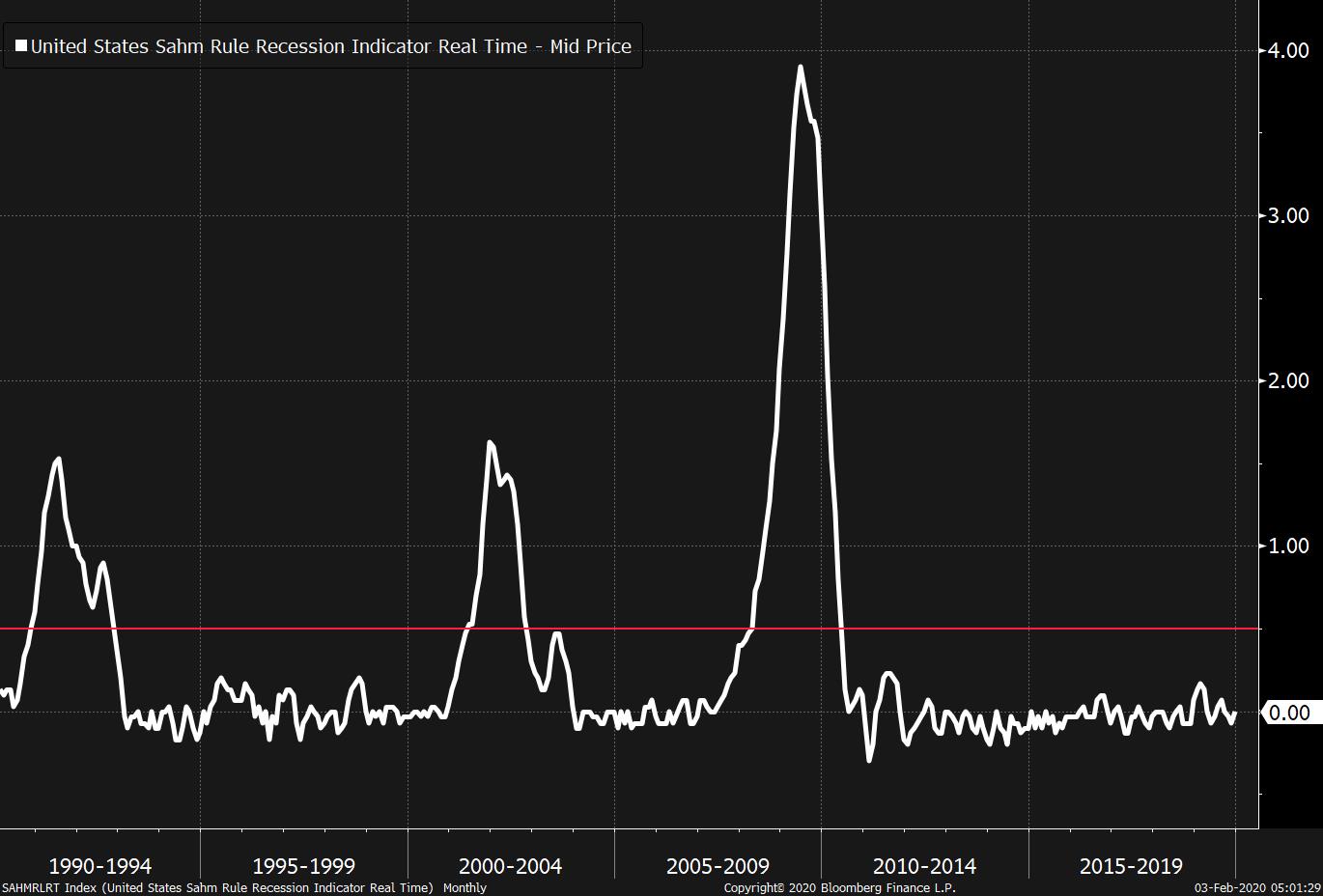

Virus spreads, global markets endure, and all eyes on Iowa. Death toll risingChina is continuing efforts to get to grips with the expanding coronavirus outbreak, with the death toll climbing as residents returned from the Lunar New Year holidays. The tally is now above 360, with confirmed cases now well above 17,000. Bloomberg News continues to track the outbreak here, while efforts to find a vaccine are accelerating. In the latest developments, Russia said it may deport infected foreign citizens, the Philippines reported the first fatality outside of China, and a Chinese foreign ministry spokeswoman said the U.S. had "inappropriately overreacted" to the deadly virus. Meanwhile markets in China reopened to the expected barrage of selling, with a gauge of stocks sliding almost 8% and commodity futures in turmoil. The central bank took action to cushion the blow. Markets endureThat decline in Chinese equities dominated regional moves, and overnight the MSCI Asia Pacific Index dropped 0.8% as of 5:34 a.m. Eastern Time. Japan's Topix index closed down 0.7%. But the Shanghai rout was expected, and other markets showed signs of recovering from Friday's slump. In Europe the Stoxx 600 Index was 0.1% higher. S&P 500 futures pointed to a gain at the open, the 10-year Treasury yield was at 1.534% and oil fluctuated. Iowa at lastThe U.S. presidential election season begins in earnest today as Democrats descend on Iowa for their first nominating contest. Voters caucus across the state to choose from more than a half dozen contenders led by Joe Biden, Bernie Sanders, Elizabeth Warren and Pete Buttigieg. Going into Monday it looked like Warren, who was once riding high in Iowa, had been usurped as the darling of the progressive left by a surging Sanders. Meanwhile Iowa Senator Joni Ernst warned Sunday that Republicans could immediately push to impeach Biden if he wins the White House. And in the really big news, Buttigieg has named his favorite Beatles song. Don't bother clicking, it's "Come Together," obviously. Trade talksNo, not those ones. The U.K. and the European Union begin their battle over a future trade deal on Monday, setting up 11 months of negotiations that risk ending in economically damaging failure at the end of the year. In a major speech in London, Prime Minister Boris Johnson put forward his interpretation of the "level playing field" the two sides agreed to pursue last year. He said the EU shouldn't have to accept the U.K's higher standards where it has them, and so Britain shouldn't have to follow EU standards to get a deal. Earlier EU chief Brexit negotiator Michel Barnier set out his negotiating position, insisting that a "highly ambitious" trade deal is on offer only if Johnson signs up to strict rules to prevent unfair competition. Five Things imagines this will go just as well as the rest of Brexit, especially with you-know-who in the White House stirring things up. Let's hope everyone can work for the common good, it'd be a shame to spoil the green shoots in euro area and U.K. manufacturing data that were on show in Monday's data. Coming upThere's a smattering of data today to keep us ticking over, including Markit's manufacturing PMI at 9:45 a.m. followed by the Institute for Supply Management's reading 15 minutes later. The earnings keep rolling in, with the stand-out name being Alphabet Inc., or to give its full name, parent-of-Google-Alphabet-Inc. That's after the market closes. Atlanta Fed President Raphael Bostic will discuss Big Data, machine learning and digital money at an event in La Jolla, San Diego, if you're into that kind of thing. And the Senate will hear closing arguments today in President Donald Trump's impeachment trial before acquitting him later in the week. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningIt's become a cliche at this point to say that in the next downturn, policymakers will need to lean more heavily on fiscal policy as opposed to monetary. Unfortunately, the public-facing conversation tends to stop right there. This leaves all kinds of questions unanswered like: What should the government spend money on? When should the government spend it? And what will be the efficacy of the response if we have to wait for self-motivated politicians to agree on something? On the latest episode of our podcast, Tracy Alloway and I talked with former Federal Reserve economist Claudia Sahm, who is now the Director of Macroeconomic policy at the Washington Center for Equitable Growth. Sahm has been doing the work for years, examining the best way for the government to start cutting checks to prevent and minimize downturns. And she's the developer of the eponymous Sahm Rule, an early warning sign for downturns. When the three-month moving average of the unemployment rate rises by 0.5% above the recent 12-month low, that's the signal that a recession is in the offing, and that it's time for the government to get in gear and spend. As you can see, her indicator is nowhere near the danger territory right now, with unemployment at its lowest point of the cycle. However, if things started deteriorating rapidly, the signal would flash quickly, as opposed to some other recession measures which can take awhile to activate. The whole conversation is worth listening to and hopefully we'll soon see more discussion about how to do fiscal policy the right way, as opposed to just bemoaning that monetary policy has reached the limit of its potential.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment