the U.S., Italy is set to reinforce and extend its near-total lockdown of the economy, while the U.K. will announce new measures in an attempt to save millions of jobs. Hurry up Treasury Secretary Steven Mnuchin urged Senate Majority Leader Mitch McConnell and House Speaker Nancy Pelosi to move fast to pass a second package of support measures, warning them that major parts of the economy are already shut down. He said that the objection is to have legislation through Congress and signed by President Donald Trump on Monday. The package announced by the Senate includes tax rebates of $1,200 to individuals targeted at those earning under $99,000 and $208 billion of loans for companies suffering from the outbreak. Coming up… Once again the economic data available today is probably going to look a little stale to markets with January retail sales for Canada at 8:30 a.m. and U.S. existing home sales numbers for February published at 10:00 a.m. There may be more to see for under-pressure oil traders in the Baker-Hughes rigcount number at 1:30 p.m. In dollar liquidity, it is a big day for Fed repo, with $1.5 trillion on offer across three different operations today. The one number that everyone is hanging on at the moment is jobless claims, with yesterday's print showing a 70,000 increase, and Goldman Sachs Group Inc. warning that it could surge to a record 2.25 million for this week, with that data published next Thursday. What we've been reading This is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morning Back in late January (ahh the good old days), I wrote about the dizzying rise we were seeing in shares of Tesla, and why it wasn't evidence of a bubble, or even really that weird. Even with the crash of virtually everything since then, I stand by my reasoning. The way I was thinking about Tesla at the time was that basically there seemed to be a binariness to its future. Either it was on its way to becoming the Apple of electric cars, or it would go bankrupt. Obviously there was and is a plausible middle path where it ended up as one of a handful of successful electric vehicle manufacturers but by and large, investors and traders tend to fall into one extreme camp or the other: domination or collapse. As such, you could think of Tesla shares as kind of being a call option on the domination scenario, and as anyone who knows anything about options understands, just a minor change in the underlying conditions can radically change the price of the option. Because of the inherent volatility and wide swings, you typically don't have people making price targets on options the same way you have people making price targets on stocks. And true enough, most sell-side analysts really never have been able to come up with a realistic Tesla valuation. It's just too inherently volatile. And now fast forward to today, and hopefully you can anticipate where I was going with the Tesla analogy. Across virtually every asset class in the entire world, we're seeing historic levels of volatility. Five percent moves in either direction are de rigueur. Circuit breakers being triggered left and right. I lost track of the times I read the phrases "since 1987" or "since the Great Financial Crisis" over the past two weeks. There is no modern precedent in the market for the virus. There's a war on, but there's not an opposing army, and we don't know if we have the tools to fight it. There's a collapse in spending, but we don't actually want stimulus for the time being. It is all extremely unusual to say the least. Plus modern life itself is changing at a rapid pace. So many things are literally shutting down, including even states holding postponing primaries. So at some level, the virus is stress testing the entire socio-economic and political system all at once. As my friend Nathan Tankus recently put it, "this is so pedal to the metal for socialism or barbarism it's nuts." I'm not totally sure that those are really the only two outcomes for us, but his phrase still captures something important, which is the seeming binariness of the moment. Does our system melt down or does it not? Some days, between the data itself (the various curves) and the political response, it looks like we might get away with a short and severe shock to the system and then a return to normal. Other days it looks like a long-lasting threat, to which no leaders anywhere are well-equipped to respond, resulting in a permanent change to the landscape. So with such extreme uncertainty, and such a wide divergence in the potential outcomes, the entire market is acting like one huge call option on which one of two ways the entire system winds up. And until the data and the policy response start to offer more clarity on the question, there's no obvious reason why the volatility will settle down.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment