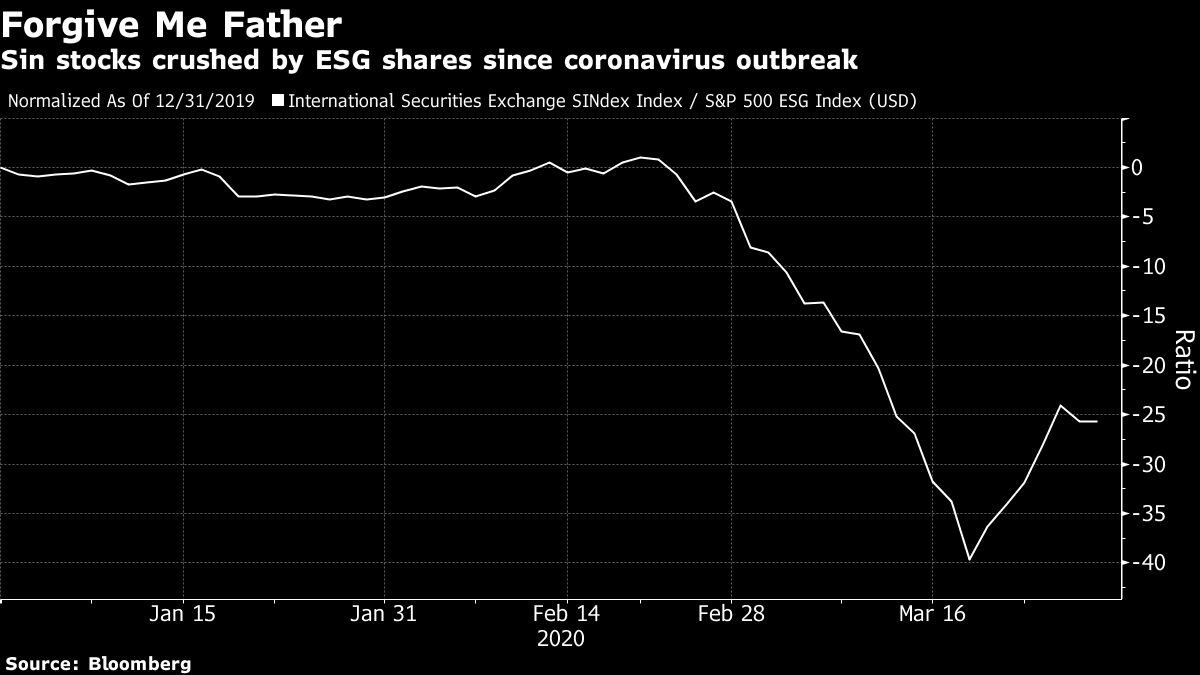

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. The U.S. now has more coronavirus cases than China, European leaders aren't quite agreeing on the best economic response strategy and a three-day rise for stocks could end. Here's what's moving markets. U.S. Cases Top China's The U.S. overtook China for the most coronavirus cases worldwide, fueled by a large jump in infections in New York, which is struggling with a shortage of ventilators, like much of the world. China, where the illness began, said the death toll rose by just five in 24 hours, as it attempts to limit new cases being imported from abroad. In this region, Italian health officials reported 6,153 new infections on Thursday, the most in five days. Here's the latest as global deaths from the pandemic surpass 24,000. EU Frictions Containment isn't the only aspect of the Covid-19 response that may be stumbling, as European leaders struggle to agree on a strategy to contain the economic fallout. A video call was expected to give the green light for the creation of credit lines from the region's bailout fund to keep borrowing costs low while governments ramp up spending. But efforts to agree on exact wording ended without success after six hours, as a group of member states including France, Italy and Spain pushed for more radical steps, such as the prospect of issuing so-called coronabonds. Faltering Rebound European equity futures are lower this morning after shares in the region on Thursday recorded a third straight days of gains for the first time in three weeks. Weirdly enough, a rebound for U.S. stocks saw the Dow Jones Industrial Average enter a technical bull market, despite remaining down about 21% year-to-date. Outside of stocks, gold slipped overnight, but is on course for its biggest weekly rise since 2008 amid a wave of global monetary stimulus, with the Reserve Bank of India joining other central banks in cutting interest rates. Banks Slow Job Cuts Deutsche Bank AG became the latest big lender to hit the pause button on job cuts due to the spread of the coronavirus. The company, which aims to eliminate 18,000 jobs by the end of 2022, hopes to avoid additional emotional distress for employees amid the pandemic, it said in a memo to staff. The announcement follows similar statements from rivals like HSBC Holdings Plc, Credit Suisse Group AG and Morgan Stanley. Most cited the current economic hardship as at least one reason to slow or pause headcount reduction programs. Coming Up… Data are expected to show a plunge in consumer confidence in both Italy and France as the countries tackle their respective stages of the virus crisis. China industrial profits slumped the most on record in the first two months of this year, statistics revealed overnight. There's not much on the European earnings slate, but watch sports apparel stocks after U.S. athleisure company Lululemon Athletica Inc. reported an acceleration of sales growth in the latest quarter, but refrained from offering an outlook for the current year due to virus uncertainty. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning Having looked at the virtues of ESG shares during the sell-off, it's only appropriate to check in on how their evil twins are doing -- sin stocks. The answer is not good. The International Securities Exchange SINdex Index -- a basket of alcoholic beverage manufacturers, casinos and tobacco companies -- has fallen as much as 55% since mid-January, before the recent rebound pared losses to a still hefty 40%. That compares with the S&P 500 ESG Index now sitting on about a 20% decline. With the leisure and entertainment trade decimated and much of the world in lockdowns, the underperformance can't come as a huge surprise. Still, the depth of the decline suggests there may be some opportunities in the sell-off, for the less morally-swayed investor of course. The tensions of being cooped up at home and the stress of the horrific human toll of the outbreak could lead to a cathartic release that benefits the gauge's members, when the restrictions on social interaction are finally lifted.

Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment