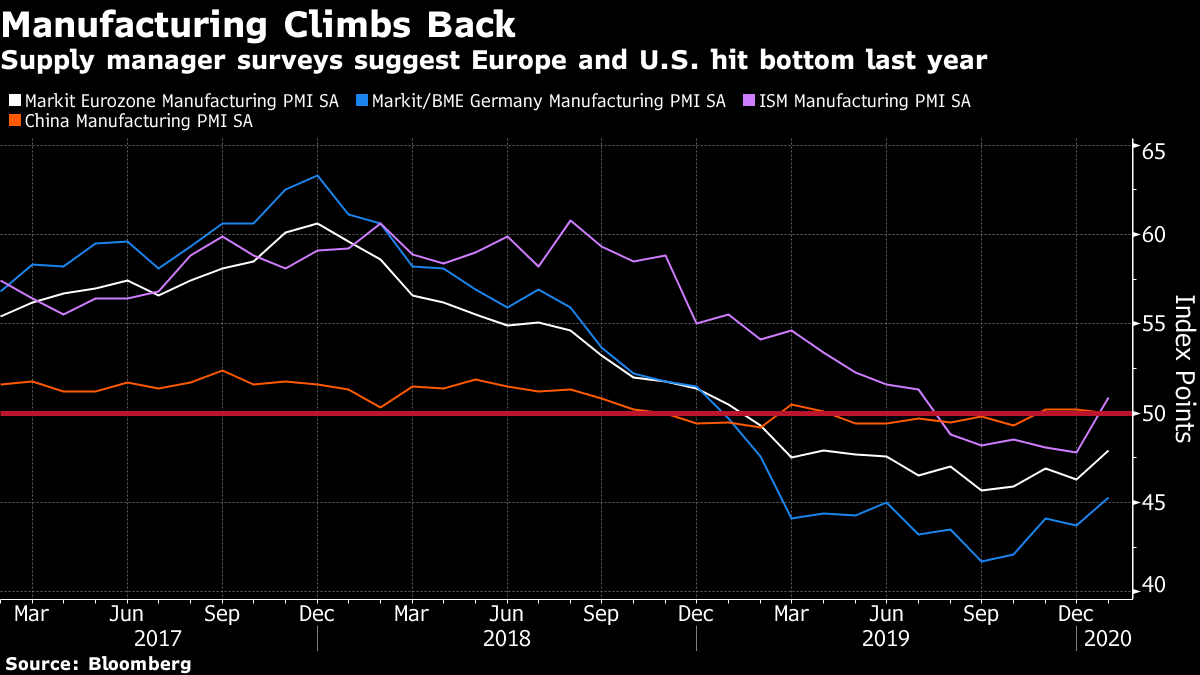

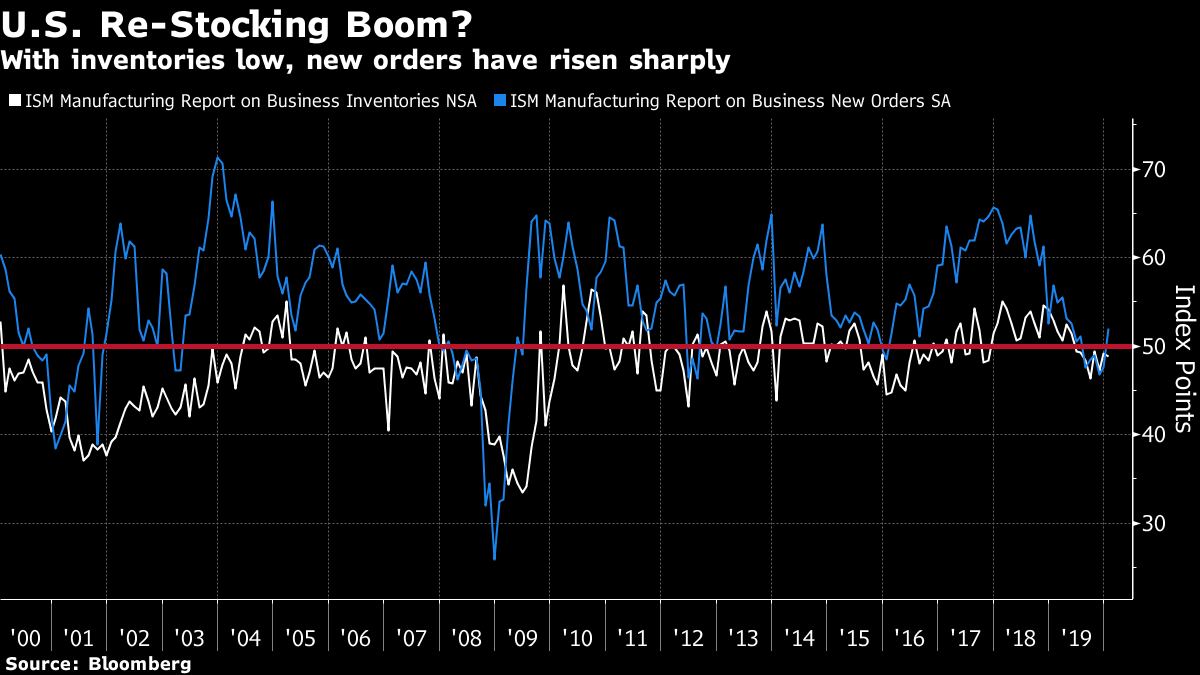

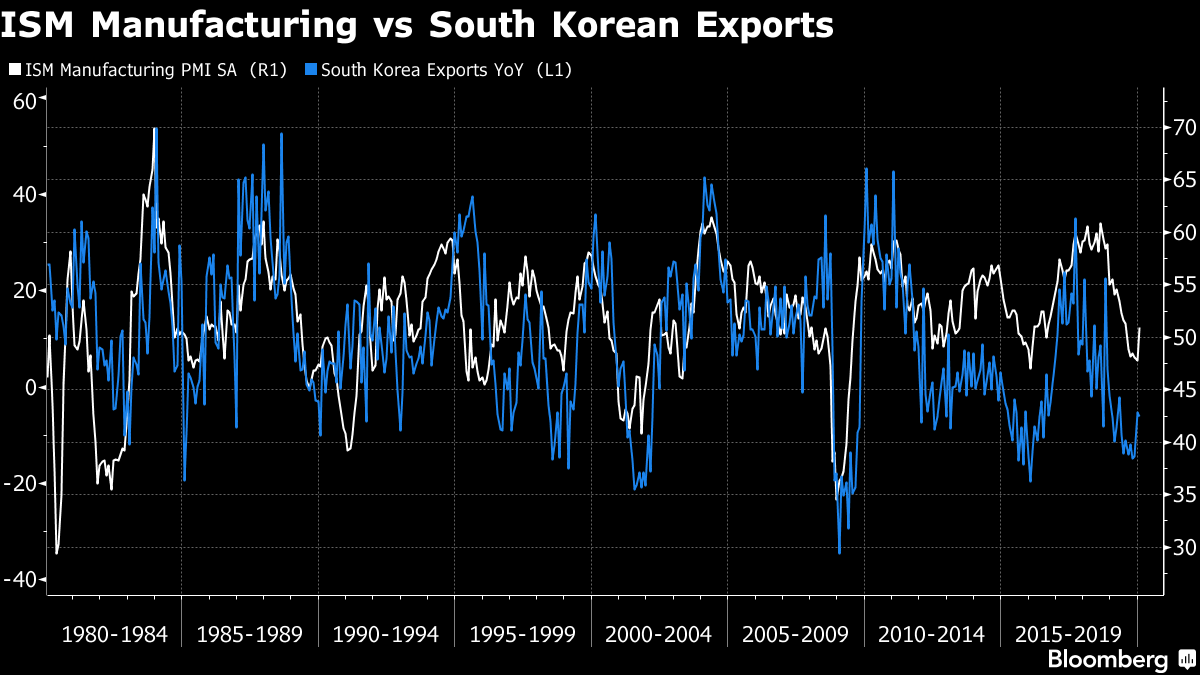

Goldilocks and Contagion We are all amateur epidemiologists now. But as a worried population around the world tried to master exactly what progress the novel coronavirus is making, and how a great a threat it poses both to human life and economic activity, there was plentiful new evidence Monday on what the economic world might look like without the health scare of the last two weeks. The first working day of each month brings a rash of economic data, led by supply manager surveys of the manufacturing sector, which in each country are fixed so that 50 marks the dividing line between expansion and contraction. The surveys would not yet show any impact from the virus, so they give a good idea of whether the recent extreme bearishness in the bond market has been driven only by the epidemic, or by more fundamental trends. And they suggest that things were indeed improving, as many thought at the end of last year, at the point that the virus took over the news. This chart shows the survey numbers for Germany, recently the sick man of global manufacturing, the eurozone, China and the U.S.:  On the face of it, the belief that manufacturing had hit bottom and started to recover toward the end of last year looks to be confirmed (although the Chinese figure, like many other statistics from the country, appears suspiciously stable around the level of 50). The widespread factory closures and travel restrictions in China guarantee that number should be much lower next month. Meanwhile, if we look at the detail of surveys for the U.S., we see what looks to be a classic restocking boom. Both new orders and inventories had been depressed for much of last year, as businesses held off amid the uncertainty over trade. New orders have jumped above 50, suggesting the time has come for long-delayed requirements to be met. If companies cannot meet orders from existing inventories, they will have to make more; this is the classic business cycle at work:  Other numbers from around the world confirmed that the economy didn't look so bad. As my Markets Live colleague Ye Xie pointed out, South Korean exports also improved notably (they were down year-on-year, but by far less than they had been for the preceding months). Over time, Korea's exports tend to correlate closely with U.S. manufacturing, and so this also supports a picture of a manufacturing sector that has hit bottom and begun to recover — even if it remains in poor health.  The manufacturing data helped bond markets to move to a less extreme position, with yields rising and curves steepening somewhat from the exposed position they had reached at the end of last week. So the doom written into the bond markets has been amped down a little. The mania in the U.S. stock market, however, moves on apace. Excitement has been concentrated in a small number of large stocks, and they continue to rally. Indeed the NYSE Fang+ index, which includes a number of dominant internet companies and a few other fashionable stocks, including Tesla Inc., had its best day since last January.  As for Tesla itself, the electric-car manufacturer, already up 263% since June, rose by another 19.8%. It now trades at 21 times its book value. This looks expensive to me. The S&P 500 as a whole remains only 2.4% below its record, set last month. Meanwhile commodity markets continue to behave in the classic fashion that can be expected when there are problems with China's economy. West Texas Intermediate crude briefly traded below $50 per barrel, for the first time since the growth scare at the end of 2018. It avoided further declines in Tuesday trading in Asia, but is plainly still signaling serious problems for China's economy. Where does this leave us? Very different scenarios remain alive, but it seems to me that the predominant belief is that the epidemic has interrupted what was otherwise looking like a reflationary picture. Vincent Deluard, global macro strategist at INTL FCStone Financial Inc. in San Francisco, suggests that the coronavirus scare intervened in a move toward reflation — a stance that the manufacturing data appear to confirm. He had been recommending moving into assets that traditionally benefit from an inflationary environment, such as emerging markets and commodities, but concedes that this is now a very difficult call to make until the full extent of the epidemic is clear. Meanwhile David Kotok, the veteran market observer who heads Cumberland Advisors Inc., suggests that the most likely scenario is as follows: China has allowed the virus to spread too far before taking action, and now has little choice but to take measures that will have a severe effect on its economy. It also risks losing credibility in trade negotiations, and seeing its position weakened. Meanwhile in the rest of the world, the epidemic adds to the pressure on governments and central banks to keep conditions easy. With interest rates held low, and stocks having just sold off, he moved to buy U.S. stocks Monday, depleting his position in cash. His narrative is a little like the traditional "Goldilocks" scenario, when the economy is "not too hot" for higher interest rates and "not too cold" for growth to suffer. On this occasion, Goldilocks' enemy appears to be an insidious and terrifying virus, rather than three bears. While the risk of the epidemic remains, and while it continues to dent the Chinese activity that is essential to much of the global economy, there is nothing for it but to keep money very easy — and this, as we all know well by now — supports stocks. In the face of disease and contagion, There Is No Alternative to U.S. stocks. Meanwhile, Chinese stocks and the halo of emerging markets depending on them are set to suffer. And nothing matters more than the damage that the virus can do. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment