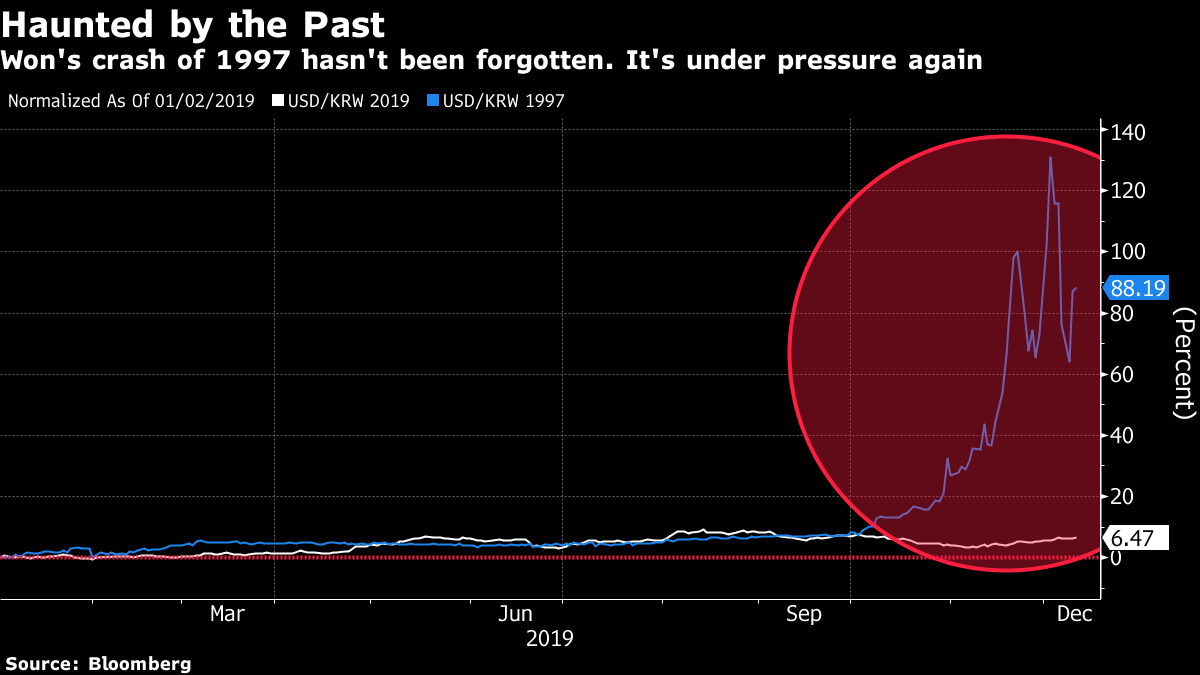

| Trump signs off on a phase one U.S.-China trade deal, Boris Johnson looks set to win a majority in the U.K. election and the House considers two articles of impeachment against the American president. Here are some of the things people in markets are talking about today. President Donald Trump signed off on a so-called phase-one trade deal with China, averting the Dec. 15 introduction of a new wave of U.S. tariffs on about $160 billion of consumer goods from the Asian nation, according to people familiar with the matter. The deal presented to Trump by trade advisers Thursday included a promise by the Chinese to buy more U.S. agricultural goods, according to the people. Officials also discussed possible reductions of existing duties on Chinese products, they said. The terms have been agreed but the legal text has not yet been finalized, the people said. A White House spokesperson declined to comment. Asian stocks are set to gain after trade deal optimism pushed American equities to records. The S&P 500 rallied after Bloomberg's report that U.S. officials had reached a deal in principle. A breakthrough on trade would remove a major overhang for equity investors just a day after the Federal Reserve signaled it is no rush to raise interest rates as the economy shows steady improvement. The yuan jumped and yen retreated. In Europe, the central bank said it would maintain bond buying and keep rates low until it gets near its inflation goal. The pound surged after a U.K. exit poll forecast a majority for Prime Minister Boris Johnson's Conservatives. Prime Minister Boris Johnson is on course to win a decisive victory in the U.K.'s general election, according to the official exit poll. A win would vindicate his gamble on an early vote and put the country on track to leave the European Union next month. The main opposition Labour Party is projected to secure 191 seats. While some Tory hard-liners will want Johnson to cut ties with the EU entirely, his large majority will give him more power to get his own way, especially if he needs extra time to negotiate with the bloc. Labour leader Jeremy Corbyn staked everything on a radical plan to hike taxes for the rich and nationalize swathes of industry, but is now likely to face intense pressure to quit if the forecast is confirmed by the results. See the results with our interactive map. In the U.S., the House Judiciary Committee is likely to vote on two articles of impeachment against President Donald Trump as early as Thursday. The hearing began with the reading of the two charges against the president — abuse of power and obstructions of Congress — and quickly turned to Republican complaints about the impeachment process. There are "absolutely no factual underpinnings" for impeaching the president, Doug Collins, the panel's ranking Republican, said in the hearing. "This is just a travesty and a sham from day one." A simple majority vote by the House, where Democrats hold 235 of the 435 seats, on any article of impeachment will send it to the Senate for consideration. Here's an explainer on the impeachment process. Even China can't fix its affordable housing crisis. When Beijing introduced price caps for almost two-thirds of apartments in late 2016 as part of a program to provide homes for millions of middle-class citizens to buy, an array of cheap condominiums began springing up on the city's outskirts. Three years on, the cramped, poor-quality units that are far from anywhere lie mostly empty. It's an awkward reality confronting authorities in the nation's sprawling capital, which introduced the stringent housing curbs to quash prices that had shot up almost 30% in the 12 months through September 2016. Few policy makers globally are armed with the tools to make such granular decisions, making Beijing's problems all the more awkward. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Tracy's interested in this morning Regular readers of this small slice of the newsletter know that I have a thing for emerging-market classifications. Usually we talk about those with regards to benchmark indices for bonds or stocks, but today let's take a look at how they apply to currencies. Bloomberg reports that South Korea — in many ways a developed economy with a relatively wealthy and slow-growing population — still has a currency classified as emerging market. That's because it operates a pretty restrictive FX-trading regime: The won can only directly be exchanged with the dollar and the yuan and the foreign exchange market is open for just six and a half hours a day.  The argument is that tightly controlling the currency allows the government to insulate the market from shocks (such as in the Asian financial crisis). But there are others who think loosening the trading regime could be a good thing. They argue having to swap the won into dollars before it can be exchanged into another currency (like the yen or euro) increases the cost of doing business and ultimately makes the economy more tied to the U.S. dollar. It's an interesting debate and one worth reading about. You can follow Bloomberg's Tracy Alloway at @tracyalloway. The best in-depth reporting from Asia Pacific and beyond, delivered to your inbox every Friday. Sign up here for The Reading List, a new weekly email coming soon. Before it's here, it's on the Bloomberg Terminal. Find out how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment