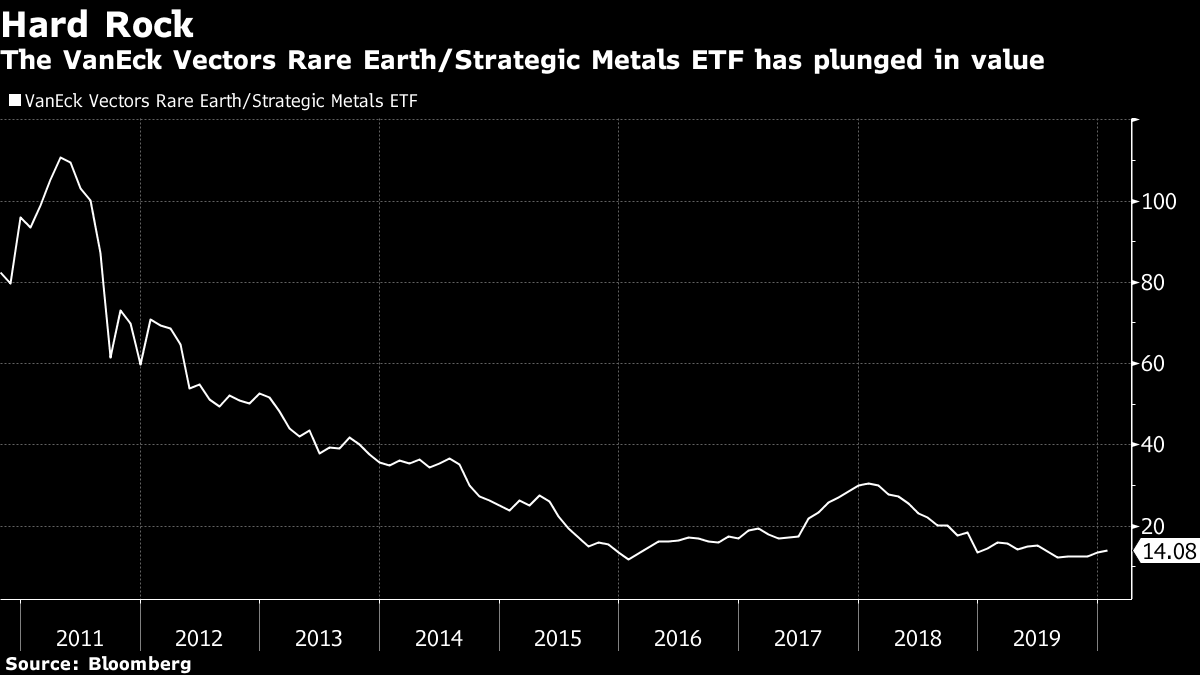

| A distressed debt cycle looks set to start in China, the Australian stock market is the year's best performer — despite the wildfires — and there could be trouble ahead for Xi Jinping and Donald Trump. Here are some of the things people in markets are talking about today. Now that the trade deal is officially signed, Xi's wider fight with the U.S. is only just beginning. In a letter read out during Wednesday's trade deal signing at the White House, Chinese leader Xi Jinping asked U.S. President Donald Trump to take steps to "enhance mutual trust and cooperation between us." That won't be easy: Apart from the trade agreement, the U.S. and China are butting heads on everything from technology to human rights to territorial disputes. Just this week, Secretary of State Michael Pompeo told executives in Silicon Valley the U.S. is "facing a challenge from China that demands every fiber of your innovative skill and your innovative spirit." A return to acrimony could have major consequences for China, and for Xi. In the short term, renewed tensions with the U.S. risk weakening an already fragile economic situation, while investment restrictions could hamper plans to secure technologies essential to driving growth. For Xi, a perceived failure to manage U.S. ties could also dent support for a third term in office. Meanwhile, economists aren't seeing any U.S. growth bump from the U.S.-China deal. Also, here's a list of trade war winners and losers. Asian stocks looked set to advance as the record-setting U.S. rally showed little sign of letting up amid signs of strong American consumer demand. Treasury yields edged up, while futures rose in Japan, Hong Kong and Australia. The S&P 500 climbed to a fresh all-time high on Thursday, with technology and financial shares leading the charge: Alphabet's market valuation hit $1 trillion for the first time. Treasuries fell after data showed U.S. retail sales strengthened in December, while the dollar nudged higher. Elsewhere, crude oil advanced and gold slipped. Deutsche Bank sees a "distressed debt cycle" beginning in China. Amid rising defaults and tighter liquidity for Chinese privately-owned enterprises, the nation's banks are letting some companies fail, something that Deutsche Bank says presents bigger opportunities for foreign investors in troubled debt. The German lender is an active distressed player in Asia Pacific and has bet on some of the biggest restructuring in the region, including commodities trader Noble Group. China, meanwhile, is taking steps to allow more foreign investment into the country's 2.37 trillion yuan ($344 billion) non-performing loan market. It will give U.S. investors direct access to the nation's soured debt market as part of its trade deal. "Distressed debt in China is going to be really interesting," said Amit Khattar, co-head of investment bank for Asia Pacific, in an interview. Defaults in China's onshore corporate bond market hit a record in 2019 and troubles have continued in the offshore market as well this year. Less than a month into 2020, Australian stocks are the world's best performers — despite the wildfires. The S&P/ASX 200 index has jumped 5.4% this year, besting all equity benchmarks in the developed world, according to data compiled by Bloomberg. Optimism over the U.S.-China trade deal, coupled with lower-for-longer interest rates and the potential for further cuts are helping the gauge extend gains following 2019's best-in-a-decade surge. The benchmark closed at a record high for the third consecutive session Thursday and finished above the 7,000 level for the first time. The strong performance is making consumers more positive — they contributed to a boost in confidence data earlier this week, according to a note from Craig James, chief economist at Commonwealth Bank of Australia's securities unit. "A market at all-time highs is as bullish as you can get," said Chris Weston, head of research at Pepperstone Group in a note to clients. "To promote a decent move to lower, and not just a synchronized wave of profit-taking, we are going to need to see news that is not yet known." Trump's tax cut handed a $32 billion windfall to America's top banks. Savings for the top six U.S. banks from the Trump administration's signature tax overhaul accelerated last year, as the lenders curbed new borrowing, pared jobs and ramped up payouts to shareholders. JPMorgan, Bank of America, Citigroup, Wells Fargo, Goldman Sachs and Morgan Stanley posted earnings this week showing they saved $18 billion in 2019, more than the prior year, as their average effective tax rate fell to 18% from 20%. Bloomberg News calculated the haul by comparing the lower tax rates to what they paid before the law took effect, which averaged 30%. Debate has raged over the tax overhaul's impact since Trump signed it into law near the end of his first year in office: Critics say it's worsening inequality by favoring the wealthy and inadequately stimulating economic growth. Because banks used to pay higher tax rates than many other industries, they were among the biggest beneficiaries. Proponents predicted lowering rates would give lenders more cash to fuel the economy, helping companies invest in expansion, hire workers and raise pay. No matter which side you take though, it's undeniable that the banks have come out on top as the tax savings have spurred record profit. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Tracy's interested in this morning Scandium and yttrium have to be among the weirder things on the schedule of stuff that China has agreed to buy from the U.S. as part of the phase-one trade agreement. As Bloomberg reports, these are two types of rare earth minerals that aren't really mined at all in the U.S. and yet they appear on the list of manufactured goods that China will be buying from America. (In fact, China's dominance in rare earths mining has often been viewed as leverage that it could hold over the U.S., with the U.S. Commerce Department last year recommending that the U.S. take steps to ensure it doesn't get cut off from its supply).  It's possible that the relevant tariff code listed in the agreement (284690) includes lanthanides — which the U.S. does compete with China to produce — alongside scandium and yttrium. But overall, it's kind of a weird thing to throw in there. In any case, I mention it mostly as an excuse to show the long-term chart of the VanEck Vectors Rare Earth/Strategic Metals ETF. Rare earth minerals were a huge speculative bet a decade ago. Now, not so much. You can follow Bloomberg's Tracy Alloway at @tracyalloway. Australia has some big decisions to make about its future. For a fresh perspective on the stories that matter, sign up for our weekly newsletter. |

Post a Comment