| This is Bloomberg Opinion Today, a willing coalition of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  Portraits of Iran's Qassem Soleimani and Ayatollah Ali Khamenei. Photographer: ATTA KENARE/AFP/Getty Images Who Had 'War With Iran' on Their 2020 Bingo Card? We knew 2020 would be an interesting year, in the old-curse meaning of the word. It only took two days for us to begin to find out just how interesting it will be. American drone strikes on Thursday killed Qassem Soleimani, leader of the Quds Force of Iran's Islamic Revolutionary Guard Corps. Some pundits equated this to taking out a country's vice president; he was just that big of a deal in Tehran. He was also a monster responsible for hundreds of thousands of deaths, writes Bobby Ghosh. His own demise was the inevitable outcome of his hubris and Ayatollah Ali Khamenei's growing aggression toward the U.S. Past presidents avoided harming Soleimani, hoping to avoid pushing tensions to dangerous new heights. But Eli Lake writes that President Donald Trump was right to treat him and the regime like terrorists. Contrary to widespread fears, this isn't starting a new war, in Eli's estimation, but opening a new phase in an old war. Still, it's a huge gamble and a momentous change in U.S. policy: Where once it avoided an escalating spiral of violence with Iran, now it seems to be trying to shock it into de-escalation, writes Hal Brands. And the ploy just might work. But its success will require far more finesse than Trump has exhibited so far, Hal warns. Markets have exhibited mild concern, with oil and safe-haven assets rising and stocks falling. But there's been no panic, mainly because the risks from here are all black swans, writes John Authers, and thus impossible to measure. The currently measurable risks aren't all that destructive to capital yet. Traders may also believe armed conflict between the U.S. and Iran is off the table and that central banks will rush to the rescue in any event, writes Mohamed El-Erian. And they may be right. But they also may need more hedging, because the risks of a profound mistake keep rising dramatically with every new provocation. And the Soleimani assassination drives home how America's global influence is no longer a stabilizing force for oil and other markets, writes Liam Denning. Things could soon enough get much more "interesting." Side Effects of Easy Monetary Policy May Include ... Somewhat lost in the day's headlines was a report from the Institute for Supply Management that showed America's manufacturing sector is still in recession. (Unwelcome news for industrial stock prices, which got a bit over their skis pricing in a recovery, writes Brooke Sutherland.) It was a reminder that another war, the one involving trade with China, is still hurting the economy. Of course, that economy is also still enjoying a record expansion, thanks largely to those aforementioned helpful central banks. But this source of strength is also a potential source of weakness, warns Jim Bianco. Every time central bankers have tried to withdraw support, markets have cratered. Easy money has driven asset prices to records, but it has also pushed global debt levels higher than before the crisis, notes Satyajit Das. This makes economic "doom loops" far more likely if there's a shock to the economy, with indebted consumers closing their wallets and selling stuff to pay the bills, driving prices and growth ever lower. Further Economics Reading: Five big-picture questions face economists at the dawn of a new decade. — Narayana Kocherlakota Australia's Burning Question Let's say you are the prime minister of a country that is being consumed by wildfires in large swaths. Do you: - Grab a bucket and start fighting the blaze, or

- Jet off to Hawaii?

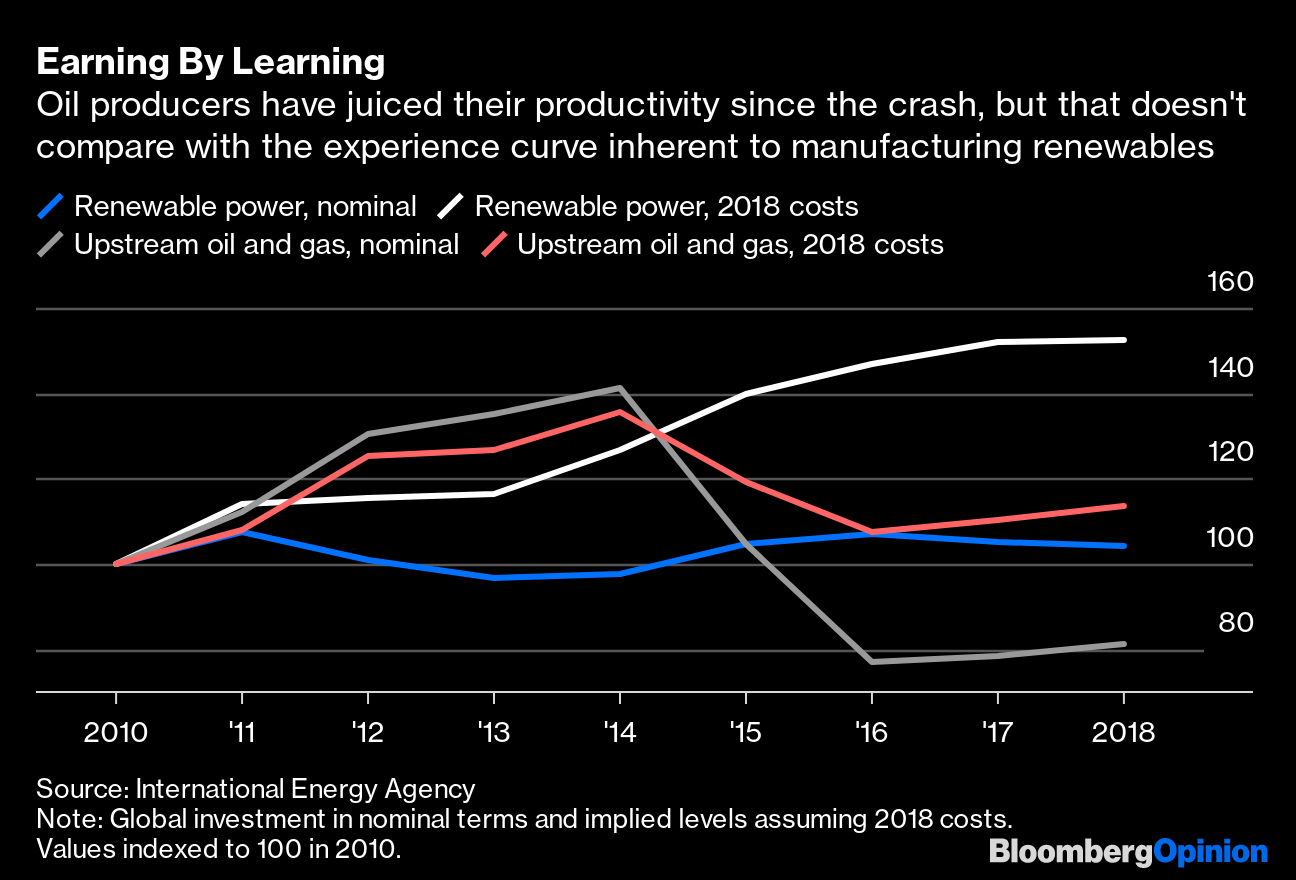

If you picked "2," then our condolences: You are perhaps Australia's Scott Morrison, whose premiership is under siege because he made that same poor choice, leading to responses such as these:  Roasting Morrison over his inept response is legitimate, but it doesn't go far enough, write Dan Moss and Tim Culpan. The nation's leaders still haven't come to grips with the fact that apocalyptic wildfires, which used to occur only once in a generation, will now be routine as the planet warms. Telltale Charts Greta Thunberg, Trump, frackers and more dramatically overhauled energy in the 2010s, writes Liam Denning. They've set the stage for what could be a wildly different 2020s.  Further Reading European banking regulations are full of holes that money launderers exploit all too easily. — Elisa Martinuzzi It's not clear how dangerous Germany's far right is, but now's the time to keep an eye on it. — Andreas Kluth The death of brokerage fees didn't start with online brokers, but at the NYSE decades ago. — Stephen Mihm It's hard to argue the nomination process was unfair to Julian Castro. — Jonathan Bernstein Simple economics can curb health-care costs. — Gary Shilling ICYMI Venezuela has too many dollars. Nine U.S. states face economic contraction, the most since 2009. Carlos Ghosn's getaway jet company has a colorful history. Kickers A Turing mechanism may explain how Azteca ant colonies cluster. (h/t Scott Kominers) Particle accelerator fits on the head of a pin. 160,000-year old jaw hints at how humans adapted to high altitudes. Dr. Phil's very strange house is for sale. Note: Please send particle accelerators and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment