| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. Investors are trying to predict when coronavirus cases will peak and how deep the economic recession will be, just as governments ramp up their response measures. Here's what's moving markets. Peak Speculation Market participants are racing to predict the peak of coronavirus infections in Europe, after the region replaced China as the epicenter of the pandemic. In the darkest days of 2003's SARS epidemic, markets troughed shortly after infection rates peaked. JPMorgan sees potential for Italy's active case count to peak during the next seven days. RBC, meanwhile, still sees Italy's outbreak in a fast-growth phase, but points out that China's case rate slowed down around day 25; it's day 27 in Italy. Sizing Up With many economists agreeing that a global recession is coming, the debate has turned to how deep the slump will be. Morgan Stanley expects growth this year to fall to 0.9%, while Goldman Sachs predicts a weakening to 1.25%. Such numbers would not be as painful as the 0.8% contraction of 2009, as measured by the International Monetary Fund, but they would be worse than those of 2001 and the early 1990s. Perhaps unsurprisingly, investor confidence in Europe's biggest economy has plummeted to levels last seen during the sovereign debt crisis.

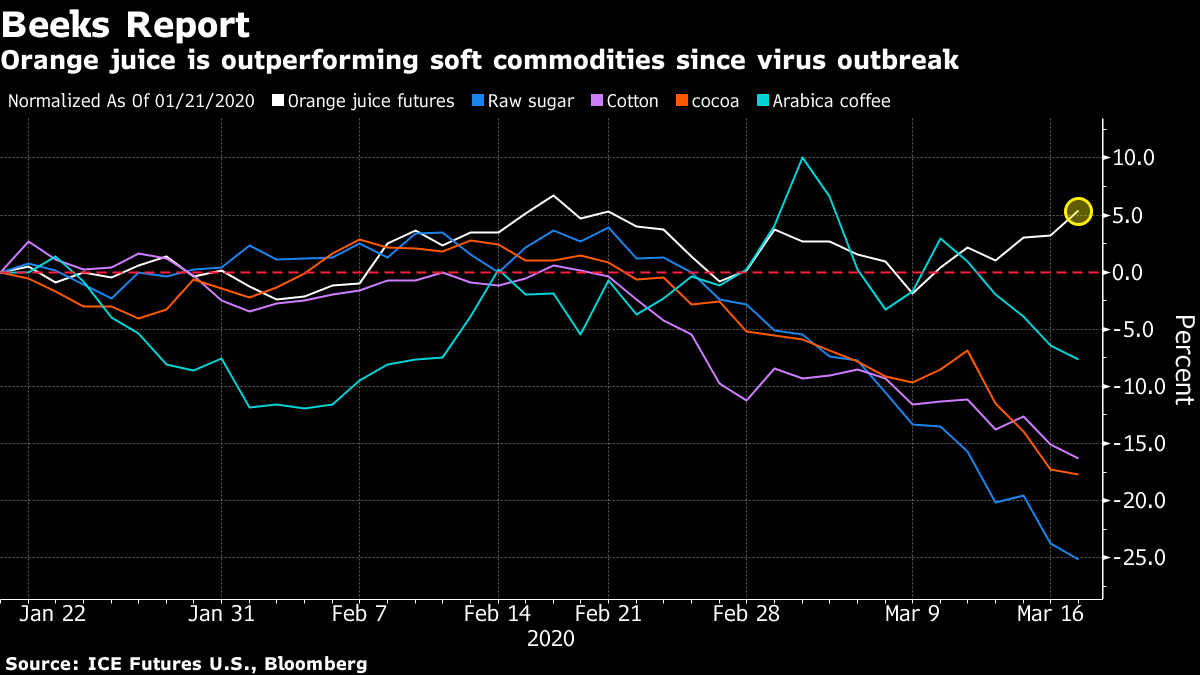

Wartime-Like Spending More European nations are outlining their responses to the health crisis. The Spanish government will provide 100 billion euros ($110 billion) of guarantees for company loans and another 17 billion euros of direct aid, while U.K. ministers pledged "wartime"-like spending to help with mortgage payments, and support for airlines, shops and the hospitality industry, with 330 billion pounds ($398 billion) worth of government-backed loans for struggling companies. France will present an emergency budget on Wednesday. Stock Futures Fall The U.S. has also been busy on the response front. The White House moved to send checks to Americans in as soon as two weeks, while the Federal Reserve reintroduced additional crisis-era tools to stabilize markets. Even so, the latest rebound in stocks could prove to be brief, with both U.S. and European futures retracing most of Tuesday's rise. Traders in this region are still digesting an unprecedented agreement by European Union leaders to restrict most travel into the trading bloc, as borders across the world continue to close. Coming Up… The Fed's scheduled interest rate meeting was cancelled following the central bank's emergency actions, but we are due to get monetary policy updates from Denmark and Brazil. Meanwhile, corporate earnings come from WM Morrison Supermarkets Plc, a potential beneficiary of stockpiling by consumers, as well as Inditex, owner of the Zara fashion retail chain. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning Don't tell Clarence Beeks but orange juice futures are on the rise again. In the 1980s classic Trading Places, Eddie Murphy and Dan Aykroyd turned the tables on the dastardly Duke brothers and their henchman with a series of winning trades in the OJ market. Today, traders long the contracts are also sitting on gains -- about 5% since the coronavirus first roiled markets late-January. That compares with an 8% decline for coffee, an 18% slide in cocoa and a 25% plunge in Arabica coffee, as pointed out Tuesday by my colleague Marvin Perez. Investors are likely betting the virus-enforced jump in people staying at home will bring orange juice back into fashion for those seeking comfort and vitamin C, having been shunned in recent years for being too sweet and having too many calories. "More OJ is consumed at home than anywhere else," said Judy Ganes, president of J. Ganes Consulting. No doubt Billy Ray Valentine would approve.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment