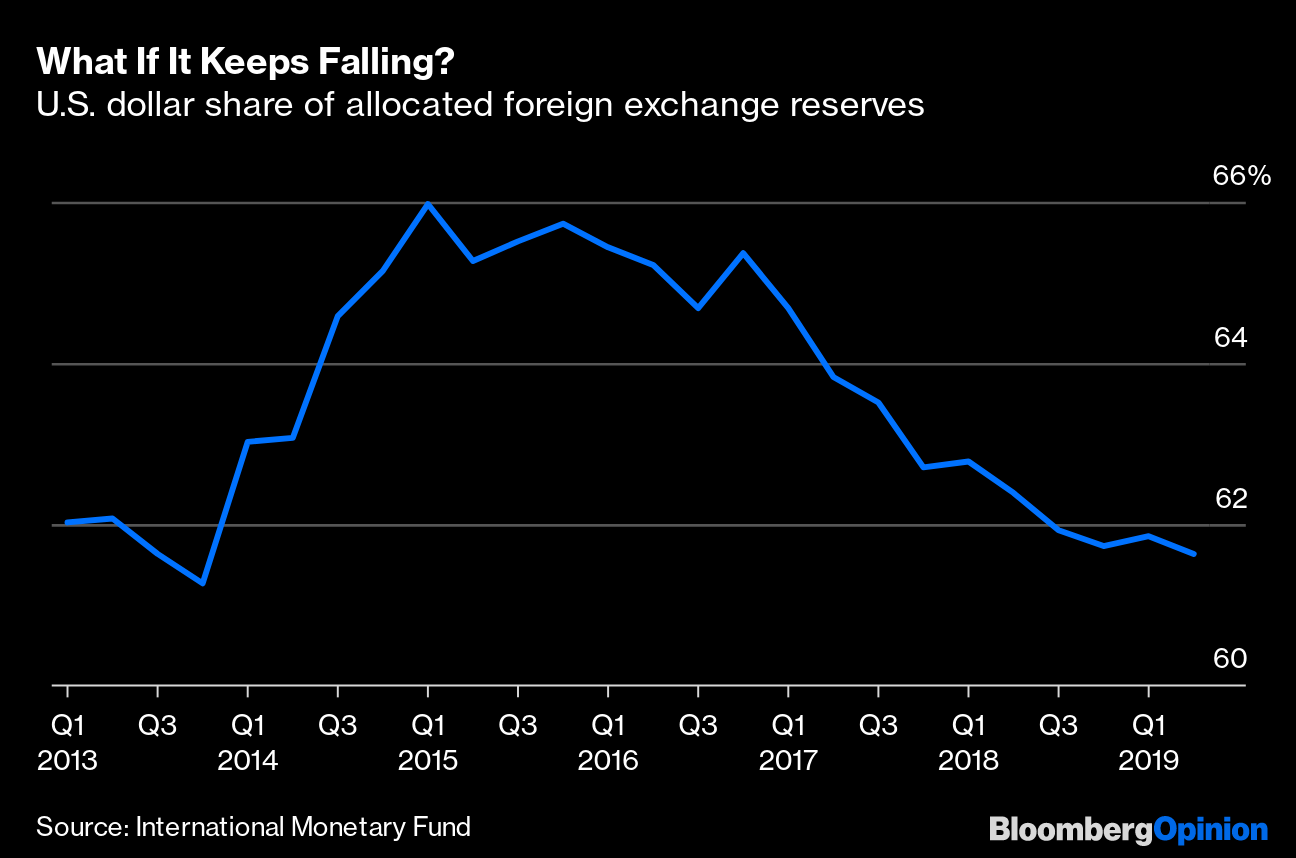

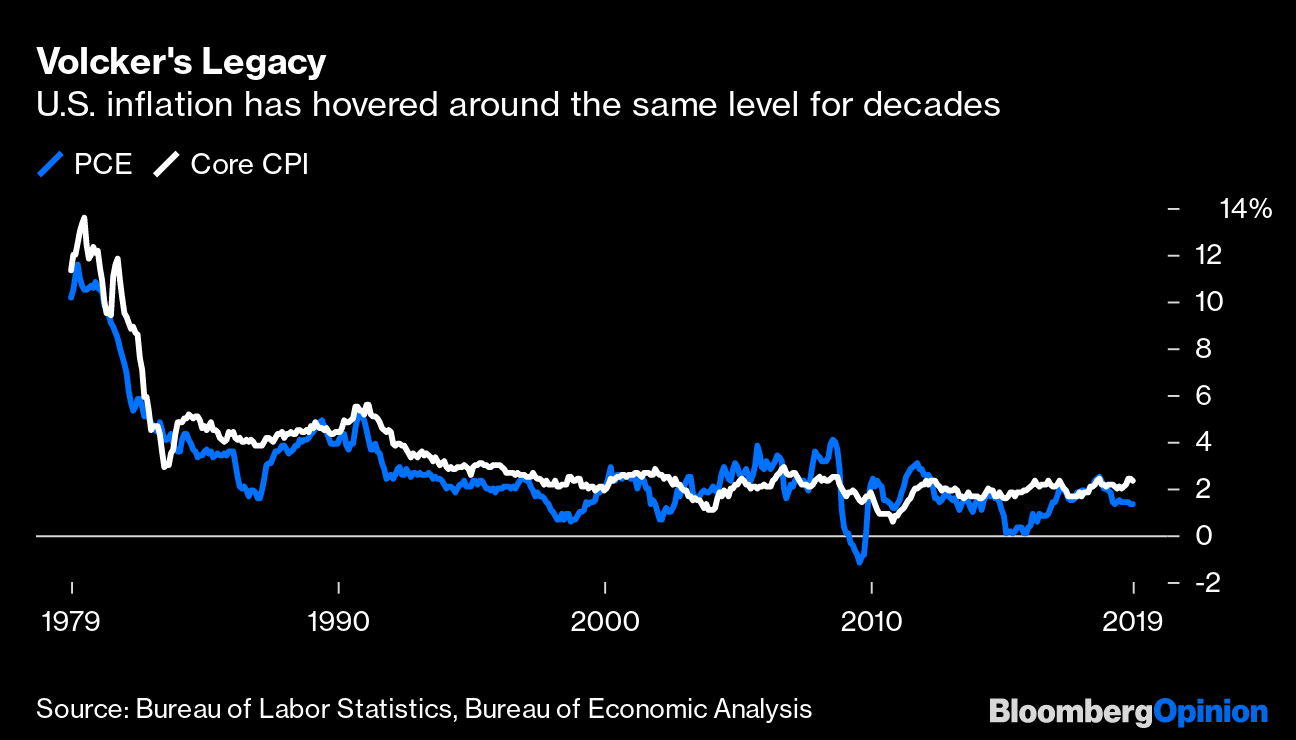

| This is Bloomberg Opinion Today, a warm slurry of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  This Is the Era of Peak Big Oil About 14 years ago, all anybody could talk about was Peak Oil Supply: We would soon start running out of the stuff, reverting us to a donkey-powered global economy. Now everybody talks about the opposite: Peak Oil Demand. And that has led to another oil-related peak: Peak Big Oil. We got a couple of examples today. First, Saudi Aramco's IPO started trading in Riyadh, the stock exchange to which Aramco retreated after its painful realization that foreign investors would balk at making it a $2 trillion company. Crown Prince Mohammed bin Salman is apparently fixated on that number. So wealthy Saudis were encouraged to invest, with memories still fresh of the all-expenses-paid vacation at the Riyadh Ritz-Carlton MBS gave them a couple of years ago. Lo and behold, Aramco jumped 10% in its first day of trading, pushing the valuation toward that magical $2 trillion number. The IPO's tortured (no pun intended) "success" could, Matt Levine suggests, encourage foreign investors to jump on the team and come on in for the big win in a subsequent offering. But those original investor qualms just get stronger by the day, writes Chris Hughes. These include not only Aramco's lack of transparency and domination by an authoritarian regime, but worries about oil demand sagging as the globe warms. Aramco increasingly looks like a relic of the era of Big Oil companies doing Big Projects to ease worries about Peak Supply. The opposite is in vogue with investors now, as another Big Oil company, Chevron Corp., acknowledged today. It wrote off more than $10 billion of an investment in Marcellus shale gas, becoming the latest in a string of companies to retreat from big spending, notes Liam Denning. They realize their cash is better spent enticing investors with dividends and other such goodies. Aramco, which so far has resisted this lesson, could soon end up a fossil-fuel-pumping fossil. T-Mobile and Sprint Haven't Rewired Economics You can probably trust T-Mobile US Inc. and Sprint Corp. to master something as mundane as 5G technology, because they have apparently figured out how to reverse the basic laws of economics. Fighting for their merger in court, they are arguing that reducing the supply of mobile-phone service by taking out one viable competitor will somehow leave the price of mobile-phone service unchanged or maybe even magically lower. U.S. antitrust regulators have swallowed this argument, but consumers and courts should not, writes Tara Lachapelle. Though Sprint has struggled, its existence has lowered prices, Tara writes, and the remedies regulators have come up with won't fill the hole it leaves behind. Bonus Corporate-Speak Reading: Boeing Co. has once again proven it's too rosy about the 737 Max return timeline. — Brooke Sutherland Fed to Trump: You're on Your Own Shocking no one — but possibly upsetting President Donald Trump, who keeps demanding negative interest rates — the Federal Reserve today held rates steady, basically declaring an end to its three-cut easing campaign. Even the central bank's implied promise to leave rates alone throughout 2020 wasn't all that shocking, notes Brian Chappatta. But the Fed unexpectedly launched a shot across the bow of its tormentor Trump: In its policy statement, and in carefully chosen words from Chairman Jay Powell, it suggested it's growing weary of saving Trump from the consequences of his own trade war. The Fed might help if growing hostilities do real economic damage next year, Brian writes, but it's apparently done soothing markets every time Trump ratchets up the rhetoric. On-the-Other-Hand Fed Reading: The economy could still be a lot better, and the Fed should keep cutting rates. — Karl Smith Big Impeachment Question: Keep It Simple? It was a quiet day on the impeachment front, with Democrats possibly tuckered out from a long day of delivering articles of impeachment while delivering Trump a big win on trade and then attending a dress-up ball at the White House. Nice political enemies, if you can get them! Anyway, there's still time for Democrats to expand the two narrow articles they announced yesterday, writes Jonathan Bernstein. It happened to Richard Nixon, and we should at least expect some Dems to try. Still, keeping impeachment tightly focused on Trump's gross abuse of power for personal gain to undermine the 2020 election will help keep our politics from devolving into a tit-for-tat impeachment cycle, writes Cass Sunstein. Bonus Politics Reading: The Dems' winnowing strategies aren't perfect if they let Tom Steyer and Andrew Yang on the next debate stage but leave Cory Booker and Julian Castro off. Telltale Charts The dollar is fading as a global reserve currency, but it will be difficult to replace, writes Noah Smith.  The bond market is underpricing the odds of higher inflation next year, which could make TIPS a winner, writes Brian Chappatta.  Further Reading The rest of the world isn't just laughing at America under Trump; it's starting to hate and fear it. — James Gibney Europe's new young leaders favor issue-by-issue pragmatism over party dogma. — Leonid Bershidsky Away's CEO has been sent away over her treatment of employees, but far too many CEOs out there are just like her. — Sarah Green Carmichael Health-care cost growth may be slowing, but not in Medicare. — Peter Orszag The Supreme Court's threat to the regulatory state has been greatly exaggerated. — Ramesh Ponnuru In its final season, "Silicon Valley" delivered a serious message about Silicon Valley. (Spoilers ahoy.) — Joe Nocera ICYMI Joe Biden suggested he would only serve one term if elected president. Your technology is probably listening to you right now. Facebook Inc. and Google dropped out of Glassdoor's top 10 "Best Places to Work." Kickers Plants may let out ultrasonic squeals when stressed. (h/t Ellen Kominers) FINALLY, researchers create pig-monkey chimeras. (h/t Mike Smedley) Ultrasound treatment could destroy most prostate cancers. The Ringer's 41 favorite sports moments from 2019. Note: Please send stressed plants and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment