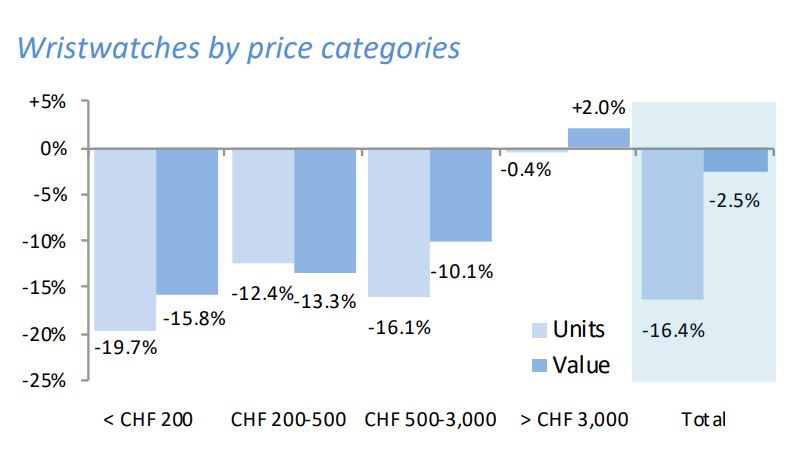

Big day for central banks, Trump impeached, and another look at year-end liquidity. Ending the experiment The Swedish central bank ended half a decade of negative rates when it hiked its key borrowing cost to 0%, a move which is seen as a test case for counterparts around the world experimenting with subzero policy. There is less excitement expected at 7:00 a.m. Eastern Time from the Bank of England where policy is forecast to remain on hold even as expectations mount for further easing in 2020. U.K. retail sales figures which showed the longest run of monthly declines since 1996 are only likely to add to that speculation. Elsewhere the Bank of Japan left monetary policy untouched and the People's Bank of China injected the most liquidity since January to ensure ample cash supply over the year-end period. ImpeachedThe U.S. House of Representatives impeached President Donald Trump on two charges, setting up a Senate trial early next year at which the Republican majority is almost certain to acquit him. While the political excitement about the developments couldn't be higher, markets -- seemingly certain that the move will die in the Senate and possibly even help Trump's re-election chances -- are completely unmoved by the events. Repo, againThere is another test of market year-end liquidity needs today when the Federal Reserve Bank of New York offers a $35 billion 14-day term operation which spans into the new year. Analysts are hoping for a less-than-full take-up of the offering which would signal dealer balance sheets are in a healthy position. The New York Fed's 30-day auction on Monday was oversubscribed, while the total at overnight operations remains low. Markets mixedGlobal equities are in something of a soft spot ahead of the holiday period. Overnight, the MSCI Asia Pacific Index slipped 0.2% while Japan's Topix index closed 0.1% lower. In Europe, the Stoxx 600 Index was 0.1% higher at 5:50 a.m. in a session which has seen the gauge fluctuate between gains and losses. S&P 500 futures were little changed, the 10-year Treasury yield was at 1.940% and gold slipped. Coming up…Weekly jobless claims figures are released at 8:30 a.m., with expectations for a return to trend after last week's surprise 252,000 total. November existing U.S. home sales and the Leading Index are published at 10:00 a.m. There is a Democratic presidential candidate debate at 8 p.m. featuring the seven leading candidates. Nike Inc., Rite Aid Corp. and Accenture Plc are among the companies reporting results. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningThe Swiss watch industry is always an interesting bellwether. Today we got news that in terms of exports, 2019 is shaping up to be the worst year since 1984. The country has shipped just 18.9 million units through November, down 13% from the year before. Not surprisingly, shipments to Hong Kong have gotten totally clobbered, with sales 26.7% lower from a year ago. The U.K., France, and the UAE also saw huge year-over-year declines, according to a release from the Federation of the Swiss Watch Industry. There is one notable bright spot, however, for watchmakers. Total sales in Swiss franc, for the most expensive watches, are actually still on the rise as the chart below shows. So what we're really seeing is a massacre for watches that merely serve the purpose of telling the time. For watches that serve the purpose of showing the world their owners can pay big for piece of precision engineering on their wrist, things remain ok. Looks like there's still some order in the world.  Photographer: Weisenthal, Joe Photographer: Weisenthal, Joe Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment