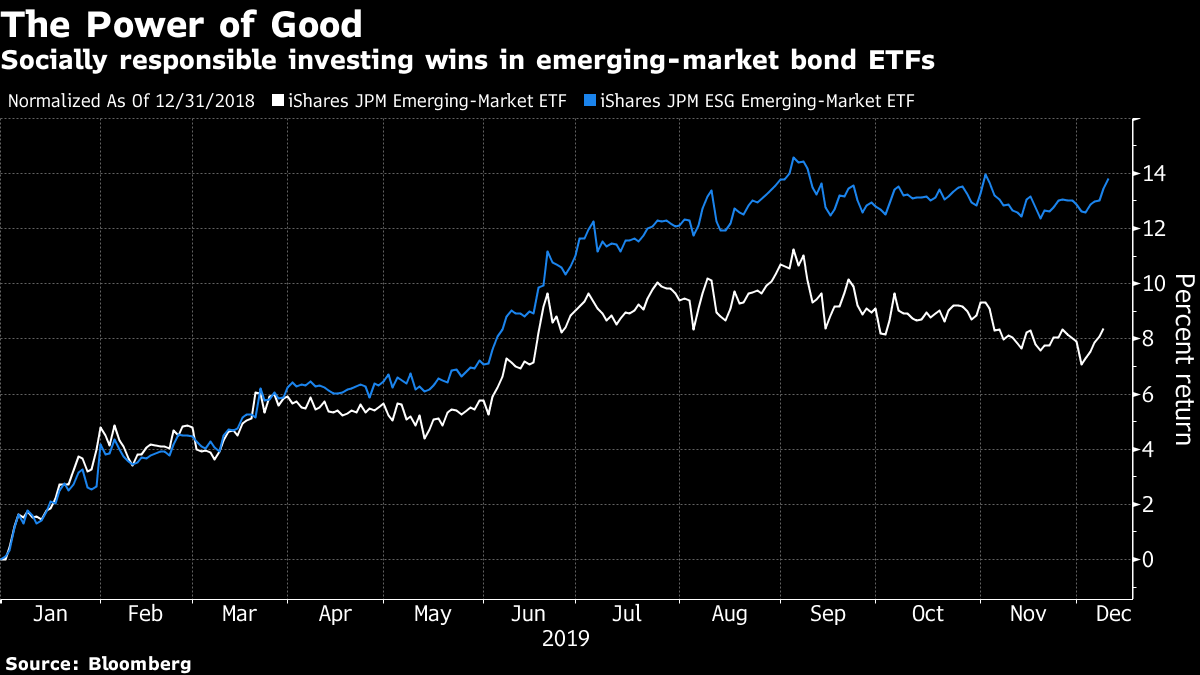

It's PMI day, China gets twin boost, and markets on liquidity watch. Feeble factoriesThere's more weakness in Europe's manufacturing sector, according to Purchasing Managers Indexes. In Germany, the factory slump deepened again with output unexpectedly falling to 43.4 in December. A similar reading for France dropped to 50.3, well below forecasts. In the United Kingdom, industrial momentum tumbled to the lowest in more than seven years at 47.4. PMI data for the U.S. economy will be released at 9:45 a.m. Eastern Time this morning. Looking betterWhile the economic outlook for Europe may be under pressure, things are looking up for China. The indefinite suspension of fresh tariffs that were due to come into effect yesterday takes a major risk factor off the table for the world's second-largest economy. It also seems that fears of a rapid slowdown of growth in China may have been overstated. Data overnight showed that both industrial output and retail sales in November were much stronger than expected. Big day for repoToday sees a repeat of the circumstances which many have blamed for the September repo blowout: a mid-month Treasury auction settlement and quarterly corporate tax payments. Since September's events, the Federal Reserve has been busy providing liquidity to the market, and today is no different with a 32-day $50 billion offering as well as a $120 billion overnight operation. An oversubscription to the 32-day operation may signal continued strong demand for liquidity through year-end. Markets riseEquity markets are continuing to react to the agreement of a phase-one trade deal between the U.S. and China. Overnight, the MSCI Asia Pacific Index slipped less than 0.1% while Japan's Topix index ended a quiet session 0.2% lower. In Europe, the Stoxx 600 Index was 1.0% higher by 5:50 a.m., with the gauge hitting another record high on gains for miners and banks. S&P 500 futures pointed to a gain at the open, the 10-year Treasury yield as at 1.842% and gold was slightly higher. Coming up…Empire manufacturing for December is published at 8:30 a.m. with PMI data at 9:45 a.m. The Treasury auctions $78 billion of T-bills at 11:30 a.m. TIC flow data is released at 4:00 p.m. while Minneapolis Fed President Neel Kashkari speaks this evening. Elsewhere in monetary land, the Bank of England publishes its latest financial stability report at 12:00 p.m., with Governor Mark Carney holding a press conference 30 minutes later. What we've been readingThis is what's caught our eye over the weekend. And finally, here's what Cecile's interested in this morningA stampede into ESG investments this year means they are paying off -- not just by making their owners feel that they are doing good, but by outperforming. You can see the divergence at play in two JPMorgan indexes that track bonds of emerging market nations. The issuers that fit a criteria of being socially responsible delivered a 5 percentage point greater return than a wider-based equivalent this year, according to exchange-traded funds built from the indexes. But I can't help wonder whether this supposedly virtuous investment circle isn't creating it's own vicious circle by depriving the poorest nations of foreign investment as they're building up industries. There's a lot at stake: $30 trillion now tracks global sustainable investments, and borrowers in Russia and Peru have the most to lose from falling afoul of ESG tests, according to data firm Sustainalytics. Forcing fund managers to account for their green investments through the lens of market returns may end up doing little more than driving up valuations, according to a recent column in the Financial Times. If all it does is displace a socially neutral investor who will simply sell their green investments to a socially responsible peer at an overvalued level, then the net effect is zero, according to this opinion from Jonathan Ford. Either way, it's clear that ESG is set to widen the gap between the haves (the good) and the have-nots.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment