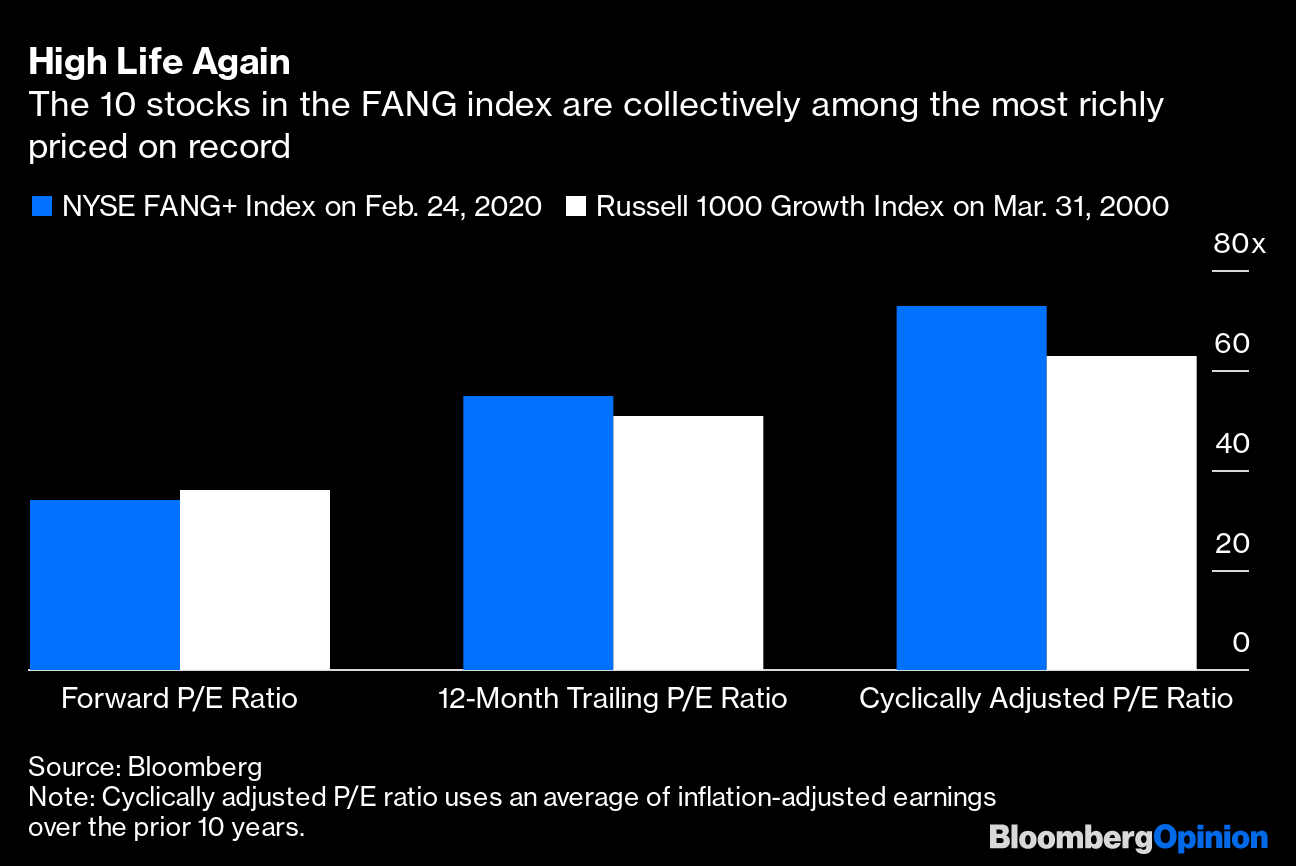

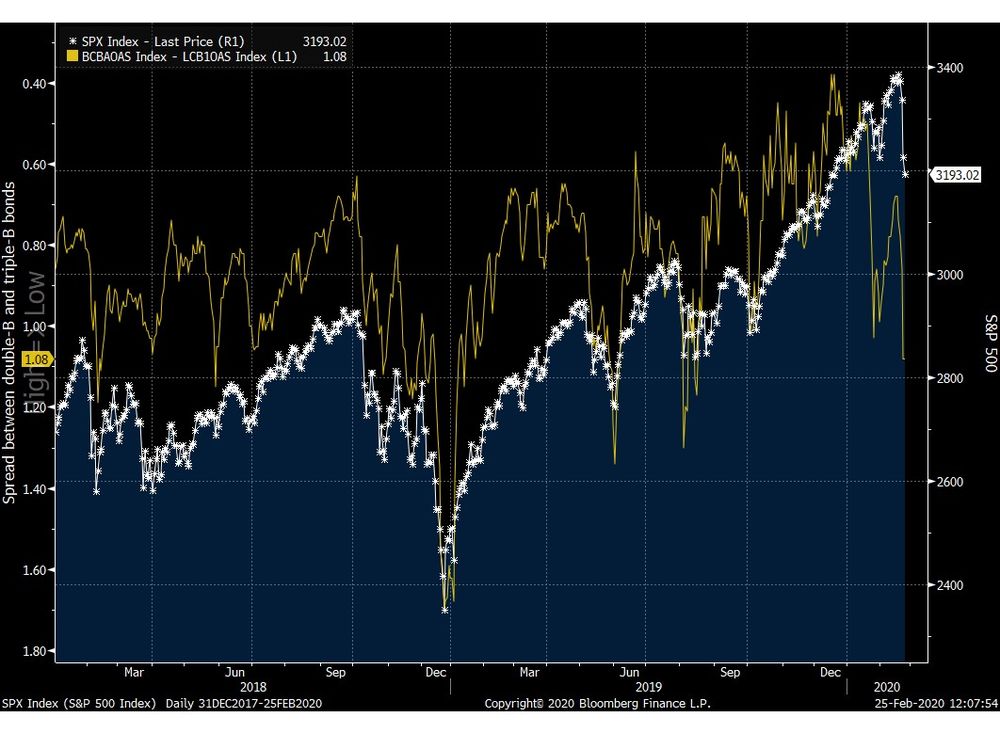

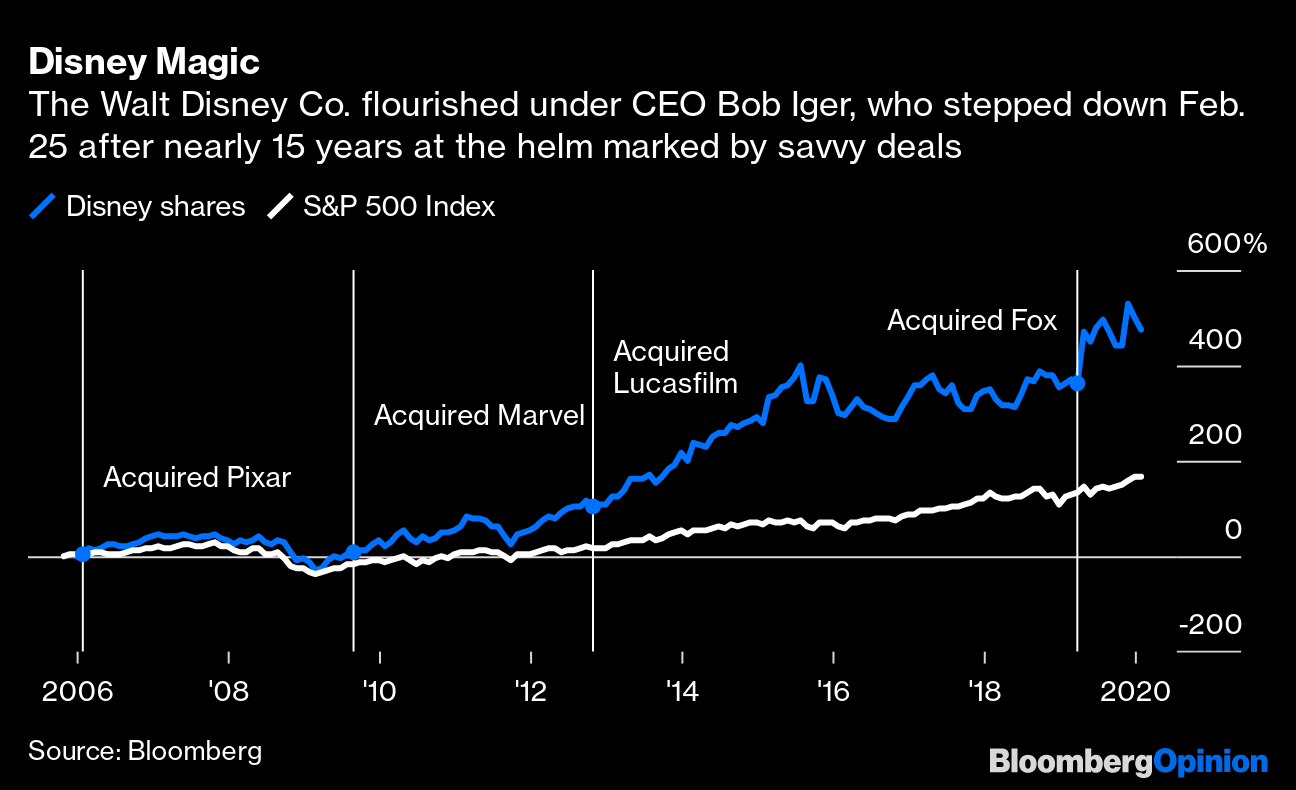

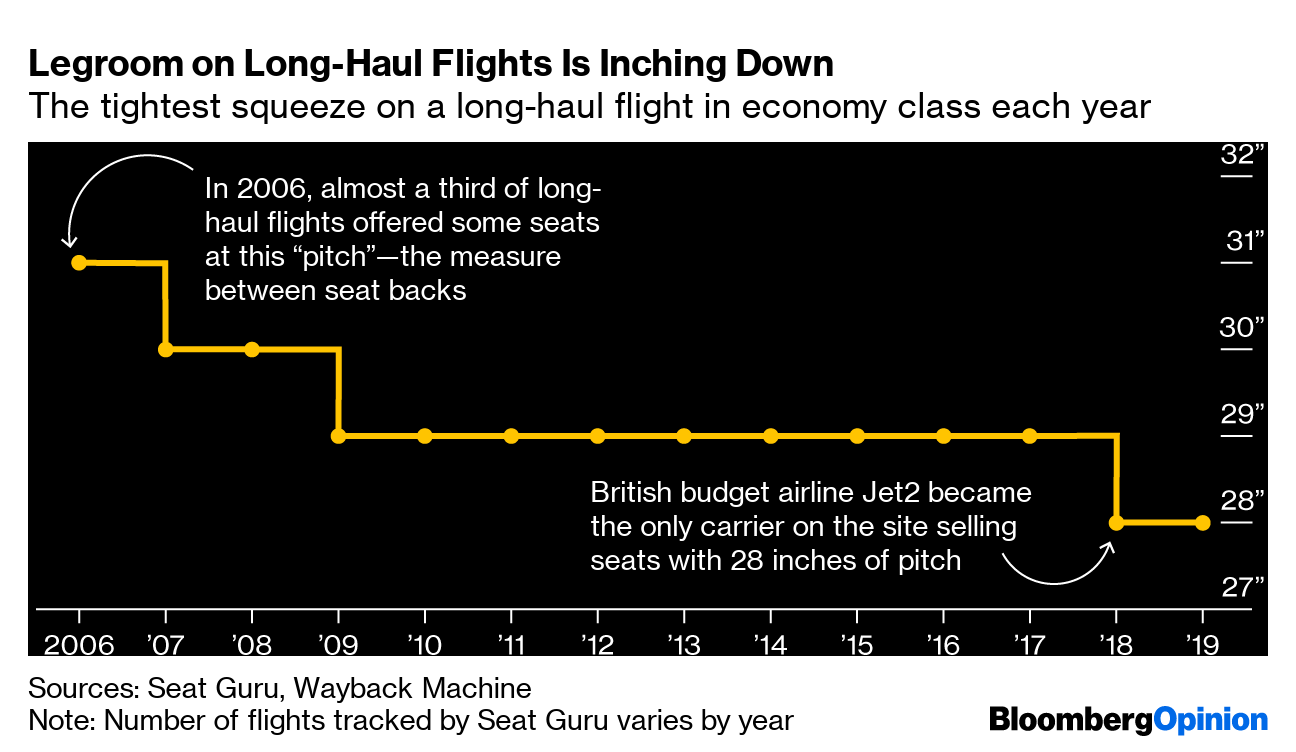

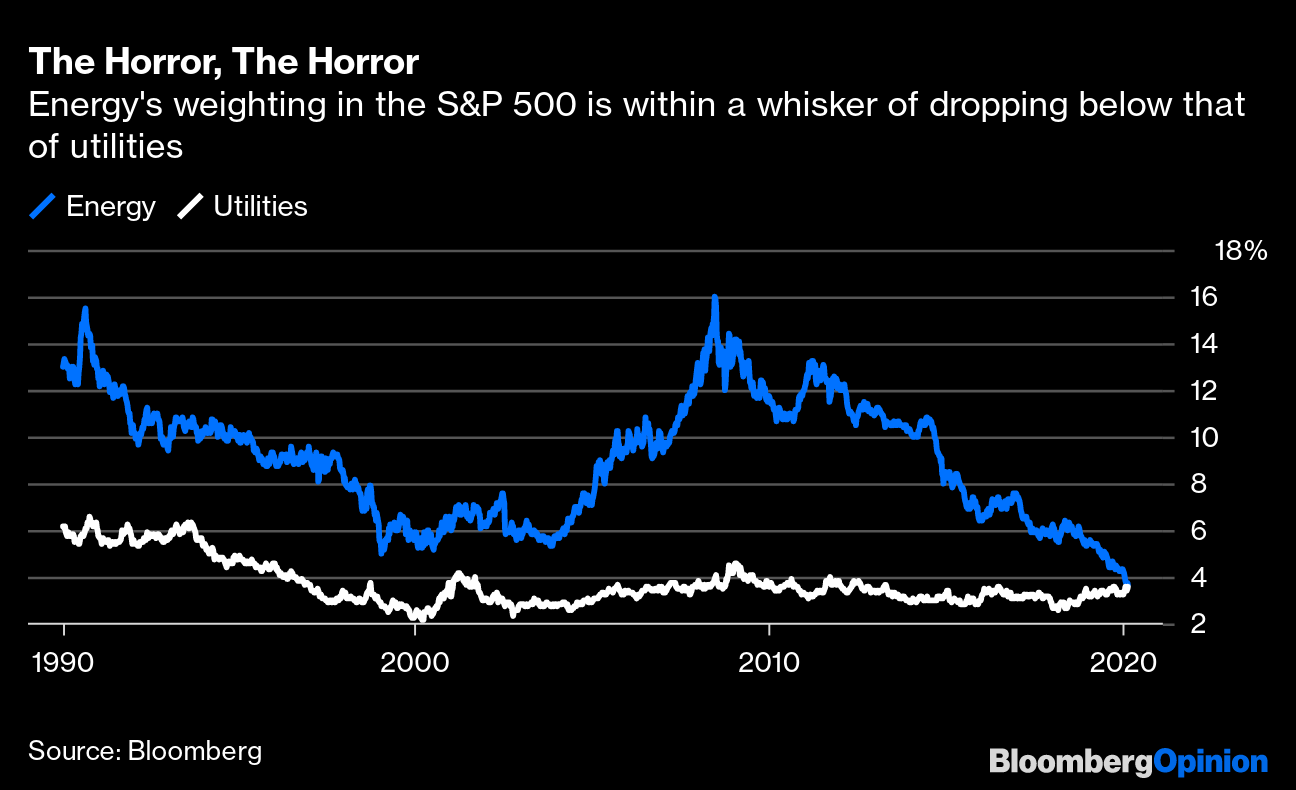

| This is Bloomberg Opinion Today, a FANG+ index of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  This week has been the longest month. Photographer: Scott Heins/Getty Images North America The Stock-Selling Will Continue Until Morale Improves The stock market has been pretty miserable lately, with big honking declines on Monday and Tuesday comprising its worst 48 hours in two years, and another loss today that was less-honking but still painful because it head-faked everybody with a gain at first. Unfortunately, this probably isn't the end of it. We still know way too little about how the coronavirus soon-to-be pandemic will play out, John Authers writes. Worse, even after their recent unpleasantness, U.S. stocks are still overvalued, at least relative to the rest of the world, writes Nir Kaissar:  Basically all of that wild outperformance of U.S. stocks in the past decade is due to eight big tech companies, or 80% of the FANG+ index. That index is expensive in a way usually associated with tulip bulbs, dot-coms and such:  The two non-American members of the FANG+ supergroup are in China, where the coronavirus will certainly hammer stocks. But it could punish American stocks even worse, Nir writes, given how very far they have to fall. The relatively high quality of America's FANGs is no defense either, especially when they are so pricey. Of course, being ridiculously expensive is no guarantee any market will fall. But there's another sign anxiety isn't going away soon, in the also-incredibly-expensive bond market. There, the spread between yields on investment-grade and junk bonds has recently yawned from previously wafer-thin levels, notes Brian Chappatta. The following chart is a bit headache-inducing, but telling:  The yellow line is the inverse of the bond spread. The white line is the S&P 500. You could read this as suggesting the S&P needs to fall a lot more to match the sudden outbreak of NOPE in the bond market, but that might oversell the pessimism. What it does suggest, at least, is that anxiety will reign until further notice. Coronavirus: Embrace the Fear One person trying to convey zero anxiety about all of this is President Donald Trump. He plans to hold a news conference about the virus tonight, a day after calling it "very well under control" and just hours after griping that the press is "doing everything possible to make the Caronavirus (sic) look as bad as possible, including panicking markets, if possible." He has also at times mistakenly claimed a vaccine is coming soon and that warm weather will solve everything. Look, it's the president's job to project calm, but such efforts do not build confidence. They also may mislead a public that should probably be just a smidgen freaked out about this disease, writes David Fickling. Not freaked out enough to go all Mad Max over the last roll of Walmart toilet paper, but just freaked out enough to, you know, wash their dang hands. Further Virus-Perspective Reading: Disney: The Iger Sanction The timing of Robert Iger's decision to step down as CEO of the Walt Disney Co. was both shocking and also perfectly understandable. The shocking part is that nobody expected Iger to go so soon, writes Tara Lachapelle, nor did anybody expect theme parks czar Bob Chapek to take over. Iger's heir was supposed to be Kevin Mayer, and there's still a mystery to unravel about why he didn't get the job. Maybe he just didn't want to try to follow this epic run of ludicrously smart media deals and stock-price nirvana:  Which brings us to the perfectly understandable part of Iger's timing: The outlook for Disney gets much less magical this year, between coronavirus, a bunch of streaming competition and a dearth of blockbuster movie releases, Tara Lachapelle writes in a second column. Why wouldn't Iger want to leave on a high note and let New Bob handle it from here? Dem Debate in Disarray Because it was Tuesday, there was another Democratic debate last night. It was an ugly slugfest. That's partly due to the sudden realization of many that Bernie Sanders will soon be unstoppable, but mostly due to poor moderation by CBS anchors, writes Jonathan Bernstein. It probably won't happen for a variety of reasons, but the parties should really run these debates instead of the TV networks. Anyway, though Sanders took many blows, he still came out mostly unscathed, writes Ramesh Ponnuru. And he has staying power, given the fragmentation and drawbacks of his rivals (including Michael Bloomberg, founder and majority owner of Bloomberg LP). They can't attack Sanders from the left, as Democratic nominating contests require, and they barely have a case against him on electability, given his polling numbers at the moment. Further Dem Reading: Sanders's AIPAC boycott suggests he's no friend of Israel. — Eli Lake Telltale Charts Yes, airline legroom is down, but don't blame capitalism, writes Noah Smith.  Energy has sunk so low that it's about to cross below utilities in S&P 500 market weighting, writes Liam Denning.  Further Reading Trump and Narendra Modi may share values, but they are definitely not good ones. — Mihir Sharma Trump's call for Ruth Bader Ginsburg and Sonia Sotomayor to recuse themselves is an attack on the Supreme Court's legitimacy.— Noah Feldman Trump's refusal to give his cabinet any power causes chaos in the government and among allies. — Kori Schake Germany is finally taking off its pointless debt brake, and it may never reset it. — Marcus Ashworth Boris Johnson's plan for British "freeports" looks costly and unhelpful. — Therese Raphael The Weinstein conviction is a hopeful sign that powerful rapists have gotten easier to convict. — Stephen Carter ICYMI Reddit traders are shaking up the stock market. Every adult in Hong Kong will get a cash handout. Singapore has a plan for a very hot planet. Kickers Inflatable trousers? Inflatable trousers. (h/t Scott Kominers) Monopoly was invented to illustrate the evils of capitalism. Workers uncover a hidden passageway in Britain's Parliament. Earth's deepest river holds clues to convergent evolution. Note: Please send inflatable trousers and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment