| Inside: Bank of England presses financial firms on exposure to global warming. BlackRock and Vanguard face shareholder pressure on climate proxy votes. Shipping faces a new clean fuel paradigm but isn't ready. The SEC is asking about ESG. Sky vacuums are getting better at fighting climate change. Having more women CEOs won't fix the gender gap. — Emily Chasan Sustainable Finance The Bank of England is inviting banks and insurers to assess their exposures to global warming and the risks associated with moving to a lower-carbon economy. BlackRock, Vanguard, JPMorgan and T. Rowe Price received shareholder resolutions from religious and socially-conscious investors saying that their proxy voting records have failed to live up to promises to tackle climate change. BlackRock also received a shareholder proposal from As You Sow, asking how it would implement a stakeholder-centric model after CEO Larry Fink signed the Business Roundtable's statement on the purpose of corporation.

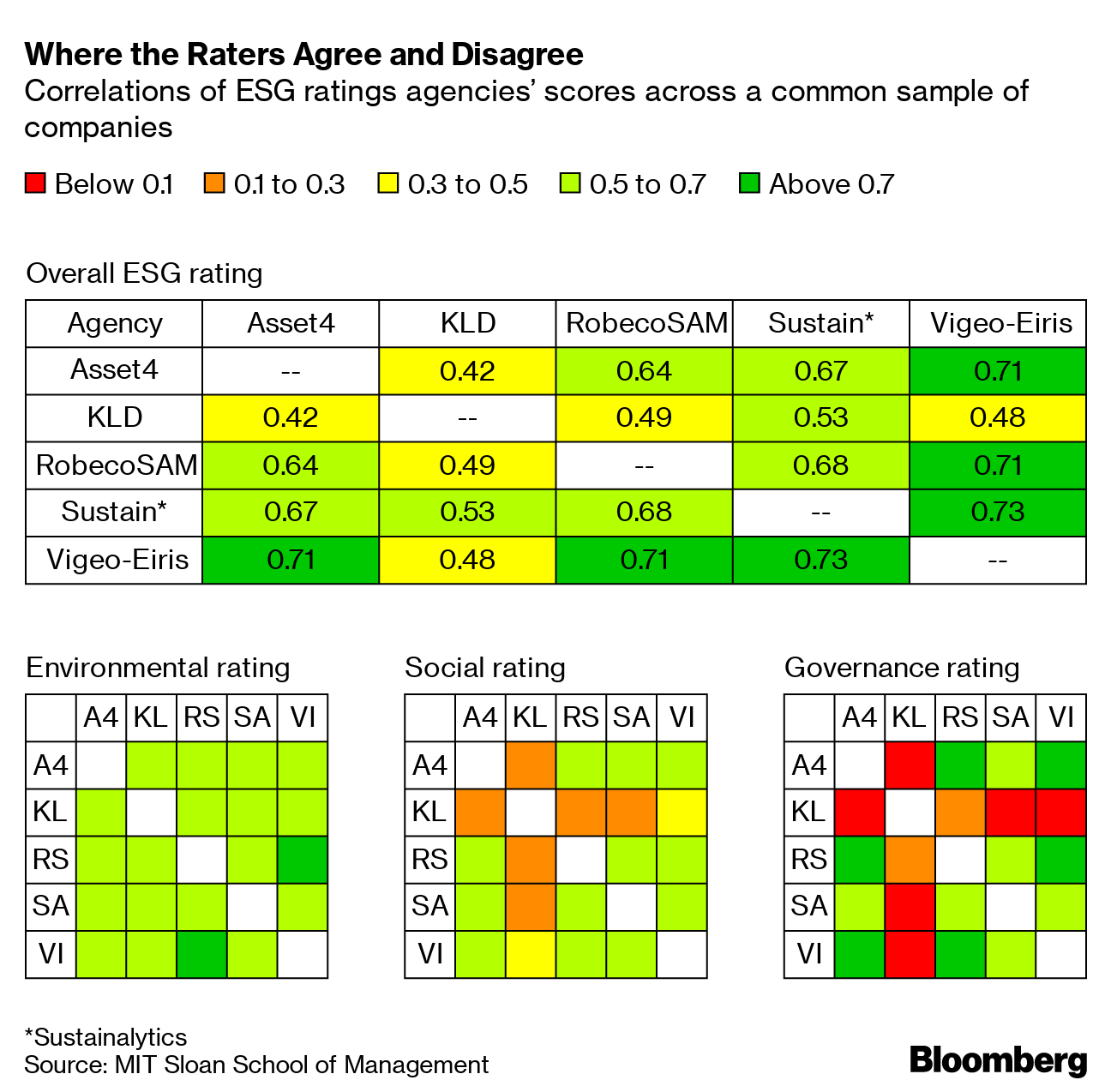

Competition in the ESG ratings market is heating up. There are discrepancies and conflicts in data and ratings, but investors are still hungry for more ESG information and fear missing out on an advantage if they don't incorporate the information, writes Bloomberg's Jacqueline Poh.  In Brief Environment

The shipping industry is planning its own $5 billion climate research fund just two weeks before new fuel regulations on cleaner fuel take effect. The historic rule change is intended to prevent the release of sulfur oxides that are seen as bad for human health and contributing to acid rain, and will have a major impact on fuel markets worldwide but key countries don't appear to be ready to enforce the switch.

Sky vacuums for carbon capture are getting a lot better and could soon play a bigger role in fighting climate change.

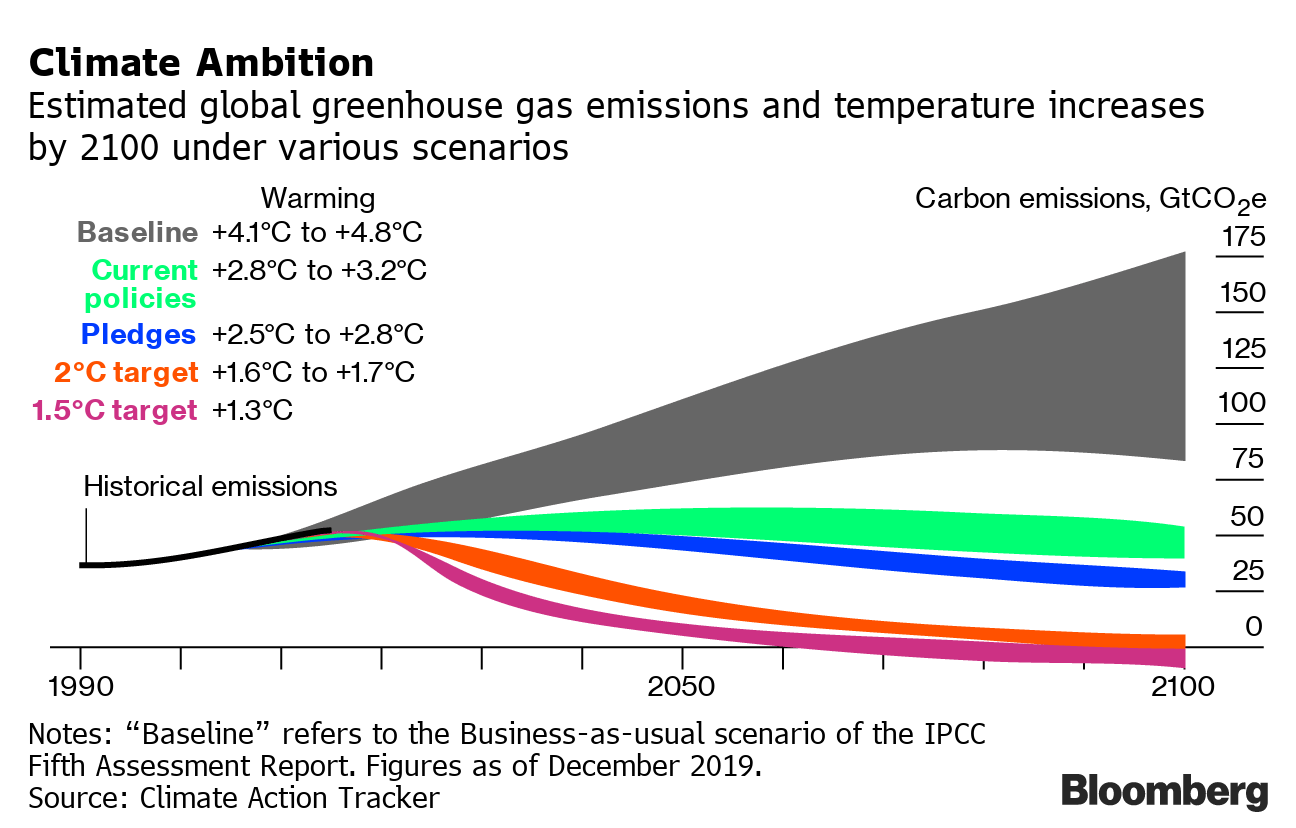

Peak emissions are closer than you think.

The CEO of the world's first palm oil plantation to achieve the RSPO sustainable certification says it's unfair to label all palm oil firms as "orangutan killers." He's trying to fix an industry blamed for deforestation and environmental damage.

The international effort to rein in fossil fuel pollution took a step backward at COP 25. The delegates from almost 200 nations left Madrid after more than two weeks of discussion, agreeing only on the "urgent need" for countries to make deeper cuts to greenhouse gases. They shelved work on adding market mechanisms as a tool for countries to meet their goals and couldn't agree about finance needed to fix the problem. And there was only one vegan food truck at the climate conference.  Social Boeing halted production for its 737 Max which was grounded following two crashes within five months. It's likely to be more than a temporary headwind for the U.S. economy.

Big tech companies like Facebook and Google, long seen as some of the world's most desirable workplaces offering countless perks and employee benefits, are losing some of their shine as they drop lower on the Best Places to Work List.

Apple, Alphabet, Microsoft, Dell and Tesla are facing a first-of-its kind lawsuit by a human rights group over }" itemprop="suid"/> alleged child labor abuses in the supply chain for cobalt used in their products.

Private prison operator CoreCivic found a friendly banker in Nomura after Bank of America cut ties with the company.

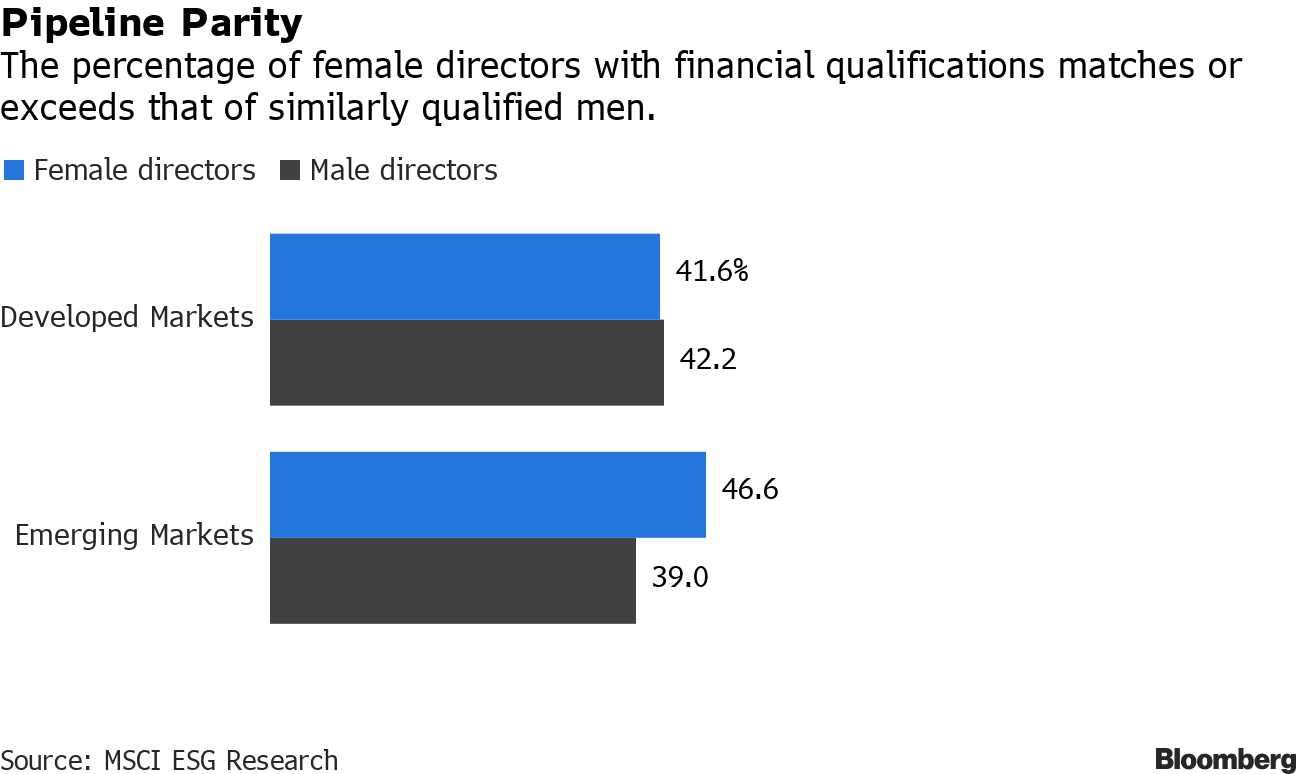

Having more women CEOs won't fix the gender gap. Governance Dutch activist fund Follow This has filed requests for shareholder votes at Exxon Mobil and Chevron's annual meetings for the first time, asking the companies to align their plans with the Paris climate accord. It has also filed resolutions for Shell, BP and Equinor ASA.

Corporate boards lacking diversity sometimes claim they can't find qualified women to become directors, but the data tell another story: Female directors meet or beat men in financial expertise.

Note: Please send tips, suggestions and feedback to Emily Chasan at echasan1@bloomberg.net. New subscribers can sign up here. To see this on the web, click here. |

Post a Comment