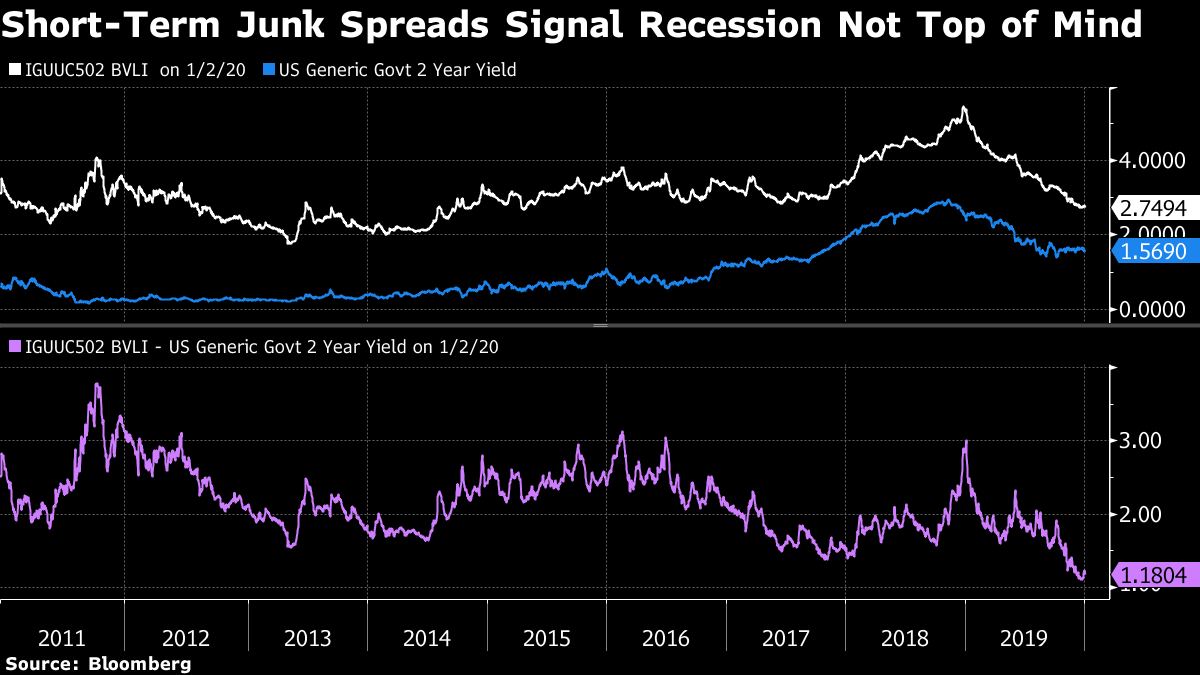

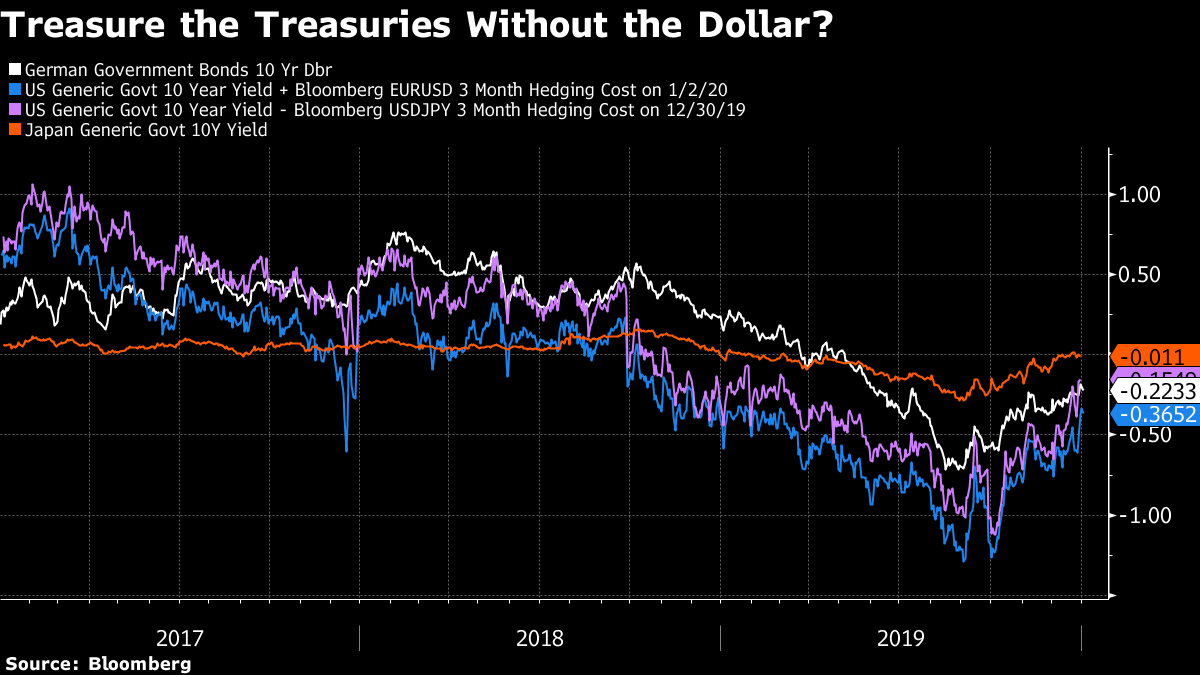

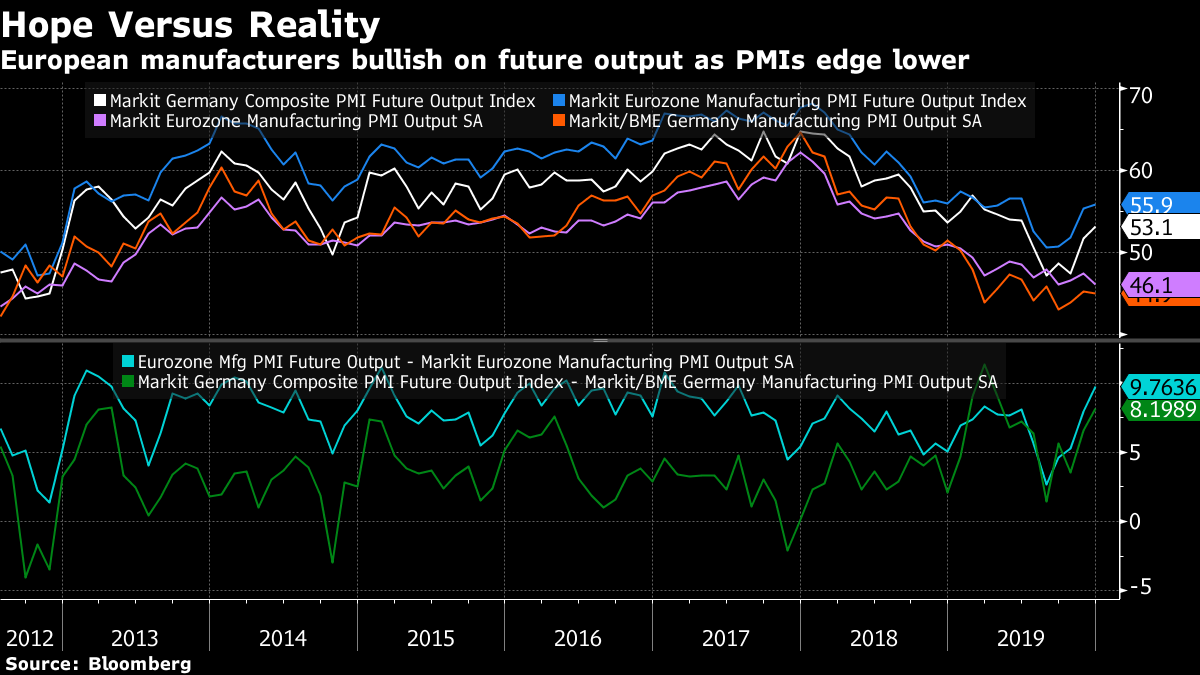

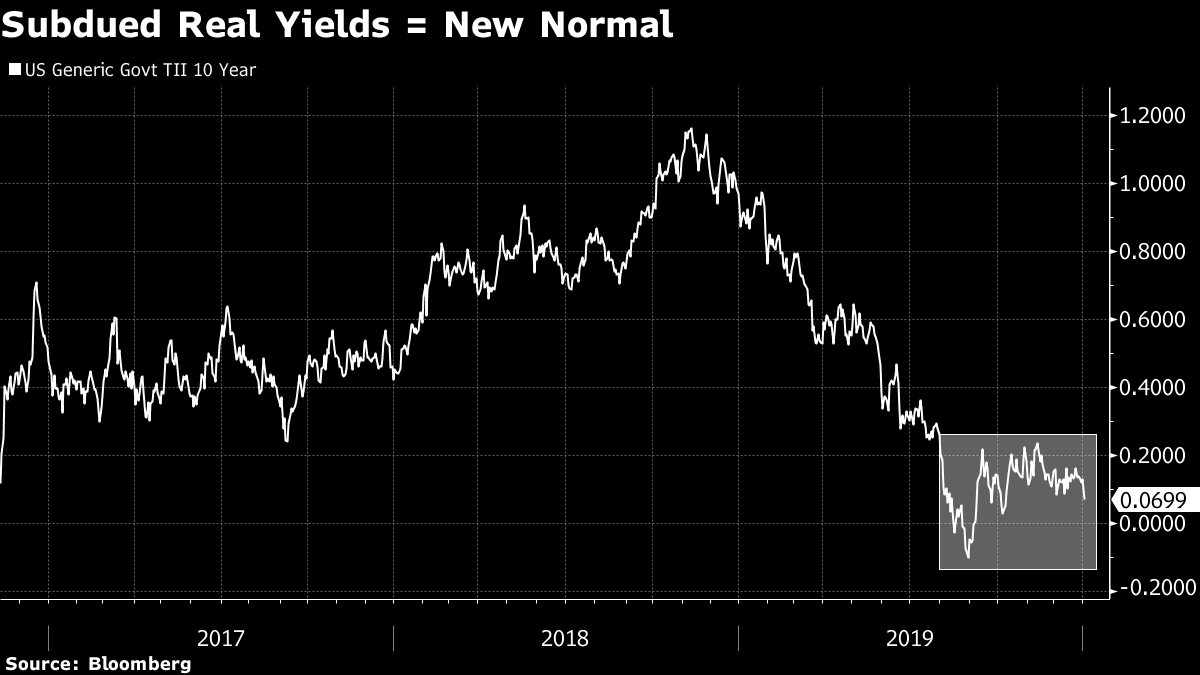

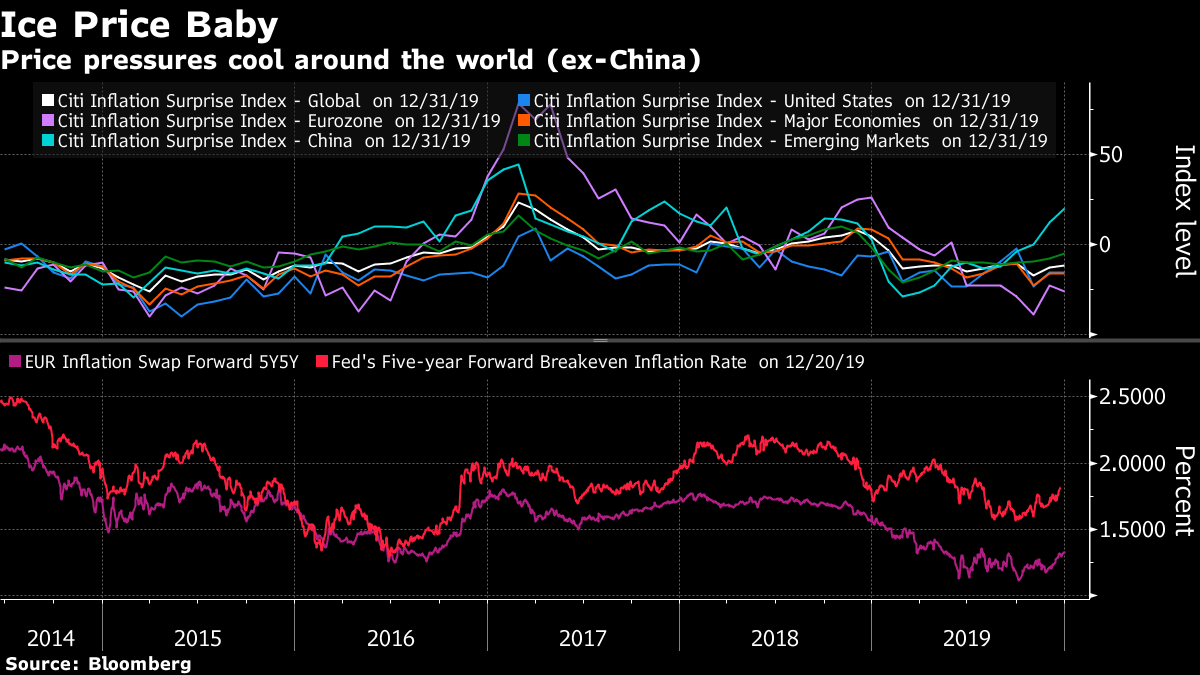

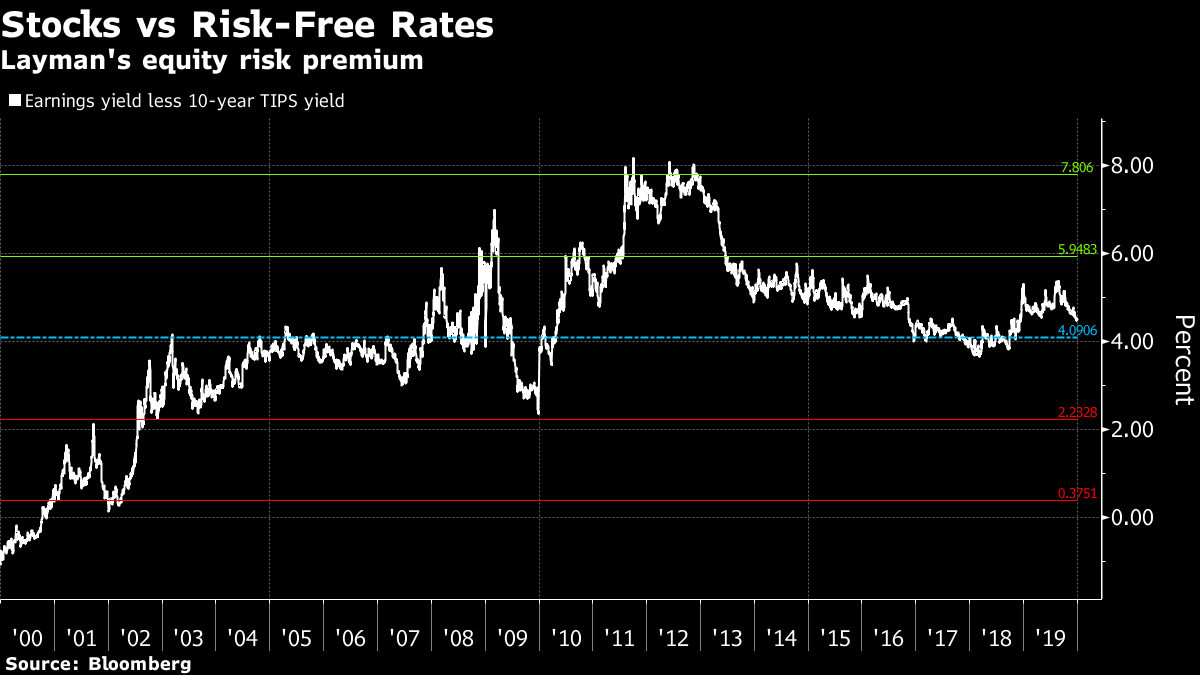

| Welcome to the Weekly Fix, the newsletter that's wondering if the bull market in risk assets is getting fresh help from not getting enough credit. – Luke Kawa, Cross-Asset Reporter 2020 Charts Apropos of another trip around the sun, here are some charts we'll be monitoring to get a sense of how fixed income themes in 2020 are developing, with implications spanning across financial markets. High Quality Junk: Credit investors scared about the possibility for duration to get whacked or a long-in-the-tooth cycle to reach its best-before date before too long have short-term BB bonds as a possible place to hide. At 2.75%, the all-in two-year BB yield has halved over the past year, but remains about a full percentage point below its 2013 low during this expansion (albeit at close to cycle tights versus U.S. Treasuries on a spread basis). If investors ever get truly worried about an imminent downturn (as was the case during the S&P downgrade/euro sovereign debt crisis in 2012, fears of a Chinese hard landing in late 2015/early 2016, briefly in the wake of the Brexit vote, and at the end of 2018), then this is where that concern should really manifest as investors begin to mull a return to the zero lower bound and the prospect of squeezing through to the exits of a high-yield bloodbath.  High Yield Low Versus EM: But a necessary prerequisite for enthusiasm about a "rest of the world over U.S. trade" to be adequately reflected across the risk spectrum may be for EM sovereigns (which are on average, rated above junk) to trade at a smaller premium over Treasuries than U.S. high-yield debt. The current streak of U.S. high yield trading tighter than developing market government debt is the longest on record (going back to the start of 2003).  The Almighty Dollar: One consensus call (again) is for the U.S. dollar – which spent the last year in a mind-numbingly tight range against its major developed peers – to stumble, if not fall. Under a "dollar smile" framework, this would purportedly be associated with better growth overseas – a good news story. Yet the ramifications of a weaker dollar aren't clear positives for all financial assets. Namely, a greenback on its back foot may dent interest in U.S. government and corporate bonds from foreign investors that have bought those securities on an unhedged basis to get some yield pick-up.  All the same, it's important to note that the real trade-weighted dollar has posted a smaller advance since mid-2014 than the Dollar Spot Index and especially versus EM FX, implying that the threat to the world from a stronger dollar may be less than meets the eye at first blush. Dollar-Hedged Yields: A piggyback to this focus on the dollar: will buying U.S. bonds on a hedged basis become attractive again? Japanese investors haven't been able to buy U.S. Treasuries on a hedged basis and come out ahead since around the time Jerome Powell said "long way from neutral." For domestic German savers, that's been even longer: since the second quarter of 2017. If realized, this could become helpful in keeping a cap on any sell-offs that might arise in U.S. debt during any "reflationary" scenarios. (The below chart compares German and Japanese 10-year yields with their U.S. counterparts, adjusted by three-month hedging costs)  Euro Manufacturing Recovery Hopes: Right now, there's a gap between the reality of activity in European manufacturing (bad) and what's expected to come (better times). That gap is best displayed through the difference between the "future output" and "output" sub-indexes of the manufacturing PMIs for Germany and the euro zone as a whole. While output is in negative territory for both, the future output gauges are comfortably north of 50. These sub-indexes tend to move in a rather coincident fashion, making it more difficult to trust expectations of future output to be a solid leading indicator. Many of the consensus 2020 trades (yields up with a steepening curve, U.S. and rest of world convergence, value over growth in equities) seemingly have an embedded European bounce-back component. Whether the optimism of manufacturing executives comes to pass may play an important role in determining their success or failure.  In Jay We Trust: The Federal Reserve has given a clear indication that it expects to and wants to stay on hold with its policy rate through 2020. A chart of the implied volatility of Eurodollar futures contracts that expire in June and December of this year shows how much the market has come to believe it. The midyear contracts retraced more than all of their 2019 pickup, and the December 2020 is considerably off its highs. If investors sense the data or outlook is pushing the Fed closer to vaulting its presumably high bar for action, then these volatilities will start to act up.  Bloomberg Bloomberg Getting Real: So long as Treasury inflation-protected securities yields are below 20 basis points, either the market is convinced that global central banks are more structurally dovish than ever, or real growth prospects haven't crescendoed to a degree that warrants much attention and continue to reflect an enduring "new normal" outlook of sluggish worldwide growth.  Inflation Risk: Now that geopolitical tensions are back at the fore for market participants on the heels of the killing of a top Iranian commander in a U.S. airstrike, it's necessary to think about the ways in which this could have an enduring impact on markets. Beyond raising risk premiums generally, one conduit for market turbulence is inflation – in this particular instance, potentially and primarily through oil prices, which could impact headline price pressures and crimp spending on other discretionary items. Moreover, an inflation shock could spell trouble for the traditional 60/40 portfolio and risk parity strategies that rely on the negative correlation between stocks and bonds to produce smoother returns. Whether inflation surprises to the upside this year – for whatever reason – could upset the apple cart for these popular portfolio structures.  Stocks and Bonds A bull case for stocks – particularly valuations approaching cycle peaks – may not be getting enough credit. Literally. Both high yield and investment grade supply are forecast to decline from 2019, notwithstanding a bumper round of issuance expected in January. Analyst Brian Reynolds has, throughout this expansion, documented how much pension funds are increasing allocations to credit, juicing returns while simultaneously propping up the part of the U.S. economy in which it could be best argued that imbalances are arising. What happens, however, when diminished supply meets increased demand? Where does the money go? The famously flowless and unloved equity rally could get a massive boost if a "there is no alternative" to stocks mentality is even somewhat accepted by major institutions in the event of a relative dearth of new paper fostering compressed spreads with tiny all-in yields. It's possible to make a valuation case for U.S. equities given the exceptionally low level of real yields: forward price to earnings ratios are within a whisker of the December 2017 cycle peak, but the yield on 10-year TIPS is more than 40 basis points lower now.  Expressed differently, the gap between the S&P 500's earnings yield and the 10-year real yield is still above its average going back to 2000 (though the tail end of the dot-com bubble does sufficiently skew these results).  On the other hand, the torrid 2019 rally may discourage such activity if it's viewed as having pulled forward returns in secular stagnation world. The notion of a falling efficient frontier in stocks and bonds may lead to a material boost in allocations to alternative assets and private credit. After all, the excesses this cycle have tended to crop up outside of public markets, not within them. |

Post a Comment