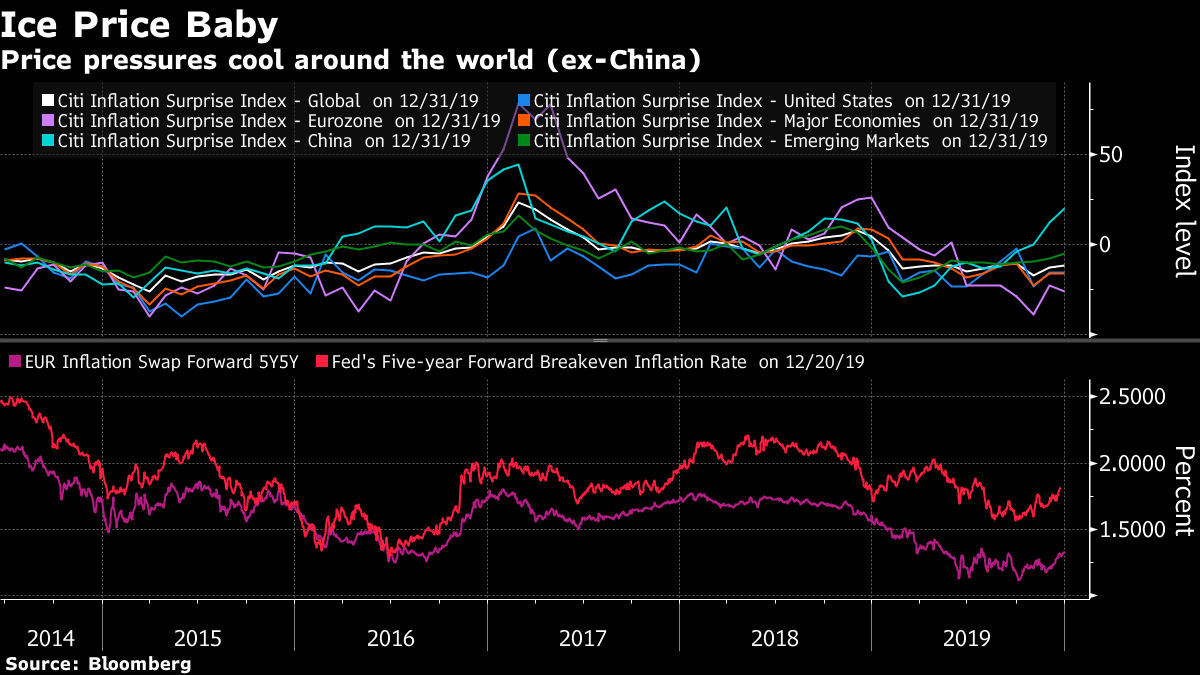

Top Iranian commander killed in U.S. airstrike, investors seek safety in havens, and Fed minutes due. EscalationQassem Soleimani, one of Iran's most powerful generals who led proxy militias that extended the country's power across the Middle East, was killed in an airstike in Iraq on orders from President Donald Trump. Iran's supreme leader Ayatollah Ali Khamenei vowed revenge. Trump's allies are hailing the assassination as one of his boldest foreign policy strokes, while his critics say it is likely to be his most reckless. The killing has inflamed tensions between the U.S. and Iran, and across the Middle East, heightening fears of a wider conflict which could pull in other countries. Rush to safetyMarket reaction to news of events in Iraq was a swift move to safety. Oil futures are surging, with Brent crude for March settlement jumping more than 4% to $69 a barrel. Gold rallied to the highest level in almost four months, trading above $1,550 an ounce this morning. Global stock markets are falling, with almost every industry sector in Europe's Stoxx 600 Index lower, while S&P 500 futures are down more than 1.5%. The 10-year Treasury yield dropped to 1.821% as strategists see investors moving to cut risk exposure across all asset classes. Fed minutes Away from the rapidly developing situation in the Middle East, today's Federal Reserve meeting minutes may provide some solace to markets on the bank's plan to maintain control over the repo market. One of the things that will be watched for is any plan to introduce a standing repo facility, a tool that would allow banks to convert eligible assets into reserves on demand. There will also be interest in any hints as to what it might take to change policymakers' view that interest rates are on hold for all of 2020. The minutes are published at 2:00 p.m. Eastern Time. Manufacturing spotlightYesterday's global manufacturing PMIs produced a mixed picture of the health of factory output from Asia to Europe. Today's ISM factory survey for the U.S. will give the first indication of whether optimism for a trade deal had a positive impact in December. Economists surveyed by Bloomberg expect an uplift to 49 from 48.1 in November, with Bloomberg Economics seeing a rise above 50, indicating expansion. Coming up…The ISM data is at 10:00 a.m., with construction spending for November also published at that time. While the oil market's attention may be elsewhere this morning, both crude oil inventories data at 11:00 a.m. and the Baker Hughes rig count at 1:00 p.m. may be worth keeping an eye on. There is a raft of monetary policy speakers due, with Richmond Fed President Thomas Barkin, Fed Governor Lael Brainard, San Francisco Fed President Mary Daly, Chicago Fed President Charles Evans and Dallas Fed President Robert Kaplan all at various events today. Automakers are scheduled to report December sales throughout the day. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Luke's interested in this morningNow that geopolitical tensions are back at the fore for market participants on the heels of the killing of a top Iranian commander in a U.S. airstrike, it's necessary to think about the ways in which this could have an enduring impact on markets. Beyond raising risk premiums generally, one conduit for market turbulence is inflation – in this particular instance, potentially and primarily through oil prices, which could impact headline price pressures and crimp spending on other discretionary items. Moreover, an inflation shock could spell trouble for the traditional 60/40 portfolio and risk parity strategies that rely on the negative correlation between stocks and bonds to produce smoother returns. Whether inflation surprises to the upside this year – for whatever reason – could upset the apple cart for these popular portfolio structures.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment