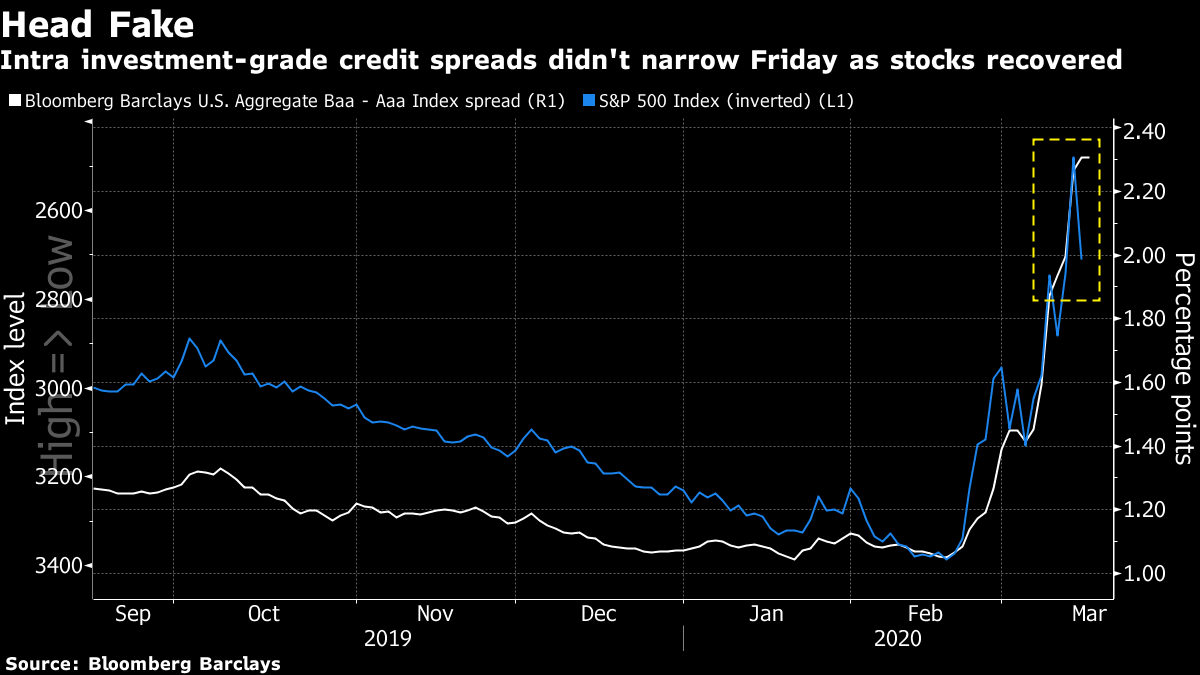

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. The U.S. and Europe have locked down many non-essential services, the Fed cut rates and Saudi Aramco has reined in spending. Here's what's moving markets. Shutdowns Over the weekend, much of the western world shut down everything deemed non-essential to try to stem the spread of the coronavirus: Parisian restaurants, New York City's schools and Amsterdam's coffee shops. More flights are being scrapped, and retailers from Apple Inc. and Nike closed stores. California's governor asked those older than 65 to isolate themselves in their homes, the Irish prime minister urged people not to replace drinking in pubs with house parties and President Donald Trump said there's no need to hoard groceries. The unprecedented moves come amid the grim news that Europe is now reporting more new cases each day than China did at the peak of its outbreak. A ray of hope, however: in South Korea, where the disease flared after China, the number of infections was 74 overnight, the second day in a row the number was below 100. In China, there were just 16 and most of those were imported. Fed The Federal Reserve swept into action on Sunday to stunt the fallout, cutting its benchmark interest rate by a full percentage point to near zero and promising to boost its bond holdings by at least $700 billion. Fed Chairman Jay Powell said second-quarter growth would probably be weak and it's hard to know how long the effects will last. Earlier in the day Steve Mnuchin was optimistic: the U.S. Treasury secretary said he doesn't see the pandemic tipping the U.S. economy into recession, though growth will slow. Goldman Sachs Group Inc. had a different take, expecting the U.S. economy to shrink 5% in the second quarter. For clues as to how lockdowns can affect an economy, China offers a roadmap: Industrial output plunged 13.5% in January and February as factories there shuttered. Markets After a Wall Street week for the history books, the Fed's move hasn't yet calmed markets: Treasuries surged, U.S. equity futures tumbled and credit markets were unimpressed. All this with U.S. equities coming off their first back-to-back 9% swings since the Great Depression. The Bank of Japan also just strengthened stimulus, doubling its target for net purchases of exchange-traded funds, though it stopped short of cutting its negative interest rate. At the moment, European futures aren't looking much better, down 3.5%. There goes any Friday the 13th relief. Buckle up. Aramco All this, and there's still the oil-price war. Saudi Aramco slashed planned spending for this year in the first sign that plunging demand and the oil-price war unleashed by the kingdom are hitting home. The oil giant said on Sunday that expenditure will be between $25 billion and $30 billion in 2020, lower than the planned range of $35 billion to $40 billion that was part of its IPO prospectus and said spending next year and beyond is also under review. The shares fell 1% Sunday after posting a 15% drop in annual operating profit. Coming Up… There are two big events today that could help chart the course going forward: The Group of Seven leaders will hold an emergency conference call and euro-area finance ministers are set to meet in Brussels to decide on their response to prevent a short-term hit from becoming a crippling, long-term slump. Still, Europe's first recession since 2013 seems all but inevitable. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning Traders busy setting up their home offices Sunday evening were interrupted by the sound of a Federal Reserve howitzer -- a perfect example of why it is so risky at the moment leaving any positions open over a weekend. The move came as a cascade of negative coronavirus updates -- from new cases to new lockdowns -- threatened to overwhelm whatever relief Friday's surge in U.S. stock markets had brought. Again the best market to judge the investor mood is credit, and even before the Fed move it was ominous that the lowest-versus-highest rated investment grade U.S. corporate bond spread hadn't narrowed despite the positive move in stocks Friday. The early reaction to the Fed in Asia trading Monday suggests that credit investors are still unimpressed. The price of credit-default swaps, which insure against missed payments, and spreads on many bond indexes rose more after spiking last week by the most in a decade. The Markit iTraxx Asia ex-Japan index of CDS rose 15 basis points to about 145.5 basis points, according to traders. That would be its highest level since June 2016. Investors are saying they want more and this time it's a fiscal bazooka they are looking for.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment