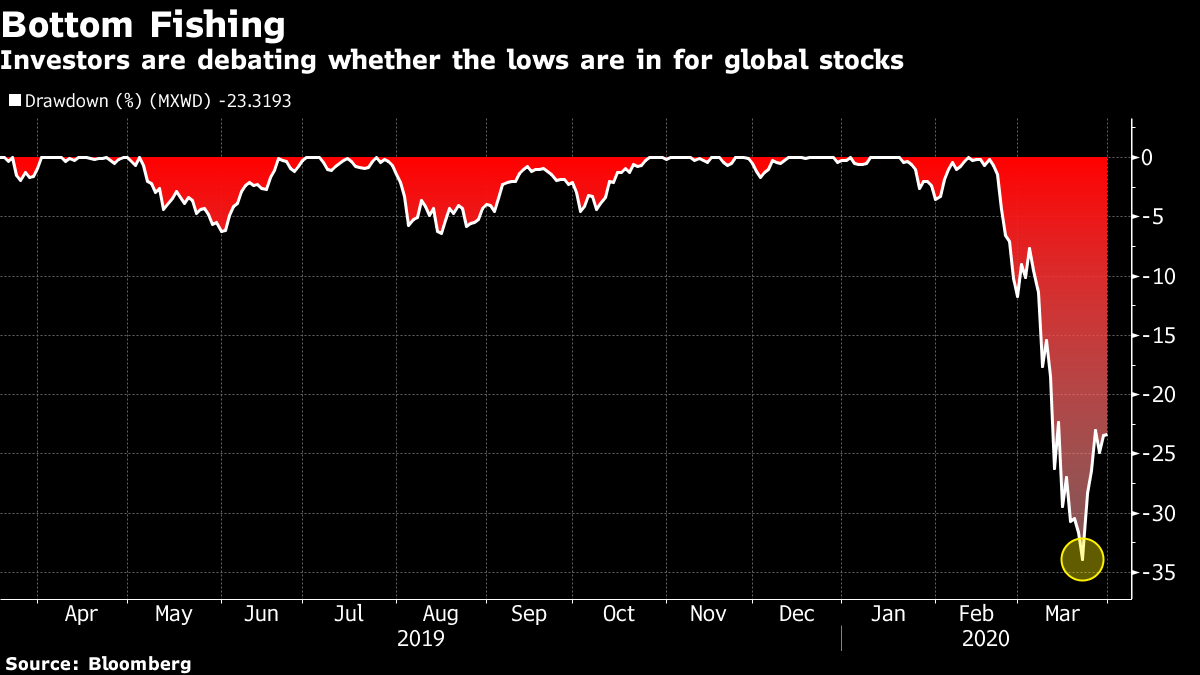

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. Signs of stabilization may be emerging in Europe, China's factories are getting back to work and the U.S. is considering more stimulus moves. Here's what's moving markets. Stabilization The World Health Organization said there are signs of some stabilization in Europe's coronavirus outbreak, noting the smallest number of new cases in almost two weeks in hardest-hit Italy, which has faced warnings about the quarantine approach and on the powder keg potential of the south. Germany's Angela Merkel had another negative virus test and the U.K.'s Boris Johnson, who tested positive, is now facing increasing pressure to speed up testing of patients and health care workers as the virus spreads. Meanwhile, Euro area finance chiefs have been warned they need to ensure that government policy takes account of the higher debt levels that European countries will have when the virus ends in order to avoid potential break-up risks. Back to Work China factory activity saw a strong rebound in March, indicating that the economy is getting back to work just as it will face a steep decline in demand due to the economic blow of the coronavirus outbreak. That helped oil prices to stage a small recovery on Tuesday, even if crude prices are still set for the worst quarter in history in a market where traders are scrambling to book overflowing tankers. Asian stocks were mixed and both U.S. and European stock futures are slightly positive going into what has been one of the most volatile quarters in recent memory. Stimulus U.S. President Donald Trump has said the country may expand the travel ban already imposed on Europe and the U.K. to other countries amid continuing efforts to slow the spread of the virus, following from a spike in deaths in New York. Retailers in the U.S. are continuing to furlough workers, even after the $2 trillion stimulus package signed into law last week, and now the White House and congressional Democrats are eyeing a possible fourth round of spending covering extra state aid plus support for areas like mortgages and the travel industry. Softs Oil prices hit an 18-year-low and the market is in turmoil, with some barrels going for less than $10, but that doesn't mean it has a monopoly on turbulence in the commodities arena. Soft commodities, covering cotton, sugar and coffee, are on pace to deliver their worst returns since 1986. Yet, even here, much of this is being driven by lower oil prices making it cheaper to manufacture synthetic fibers and damaging the outlook for biofuels in favor of sugar production. There has also been a surge in beef and egg prices as more people stay at home to cook, though bacon has missed out on that rally. Coming Up… There is a slew of European data, including euro-area inflation numbers and U.K. GDP, all of which comes with the soon-to-be-familiar caveat that it will either already be bad or giving a bad, virus-hit outlook, so reading too much into it will be tough at this point. Kantar and Nielsen will also publish their latest figures on U.K. grocery sales, which will give an insight in to what extent panic-buying has translated into higher revenue for food retailers. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning As investors debate whether a bottom has been reached in risk assets, many are looking back to the global financial crisis for guidance, which makes perfect sense. But while the financial and economic shocks of both crises share some parallels, I see a key difference in the social impact which could still roil markets — its speed. The post-GFC social response was slow moving, relatively peaceful but still impactful — think Brexit and the election of President Donald Trump as examples. This time its likely to be quick and volatile. Not every country can afford the social safety nets that a lockdown requires and even those that can won't be able to help every citizen. The coronavirus is about life and death as well as livelihoods, intensifying the fear people felt during the depths of the financial crisis. Enforced isolation fuels stress and tension. Some potential flashpoints are easy to see and distressing to contemplate — the virus ravaging Venezuela, India or Syria are examples. But other locations might surprise. Social disorder, mass migration, political conflict are some of the possibilities, though hopefully not inevitable. But the coronavirus has made much of the world a tinderbox — and its ignition could spark a fresh wave of risk aversion in global markets.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment