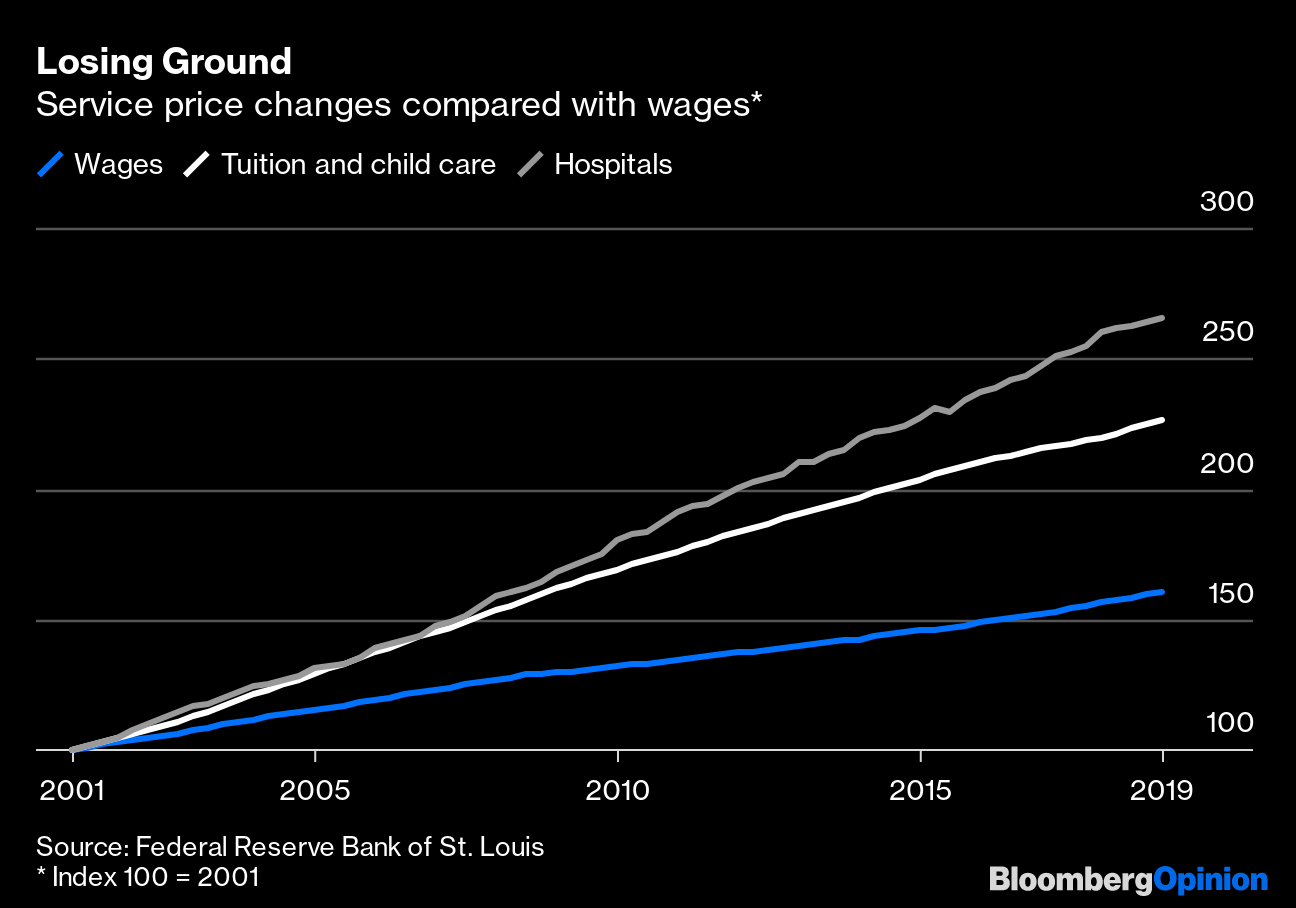

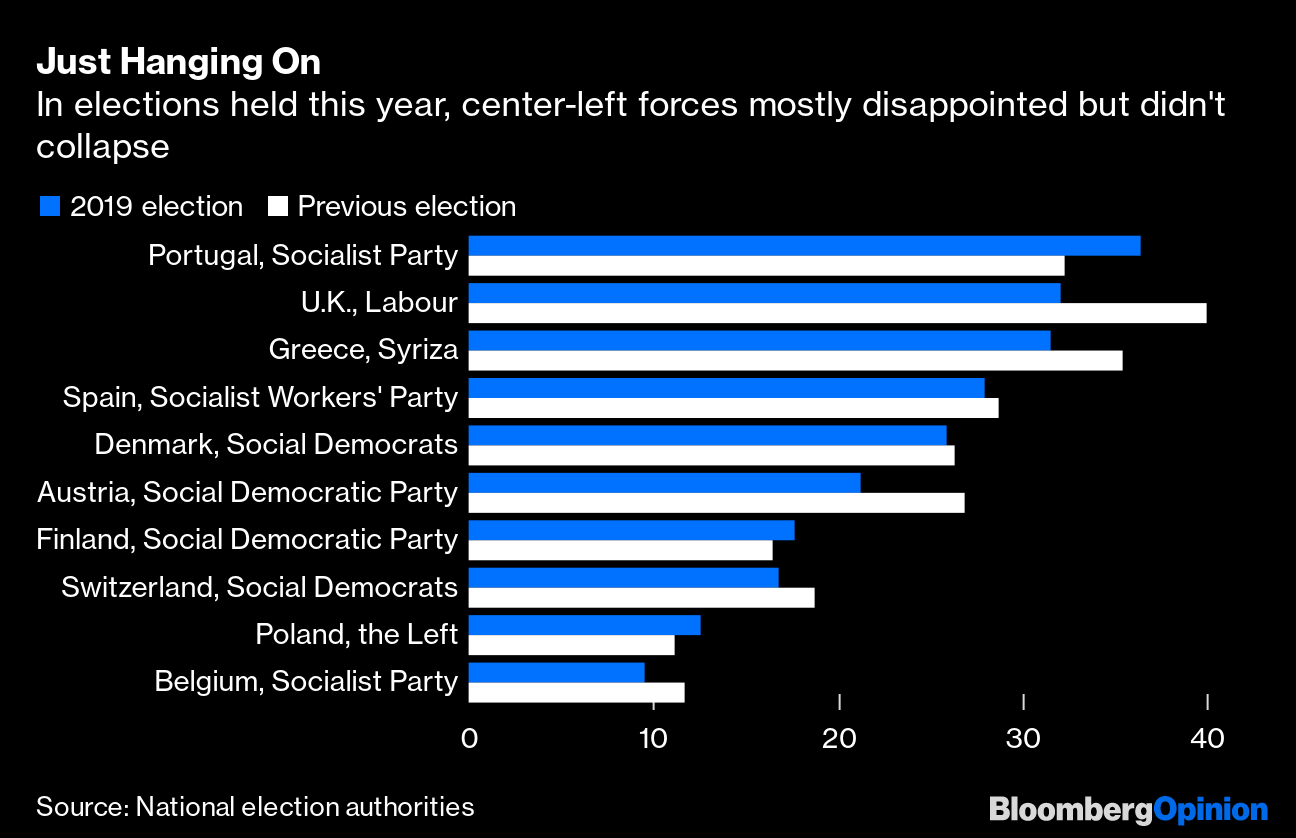

| This is Bloomberg Opinion Today, a cholent of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  What do you see? GraphicaArtis/Hulton Archive Breaking Out the Crystal Ball It's that joyful but anxiety-filled time of year when we all reflect on the past 12 months — and this time around, also ponder the decade ahead. (OK, pedants. Technically, 2020 isn't the start of a new decade.) John Authers writes that with perfect (and fictional) hindsight about the post-financial crisis decade, an investor could have made all the right moves by going long on software and short on raw materials, betting that central banks wouldn't let asset prices fall, and expecting a recovery of U.S. banks but not their European counterparts. And the biggest markets winner of the 2010s, John says, was the vanilla passive investment funds. The Amazing Kreskin of Bloomberg Opinion, Stephen L. Carter, predicts that in 2020, Congress will impose a near-ban on vaping products, the Patriots will win the Super Bowl again (ugh) and the U.S. presidential election will result in an electoral college tie (!). In a review of the technology industry, Shira Ovide (that's me) notes that the existential technology question remains for 2020 and beyond: Can we nurture the good effects of technology while mitigating its harms? Bhaskar Chakravorti also says investors need to consider that that digital companies can't necessarily easily cross borders. And Faye Flam says the awe-inspiring discovery of giant black holes in 2019 may lead to bigger astrophysical breakthroughs next year. Lastly, if you feel guilty for something stupid you did in 2019, take heart. Kara Alaimo brings you whopping public relations missteps, including Boeing's initial silence about a fatal plane crash and Sallie Mae employees' Hawaiian holiday to celebrate a record number of student loans. Be glad you're not those people, and enjoy the kickoff to 2020. How India Lost Its Groove A year ago, India was the the world's fastest-growing large economy and seen as a global colossus-in-waiting. That all fell apart. Daniel Moss says India's broken financial system and overindebted banks bear much of the blame for sharply slowing economic growth, an erosion of consumer confidence and a jobless rate that climbed to a 45-year high. Other Asian countries used crises to systematically change their financial systems and make central banks more independent. Dan says India and the world could likewise be well served by a toned-down and more structurally durable India. In foreign policy, Mihir Sharma writes that the Modi government's slide toward majoritarianism and repression is jeopardizing what had been bipartisan support in Washington for closer ties to India. Further reading: Structural failings in Vietnam's financial system, including limits on foreign investment in the country's stock market, are likely to hamper the country's progress. — Shuli Ren The New Villain Joe Nocera dubs this the private equity decade, and not in a good way. In disastrous takeovers such as Toys "R" Us, Joe says, the high-minded talk evaporated about private equity firms improving companies and investing for the long term. Joe writes that instead, the 2010s "exposed an industry that cared about lining its own pockets — often at the expense of companies it bought." The likely consequences, Joe predicts, are dislocation for companies carrying private equity debt when the business cycle turns, and a possible political assault on the private equity model. Other financial markets predictions: Andy Mukherjee writes that a national digital currency in China could be the start of a disruption with central banks taking over functions of traditional banks, and the end of currency as foreign-policy weapon. Mohamed A. El-Erian predicts there won't be an end to negative-yielding debt. And Satyajit Das says government bonds will be the propagator of risk in any future financial crisis. A Generational Shift at SCOTUS In a game of doctrine swapping on the Supreme Court, free speech and free exercise of religion turned from liberal causes to conservative ones in the 2010s. You could see that, Noah Feldman writes, in cases such as the Citizens United decision that removed restrictions on corporate political donations in the name of free speech. In a parallel development, conservative majorities in several cases showed a preference for religious liberty over equality, including in a narrow conservative majority decision about contraceptive health insurance requirements. Unless the Democrats win both the White House and Senate next year, "the 2010s in retrospect may look like the last gasp of the liberal constitutional tradition that had its heyday in the years of the Warren Court," Noah writes. Telltale Charts A growing share of Americans work in service industries that can't sustain the middle class, Noah Smith says. To resolve this paradox, Noah suggests the government should look for ways to make workers productive outside of care-based industries, and experiment with welfare programs such as universal basic income.  Europe's center-left political parties haven't necessarily done well in elections, but they have held steady thanks to political skill, Leonid Bershidsky says. That may not be enough.  Further Reading The European Union's top Brexit negotiator has to finalize talks with a Britain that could try to compete with the EU on financial regulation and trade. — Lionel Laurent Here are 12 great listens from the 2010s podcast boom. — Sarah Green Carmichael How quinceañeras outlasted the old cultural norms. — Mac Margolis Awarding the Oscars of behavior economics in film. — Cass Sunstein Twitter's "topics" feature probably won't improve its advertising targeting. — Scott Duke Kominers How an established bank nurtured an upstart one. — Barry Ritholtz's podcast ICYMI More hedge funds closed than launched for the fifth straight year. Shrinking is in store for the worst-performing industry of 2019. Top chefs name their favorite restaurant meals of the year. Kickers Analyzing 5,700-year-old chewing gum. A Roomba started a police incident. (h/t Scott Duke Kominers) Are those Vatican-approved pope bobbleheads? This tortoise is an arsonist. Note: I'm filling in for Mark Gongloff. Bloomberg Opinion Today is off until Thursday. Please send pedantic tomes about when the new decade starts to Shira Ovide at sovide@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment