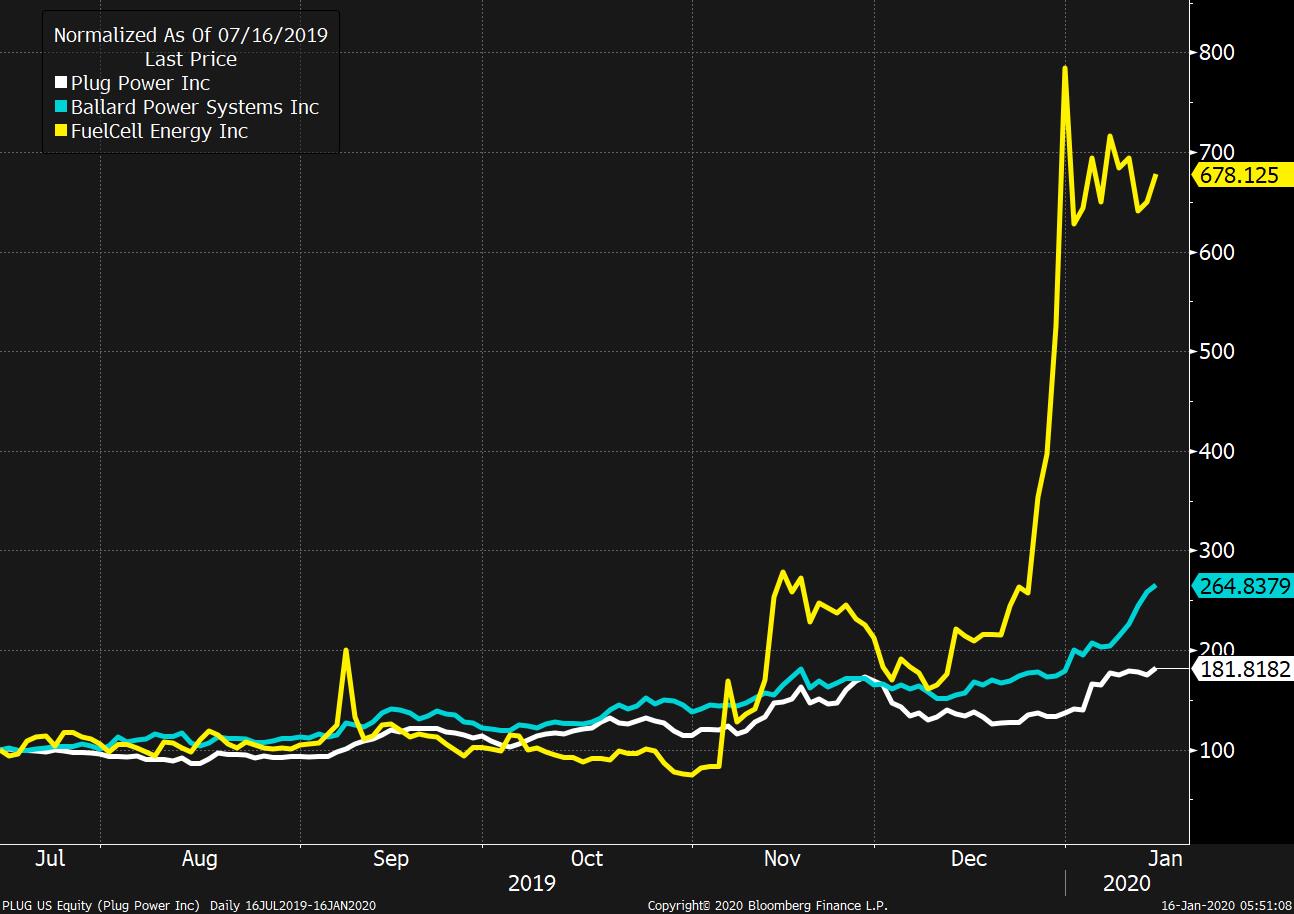

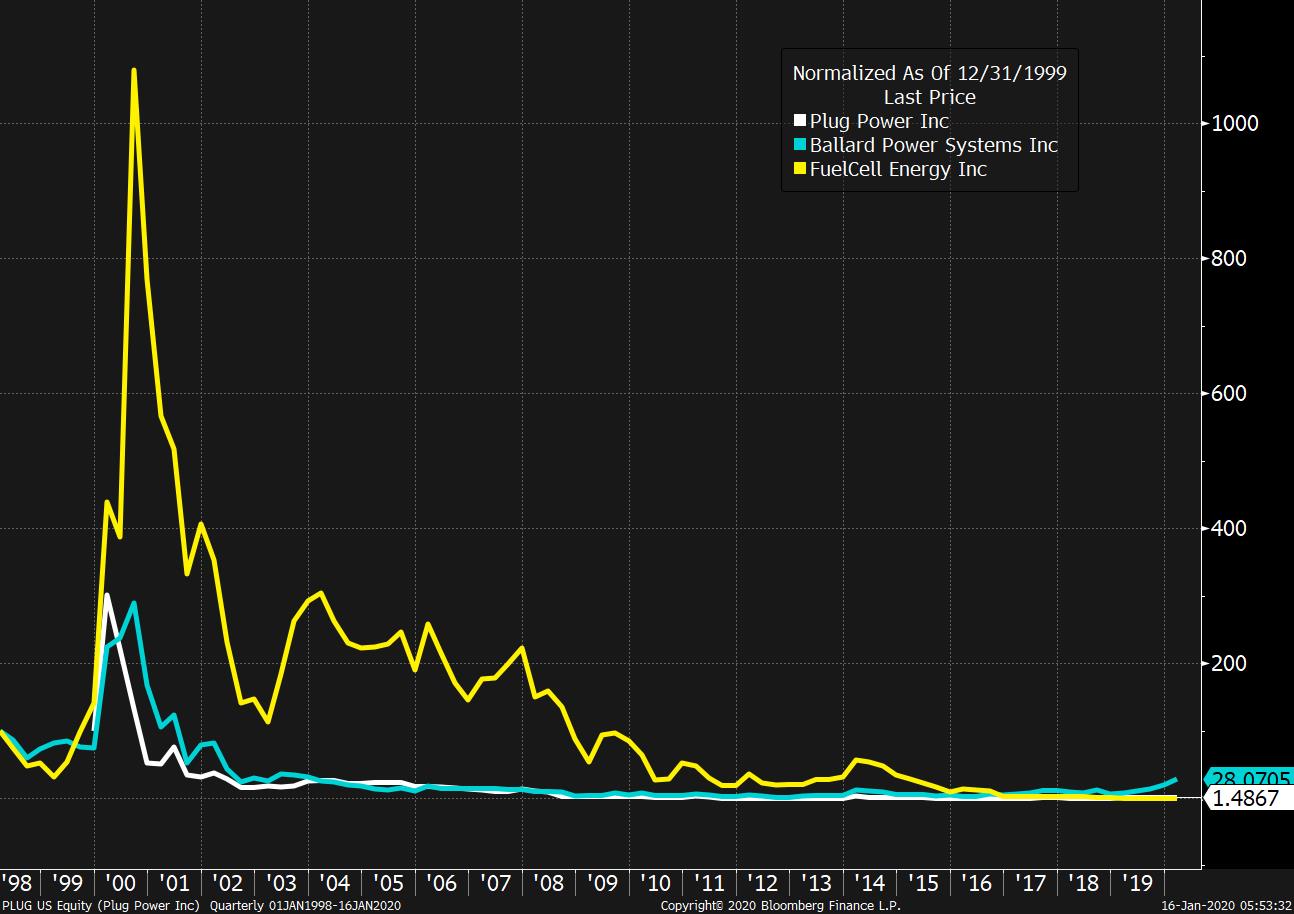

Jury's out on trade deal, more bank earnings, and oil reaps U.S.-China deal benefit. Winners, losers (and doubts)Analysts are welcoming the phase-one trade deal between the U.S. and China that was signed yesterday, while cautioning that the hardest negotiations are yet to come. There are already some doubts about the agricultural purchases China has agreed to make, with market prices for most of the sector's commodities slipping in the wake of the signing. Also in commodities, the deal calls for increased purchases of U.S. rare earth minerals that are in short supply. The biggest losers are likely to be South American farmers, Australian suppliers of liquefied natural gas, and the World Trade Organization which has been sidelined by the agreement. Earnings A generally very strong earnings season for Wall Street's biggest banks is rounded off this morning with Morgan Stanley's report before the open. The bank, which saw its stock increase 29% in 2019, may find it difficult to "substantially move the needle" in today's earnings, according to JMP Securities analyst Devin Ryan. Investors will keep an eye on fixed-income trading results with the firm also expected to provide details of staff cuts. Oil boostCrude futures are higher this morning, with the commodity seeming to be a clear winner from the trade accord. A barrel of West Texas Intermediate for February delivery traded at $58.02 by 5:45 a.m. Eastern Time with China's commitment to buy a further $52.4 billion of American energy as well as the possibility of improving relations between the world's two largest economies giving sentiment a boost. There was also possibly some risk premium remaining in the price, with a report from the International Energy Agency warning that supplies from Iraq are "potentially vulnerable" amid rising political tensions. Markets mixedStock market reaction to the inking of the trade deal has been very muted. Overnight, the MSCI Asia Pacific Index added 0.2% while Japan's Topix index closed 0.1% lower. In Europe, the Stoxx 600 Index was broadly unchanged by 5:45 a.m., giving up earlier session gains. Automakers fell with investors seeing the surge in car sales at the end of 2019 as a sign of weaker performance to come. S&P 500 futures pointed to gain at the open, the 10-year Treasury yield was at 1.786% and gold slipped. Retail salesDecember core retail sales for the U.S. are expected to climb to 0.4% after a flat November, while weak auto and gas sales may hold back the headline number. The data is published at 8:30 a.m., with weekly jobless claims, the December import index and Philadelphia Fed Business Outlook all also landing at that time. The ECB publishes an account of Christine Lagarde's first monetary policy meeting as president, which economists will read for any hints on the bank's strategic review. November TIC flow data is at 4:00 p.m. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningWith markets off to a blazingly fast start to 2020 (after a stunning 2019) everyone's grasping for parallels to previous strong bull markets. Is this January 2018 all over again? Is it 1999? There's obviously no right answer, but this is just what people do. Nonetheless, if you are looking for mini-echoes of previous booms, here's something I always like to watch as a sign of market exuberance: fuel cell stocks. Fuel cells, which promise to power cars and buildings without causing pollution, always seem to be the "next-next-thing" so to speak in renewable energy. Automakers have been rolling out prototype vehicles using the energy since long before Tesla existed. And there's a handful of players in the market developing the technology for a range of applications from automotive to industrial. Anyway there's three notable publicly traded fuel cell stocks (Plug Power, Fuel Cell Energy, Ballard Power) that have been around for over two decades now. And for those who don't recall, they went absolutely crazy during the bubble in 1999 and 2000. The stocks have been surging once again over the last six months. Now, it's important to recognize the big picture, which is that these names are literally down on the order of 99% since the peak in the old days. The scale of the boom is just nowhere close as you can see in the two charts. Nonetheless, if you want to make an argument that there's some sort of euphoric breakout, the bid in fuel cells is one piece of evidence you can use.   Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment