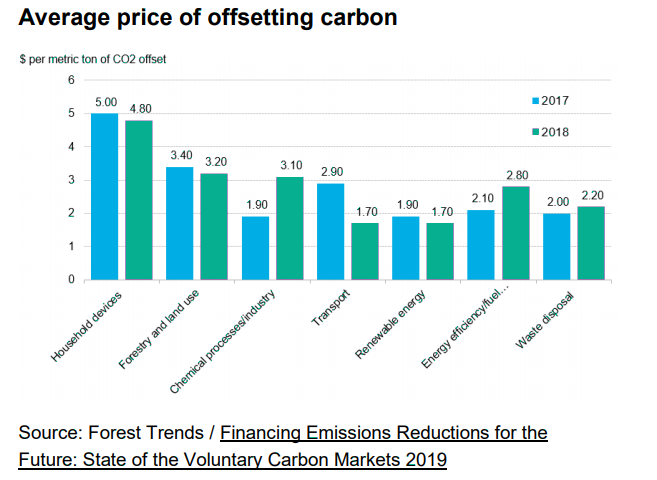

| Inside: Airline's carbon reduction goals could remake the offset market. Green debt issuance rose 78% last year to a new record. U.S. emissions are falling as utilities ditch coal. Barclays faces a climate change resolution.— Emily Chasan Sustainable Finance Airlines are coming for the carbon offset market. JetBlue said it will become the first large U.S. airline to offset emissions from all of its domestic flights and boost its use of sustainable aviation fuel, with a goal of becoming carbon neutral by July. Europe's EasyJet announced a similar plan to offset emissions from flights last year, amid growing concerns from climate activists on the industry's emissions. The options to lower the carbon footprint of air travel are growing, even for private jet flyers, and offsets are one of the only ways to handle it since jet engines rely on combustion. Airlines could have a major impact on the offset market as they pour resources into it. Corporate demand for carbon offsets has grown significantly already, according to BloombergNEF's Bryony Collins. Carbon offset retailers are reporting four- to ten-fold increases in demand in the past few years, and companies increasingly seek third-party advisors to make sure their offsets are really working. There is still no consistent, verifiable standard for voluntary offsetting that guarantees emissions reduction is permanent, and that offsets are of high quality regardless of how big the market grows.  Norway's Equinor just unveiled its most ambitious climate plan yet, with plans to go carbon neutral by 2050, but it isn't enough to get the oil and wind energy company off theexclusion list of $20 billion Danish pension fund MP Pension.

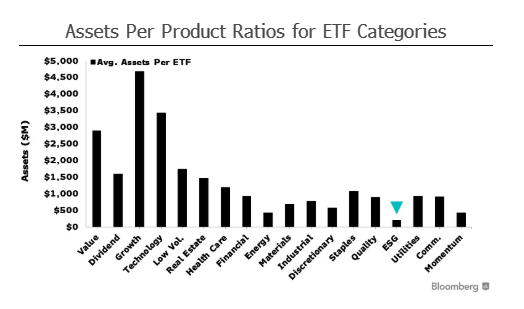

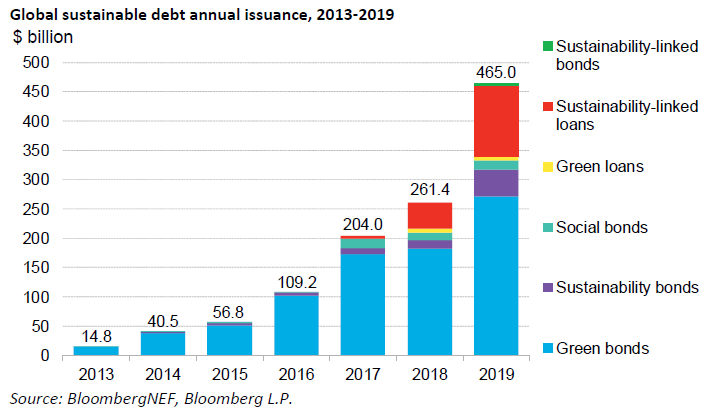

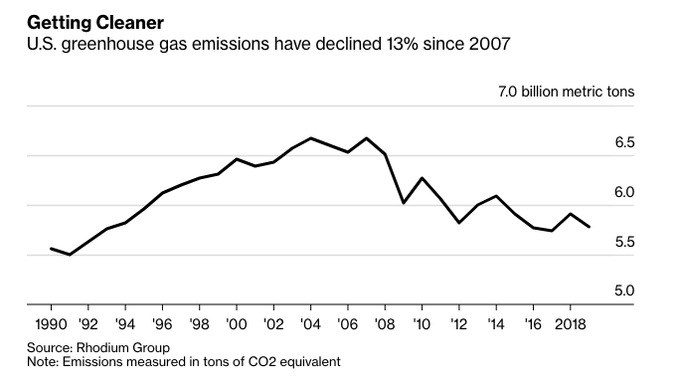

Launches of ESG ETFs could slow in 2020, since the category still has a lot of catching up to do with other asset classes, according to Bloomberg Intelligence Analyst Eric Balchunas. The category has 102 products, but only about $20 billion in assets, which is much less assets per product than other major sub-categories of ETFs.  Surging demand for socially responsible investments has led to a record $465 billion of green debt issuance in 2019, up 78% from 2018, according to the latest figures from BloombergNEF. Green bonds topped $271 billion in issuance, up from $182 billion in 2018, while green and sustainability-linked loans rose to over $205 billion. Sumitomo Mitsui Financial was the No. 1 arranger of green loans globally last year, while Credit Agricole was the top underwriter of global green bonds last year, followed by HSBC and BNP Paribas.  In Brief Environment Coal plants closing down are almost entirely responsible for a 2% decline in U.S. greenhouse gas emissions last year, according to the Rhodium Group. U.S. coal power plunged an estimated 18% in 2019. Fossil fuels and power generation are decoupling their relationship even faster elsewhere. In the U.K. carbon-free electricity outstripped power from fossil fuels for a full year for the first time in 2019, National Grid Plc said.  Elon Musk's decision to assemble Tesla cars in China required years of planning and billions of dollars in spending. Now comes the challenging part. Tesla cut the starting price of China-built Model 3 sedans by 9% as it steps up efforts to lure customers in the world's biggest electric vehicle market. Tesla's price target was raised by more than $100 at Canaccord Genuity to $515 as analysts wrote that the trend toward electric vehicles "will only accelerate in 2020."

Austria wants to radically reduce greenhouse gas emissions. Its new government has an aggressive plan to become carbon neutral by 2040 by focusing on clean energy and transportation.

The union at the U.S. Environmental Protection Agency put a demand for the right to work on climate change and conduct climate change research without political interference into its contract negotiation talks.

Thailand is facing its worst drought in 40 years. Tap water has already turned saltier in parts of Bangkok, as a river became too low to keep seawater out. The lack of water is imperiling the country's farming sector which employs 11 million people.

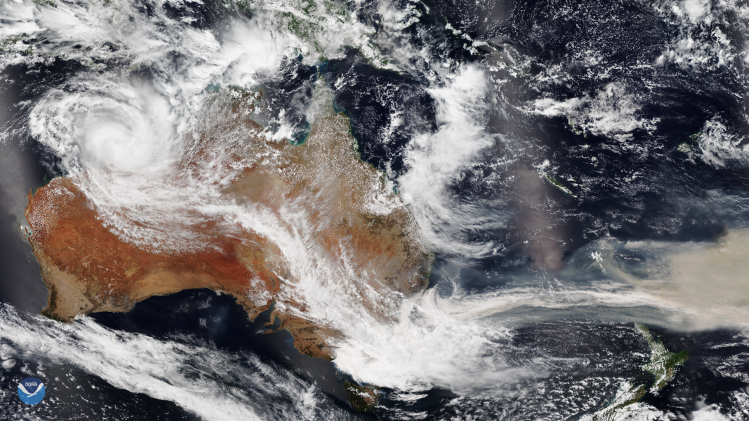

Australia's deadly wildfires are sending smoke halfway across the world, darkening skies in Argentina and beyond.  Social A boom in plant-based dairy alternatives like soy, rice and nut milk, along with rising prices for raw milk have put the squeeze on U.S. dairies. Borden Dairy was the second major U.S. milk seller to go bankrupt in the past two months. After taking on coal and oil, climate-focused investors also look like they are starting to shun meat and dairy. A group of Amazon employees who pushed the company to combat climate change say Amazon has threatened to fire some of them if they continue to speak out about their employer's internal affairs. Governance A group of Barclays shareholders have filed what they say is the first climate change resolution at a European bank, taking aim at the lender's support of fossil fuels.

Companies with dual-class shares have stoked outrage among investor advocates concerned about limiting shareholder rights. Now there's an ETF for them.

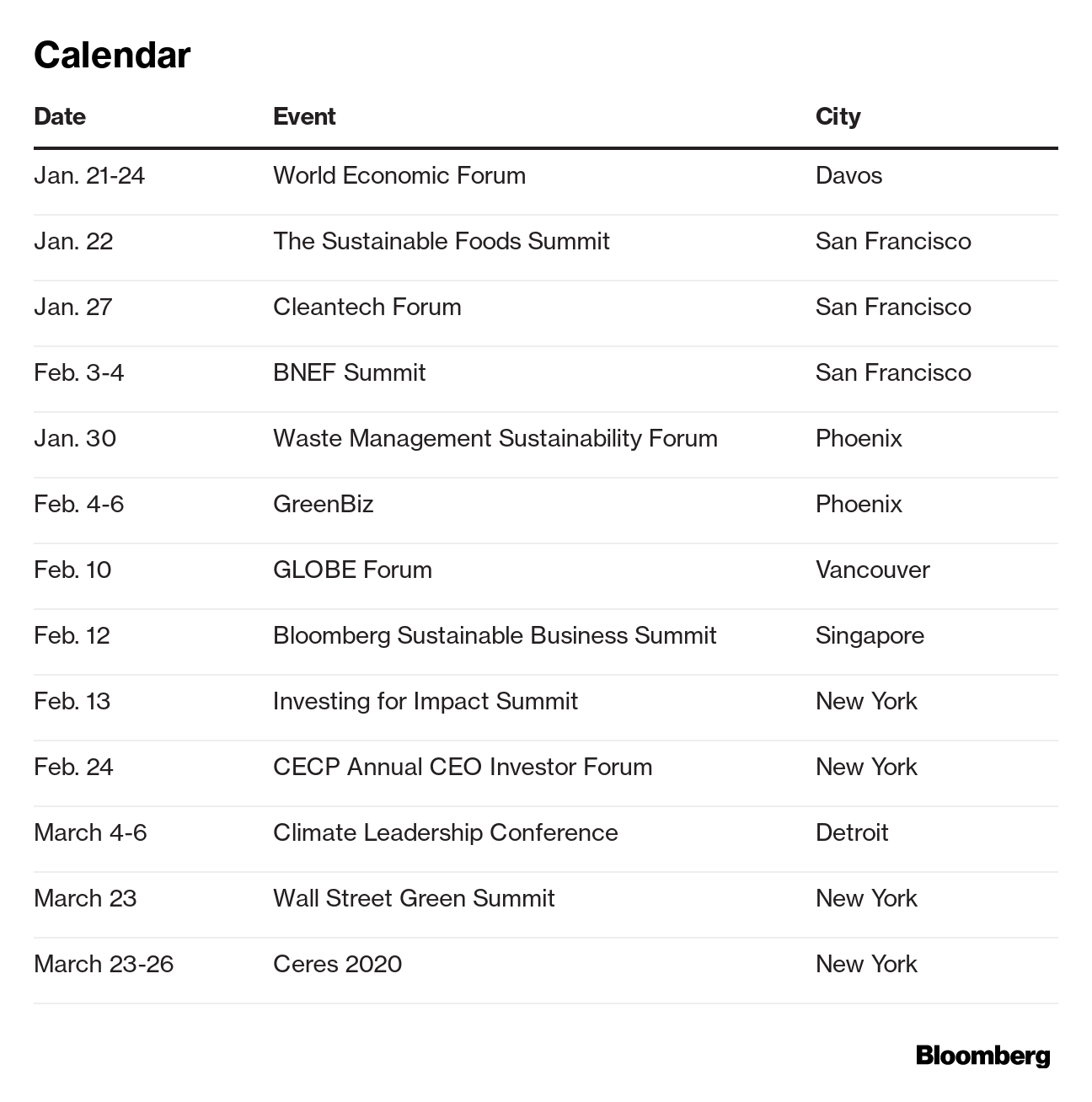

The U.S. Securities and Exchange Commission's proposal to change the rules around how shareholders submit resolutions at annual meetings, would have prevented shareholder proposals that ultimately led to changes at Wells Fargo, Boeing and Chevron, the Shareholder Rights Group coalition said.  Note: Please send tips, suggestions and feedback to Emily Chasan at echasan1@bloomberg.net. New subscribers can sign up here. To see this on the web, click here. After five years convening C-suite executives, influential investors, and innovative thought leaders in North America and Europe, Bloomberg's signature Sustainable Business Summit series will come to Asia for the first time in 2020. Sign up here for the Feb. 12 event in Singapore. |

Post a Comment