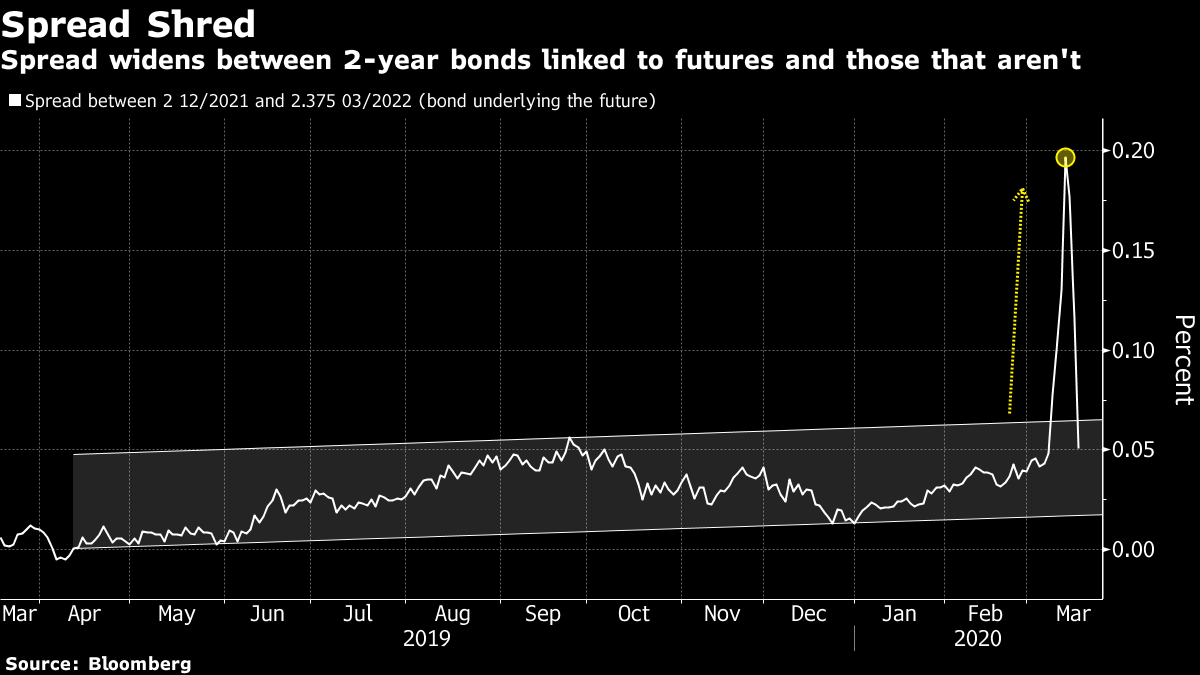

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. People around Europe are preparing for long stints at home to stem the spread of the coronavirus. For the financial world, it was another rough Monday, though international institutions are eyeing new responses and there are still some optimists out there. Here's what's moving markets. Subdued St. Patrick's Day It might be St. Patrick's Day, but don't expect to see many public celebrations. Citizens around Europe are getting used to the prospect of minimal social contact for a prolonged period, including in the U.K., which urged "drastic action" by all, following on from the mass closures seen on the continent in countries like France, Spain and Italy. Elsewhere, the U.S. is stepping up its measures: In states in the New York City area, crowds of more than 50 are banned, and bars and restaurants were told to close. It's Bad U.S. stocks suffered their worst daily loss since 1987 amid fears the virus will bring a recession and President Donald Trump declaring "it's bad." That followed another session of savage losses for European shares, where the travel sector was hit hard once again. Airlines said they'd slash operations, while one consultant warned most carriers could be bankrupt within months without government help. Things could get even uglier for the sector after the European Union proposed a halt to non-essential travel to the bloc for 30 days. Flexing Muscles Central banks' efforts to stem the impact of the virus--including the weekend's emergency U.S. rate cut--have been given a mixed reception by investors, to say the least. Just ask fund manager Ray Dalio, who says the move leaves the Federal Reserve with little firepower from here. Focus may now turn to the Group of Seven, whose leaders pledged Monday to do "whatever is necessary" to ensure a globally coordinated response. The International Monetary Fund, meanwhile, is ready to mobilize a $1 trillion lending capacity, while the euro area's gigantic bailout fund is exploring how it can use its reserves. Some Optimists A gauge of investor fear is jumping, and analysts at HSBC are predicting trading suspensions and write-downs as a result of the illness. But not everyone's downbeat: Credit Suisse told its wealthy clients that the stock market crash has reached an extent where long-term investors should start adding to holdings, without getting overly exposed, while Morgan Stanley reckons markets could be bottoming. For now, European and U.S. equity futures are paring Monday's slump amid volatile trading in Asia. Coming Up… Macro data heading our way includes U.K. unemployment and U.S. retail sales, but both are probably too backward-looking to have a real impact at this stage. The latest German ZEW survey, meanwhile, may reflect the bearishness that's been sweeping global markets. The earnings calendar is light, but we can expect companies to continue to highlight the virus's impact on their businesses. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning It is said that liquidity is a coward, it disappears at the first sign of trouble. What happened in Treasuries last week was one example of this, as trouble in one small corner of the bond market helped spark a liquidity crisis in another. As coronavirus cases spiked around the world, investors rushed to the safety of Treasuries. But even the Treasury market has a hierarchy of liquidity so they rushed to futures first rather than cash bonds, driving spreads between the two much wider. That in turn disrupted a normally sleepy trade popular with leveraged investors known as the cash-futures basis - that profited from the typically small differences between the two. Caught on the hop, the speculators were forced to close their positions, leading to further dislocations in the spread. Larger funds saw an opportunity to invest as spreads became more attractive, and did so with cash they would have usually allocated to the commercial paper market. The shortage of money in that market then exacerbated the stress on cash-strapped companies looking for funding, under pressure to deal with the financial impact of the coronavirus outbreak. All this is just one overly-simplified example of the various dominos that were falling in financial markets last week that lead to an unprecedented $5 trillion Federal Reserve promise to calm the waters.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment