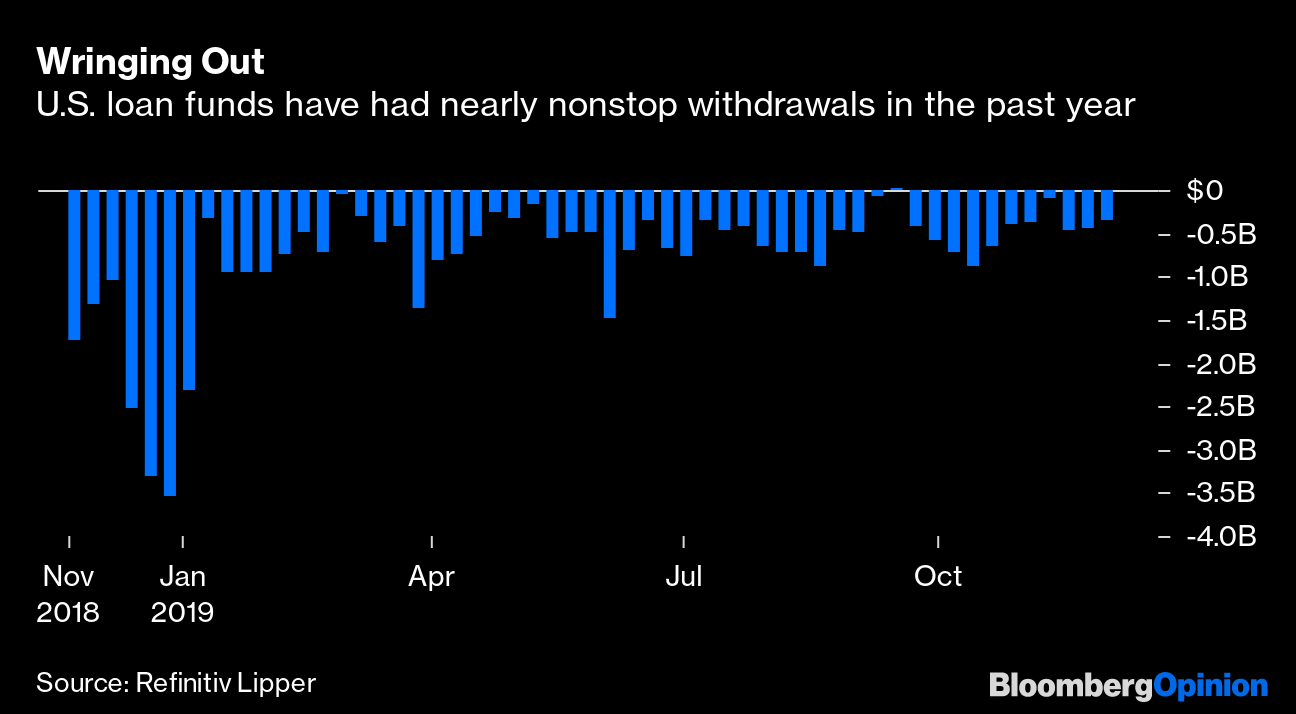

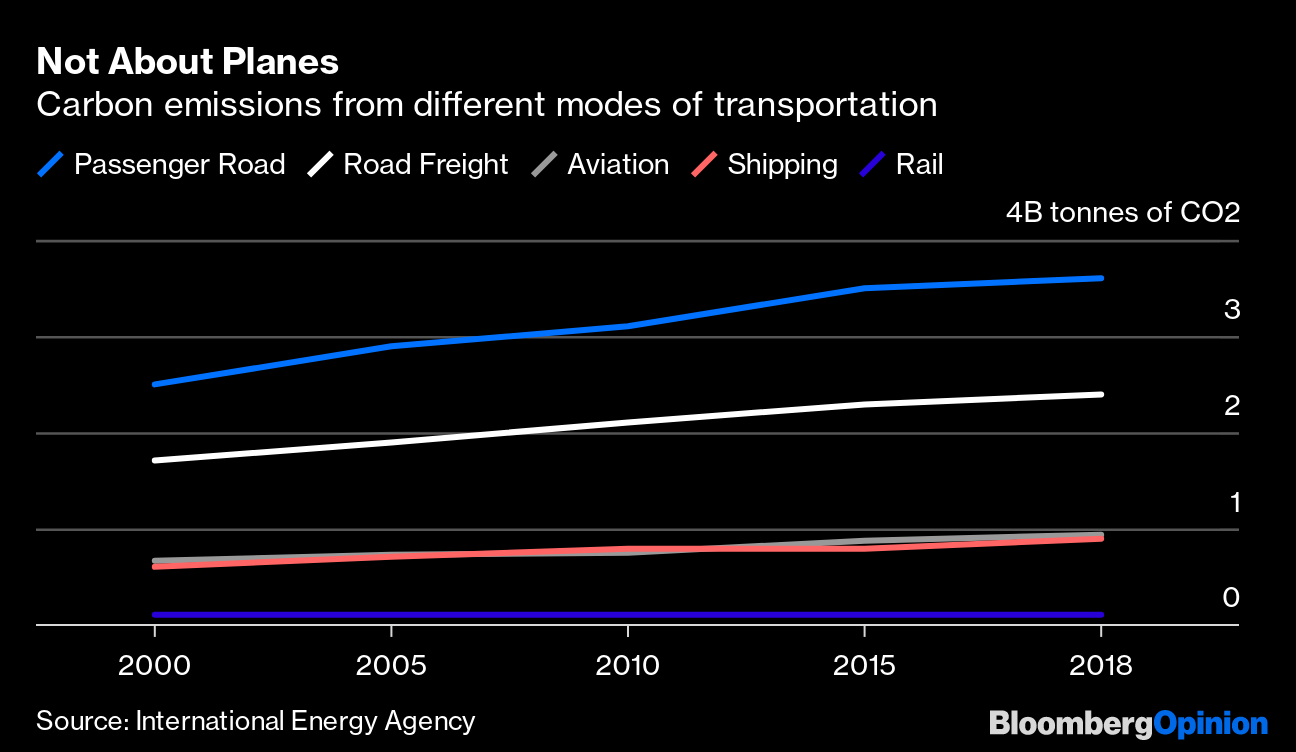

| This is Bloomberg Opinion Today, a palaver sauce of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  Seems fun, but... Photographer: SVEN NACKSTRAND/AFP/Getty Images Fine, Let's Try Raising Interest Rates One of 2019's best movies was "Midsommar," about an unorthodox Swedish summer-solstice party. Now real-life Swedes are doing some unorthodox winter-solstice central banking, hopefully with much less human sacrifice. Sweden's Riksbank, zigging while the rest of the world zags, just raised interest rates, despite anxiety about the economy and sluggish inflation. It's a bit of desperation central banking, Mohamed El-Erian explains. Rates around the world are at or below rock bottom, without supercharging growth. Meanwhile savers and banks suffer, which may defeat the purpose of low rates, and wild gambling with cheap money fosters zombie companies and boosts the odds of a blow-up. Ferdinando Giugliano suggests Sweden is panicking about negative rates for nothing. There's no proof they're doing real damage yet, he argues. Hiking rates, meanwhile, could definitely hurt the economy, forcing the Riksbank to reverse its decision. Still, central bankers around the world clearly fear their go-to post-crisis tools of QE and negative rates have lost their edge. One big reason for this, as Mohamed notes, is that fiscal policy hasn't done its share of the work. Central bankers are now openly calling on governments to do more, which is a slippery slope toward uniting the two, writes Alberto Gallo. Central bankers joining forces with politicians may make stimulating economies easier, but at the cost of central-bank independence. And it could make market distortions even weirder and scarier — not in a "Midsommar" way but more like a "Cats" way. Is Everything OK, Bank of England? The U.K.'s central bank, meanwhile, has its own set of problems. Most importantly, it will soon need a new leader to replace its departing rock-star governor, Mark Carney. The list of candidates that Prime Minister Boris Johnson has floated is … uninspiring, suggests Ferdinando Giugliano. The trouble is that the Bank of England needs an especially skillful leader to deal with Brexit — but thanks to Brexit, the best candidates have run screaming the other way. Meanwhile, the BOE is dealing with an embarrassing scandal: A contractor that records its press conferences sold audio to traders to give them an eight-second edge over the poor saps waiting for the slower video feed. This was a silly oversight on the BOE's part, writes Marcus Ashworth, although Carney rarely says anything interesting in these gaggles. And if this helped market efficiency, Matt Levine asks, who did it really hurt? If you're a regular person trading around BOE press conferences, maybe you should reconsider your life choices. Bonus British Reading: Labour is in an existential crisis because it stopped listening to voters. — Matt Singh Representative Democracy Just Needs to Lay Down For a Minute The House of Representatives impeached President Donald Trump last night, while he was at a rally suggesting the late Rep. John Dingell was in hell. Then the impeachment train stalled before it could even leave the House, with Speaker Nancy Pelosi feuding with Senate Majority Leader Mitch McConnell over terms of the eventual trial. Honestly, you could be forgiven for suspecting the American experiment is nearing the end of its useful life. Trump's presidency has certainly put an unusual strain on the Constitution, writes Noah Feldman. But this impeachment, as imperfect as it may be, is a sign the old document still has breath in it. Not that Republicans defending Trump have played a productive role; they rely either on lies or disingenuous complaints about process, writes Jonathan Bernstein. But it's possible the handful of old-school Republicans still in the building — cough, Mitt Romney, cough — could redeem the party, and maybe save its future, by at least taking the Senate trial seriously, writes Frank Wilkinson. Further Impeachment Reading: Trump's own defense has a "royal we" problem. — Jonathan Bernstein Unicorns Can't Keep Coddling You The public-market flops of Uber Technologies Inc. and other former unicorns, followed by the spectacular swan dive of WeWork, have venture capitalists doing some soul-searching (OK, maybe not all of them). One upshot is that Uber and its ilk are chasing profitability earlier than they might have liked, writes Shira Ovide. That means they're much less likely to keep burning money to attract customers. This means your car rides, dog walks, food delivery, etc., will be less "disrupted" — meaning more expensive. This trend is spreading through the non-unicorn universe, too, writes Alex Webb: BMW and Daimler just ditched their own car-sharing service. Telltale Charts Individual investors keep retreating from leveraged-loan funds, and a new Financial Stability Board report won't ease anybody's worries about them, writes Brian Chappatta.  Flight-shaming isn't changing behavior in a meaningful way, writes Leonid Bershidsky. Personal carbon trading could be the answer.  Further Reading The job market isn't as healthy as it seems because the jobs are increasingly terrible McJobs. — Daniel Alpert and Robert Hockett Someday we'll wonder why we tried to quash vaping; it's better than just letting people smoke cigarettes. — Joe Nocera Why buy expensive U.S. stocks when overseas ones are so much cheaper? — John Authers 2019 was the year cities rose up against nation-states, and the trend's not going away. — Leonid Bershidsky Lebanon's new prime minister is too beholden to Hezbollah to be a change agent. — Hussein Ibish Anarchy's time has come again. — Pankaj Mishra Special Holiday Section: Bloomberg Opinion Book Club Here are the 11 books you must read (15 if you count each "A Song of Ice and Fire" novel separately) in 2020. ICYMI Scottish First Minister Nicola Sturgeon wants an independence referendum. How Wall Street avoids its #MeToo reckoning. The optimist's guide to 2020. Kickers Wakanda is no longer an official U.S. trading partner. (h/t Zoe DeStories) Homo erectus lasted a lot longer than we thought. (h/t Scott Kominers) Trees started rooting much earlier than we thought. Don't sweat the decade's end because time's not real. Note: Please send vibranium and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment